In his latest annual letter to his Berkshire Hathaway shareholders, super investor Warren Buffett said, “Berkshire will always be building,” and that bodes well for some energy names as well as a few clean energy ETFs.

We know that’s true as since he bought Berkshire in 1965, he has assembled a diverse group of more than 70 companies in the Berkshire portfolio, as well as partial ownership in hundreds more.

Buffett built his reputation by buying companies that he believed were undervalued, in terms of today’s numbers. And with a 20% annual return over those 57 years—just like the old commercial said, “When E.F. Hutton talks, people listen,” I feel the same way about Buffett. When he buys into a new stock or sector, my ears are wide open.

[text_ad]

So, when he mentioned that energy—that is, Berkshire Hathaway Energy (Energy)—in his annual report, I took note. He said Energy was Berkshire’s fourth “giant” investment engine, after its investments in Apple (AAPL), BNSF Railway, and National Indemnity, the company’s property and casualty insurance business, the latter two being private companies.

Buffett bought Energy in 2000, a time when it had little or no clean energy investments. That has changed dramatically, with Buffett saying the company’s income has grown by 30 times since its acquisition, mostly due to clean energy projects, primarily in wind and solar transmissions in the U.S.

As of the end of 2021, Energy had invested $6.7 billion in solar projects, two of which are among the largest projects in the U.S. In California, Energy’s Renewables segment plans to complete a demonstration project to produce battery-grade lithium carbonate planned to be online in spring 2023, with construction of the first commercial plant beginning as soon as 2024. And the company also has significant investments in wind and geothermal energy projects.

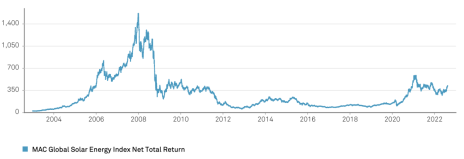

What caught my eye is Buffett’s investment in solar. In the past few years, solar stocks have mostly gone sideways, as you can see in the following chart of the MAC Global Solar Energy Index (SUNIDX), although they recently have picked up a little momentum.

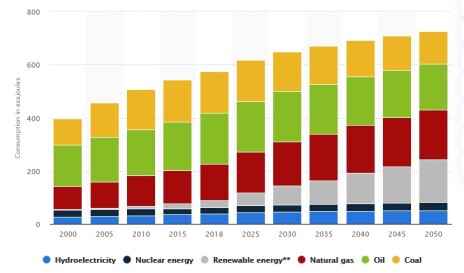

Supply chain disruptions have slowed the growth of renewable energy in the U.S. since COVID. And trade policy uncertainty and rising inflation have also hurt the industry. However, renewable experts are predicting that growth in 2023 will pick up, as a result of clean energy incentives and tax credits in the Inflation Reduction Act (IRA), as well as growing demand. Here’s the current forecast for the expansion of clean energy into 2050.

Source: https://www.poems.com.sg/

I like what Buffett is buying, but the price of Berkshire Hathaway stock—at $472,115.00 is outside my reach, so I decided to “go shopping” for some solar ideas.

As in any industry in which I feel like I know just enough to hurt myself, I tend to stay away from individual stocks—just too speculative for me.

That’s why I decided to take a look at the clean energy ETFs, as their diversification among companies will somewhat limit my risk.

I reviewed about 10 renewable energy ETFs, focusing primarily on solar, and came up with three that I think are worth considering.

3 Clean Energy ETFs Worth Considering

| Company/Symbol | Price ($) | Expense Ratio (%) | Analyst Rating |

Invesco Solar ETF (TAN) | 81.70 | 0.69 | Strong Buy |

iShares Global Clean Energy ETF (ICLN) | 20.82 | 0.40 | Strong Buy |

Invesco Global Clean Energy ETF (PBD) | 21.66 | 0.75 | Buy |

Following are the top 10 holdings of each ETF:

Invesco Solar ETF (TAN)

| Name | Symbol | % Assets |

| Enphase Energy Inc | ENPH | 11.34% |

| SolarEdge Technologies Inc | SEDG | 10.01% |

| Sunrun Inc | RUN | 7.18% |

| Xinyi Solar Holdings Ltd | 968 | 6.88% |

| First Solar Inc | FSLR | 6.21% |

| Daqo New Energy Corp ADR | DQ | 3.53% |

| Shoals Technologies Group Inc | SHLS | 2.93% |

| GCL-Poly Energy Holdings Ltd | 3800 | 2.63% |

| Hanwha Solutions Corp | 009830.KS | 2.61% |

| Sunnova Energy International Inc | NOVA | 2.56% |

iShares Global Clean Energy ETF (ICLN)

| Name | Symbol | % Assets |

| Enphase Energy Inc | ENPH | 11.20% |

| First Solar Inc | FSLR | 6.21% |

| SolarEdge Technologies Inc | SEDG | 6.07% |

| Vestas Wind Systems A/S | VWS | 5.50% |

| Consolidated Edison Inc | ED | 5.43% |

| Plug Power Inc | PLUG | 5.18% |

| NextEra Energy Inc | NEE | 4.29% |

| Xcel Energy Inc | XEL | 4.18% |

| Enel SpA | ENEL.MI | 4.02% |

| Iberdrola SA | IBE.BC | 3.96% |

Invesco Global Clean Energy ETF (PBD)

| Name | Symbol | % Assets |

| Ganfeng Lithium Co Ltd | 1772 | 1.21% |

| Ecopro BM Co Ltd Ordinary Shares | 247540.KS | 1.15% |

| SK Ie Technology Co Ltd | 361610.KS | 1.15% |

| Solarpack Corp Tecnologica SA | SPK.BC | 1.11% |

| West Holdings Corp | 1407 | 1.07% |

| JinkoSolar Holding Co Ltd ADR | JKS | 1.04% |

| RENOVA Inc | 9519 | 1.04% |

| Flat Glass Group Co Ltd Shs -H- Reg S | 6865 | 1.02% |

| Enphase Energy Inc | ENPH | 0.99% |

| Nordex SE | NDX1.DE | 0.97% |

As you can see, there are quite a few foreign stocks held in each of these ETFs, which tends to make them more speculative. So, please review each holding carefully to decide if any of these ETFs match your personal investing strategy and risk profile. And if so, may your investing days become increasingly sunny!

[author_ad]