One slam-dunk way to locate undervalued stocks is to take a look at industries that got crushed by the economy, changes in the political and regulatory environments, stock market overvaluation or other harmful industry-specific events. All of those situations can harm stock prices for several years. You recall this happening among technology stocks in the late 1990s, then 10 years later, housing and financial stocks suffered similarly. More recently, energy stocks were harmed not only by a drastic drop in oil prices, but by a harsh regulatory environment and a political climate that was hostile to almost all traditional forms of energy production.

As an investor, all you really need to do is wait for the dust to settle. Eventually, opportunities will abound in the form of undervalued growth stocks. That’s why the energy sector is the number-one area where I’d put my money in 2017.

I recently recommended four different oil & gas and refinery stocks in Cabot Undervalued Stocks Advisor. It wouldn’t be prudent to overload my portfolios with energy sector plays, so I’m offering you an energy stock gem today that I haven’t (yet) recommended to my subscribers.

[text_ad]

Valero (VLO) a Top Energy Stock

Valero Energy (VLO) has 14 oil refineries in Canada, the U.K. and the U.S., with a concentration on the Gulf Coast. Valero is the largest independent player in its industry. Valero is also the general partner and 69% shareholder in Valero Logistics Partners.

Valero reported a strong fourth-quarter 2016 earnings beat in January. The increased profit was attributed to very strong margins in ethanol, and lower tax and interest expenses.

The current quarter is also looking somewhat more productive and profitable than normal. That’s because the refinery turnaround season is ending earlier than usual in the U.S. A turnaround is a planned break in refinery operations, during which the company takes care of repairs and renovations.

There’s significantly lower-than-normal turnaround time remaining in first quarter 2017, not only at Valero, but throughout the refining industry. This is good news, because with less down time, the refining industry will likely have a more profitable first quarter than usual. In addition, refinery exports are currently running at double the normal five-year pace, as turnarounds and unplanned outages are taking place in foreign markets, many extending through April.

Valero achieved $3.72 earnings per share (EPS) in 2016 (December year-end), and is expected to reach $5.26 and $6.31 EPS in 2017 and 2018. That represents earnings growth of 41.4% and 20.0%. (For perspective, I consider 15% annual earnings growth to be a very attractive growth rate.) Therefore, Valero can appeal to growth stock investors.

Valero can also appeal to value investors, because it’s got both low debt levels and a low price/earnings ratio (P/E). As a matter of fact, VLO has the second lowest 2017 P/E within its peer group of nine major refinery stocks. Based on Wall Street’s consensus EPS projections, the 2017 and 2018 P/Es are 12.9 and 10.7; each much lower than the earnings growth rates, indicating lots of room for the stock to rise before the market might consider it to be fairly valued.

VLO’s debt-to-capitalization ratio declined from 26% in 2015 to 23% in 2016, and is expected to decline incrementally in 2017 and 2018. The low debt ratio helps give the company flexibility when considering acquiring attractive companies or allocating cash toward shareholder distributions.

Valero spent $169 million on dividends and share repurchases during the fourth quarter, and a total of $2.4 billion during full-year 2016. The quarterly dividend, which is often increased at a better-than-annual pace, rose in January from $0.60 to $0.70. The current yield is 4.1%.

The company has $2.5 billion remaining in its repurchase authorization. Basic shares outstanding have fallen by 18% from year-end 2011 through year-end 2016, to 461 million shares.

VLO a Must-Have for Energy Stock Investors

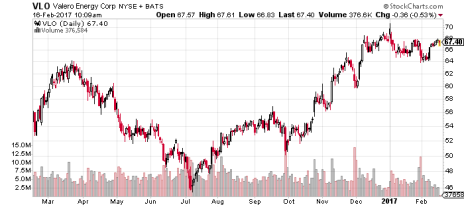

VLO had a big price correction and recovery in 2016, both beginning and ending the year near 70. More recently, the stock has been trading between 64 and 70, and appears ready to break past 70 in the very near future, assuming no general stock market disruptions.

My confidence in the price chart pattern would lead me to buy VLO right now, rather than wait for either a bounce at 64 or a breakout past 70. (I think the breakout is far more likely to occur than the bounce.)

I consider energy stocks a must-have for 2017. There are lots of great companies that offer both growth and value right now. Valero Energy is at the top of my energy stock list for outsized capital gain opportunities. Make sure you strongly consider an energy boost to your 2017 stock portfolio!

[author_ad]