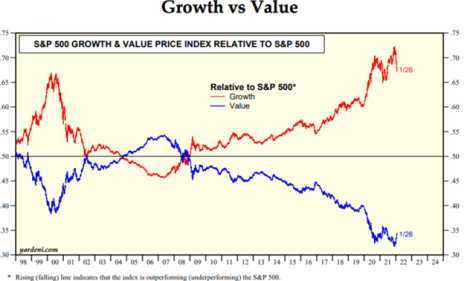

The biggest story of 2022 is the meltdown of growth stocks. But you find growth stocks at value prices by investing in micro-cap value stocks. More on those in a bit.

Yes, the S&P 500 is down ~9% year to date, but the ARK Innovation ETF (ARKK) – the poster child for Covid winners – is down 27% year to date and 50.9% over the past 12 months.

Many individual stocks have pulled back more than 50%. Roku (ROKU), Teladoc Health (TDOC), and Zillow (Z) are a few examples.

[text_ad]

If you believe the growth stock meltdown is going to mirror what happened after the 2000 Tech bubble, you want to stay on the sidelines.

Source: Yardeni Style Guide

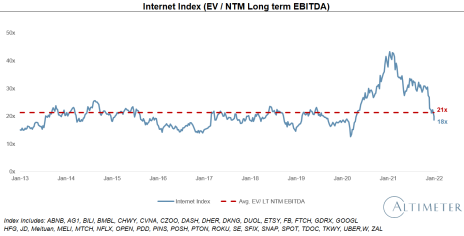

But if you believe this pullback is going to mirror other growth stock pullbacks, it’s probably time to step in and start buying, especially because valuations are starting to look more reasonable compared to long-term historical averages.

Source: Altimeter Capital

What am I going to do?

It’s tempting to step in and try to pick a few of the long-term secular winners, even though the charts look horrible.

Take a company like Zoom Video Communications (ZM). Sure, it was a Covid beneficiary. But we all use and love the product, right? And they should have plenty of room to grow with ancillary products such as Zoom Phone and Webinars.

And it’s only trading at 29x forward earnings.

Seems pretty compelling to me.

2 Micro-Cap Value Stocks as an Alternative to Growth

But I’m probably not going to buy the stock. I will most likely just sit back with my popcorn and watch it all unfold. If I see a compelling opportunity (Zoom or another high growth name), I may try to jump in, but I will probably just stick to my specialties: 1) micro-cap stocks and 2) special situations.

Through micro-caps and special situations, it’s possible to buy growth stocks at value prices. Two examples are Leatt Corp (LEAT) and IDT Corp (IDT).

Leatt (LEAT) Corporation is a South African company that designs and manufactures protective equipment for motocross riders. Despite a revenue compound annual growth rate (CAGR) of 24% from 2017 to 2020, and an earnings per share CAGR of 165%, the stock trades at a forward P/E multiple of just 9x. In the most recent quarter, revenue growth exceeded 90% despite headwinds from supply chain issues. Insiders own 45% of shares outstanding, and I expect strong growth ahead. I think this stock could double over the next 12 months.

Another good example is IDT Corporation.

On the surface, IDT looks like a boring conglomerate with 9.9x trailing EBITDA. But if you look under the hood, you see something completely different.

IDT is run by Howard Jonas, one of the best value creators in the world. The stock is trading at a big discount to its sum-of-the-parts valuation, but the imminent spin-off of one or more of its high growth technology subsidiaries will unlock that value. Insiders own 25% of shares outstanding ensuring we are well aligned with management. On a sum-of-the-parts basis, the stock is worth 55, implying significant upside from its current share price (35).

If you want to know what other micro-cap stocks I’m currently recommending to my Cabot Micro-Cap Insider readers, click here.

Do you own any micro-cap value stocks in your portfolio? If so, tell us about them in the comments below.

[author_ad]