Blood in the Streets … Time to Buy?

Stock Market Video

Don’t Cry

In Case You Missed It

---

Taking on the title of Editor is always a little dizzying for someone who thinks of himself primarily as a writer. I’ve been at Cabot for more than seven years, and I’ve been the Editor of the Cabot China & Emerging Markets Report for six of those years. Being called the Editor means that I take responsibility for seeing that it gets written and for everything that it says. And that’s the way it will work in my new additional role as editor of Cabot Wealth Advisory as well.

If you have any questions, comments, criticisms, quibbles or kudos—and I hope for lots of each—I hope you will put your hands to the keyboard and send them along. I will read everything you write, and will respond whenever it seems called for. Let me hear from you.

Today, while the New England summer is letting us know that it will start when it darned well pleases, I’ve been thinking about the difference between the weather and the stock market.

When the sun comes out in this region and the thermometer tops 80º, it takes no time at all for New Englanders to head for the beach. Even if it’s been cloudy for so many weeks that webs are growing between their toes, people in New England know that they’d better slap on the sunblock and look for a spot on the sand for towels and coolers.

But it’s a little different with rainy stretches in the stock market. Even after the major indexes have shown some good strength and have climbed back into convincing uptrends, many investors continue to sit on the sidelines. And many of them will continue to sit while loads of money is being made by people who are climbing back on the bandwagon.

The real shame is that some will persist in shunning the market until the rally has gone on for so long that everyone is happy and totally optimistic about stock investing. Maybe there will even be a cover story in Time magazine about the new, improved stock market.

So they finally jump into the market … just as it begins to peak, stalls out and starts the correction process that will wipe out all late arrivers, which is what it always does. This is the wrong time to buy.

Some legendary investor—sources suggest that it was Baron Rothschild in the days following the defeat of Napoleon at the Battle of Waterloo—said that the time to buy is when there’s blood in the streets.

If you take that to mean that it’s a good time to buy when assets are extremely oversold, it’s probably true. But what’s true for a massively wealthy banking family isn’t necessarily true for individual investors.

And if you take the quote to mean that you should try to buy the market at the bottom, then it’s not only false, it’s impossible!

If you would like to know how to make the transition out of a bear market with confidence when it’s time to buy, I have a suggestion. And it should come as no surprise to you that it involves a Cabot newsletter.

The suggestion is based on the fact that the Cabot Market Letter has 41 years of experience getting investors out of bear markets and into cash, and then out of cash and back into bull markets. The method has nothing to do with intuition, economic predictions or the Magic Eight Ball.

The Cabot Market Letter’s Cabot Trend Lines, Cabot Tides and the Two-Second Indicator have been honed and refined to make sure you never, repeat NEVER, miss a major bull move and never stay heavily invested during a major bear move.

Bull markets are a great phenomenon; they make you feel smart and they make you money. And the confidence that comes from following a proven market timing system only adds to the experience. With the Cabot Market Letter and its award-winning timing system, you will Know the Bull when it arrives. No Bull. For details, click here.

---

In this week’s Stock Market Video, Mike Cintolo, the editor of Cabot Market Letter and Cabot Top Ten Trader, says that the recent strong day or two in the market is a good sign, but there’s still more work to do before the trend turns up. It’s a time to remain defensive and avoid predictions of either future strength or future disaster. Stocks discussed include Apple (AAPL), Chipotle Mexican Grille (CMG), Amazon (AMZN), and Equinix (EQIX). Click below to watch the video!

Here’s this week’s Contrary Opinion Button. Remember, you can always view all of the buttons by clicking here.

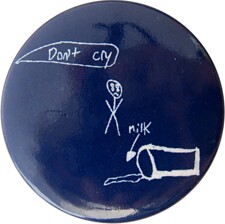

Don’t Cry

Created by a child of Alex Seagle, current co-owner of Fraser Management, which created all these buttons. Note the spilled milk. The point is that you shouldn’t obsess over past mistakes or bad luck. Learn and move on.

[Editor’s note: Some people have no problem at all with the “moving on” part of this interpretation; it’s the “learning” part that escapes most people. The market is always offering lessons on what works and what doesn’t, but you have to be willing to change in order to learn from them.]

---

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 6/7/12 - The Aggressive Aggressive Investor

Mike Cintolo takes on the techniques and rewards of swing-for-the-fences growth investing and sees value in a company that most of us see every day, and maybe use as our coffee and donuts stop. Featured stock: Dunkin’ Brands (DNKN).

---

Cabot Wealth Advisory 6/4/12 - War or Peace?

In this issue, Tim Lutts takes on some big issues, speculating about what might be necessary to reduce the persistence of armed conflicts. He also features a small company with a promising anti-obesity drug. Featured stock: Vivus (VVUS).

Enjoy the weekend,

Paul Goodwin

Editor, Cabot Wealth Advisory