My investing advisory, Cabot Benjamin Graham Value Investor, recommends stocks based on the time-tested investment principles laid out by Benjamin Graham and David Dodd in their book, Security Analysis.

Value investors like Warren Buffett (who was a student of Benjamin Graham at Columbia University), Seth Klarman and Howard Marks have reaped the benefit of their time-tested principles and amassed billions of dollars.

On a smaller scale, my Benjamin Graham value investing strategy aims to do the same for my subscribers!

Cabot Benjamin Graham Value Investor presents an opportunity for investors, brokers and advisors to benefit from Graham’s principles without personally having to go through Graham’s rigorous investment approach.

My Value Investing Strategy

My value investing strategy is to find stocks that are undervalued and have the potential to grow in the long run. When I search for such stocks, I am broadly interested in two categories of stocks:

1) cheap stocks with visible growth prospects and

2) cheap stocks with invisible growth prospects.

[text_ad]

Before I elaborate on these two categories of stocks, let me borrow three key principles of investing from Benjamin Graham and Warren Buffett:

1) Benjamin Graham’s Intrinsic Value

Intrinsic value is an approximate estimate of how much a company is worth. The estimation of intrinsic value varies with the prevailing opportunity cost, which, in general, is related to the 10-year treasury bond yield. In periods of low interest rates, stocks which otherwise would appear to be expensive turn out to be inexpensive.

Intrinsic value may be determined by various means such as discounting future cash flows, valuing the underlying value of equity, valuation through a reasonable price-to-earnings estimate, calculating stocks trading under net current asset value, or a combination of all these techniques. In essence, the intrinsic value is a rough estimate to set a benchmark to determine if a stock is undervalued or overvalued.

2) Benjamin Graham’s Margin of Safety

A margin of safety is essentially a principle that calculates the downside risk based on a fundamental level. It gives ample cushion from imprecision, bad luck or analytical error while estimating intrinsic value.

Contrary to modern portfolio theory, which measures risk based on the volatility of historical stock price, Ben Graham’s approach is balanced between the downside risk of earnings, equity and price-to-earnings (P/E) ratio.

In other words, to reasonably estimate how low earnings would go from the current level, bankruptcy-related risks and the lowest foreseeable P/E ratio. In simple terms, an asset worth $100 and bought at $80 has a better Margin of Safety than the same asset bought at $95. Having these in mind, one may estimate the total downside risk associated with investing in the undervalued stocks.

“Ideally, considerably less. The bigger the discount, the bigger your margin of safety. Too small a discount and the limited margin of safety provides no real protection at all,” Seth Klarman wrote in the notes to The Most Important Thing Illuminated by Howard Marks.

3) Warren Buffett’s Circle of Competence

Tom Watson Sr., the founder of IBM, said, “I am no genius, I am smart in spots—but I stay around those spots.” The circle of competence is the acknowledgement of your competency as you evaluate a company’s long term economics. Warren Buffett says that finding the circle of competence is the most important aspect of investing. At Berkshire Hathaway (BRK-B), Warren Buffett, Charlie Munger, Todd Combs and Ted Weschler spend most of their time improving their circle of competence to improve their intuition on the economics of businesses.

For example, you might ask, “What’s the probability that the business will continue to be sustained in 10 years?” If you can come up with an answer with reasonable confidence, then you are pretty much in your circle of competence.

There are two categories of stocks we are likely to encounter as we search for undervalued stocks: 1) cheap stocks with visible growth prospects and 2) cheap stocks with invisible growth prospects.

Cheap stocks with visible growth prospects are often hard to find in a bull market, but can be found in abundance in a bear market.

These stocks are trading at discounts relative to their intrinsic values, despite their decent growth rates, profit margins and returns on equity. In spite of their strong balance sheet, good management and adequate cash flow, the market values them at depressed levels due to the general bearish sentiment in the economy. It’s a no-brainer for value investors to buy these stocks and reap extraordinary profits when the market returns.

The bottom-up approach suggested by Seth Klarman in his classic book Margin of Safety works best when the market is undervalued. Klarman says that the probability of going wrong by analyzing from top to bottom (economy to company level) is much greater than the probability of going wrong by analyzing from bottom to top. Benjamin Graham’s advice to value a stock based on consistent historical fundamentals and margin of safety comes in handy when evaluating such stocks.

However, when the market heats up and most companies are trading at or above their fair values, a bottom-up valuation based on historical numbers may not reveal a lot of opportunities. We may need to add second-level thinking to reveal companies in an overpriced market.

Second-level thinking is essentially a process to find value by going against the crowd. The crowd is often right, but not always.

The crowd often makes wrong conclusions because of psychological affirmations lead by the top-down or bottom-up flow of information and misleading facts promoted through vested interests or scientific inaccuracies. Following the crowd when it’s wrong can reap great returns, but those gains are usually temporary in nature, and there’s a good chance of losing with the crowd when realities are brought to light.

Apart from the general tendency of the crowd to overreact to positive information, the crowd can also overreact to negative information. In value investing, such overreaction to negative information can lead to great opportunity. As John Malone said, “Most of the money I have made in my life is when most of the people do not like what’s going on—when things are cheap, that’s an opportunity.”

Such overreactions or negligence by the market brings us to the second category of stocks, cheap stocks with invisible growth prospects. These stocks can be found both in bearish and bullish markets, but this analysis is more helpful in a bullish market. Because these stocks’ growth prospects are ‘invisible,’ their depressed performance cause investors to have negative sentiments. However, some key insights on the dynamics of their industries can help us to distinguish the higher potential among these stocks.

To identify them, I borrow some principles from exemplary value investors:

My Value Investing Principles

1) Defensive, sustainable and predictable business models

In his 2017 annual letter, Founder’s Capital Principal Patrick Terrion revealed two business models which can provide a significant long-term moat against competitive pressures:

- Controlling the Middle is a strategy of gaining power by controlling from the middle of the game. Examples: Rockefeller’s expansion of Standard Oil by buying refineries and Microsoft’s expansion by controlling the operating system.

- Segregation and Integration is a modern strategy which seeks the best opportunities from the traditional vertical and horizontal integration strategies. Terrion gives the example of Coke, which throughout its history has established a delicate balance between segregation (franchising and decentralizing) and integration (integration with bottlers, centralized advertising, etc.). The idea is to see if the competence of a particular company is properly leveraged by segregation or integration for the benefit of long-term internal and external goals.

2) Philip Fischer’s scuttlebutt approach:

Warren Buffett once said, “I am 15% Fisher and 85% Benjamin Graham.” Philip Fisher, in his classic book Common Stocks and Uncommon Profits, highlights some essential questions an astute investor should ask when estimating the growth and sustainability of a company. Fisher also stressed what he called a scuttlebutt approach, where an investor would seek non-traditional means to seek a company’s information.

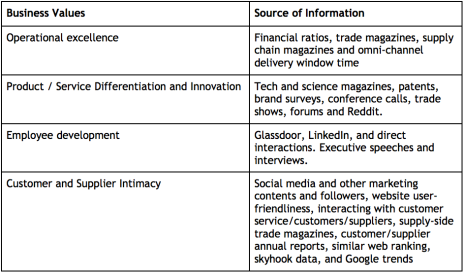

The scuttlebutt approach is most reliable when you apply it to these four business values that enhance competitive position of a company:

3) Management’s strategic vision and quality

The final tenet of my value investing strategy is assessing the rigor and quality of management. Some fundamental questions to be asked are:

- How much skin in the game do the insiders have?

- Does the management have a clearly articulated vision, realistic strategy and adequate resources to achieve the goal?

- In case of a turnaround company, is the CEO focused on its strategic imperatives? Do you agree on those strategies? And, do you agree on the quality of CEO to achieve those goals?

It is also good to keep in mind the need to optimally diversify your investment.

Convergence of intrinsic value of a business to the market price may happen at different intervals of time. There is no way to predict when market will appraise the business to its intrinsic value. It may happen the same day or could take years—patience is one of the vital elements to any value investing strategy. Thus, diversification can decrease the overall duration of your investments.

Diversification in a group of undervalued stocks is also important if you believe the market is undervaluing a particular industry. For instance, as of Q3 2017, the airline industry is trading at 12 times its 12-month earnings while S&P 500 is trading at 22 times its trailing 12-month earnings. If you believe that the airline industry will grow on par with the economy with no significant advantage to a single company, selecting a few reasonably-valued and competitively-positioned companies in the industry will greatly improve your success.

However, you need to be aware of the two contrasting factors of diversification:

- The more stocks you own, the less you’ll be hurt if one falls apart.

- The more stocks you own, the less you can truly know about each one.

A fine balance between the above two contrasting factors will help you to be reasonably diversified.

To get the guide in finding the best undervalued stocks, consider taking a trial subscription to Cabot Benjamin Graham Value Investor.

[author_ad]