The massive climate change program signed by the president provides a lot of support for Greentech stocks. Among its more than $360 billion in climate funding is some $60 billion for domestic solar panel and wind turbine manufacturing, a $7,500 tax credit for new EVs and a $4,000 tax credit for buying a used EV. That’s let the Greentech bulls free to run out of their pen, as I described in a recent post.

While the bill’s great for Greentech stocks now and in the immediate future, it also provides funding for some exciting technologies that are a little further down the line. To me, the most exciting is support for superhot rock energy. In addition to having a great name, superhot rock is, like nuclear fusion, a holy grail technology. If successfully developed it could provide cheap, unlimited carbon-free power.

Superhot rock is geothermal energy to the max. Today’s geothermal energy plants take advantage of the relative nearness of hot spots to the Earth’s surface, usually in volcanic regions, in which the hotter rocks below are able to heat water for providing heat and electricity on the surface. In a geothermal system for your house, the wells are anywhere from 150 to 400 feet deep. Utility-scale geothermal plants can go deeper, as much as about 1.5 miles down, but usually are constructed with shorter wells to reach water that has moved close to the surface from the depths where it was heated.

[text_ad]

Superhot rock systems aim to drill from a minimum of two miles deep to as much as 13 miles into the Earth’s crust. There, superhot crystalline basement rock is found at temperatures of 400 degrees Celsius. The water is so hot in these formations that it has the qualities of both a liquid and a gas and, in a method somewhat like fracking rock for oil, allows water injected from the surface to pass through it quickly and get so hot it carries much more energy than current geothermal systems. At the surface, the steam powers turbines to make electricity.

According to the Clean Air Task Force, a group that has been advocating for superhot rock for years, a test in Iceland demonstrated a superhot rock well could generate 36 megawatts (MW) of energy at the surface, compared to about 6 MW for a geothermal well. That means a superhot rock plant could require one-tenth the land use and one-tenth the water use of traditional geothermal, according to AltaRock, a private Oregon company founded to pursue the technology. Beyond electricity generation, at such a scale the plants could also be used to create cost-effective green hydrogen – green being a term for hydrogen produced from carbon-free operations. Once mature, the levelized cost of energy for superhot rock energy could be around $30 a megawatt hour. By comparison, utility-scale solar is the cheapest source of electricity with a levelized cost of $36 a megawatt hour, according to data compiled by Lazard Freres.

The science of the idea is firm, so the challenges to make this come true are largely technical – mainly the tech know-how to reliable drill so deep, into very hot temperatures. Potentially, such plants could provide half the world’s energy needs, once the deepest part of the drilling range is achievable.

3 Reformed Greentech Stocks with Exposure to Superhot Rock

As with any emerging technology, investing in this idea isn’t simple – there aren’t any pure-play superhot rock Greentech stocks that are publicly traded. But there are a handful of established businesses that seem promising. Nabors Industries (NBR) is a specialist in drilling and equipment. It mainly serves the oil and gas industry today – and its shares have been in a protracted downtrend since 2008 because of it. But management recognizes the future is in Greentech and sees being a part of the shift to clean energy as a pillar of its business model. It’s developing business lines in hydrogen and carbon capture, and, more significantly, sees geothermal as a natural extension of its drilling expertise. Nabors has been investing in the Greentech ecosystem including this spring buying a stake in a Slovakian company, GA Drilling, that has a special drill bit designed for superhot rock environments. Nabors is on the smaller side of Greentech stocks, with a $1.1 billion market cap and shares are a long way from their all-time high of $2,109 (the result of a 50-for-1 reverse split), but after bottoming out of a 12-year long downtrend in 2020, shares are trading just below key moving averages and working on establishing an uptrend.

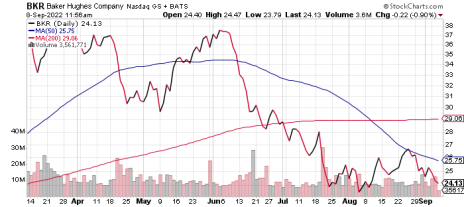

Another option is the much larger ($25 billion market cap) Baker Hughes (BKR). It’s another company that has lived off of drilling expertise for the oil and gas industries and sees a way for its abilities to transfer to Greentech. Lately, it’s working with AltaRock to develop the first superhot rock plants in the U.S., at Newberry Volcano in Oregon. They have to drill about 2.5 miles down to get to superhot rock there, which will be a crucial learning experience for techniques and equipment. Like with Nabors, Baker Hughes shares are well off their fracking-fed glory days of the late 2000s, but are above August lows and fighting to establish a solid bottom.

Perhaps the best candidate to explore superhot rock is Ormat Technologies (ORA). It’s a U.S.-based developer of geothermal plants that owns 910MW of geothermal around the world. Ormat’s been a reliable, if slow, grower for many years. Lately, management seems to recognize it should quicken its growth pace, vowing to raise total renewable energy and storage capacity to where sales could double to $1.15 billion by 2026. Ormat hasn’t announced projects into superhot rock, but the business has the experience developing and operating geothermal successfully, so it would be a surprise if it doesn’t end up a player.

Subscribers to Cabot SX Greentech Advisor, of which I’m editor and Chief Analyst, bought Ormat at the start of August and we’re enjoying a 10% gain already. Shares are just off all-time highs and I still consider them a strong buy.

[author_ad]