From a young age I was fascinated with investing, and my father taught me everything he knows.

He was a large-cap portfolio manager who managed a billion-dollar portfolio for institutions looking to invest in value stocks.

I looked up to my father (still do!) and soaked up everything he taught me about investing.

His approach was to look for securities that the market had written off due to temporary “issues.”

Eventually, the “issues” are resolved and the unloved value stocks recover to generate an attractive return.

[text_ad]

While my father was my first mentor, I adopted several other “virtual” mentors over time. Warren Buffett was one of them, and I read everything that I could about him.

One of Buffett’s famous quotes is, “Price is what you pay, value is what you get.”

In other words, spend your time understanding the business and trying to estimate its intrinsic value.

This is the approach that I adopted.

But the more time I spend in the market, the more I’ve grown to appreciate momentum investing.

The Power of Momentum Investing

I don’t know why momentum works, but it does, and has been working for a long time.

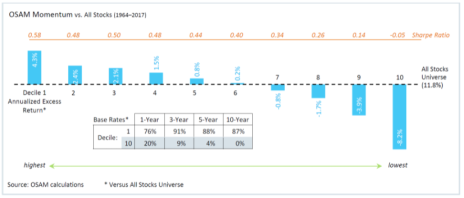

O’Shaughnessy Asset Management (OSAM) looked at all stocks from 1964 to 2017 and concluded that high momentum stocks outperform low momentum stocks.

Specifically, the first decile of high momentum stocks generated annualized excess returns of 4.3% while the bottom decile of high momentum stocks generated annualized excess returns of -8.2%.

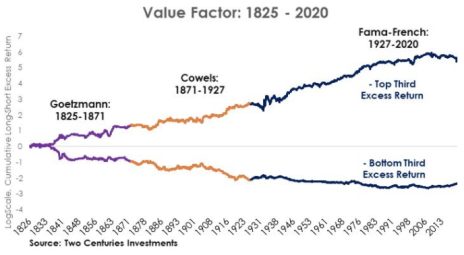

Two Centuries Investments looked back even further (all the way to 1825!) and had the same conclusion.

Let’s take a step back and define “momentum.”

In a nutshell, momentum means that stocks that have outperformed (over six months or 12 months) tend to continue to do so. On the other hand, stocks that have underperformed also continue to do so.

Given this data and my new appreciation for it, momentum is an important factor that I consider when picking stocks.

Many investors have asked how to identify high momentum stocks.

The best way to do so is to simply browse stocks that are trading at a 52-week high. Here’s a good free resource to do so.

Momentum Investing vs. Value Investing: How About Both?!

But I don’t believe in using momentum in isolation.

My ideal stock is one that has the following six characteristics:

- Fast growth

- Cheap valuation

- High insider ownership

- Reasonable balance sheet

- Low share count (under 30 million shares outstanding)

- High momentum.

My new appreciation for momentum has also gotten me more comfortable with averaging up or buying more shares of a stock that has appreciated (if I still believe it’s ultimately undervalued).

IDT Corp (IDT) (disclosure: I am long IDT) is a perfect example.

I first recommended IDT to my Cabot Micro-Cap Insider subscribers at 19.47 per share in this February. At the time the stock was at a 52-week high and had all six characteristics that I look for.

Despite being at 52-week highs when I recommended it, the stock is up 167% since then, and still satisfies all six characteristics on my checklist, so I have no plans to sell.

If you don’t already, you may want to consider incorporating momentum into your investment process. It will help you find winners like IDT.

And if you want to know what other micro-cap stocks I’m currently recommending – all of which have similar blends of momentum and value, and boast an average return of 67% – you can become a Cabot Micro-Cap Insider subscriber by clicking here.

[author_ad]