Four days was all it took for FTX and its well-known founder Sam Bankman-Fried (SBF) to go from a white knight riding in to save distressed crypto firms to one of the biggest villains in the space. Much of the coverage of what happened to FTX has focused on the optics around SBF and his cadre of inexperienced “effective altruists” that were responsible for in the neighborhood of $15 billion of customer assets (with an estimated range of $10-50 billion in industry losses depending on how leverage was stacked and how much contagion there has been).

Fortune, as an example, has written articles detailing SBF’s lavish lifestyle, while Forbes has profiled Alameda CEO Caroline Ellison as “a math whiz who loves Harry Potter and taking big risks” (in fairness to Forbes, they have also written appropriately critical coverage of the frequently maligned SEC Chair Gary Gensler, who had a ringside seat to the debacle). Other coverage has touched on various allegations around extensive stimulant use, the personal relations between a group of 10 or so insiders that serially dated one another, and the impact on SBF’s charitable endeavors or political contributions.

[text_ad]

What is often left out of coverage is the prospective impact to somewhere in the neighborhood of one million investors that had assets on the FTX exchange, the multitude of other crypto firms that are asking for bailouts, and the absolute absence of any oversight of the firms’ practices.

We’ll dive deeper into these failures, but I’d like to allow the new CEO John J. Ray III to explain what happened to FTX in his own words, from the firm’s bankruptcy filing:

“4. I have over 40 years of legal and restructuring experience. I have been the

Chief Restructuring Officer or Chief Executive Officer in several of the largest corporate failures

in history. I have supervised situations involving allegations of criminal activity and

malfeasance (Enron). I have supervised situations involving novel financial structures (Enron

and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas

Shipholding). Nearly every situation in which I have been involved has been characterized by

defects of some sort in internal controls, regulatory compliance, human resources and systems

integrity.

“5. Never in my career have I seen such a complete failure of corporate

controls and such a complete absence of trustworthy financial information as occurred here.

From compromised systems integrity and faulty regulatory oversight abroad, to the concentration

of control in the hands of a very small group of inexperienced, unsophisticated and potentially

compromised individuals, this situation is unprecedented.”

That is the man who oversaw the dissolution of Enron saying that, in his opinion, Enron had better corporate controls and more trustworthy financial information than FTX. The full filing is only 30 pages and I recommend reading it (and this who’s who from Yahoo Finance) if you’re interested in delving deeper.

To wit, the bankruptcy filing alleges that the firms’ “approach to human resources combined employees of various entities and outside contractors, with unclear records and lines of responsibility” and that record-keeping practices were so bad that they’ve “been unable to prepare a complete list of who worked for the FTX Group.”

The filing is replete with these types of basic failures.

What is clear is that as sophisticated as some of these investments may have been, the oversight and controls were anything but.

In fact, and we’ll get back to this later, in a text exchange with a reporter from Vox, SBF revealed that backers and lenders would send money to Alameda Research to fund their investments in or with FTX because “FTX doesn’t have a bank account, I guess people can wire to Alameda’s to get money on FTX.”

In the same exchange, SBF seems to tacitly admit that that practice may have been going on for years. That’s not just commingling customer assets with firm assets, that’s assets being spread between multiple ostensibly distinct firms, one of which is an exchange and the other a trading desk.

There are potentially incestuous relationships between more than 100 affiliated firms, but the failure point appears to have been the trading/liquidity losses of Alameda and the use of customer deposits at FTX.

Alameda and FTX

Alameda was founded by SBF in 2017 and began its life as an arbitrage player that would take advantage of price discrepancies in tokens on various exchanges globally. The generally accepted picture is that Alameda was initially a successful trading house, although reports have recently emerged that they carried forward as much as $3.7 billion in net operating losses to start 2022.

The early success of Alameda led SBF to launch FTX in 2019. The firm was at one point the third-largest cryptocurrency exchange in the world and, as recently as January 2022, was raising venture capital (VC) funding to the tune of $400 million, giving the company a $32 billion valuation.

In fact, as recently as July and September, FTX was using its own apparent position of strength to bail out failing firms BlockFi and Voyager Digital. The Voyager Digital rescue package has since fallen apart due to FTX’s own insolvency, and there are credible allegations that the BlockFi “rescue” was a cheap ploy to gain access to customer deposits to further cover Alameda trading losses.

If the story ended there it would be one of young, inexperienced traders that got in over their heads in the midst of a four-year bull run that saw the price of Bitcoin rise 1,100% before crashing to earth. But it doesn’t.

Losses Piling Up

What happened to FTX next is probably a question for a criminal court, but evidence is emerging that the crypto crash hit Alameda hard. In the aforementioned text exchange, SBF admits that FTX and Alameda were caught up in the collapse of Luna/Terra (although that doesn’t explain the carry-forward loss), and CEO Caroline Ellison admitted in a company meeting that she, SBF, and at least two other company executives decided to use customer deposits to cover Alameda shortfalls.

What is unclear, given the information we have now, is when it began and who was in charge at the time. Ellison was appointed co-CEO of Alameda alongside Sam Trabucco in October 2021, when SBF decided to put a gap between FTX and Alameda. Ellison took on the full role of CEO when Trabucco left the firm in August of 2022.

To reiterate, at that time, FTX was still winning the “confidence game.” It was seen as a crypto savior coming to the rescue of exchanges/firms/investors that had overleveraged or been caught up in other highly visible collapses like 3AC.

But under the hood, Alameda was likely losing a lot of liquidity, either from racking up trading losses or from using credit/liquidity/customer funds to bail out highly illiquid crypto startups. Trading liquidity for illiquid assets is not a problem if you don’t need immediate liquidity; ethically it’s no different from you or me investing in a one-year CD. It is a problem if your liquidity needs are mismatched with your maturities. It’s doubly a problem if you’re locking up customer funds. It’s a catastrophe if you lose investor confidence.

The Cracks Begin to Show

Much of what happened to FTX next is a whirlwind of veiled threats and Twitter fights between SBF and Changpeng Zhao (or “CZ” as he’s known colloquially), an initial investor in FTX and a polarizing figure in his own right. Whether CZ had ulterior motives in questioning the solvency of FTX, SBF’s intentions, or the strength of the FTT token (FTX’s native token for the exchange) is something only CZ can answer, but their public spat set the backdrop for what would become the first domino to fall.

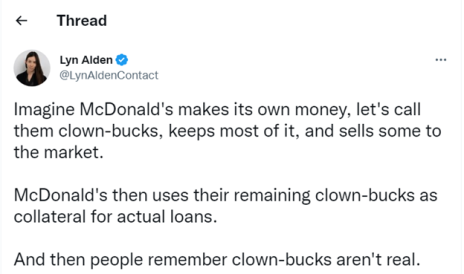

On November 2, CoinDesk reported that a disproportionate amount of the assets collateralizing Alameda’s debts to FTX (and possibly others) were FTX’s own FTT tokens. I’ll allow @LynAldenContact to explain why that’s a problem:

The tweet was accompanied by the following chart from November 8 (the bounce from 15 to 19 was on the heels of a possible but ultimately unpursued bailout by Binance):

In essence, FTX/Alameda was treating the FTT token (a token which had no practical liquidity apart from FTX buying it back to “burn” as a way of accreting exchange fees) as a valuable and liquid asset that it could sell (or use as collateral) at its fully diluted cap despite there being no material buyers apart from FTX/Alameda and not nearly enough of a market to support the sale of those volumes.

SBF claimed $10 billion in reserves between the FTT token and a second token SRM (which is another incestuous asset) in the negligently unsophisticated balance sheet for FTX, which you can view in the Financial Times here. The bankruptcy filings value all liquid cryptocurrency holdings at only one tenth of that.

Losing the “Confidence Game”

The price chart above is effectively a bank run in real-time (a bank run should be impossible for an exchange that should not be borrowing customer assets at all, but that’s another story). It was a signal that SBF/Alameda/FTX had lost the “confidence game.” FTX depositors pulled billions in assets and FTT token holders sold at whatever price they could get.

I do hope you’ll note, and this is particularly important, that at no point did the cryptographic properties of cryptocurrencies even come into play here. What happened to FTX was entirely a failure of unregulated trading at an exchange that was, due to lack of regulatory guidance in the U.S., incentivized to set up shop in a place and manner that had no regulatory controls or enforcement mechanisms.

This is the story of Ponzi, Madoff, Lehman, Enron, or any other malfeasant lending/earning scheme with a crypto haircut.

What Happened to FTX After the Fall?

What happened next was incredibly chaotic. SBF lost $15 billion of his net worth essentially overnight. The FTT token traded as low as 2 in the days that followed and has since traded to the 1.30 range (where it’s still being propped up by speculators but should be considered a total loss). Untold numbers of crypto founders that deposited working capital with FTX are resigned to the ranks of unsecured creditors alongside a million individual depositors that will likely lose hundreds or thousands or more as this bankruptcy grinds ahead over months and years.

In the immediate aftermath, an unidentified party moved approximately $400 million off the FTX exchange. It has been attributed to a hack, a rogue employee with backdoor access, and the Bahamian government (where FTX was operating) among others.

SBF and other executives are not in custody but are being observed by Bahamian authorities and at least one criminal investigation has been opened in New York.

Contagion has spread to some degree, especially among those that were unfortunate enough to be bought or “rescued” by FTX, and several crypto exchanges are actively seeking bailouts or further capitalization.

What to Do Now?

If you are invested in crypto, now would be a good time to consider learning self-custody and avoiding centralized exchanges entirely. If forced to use a custodian, use a publicly traded company that is subject to regulatory oversight and robust accounting standards. Coinbase, despite its recent stock performance, is a better option than an exchange like Kraken, which is subject only to voluntary disclosures (although firms like Binance are making strong pushes for publishing proof of reserves as well).

A mantra that is often cited by the Bitcoin community, which has had any number of exchange failures, Mt. Gox most notably, is “not your keys, not your coins.” Which translates to, get your own hardware or software wallet and custody your own on-chain assets.

The question I’m left with is, could this have been prevented? The answer is a resounding yes. A bare minimum of due diligence by “sophisticated” VC firms should have prevented FTX from ever growing to the size it did. Their absolute failures with accounting for assets (see the “balance sheet” above), their terrible business practices, and the fact that, to make an investment with them, early backers may have had to wire money to a completely different company, are significant red flags.

But like the red flags from any scam, these are most clearly visible in hindsight, when the haze of greed, exuberance and FOMO have cleared.

[author_ad]