Unless you’ve been living under a rock, you know the bull market is over.

The bull market lasted from March 2020 to June 13, 2022.

It was good while it lasted, but we are officially in a bear market.

What happens next?

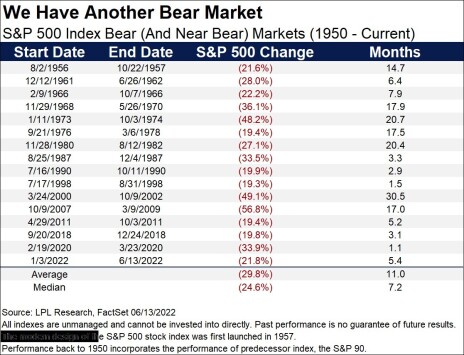

Typically, bear markets last about 11 months and average a peak to trough drop of 29.8%.

The current bear market has lasted for almost six months and the current drawdown of the S&P 500 stands at -19% (the market has bounced back a bit).

In mid-June, the S&P 500 touched 3,637, marking a 24.5% peak drawdown (so far!).

[text_ad]

Using history as a guide, the worst is probably behind us, and we are near the low or have already reached it.

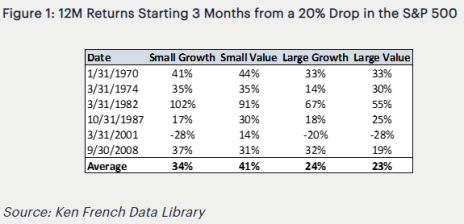

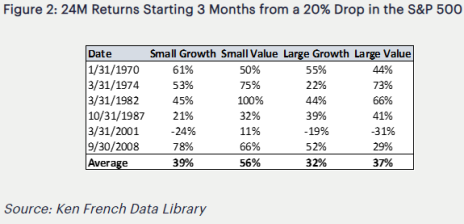

In the depths of the pandemic in March 2020, Verdad published a great piece about investing during times of crisis.

The conclusions were quite encouraging. In short, if you invest three months after the S&P 500 drops 20%, the 12-month and 24-month returns look terrific for all stocks.

The S&P hit the 20% pullback threshold on June 13, 2022. Again – using history as a guide, if we buy in September 2022, odds are forward returns looking out 12 months and 24 months will look quite strong.

I’m not necessarily trying to time the market. Instead, I’m looking at individual stocks that look compelling based on their fundamentals and valuation.

Why I Like NexPoint Diversified REIT

NexPoint Diversified REIT (NXDT) is my favorite name at the moment (disclosure: I’m long). It’s a “special situation” which means that the outcome of the stock won’t necessarily be determined by what the broader stock market is doing.

Let me explain.

NexPoint is currently a closed end fund with very few natural buyers. Who wants to own a closed end fund that charges a significant management fee when you can own a low-cost ETF or pick individual stocks?

As such, the stock has languished, and it’s trading at a 40% discount to its net asset value (NAV).

But that is all about to change.

Eighteen months ago, the company got shareholder approval to transition from a closed end fund to a real estate investment trust (REIT).

That’s important because REITs don’t typically trade at a discount to NAV. Rather, they trade at a multiple of funds from operation.

Further, many index funds and ETFs are focused on REITs, and it’s likely that these funds will buy NexPoint indiscriminately once the transition is complete.

The transition to REIT has taken longer than everyone expected, but was recently approved by the SEC.

A couple other data points that are encouraging:

- The stock pays a 3.7% dividend yield, so we get paid to wait.

- NAV is ~$26 vs. the stock price of $16.

- James Dondero (CEO) continues to buy like a madman (his last buy was last week).

While bear markets aren’t as fun as bull markets, they do create a ton of excellent opportunities. Especially in the micro-cap world!

And if you want other names of grossly undervalued micro-cap stocks with the potential to double or more, you can subscribe to my Cabot Micro-Cap Insider advisory and gain access to my full portfolio of micro-cap stocks.

[author_ad]