Stock buybacks slowed to a crawl in the second quarter. But that didn’t stop the Oracle of Omaha repurchasing a record amount of BRK shares. What does he know?

Warren Buffett announced that Berkshire Hathaway (BRK-B) had repurchased $5.1 billion of its own stock in the second quarter, almost double the record $2.2 billion the company bought back in the fourth quarter of 2019. During the quarter, Buffett also sold more than $13 billion in stocks he owns, mostly airline stocks.

Buffett’s stock buybacks are interesting during this time of rising stock prices. Last year, Fortuna Advisors reported that the 364 public companies with the largest-volume stock repurchase programs “spent an all-time high of more than $3 trillion on those programs during the five-year period ending in 2019.” That followed $770 billion in buybacks in 2018, that was widely thought to be the result of the 2017 Tax Cuts and Jobs Act, which encouraged companies to bring back to the U.S. funds that they had held overseas.

[text_ad]

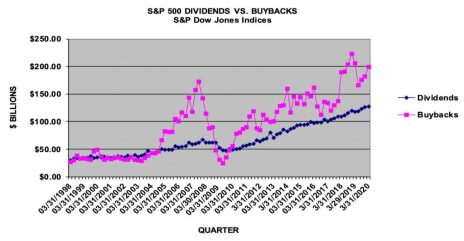

However, 2020 has been another story. You can see in the following graph, that both dividends and stock buybacks have risen pretty steadily—up through the first quarter of this year.

In the first quarter of this year, share buybacks were alive and well, totaling $198.7 billion, down 3.4% from Q12019. The buybacks for S&P 500 companies by sector:

- Technology: 29.8%

- Financials: 23.5%

- Health Care: 10.5%

- Industrials: 10.4%

And there have been some pretty large buybacks. Here are a few examples, with most occurring in the first quarter:

| Company | Date | % | Amount |

| 3/12/2020 | 9.8% | $15 billion |

| 2/4/2020 | 15.4% | $10 billion |

| 1/28/2020 | 17.4% | $5 billion |

Cognizant Technology Solutions

| 2/5/2020 | 5.8% | $2 billion |

| 3/3/2020 | 7.7% | $2 billion |

| 7/14/2020 | 7.8% | $2 billion |

| 3/12/2020 | 12.7% | $1.6 billion |

| 1/28/2020 | 14.1% | $1 billion |

| 2/5/2020 | 3.2% | $1 billion |

Source: MarketBeat.com

But stock buybacks have come to an almost-screeching halt since the first three months of the year. According to Informa Financial Intelligence, the coronavirus pandemic severely impacted stock repurchases, with more than one-third of companies in the Standard and Poor’s 500 Index suspending their buyback programs since the pandemic began. Notable companies that have suspended buybacks this year include McDonald’s, 3M, Intel, ConocoPhillips, Chevron, Best Buy, Starbucks, and Booking Holdings (owner of Priceline.com).

But because of the coronavirus impact on earnings, its’s expected that buybacks will average $50-$75 billion per quarter.

So, Why Should You Care about Stock Buybacks?

First, let’s talk about the definition of a buyback and why companies are compelled to repurchase their shares.

A buyback is when a company repurchases its own stock just like you and I would do—in the market. Investors like buybacks because they reduce the number of outstanding shares and also enhance the company’s per-share profitability measures, such as EPS, Return on Equity, and cash flow per share. Over time, those better ratios will often lead to higher share prices, adding to investors’ pocketbooks. And, the buyback isn’t taxed until the stockholder sells his shares.

As well, following a buyback, it’s not unusual for a company to increase its dividend, and that gives shareholders a further bonus.

From a corporate standpoint, buybacks are optional, but are often done for two reasons:

- The company has excess cash. If excess cash is the impetus, the company has the choice of what to do with its extra cash—it is not obligated to repurchase shares. It can just plow the money back into the company.

- Its share price—in its estimation—is cheap. If the company’s C-suite thinks the shares are undervalued, they may use buybacks as a way to (hopefully) improve the share price.

The timing of a buyback is also important. Companies want their buybacks to look like a show of strength—confidence in the company’s future. And while share prices can—and often do—rise after a buyback, if, for some reason, they took a dive, the buyback may be considered a failure.

And if the shareholders believe the company should be investing its excess cash back into the growth of the company instead of repurchasing shares, the buyback could backfire.

There are some disadvantages of a stock buyback:

- The company doesn’t see a better use of its cash, such as buying the competition or investing in new products or technology. That may raise some questions as to the company’s confidence in future growth—and for investors, appreciation of their stock.

- The buyback process can be time-consuming and expensive, as a company must provide stock exchanges and regulators reams of disclosures, and usually, it also has to hire investment bankers.

So, as I said earlier, it’s pretty interesting that in the midst of the pandemic, with declining earnings (for most companies) and rising share prices, that Buffett decided to buy back stock. I can only assume that he wants to do something with Berkshire’s cash, and that he thinks the opportunities presented to him for investment in other companies just look too rich right now.

A buyback—or lack thereof—is not the primary reason to buy or sell a stock. Further investigation is always needed. Before COVID-19, companies had lots of cash, as earnings had been on a trek upward. But now, conservation of that cash during a challenging period for earnings is of prime importance.

Consequently, a big buyback like Berkshire’s should raise questions. I’m betting that Buffett is rewarding his shareholders by sharing the company’s cash, and is biding his time for the next market downturn, when he can gobble up some more companies to add to Berkshire’s coffers.

[author_ad]