Ever since I wrote my senior thesis at Trinity College on behavioral finance, I’ve been fascinated with market anomalies.

What’s a market anomaly? When a certain subset of stocks that can be identified ahead of time consistently outperforms.

These market anomalies defy the efficient market hypothesis.

There are many well-documented anomalies including the Calendar Effects, Stock Splits, the Dogs of the Dow, and others.

My two favorite market anomalies are micro-cap stocks and stock spin-offs. Both tend to outperform, and have for years.

One market anomaly that I’ve been thinking about recently is the tendency for negative enterprise value stocks to outperform.

It doesn’t take a huge leap of faith to understand why negative enterprise value stocks tend to do well. First, let’s define what a negative enterprise value stock is. Start with the market cap, then add debt and subtract cash. If the result is a negative enterprise value, you have a negative enterprise value stock.

Let’s use an example to make it more concrete.

If we assume that a $100MM market cap company has $0 in debt and $120MM of cash, it has an enterprise value of negative $20MM.

In this example, an investor could theoretically buy the entire company for $100MM and get access to the $120MM of cash for a return of 20%. Heck, the investor may even be able to sell off other parts of the business to further enhance his or her return.

Historically, negative enterprise value stocks are quite rare, but they do exist.

And the returns are very attractive.

Negative Enterprise Value Stocks Outperform

I haven’t been able to find many academic studies on negative EV stocks, but there have been a couple practitioner studies that point to significant alpha potential.

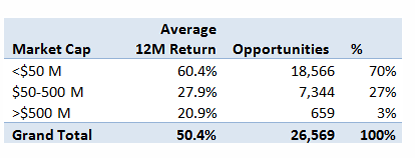

This study on the CFA website looked at negative EV stocks between 1972 and 2012 and found that the average negative EV stock returned 50.4% over the subsequent 12-month time period.

Not surprisingly, the most profitable negative EV stocks were micro-caps.

Source: Returns on Negative Enterprise Value Stocks: Money for Nothing?

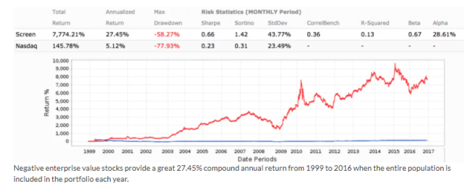

Broken Leg Investing did a similar study of negative enterprise value stocks between 1999 and 2016. They found that negative EV stocks generated a compound annual return of 27.5%, crushing the Nasdaq, which returned 5.1% over the same period.

Source: Negative Enterprise Value Stocks: How To Earn Great Returns

Before rushing out to buy some negative EV stocks, there are several caveats.

First, it’s not optimal to concentrate in a few or even 20 negative EV stocks. Broken Leg Investing analyzed a more concentrated portfolio of negative EV stocks and found that performance eroded significantly.

So to maximize performance, you are not going to want to own all negative EV stocks in the market. A 150-stock portfolio is probably a bit too unruly for most investors.

Second, avoid financials, as a negative enterprise value isn’t indicative of a cheap stock in this sector.

Third, avoid Chinese stocks as there is a great risk of buying fraudulent companies.

Why am I thinking about negative EV stocks?

There has been a brutal bear market in biotech stocks and my screener indicates there are 100+ public biotechs in the U.S. market that are trading with a negative enterprise value. While I’m sure many will go bust, my hunch is a basket of them will do quite well over the next couple of years.

Had you heard of negative EV stocks prior to reading this article? If so, how have they performed? If not, do you have any questions? Leave a comment below!

*This post has been updated from an original version.