A sudden glut of recent earnings gaps is a bullish sign for the market. But the gaps don’t always mean the same thing for the stocks involved.

One of the market maxims we definitely subscribe to is that the market fools the majority of investors the majority of the time. Because the market is basically human nature on display, it’s often filled with shakeouts, dips and contrary behavior that keep most people off balance.

At no time is that seen more than during earnings season, when, thanks to Regulation FD (instituted back in the early 2000s), we typically see a ton of growth stocks gapping up or down based on their quarterly reports and guidance. And it turns out these earnings gaps often send powerful signals for the intermediate-term … but not in how most expect.

When a stock gaps up powerfully, it often portends further solid gains in the weeks and possibly months ahead. Of course, few investors will go ahead and buy a stock that gaps up 20%, 30% or more because it looks “too high”—but the bigger the gap, the better the chance a stock can continue higher, assuming it has a solid growth story.

[text_ad]

And the good news is that, last week, I saw as many powerful earnings gaps among growth stocks as I have in years! All else equal, that bodes well looking down the road.

However, investing is never easy, and just buying a stock that gaps up 20% isn’t guaranteed to make you money—you still have to keep in mind the stock’s overall action and the market environment. So today I thought I’d go over a handful of stocks that have gapped this earnings season from different positions on their charts and share my thoughts.

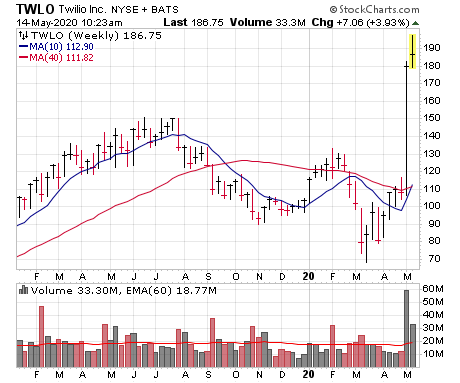

Earnings Gap #1: Big Base, Gap to New Highs – Twilio (TWLO)

When I say “big base” I’m usually talking about a stock that’s consolidated for at least a few months if not much longer, with lots of ups and downs (including a big shakeout or two) that wore down and scared out the weak hands. And then, usually with the stock in the middle to upper portions of that big consolidation, comes a massive earnings gap that takes the stock to new highs.

That’s the script that TWLO followed, with a top near 150 in June of last year, two big declines (one to 90 last October, then to 68 during this year’s crash) before bouncing back to 110 or so two weeks ago. Then the roof blew clean off after earnings, with the stock rallying a whopping 40% the day after earnings on trading volume that was more than eight times average.

Again, such a big move seems like it would lead to a sharp pullback, but usually (not always!) it’s more of a blastoff signal. That’s been the case so far with TWLO. (For another recent example, look at Chegg (CHGG), which had a similar big base and huge earnings move.)

Interpretation: These types of big gaps out of big bases often launch big moves and can be bought right away—and after their first pullback. We’ll see if TWLO and CHGG follow the usual pattern. So far, so good.

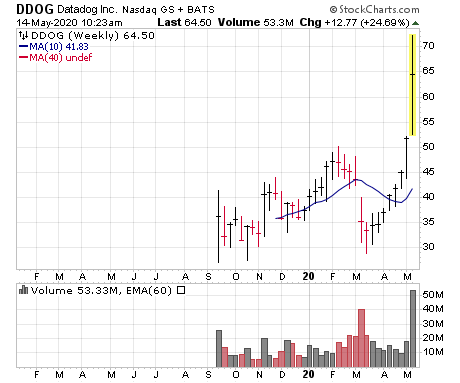

Earnings Gap #2: Gap to New Highs, but Narrow Base – Datadog (DDOG)

This is the same sort of powerful gap, but instead of coming out of a six-, 12- or 18-month consolidation, the gap pushes the stock to new highs out of a jagged launching pad of just a few weeks.

Datadog (DDOG) is an example here, as it came public last September, rallied nicely for a few months and then crashed with the market in March. But the advance from the lows was persistent, and it began accelerating in April and then went bonkers this week, pushing to new highs ahead of earnings and then gapping up wildly on Tuesday after results.

Interpretation: Any gap out of a base is bullish, but this example is higher risk than when a stock gaps out of a longer base. Why? These narrow launching pads usually mean the stock has come basically straight up from its lows, which means there could be plenty of pent-up selling pressure, short-term. Thus, it’s usually best to start small on these names or wait for some sort of pullback or shakeout after the gap before entering.

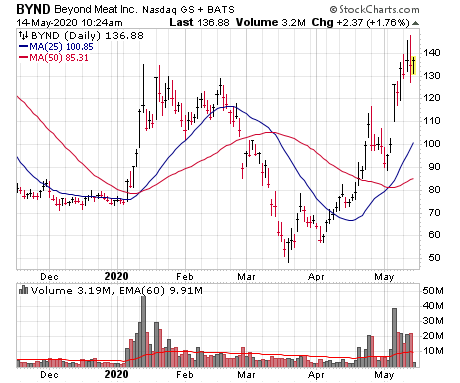

Earnings Gap #3: Gap from Near the Bottom – Beyond Meat (BYND)

These situations can be lucrative, but are a bit more like lottery tickets than other earnings gaps. Beyond Meat (BYND) fell from a high of 240 (!) back in July of last year all the way to a low of 48 when the market crashed; even after a solid rally, the stock was hanging around the century mark before earnings, no higher than it was two, four and six months beforehand.

But then earnings came out and the stock went nuts—it rallied 26% on the day and has continued to motor higher since.

Interpretation: These situations usually aren’t reliable—but I will say that, when they work, they tend to do great. Thus, if you’re familiar with the company, really like the story and see the gap, you can consider starting small and adding more shares if the stock heads higher. Just realize that, since these stocks are usually still in overall downtrends, many will stall out or fall apart soon after the gap.

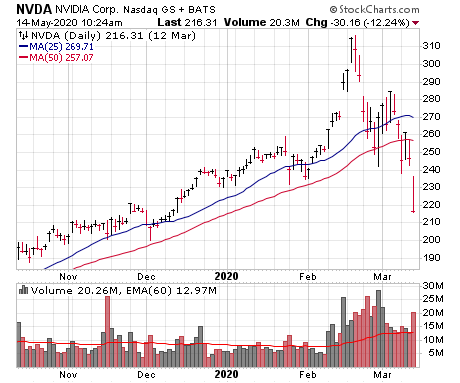

Earnings Gap #4: Gap after an Extended Run – Nvidia (NVDA) from February

Like I wrote in the intro, the market is there to fool investors, and this is a good example. There aren’t many stocks with extended runs nowadays, so let’s go back a few months. Here’s Nvidia (NVDA) from back in February—you can see that the stock was trending higher along its 50-day line for a few months, then started to accelerate higher. The earnings move itself wasn’t the biggest ever (up 7%), but it led to a few days of straight-up action.

Interpretation: Ironically, while most earnings gaps portend good things, this situation is often bearish—it’s a matter of it being too good to be true. Usually if a stock has been running for five or six months and then gaps up, it’s a good time to take at least partial profits, or trail a tight stop.

[author_ad]