Sen. McConnell Thinks Health Insurance Companies Are in Trouble

Today, I want to write about health insurance stocks, many of which look pretty good despite Congress’ claims that the entire sector is suffering financially. Let me elaborate.

On the morning of August 6, as I perused news stories, I read that Senate Majority Leader Mitch McConnell suggested that the U.S. government give cost-sharing subsidies to health insurance companies to appease them for the expense of implementing the Affordable Care Act. In English, that means Sen. McConnell wants to bail out health insurance companies for the financial train wreck known as Obamacare, in order to keep his donation dollars flowing.

Not on my watch!

[text_ad]

Does it make sense that millions of Americans knew that Obamacare was not a financially feasible idea back in 2009, when they were protesting the legislation across the U.S., yet somehow health insurance companies did not foresee the trouble? I personally phoned at least 30 House members, asking them to vote “No.”

Health insurance companies certainly also knew that the financial aspect of Obamacare was unworkable; that the financial cost to taxpaying citizens and insurance companies would skyrocket. We all knew this because it was basic math. Granted, the financial cost for health insurance and healthcare to non-taxpaying citizens and to illegal aliens actually improved under Obamacare, but it did so at the expense of the aforementioned parties.

Health insurance companies had every opportunity to tell Congress that Obamacare was not going to work, that costs would skyrocket, and that the middle class would be left holding the bag. But they didn’t do that, did they? And now they’ve been alerted to stand in line and await a monetary gift from Senator Santa Claus.

By the way, Sen. McConnell and his allies will be extremely careful not to call their idea a “bailout,” because “bailout” has negative connotations, as it should. A bailout is when the U.S. government takes money from its taxpaying citizens and gives that money to American corporations to help keep them financially afloat.

Oh joy! Please, let me write a check directly to UnitedHealthcare!

Let’s slow down and consider whether health insurance companies require a bailout to remain solvent. After all, they employ millions of Americans. We want to be sure that these companies and workers don’t all go bankrupt, right?

Fortunately, American health insurance companies are not in dire straits. They’re not taking net losses. As a matter of fact, they seem to be thriving.

EPS = earnings per share

As you can see on the chart, every one of eight major health insurance companies is profitable. Indeed, their profits are growing in 2017, and all are expected to have profit increases again in 2018. What’s more, they have so much cash laying around that they’re giving it away to shareholders. In the last 12 months, these companies have paid $3.9 billion dollars to shareholders in the form of dividends. They wouldn’t be giving away money like that if they were suffering financially!

It’s a huge relief to know that we don’t have to run out and sell our health insurance stocks due to poor fiscal management. As is common in the stock market, some industry stocks offer prospects of better capital gains than others, so let’s take a closer look at these financially-fit companies and see what the numbers are telling us.

Health Insurance Stocks That Stand Out

The first thing you’ll notice is that all eight companies are expected to achieve double-digit earnings growth rates in 2017 and/or 2018. That’s impressive! That means that despite the difficulties within their Obamacare businesses, their overall business plans are delivering annually growing profits. You can’t ask for more than that!

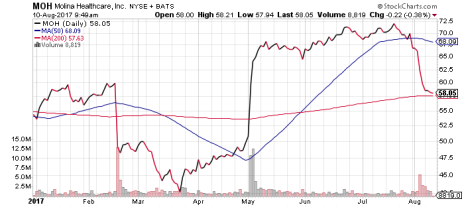

Molina Healthcare’s (MOH) profit growth looks particularly eye-popping, and even though the 2017 EPS growth number is skewed due to smallish profits in 2016, you can see the earnings per share (EPS) are expected to grow another 32.6% in 2018. Clearly whatever hurt the company’s bottom line in 2016 is no longer affecting the business outlook.

The slowest-growth insurer on the list is Anthem (ANTM), expected to grow EPS by 7.5% and 10.1% in 2017 and 2018. Since EPS growth correlates to share price growth over medium- and longer-term time periods, it could be wise for ANTM shareholders to move their capital into a faster-growing company.

What about price/earnings ratios (P/Es)? We can assess value by comparing P/Es to EPS growth rates plus dividend yields. Generally speaking, stocks with P/Es that are lower than their EPS growth rates plus dividend yields can be considered undervalued. To be more specific, we can add the dividend yield to the EPS growth rates, and compare that number to the P/E in order to assess value. By screening out overvalued stocks in the stock selection process, we are screening out a certain degree of the risk associated with stock investing.

Are any of these health insurance stocks undervalued? Not too many. There are a few undervalued stocks based on 2017 numbers, including Cigna (CI), Molina Healthcare and United Healthcare (UNH). But we also want to look forward to 2018, because if the stock is not also undervalued based on 2018 numbers, then perhaps the window on capital gains is closing. The only stock on this list that’s undervalued based on 2018 numbers is Molina Healthcare. And coincidentally, MOH is the only stock on this list that’s barely risen year-to-date. The rest have grown substantially in 2017.

If you’re looking for a health insurance stock that hasn’t already run up significantly year-to-date, MOH presents a trading opportunity. The stock is down 20% from its recent highs. Investors who buy in the upper 50’s have an opportunity to earn a 20%+ capital gain as the share price travels back to its recent high at 72.

[author_ad]