The combination of a strong year in the equity markets (Dow up about 15%, Nasdaq up 35.8% and S&P up 27.5% YTD) and some challenging and choppy action of late has likely led a lot of investors to book some profits at the end of the year.

Unfortunately, booking profits means you’ll be dealing with short- or long-term capital gains depending on your holding period.

The end of the year is our last chance to potentially offset those gains and is always a good time for us to take stock of our finances, assessing how well we did during the year managing our income and expenses—and most importantly—how we can keep more of our money and give less to Uncle Sam. Consequently, these five tips for reducing your investment taxes are designed to help you do just that.

[text_ad]

Five Tricks to Reduce Your Investment Taxes

Tax Harvesting. This strategy (aka tax loss harvesting) helps to offset your capital gains with capital losses when you do your investment taxes. Essentially, you’ll sell your losers to reduce the tax hit that is incurred when you sell your winners. If you have held on to a stock that just hasn’t performed as you anticipated, or you want to rebalance your portfolio, now is the time to cut your losses and sell the losers for a possible tax advantage.

Loss Carry-Forwards to Offset Ordinary Income. In the same vein, if you are holding a portfolio with several losing stocks, and the rest of your portfolio has given you some very nice gains, you may decide to “bite the bullet” and unload all the nonperformers. The IRS allows you to offset ordinary income by using up to $3,000 of your excess loss. And if you have more losses than $3,000, you may carry them forward in future years. But please remember the IRS wash sale rule, which requires that you wait 30 days after selling a losing stock before you can buy it back at the discounted price.

Don’t Trade as Much. Every time you cash in a stock for a profit, you generate a capital gain. If you hold a stock for less than a year, you will be socked with a short-term gain, taxed as ordinary income. But if you keep it for longer than a year, your gain will be taxed at the lesser capital gains rate. The long-term capital gains tax rate will be either 0%, 15% or 20%. The rate you’re subject to will depend on your income for the year.

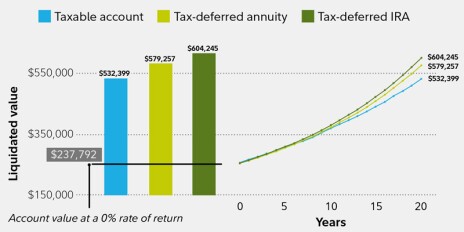

Take Advantage of Tax-Deferred Accounts. As you are well aware, investing in tax-deferred accounts, such as a 401(k), 403(b), a SEP plan (for business owners) or an IRA allows you to stockpile your savings and defer payment of taxes on your dividends, interest or capital gains until you withdraw money from the account.

The following graph from Fidelity.com compares the tax savings of placing a $250,000 bond in a taxable account vs. a tax-deferred annuity and a tax-deferred IRA. It’s a pretty significant difference!

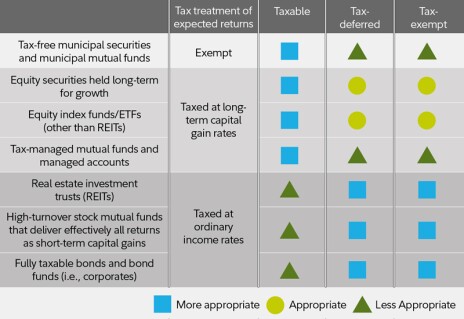

Make Sure Your Assets Are Allocated to the Right Accounts for Tax Efficiency. Your investments that generate the highest taxable income—assets such as high-turnover mutual funds or Real Estate Investment Trusts, and taxable bonds—may be best-suited for accounts that provide tax advantages, such as 401(k)s and IRAs. Alternatively, assets like munis, stock index ETFs, and long-term equity holdings—where taxes are minimized—would be better served in a taxable account.

The following chart, also from Fidelity, explains the tax treatment of various investment vehicles, and how they may be treated if held in taxable, tax-deferred, or tax-exempt plans.

I hope these ideas for how to minimize your investment taxes help you hold on to more of your hard-earned money. As you can see, it pays to plan—not just your investing strategy, but also how to maximize the tax savings on that strategy.

[author_ad]

*This post is periodically updated to reflect market conditions.