Credit Suisse just released a note to investors that included a list of 18 high-profile, blue-chip stocks that hedge funds are giving up on. “Fading stars,” Credit Suisse called them.

These were stocks that large cap hedge funds sold out of in droves in the fourth quarter of 2016. Here’s the full list, in alphabetical order:

AbbVie (ABBV)

CenturyLink (CTL)

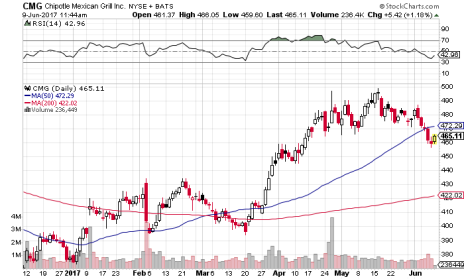

Chipotle Mexican Grille (CMG)

CVS Health (CVS)

Emerson Electric Company (EMR)

Exxon Mobil (XOM)

Ford Motor Company (F)

Honeywell International (HON)

Lowe’s Companies (LOW)

McKesson (MCK)

Mead Johnson Nutrition (MJN)

Monsanto (MON)

Mylan (MYL)

Newell Brands (NWL)

PPG Industries (PPG)

Reynolds American (RAI)

Tyson Foods (TSN)

Vertex Pharmaceuticals (VRTX)

Some of the names might surprise you. Despite the big decline in oil prices, Exxon Mobil remains the ninth-largest company in the world by market cap. Chipotle has recovered nicely since its embarrassing e. Coli outbreak less than two years ago. Ford and Lowe’s are still among the leaders in extremely lucrative fields.

[text_ad]

But none of the names truly shocked me. Each of these 18 companies has already surpassed their greatest period of growth, meaning their best days are theoretically behind them. There isn’t a Facebook (FB), Amazon.com (AMZN) or Tesla (TSLA) in the group—blue-chip stocks that are still in the midst of tremendous, all-world sales and/or earnings growth.

That said, while the characterization of these 18 companies as “falling stars” may be apt, that doesn’t mean their stocks are suddenly hopeless. Quite the contrary, actually: 14 of the 18 stocks are up this year, and 10 of them have posted double-digit returns. In fact, many of these stocks have been recommended by our value investing expert Roy Ward in his Cabot Benjamin Graham Value Investing advisory. Crista Huff, editor of our Cabot Undervalued Stocks Advisor service, is sitting on a 76% gain in Vertex Pharmaceuticals stock since recommending it to subscribers in late December.

So, while hedge funds may have lightened their load on these blue-chip stocks six-to-nine months ago, in most cases, it hasn’t had much of a carry-over effect. Institutional selling, during a quarter in which the most uncertain presidential election perhaps in history fell smack-dab in the middle, was not a death sentence.

Watching what institutional investors are buying and selling is a great way to take the temperature of where the big money on Wall Street is being invested. But charts matter too. And this doesn’t look like the chart of a fading stock …

Nor does this…

Nor does this…

If those are fading stars in the minds of Credit Suisse, then perhaps we could all use a few fading stars in our portfolio.

Bottom line: you can’t write a stock off after one (election-dominated) quarter of heavy institutional selling. Unless you’re a trader or a momentum investor (and if you are, I highly recommend subscribing to our Cabot Top Ten Trader advisory), you have to look at the longer-term picture of a stock.

For many of these supposedly down-and-out blue-chip stocks, the long-to-intermediate-term charts look quite bright.

[author_ad]