California-based QuantumScape (QS) is an EV battery stock that has taken a beating over the last two years but is still working on some breakthrough electric vehicle battery technology backed by some heavyweight industrialists as well as Volkswagen (VWAGY).

Current lithium-ion batteries are heavy, expensive to produce, don’t last all that long and take considerable time to recharge. QuantumScape believes they will eventually be rendered obsolete by solid-state batteries.

Let me explain why, though this is all a bit technical. Lithium-ion batteries are made up of three layers: a positive cathode and a negative anode, each with an electrical contact, and between them is a porous polymer separator, and the whole cell is flooded by a liquid electrolyte.

In a QuantumScape solid-state battery, there is only a cathode connected to an electrical contact through a solid-state ceramic separator. No anodes needed.

In layman’s terms, this means more energy can be stored in a smaller space, giving QuantumScape’s battery greater energy density.

[text_ad]

Greater density means these batteries can achieve greater range, superior reliability and longer life than their lithium-ion cousins. In addition, they’re also capable of charging to 80% in as little as fifteen minutes, half the time the fastest Tesla Supercharger can charge in.

Even better, these batteries will be much cheaper than lithium-ion ones once production scales up because of fewer and cheaper materials.

The chief asset of QuantumScape is the backing of respected technologists such as co-founder Jagdeep Singh who was educated at Berkeley, and Stanford University. Tesla co-founder J.B. Straubel and venture capitalist John Doerr are on board as well.

You may recall that Doerr is famous for backing Google in 1999, turning a $12.5 million stake into $2 billion when Google went public. Bill Gates is also a prominent investor and is keenly interested in battery tech.

The next positive is the company’s partnership with Volkswagen (VWAGY), the largest automaker in the world and a big player in China where it sells about 40% of its vehicles. Volkswagen has partnered with QuantumScape for close to a decade, and in 2018, the company set up a joint venture to make solid-state batteries

In 2020, Volkswagen invested $300 million in QuantumScape, securing 20% equity ownership of the company. When Volkswagen’s QuantumScape batteries go operational, Volkswagen and its brands such as Audi, Porsche and Bentley could offer cars with 450 to 500-mile range batteries.

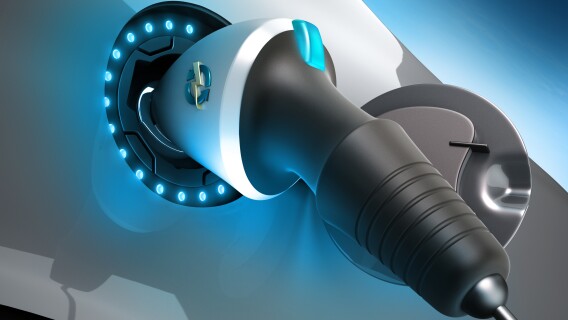

VW has hiked its planned investment in EV technologies to $86 billion over the next five years. Volkswagen also announced plans for a vast expansion in EV charging infrastructure. By 2025, it sees 18,000 public fast-charging points in Europe, a fivefold expansion from its coverage today. It’s also expanding public fast-charging networks in the U.S. and China.

QuantumScape’s stock price performance has been brutal - with shares down an incredible 97% since early December 2020.

But for aggressive investors looking for what Sir John Templeton referred to as the point of maximum pessimism, this stock could begin to turn in 2023.

The reason is that the investment community now fully realizes that the technology is years away from commercialization, so expectations are now low and realistic. Any progress will move the stock and the company still has $1.1 billion of cash to continue development and its partnership with VW provides some comfort.

To me the upside is greater than the downside, so a small position in this speculative stock makes sense for those that looking for breakthrough technologies as a play on the EV revolution.

[author_ad]