The Coronavirus Continues to Spread. Should You Be Worried it Might Infect Your Portfolio? Here’s What a History of Global Epidemics and the Stock Market Tells Us.

There is a long list of worries for investors in 2020, including known events such as the Presidential Election and a global economy not yet firing on all cylinders. Now, two unexpected worries have popped up already in January, as traders had to digest a potential war with Iran and the coronavirus spreading from China to the rest of the globe.

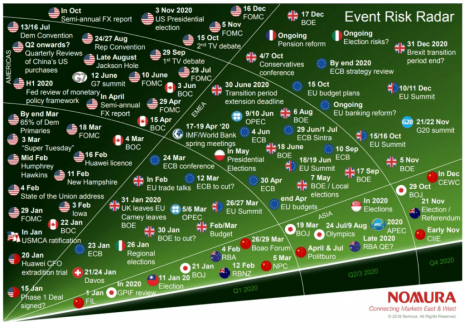

Nomura, a Japan-based financial services group, broke down the “known” Event Risk for 2020 in the graphic below:

As you can see, there are plenty of known events to worry about!

[text_ad use_post='192826']

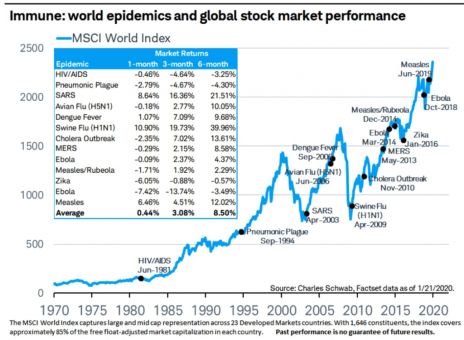

And with the “unknown” coronavirus garnering plenty of investor angst, Charles Schwab looked back at global stock market performance following previous epidemics.

This year’s worries are no different than in years past, as there is ALWAYS a lot to worry about. Think back to last year, when traders were constantly on alert for the next tweet surrounding the U.S.-China trade war. There was also the inverted yield curve and a presidential impeachment trial.

And yet, despite those worries, and some short-term bumps in the road, the market kept making new all-time highs. I thought this cartoon that plays on a popular meme did the best job of summing up 2019:

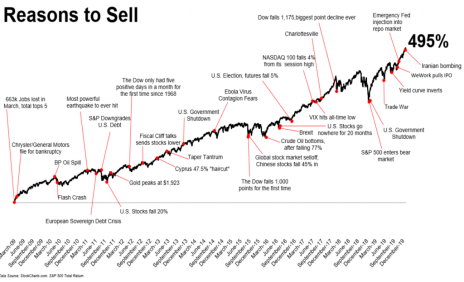

By no means was last year the only year in which traders have wrestled with short-term concerns and shocks to the markets; @michaelbatnick on twitter put together this look back at the past decade’s wall of worries, and how the market responded in the short and longer term.

As you can see, selling on these worries and dips would have been a big mistake as the market rebounded every time and soon established new all-time highs.

And while stocks have gone nearly straight up for the past several months, and we may be due for a stock market pullback, if you are bullish on the market longer term, you can use call options to get exposure to a continued S&P 500 advance.

For example, with the S&P 500 ETF (SPY) trading at 327, you could buy the SPY January 330 strike call (expiring 1/15/2021) for $18. This is a bullish position that gives you bullish exposure to the market through January 2021. And what makes this trade so appealing is that this call buy has limited downside as the most you can possibly lose on the trade is $1,800 per call purchased if the market declines in 2020.

Or longer term, you could buy the SPY January 330 strike call (expiring 1/21/2022) for $28. This trade would buy you TWO years of bullish exposure to the market, and the most you can possibly lose on this trade is $2,800 per call purchased.

Will there be bumps in the road in 2020? For sure! No market goes straight up forever. That being said, if we can block out the short-term noise, and stick to our well defined Cabot investing systems, 2020 has the potential to be another banner year for your portfolio.

[author_ad]