A couple of months ago, our contributor, Todd Johnson, editor of Dividend Lab, recommended Visa (V) stock, the global financial services company, in my advisory, Wall Street’s Best Investments.

Todd noted several reasons for his recommendation, including:

- Expanding partnerships grabbing market share

- European acquisition paying off in rising transactions and revenues

- Increased guidance by management

- Undervalued stock

He believes Visa stock is undervalued, saying, “Analysts are not fully factoring in the company’s potential earnings growth in FY17 led by the inclusion of Visa Europe and share repurchases. Visa has an average consensus analyst price target of $93.17 per share (16% upside) and a high price target of $104.00 per share (29% upside).”

[text_ad]

I, too, think Visa stock looks very attractive. Last year, revenues in its industry—electronic payments—according to BCG.Perspectives, reached $1.1 trillion, or 29% of global banking revenues.

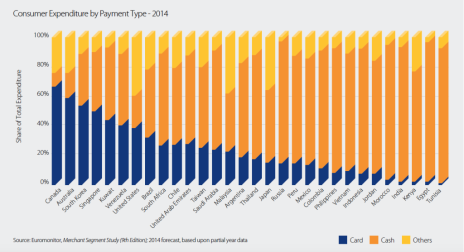

For decades, pundits have predicted the demise of cash, too, but that hasn’t yet occurred. In fact, cash still accounts for $21 trillion of global transactions, especially in the non-developed world.

Three Primary Drivers

Certainly, convenience plays a huge part in the continued expansion of the payments industry. But there are three primary drivers that will influence consumers and businesses in the next few years:

Technological Advances. The Internet of Things has become a reality due to technological leaps in cloud computing, sensors and wireless communication. That has improved financial management as well as integrated point-of-sale systems. Data and service delivery has quickened due to better application programming interfaces (APIs). And biometrics are rapidly enhancing user-friendly authentication.

Shifting Customer Expectations and Behavior. With the rapid advances in fintech (financial technology), and Apple (AAPL) and Google (GOOG), consumers expect faster, better and cheaper innovations. In the U.S., consumers have been slower than anticipated to adopt new payment types, but globally, in places like China and Europe, the pace is much quicker. Between 2013 and 2015, card transactions at point of sale locations in Europe accelerated from less than 2% of total transactions to almost 20%. Better adoption rates are illustrated in e-commerce, m-commerce (mobile) and app purchases. Those transactions are forecast to expand from 6% of all transactions to around 20% by 2020.

Regulatory Initiatives. Current and proposed regulations are targeting financial inclusion, consumer protection, competition and infrastructure improvements. Under a Trump presidency, we can expect to see some alterations to that environment. But a drive to reduce the rates for consumers without bank accounts to drive them to e-payments from cash will continue. As well, around the globe, payment channels to nonbank competitors are being widened. And a push is on to improve infrastructure in order to make payments faster—known as instant payments or real-time, low-value payments.

Bottom line: The market for electronic payments is going through some revolutionary changes that should spike growth for decades to come.

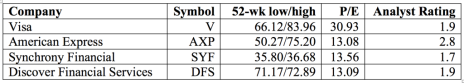

And that puts payment processors—including Visa—in the right place at the right time. According to Morningstar, Visa stock has some 24 competitors, many of whom also look attractive. I did a bit of research and found three more that may be of interest to you.

Most of these companies look undervalued, and three out of the four have attractive “Buy” ratings by Wall Street analysts.

As always, please make sure you do your due diligence to ensure that they fit into your long-term investing strategies and goals.