Many of us join businesses without understanding the full picture of the company. Great companies share similar defining qualities that reflect a higher propensity for long-term success. Understanding these patterns can be extremely useful for both investors and active working professionals seeking their next job opportunity. Simply put, what key indicators stand out to help identify great companies?

This brief framework will help you to understand the basics, while exerting less mental energy than you expect, and all the resources you need to conduct this exercise are free and online.

Doing this can help you to de-risk your investments and identify great places to work – unlocking personal mobility, expanding your “opportunity surface area” and providing a better framework for financial empowerment.

[text_ad]

Once you identify great companies through these simple ways, it will be hard to turn back and view the world the same way.

Brief disclaimer: I have no sponsorship or affiliation with any of the companies or websites provided in this article.

5 Steps to Identify Great Companies

- Research the Founder or Co-Founders

Focus on longevity and track record. Have the founders successfully exited a previous enterprise? If not, how long have they been involved in their current business? Watch brief videos to get a sense of how they think and answer questions. Try to understand their ethos and motivation.

Also ask yourself: Do they still hold substantial equity in the business that they created? That gives you a window into whether the fate of their own personal success is well aligned with the success of the organization, and shows you how much they still believe in the business. For public companies you can find this on Yahoo Finance. I’ll elaborate further below.

- Look at the Investor Base

Who is supporting the company? What is their investment track record? I caveat this by saying don’t borrow conviction. Just because large investors own stock does not mean it will be a good investment, but information is the only advantage you have when making investment decisions.

One tool to use for looking at company ownership is Whale Wisdom, which is free to use for what most people need. Another great tool here is simply Yahoo Finance. Go to the “Holders” tab on the top right section of each individual stock page. Here you can see Warren Buffett’s Berkshire Hathaway is the third largest holder of Apple (AAPL) stock.

It’s not a perfect indicator of future success but who wouldn’t sleep better at night knowing you own the same stocks as WB (not to be confused with /WallStreetBets)?

For private company info or start-ups, check out TechCrunch and company press releases. Skim for these at least 10 minutes per day!

Pick a few companies in an area of your interest and track them over their lifecycle. Are they raising larger amounts of money? If so, they’re going to be hiring …

This process helps you to start with a better understanding of the business if they end up going public through an IPO.

- Purpose & Business Model

Understanding how the business makes money is foundational to making an investment. It should be straightforward what the company does; on the surface all the best companies keep it simple by design. They should be articulating their value proposition clearly.

Is the company B2B or B2C? Does the company sell products or services to us everyday people (B2C), or to other businesses (B2B)?

B2C = Tesla, Yeti, Lululemon, Meta Platforms, Tik-Tok (All are consumer facing; Meta & Tik-Tok are a little different because they offer businesses a monetizable user base and are therefore desirable as an advertising platform).

B2B = Salesforce, Investment Banks, Oracle, Nvidia (All are positioned to mainly serve other businesses. Enterprise software is known to be sticky and can be difficult to rip out once adopted).

The truth is many of the best companies have incorporated some elements of the best of both worlds.

- Revenue & Profitability

Focus on two line items: revenue and income from operations. This information must be readily disclosed by public companies.

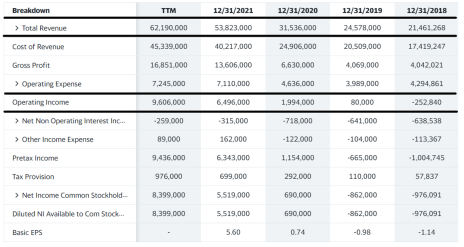

Here is Tesla’s Income Statement:

Reading from right to left, you see that both revenue and operating income have increased significantly from 2018 to 2022 (TTM or LTM means the prior 12 months).

You didn’t have to be reading the tea leaves to see that since 2018-2019, Tesla (TSLA) has generated an operating profit, flipping from a loss of $252 million to a gain of $80 million.

This event served as a massive catalyst for Tesla’s share price.

Check out:

Below is a chart of TSLA’s stock price since the above Q3 2019 earnings were released in late October of 2019:

Look at where the TSLA began to take off. It was only after they started to generate positive free cash flow from operations.

Why is this important? Many companies in their early years spend aggressively to grow, pouring money into things like sales and marketing to “get big” fast. Yet, in the eyes of public market investors, this is riskier, because profits will not be generated until a future date (if ever).

When a company goes from generating negative operating income to positive cash flow, this is an asymmetric opportunity!

- Talk to people who work there and look for patterns in daily life that demonstrate increasing adoption of the product or service

Peter Lynch, famed portfolio manager of the Fidelity Magellan fund, invested in Dunkin’ Brands (taken private on November 2020) after seeing firsthand the lines outside the door of his local Dunkin’ Donuts growing longer, exemplifying user adoption.

Similarly, simply observing the number of Teslas and Amazon delivery trucks on the road is a good indicator to research the company and consider investing.

To identify great companies, sometimes the easiest way is to just look at the world around you.

How do you identify great companies? Anything we didn’t list above? Tell us about your methods in the comments below.

[author_ad]