I like statistics, although that wasn’t always the case. As a college student, I really dreaded having to take a statistics class, as I had heard how terribly difficult they could be. But I was one of those fortunate students who had a fantastic introduction to the subject via a great teaching assistant (at Ohio State, most introductory classes were taught by assistants to the professors).

After that, there was no looking back—I ended up actually minoring in statistics! Fast forward to today, and I just can’t help myself—I’m always looking at the market from a numbers point of view. So, I thought it would be interesting to see if there were still a lot of undervalued stocks, as indicated by their price-to-earnings ratios, and hopefully identify the best undervalued stocks.

A price-to-earnings ratio, or P/E, is simple the price of one share of a company’s stock divided by four quarters of its earnings. Most analysts rely on trailing P/Es (the last four quarters of earnings) or forward P/Es (the next four quarters of estimated earnings).

[text_ad]

The P/E of the S&P 500 is around 20 today, as compared to its historical average of 16.8. So, I decided to first look for companies with P/Es less than or equal to 15. I began to lose count of the results, so I’ll just tell you I had more than 2,500 companies trading at that level.

As you know, P/E ratios are not the be all and end all of analysis; instead, they are just one factor in a series of parameters that need to be evaluated for a complete analysis. The P/E just tells us the relative valuation of a company’s shares and earnings, compared to the rest of the stock universe. But it’s a good starting point.

Next, I decided to pare these companies down by looking at which ones were growing their earnings at a rate of more than 25% annually. That’s usually a very good indicator of the fortunes of a company. Applying that criteria reduced the list by half.

And to narrow it further, I looked at companies in which institutions had recently ramped up their buying. Usually, when Wall Street begins piling into a stock, that is an indicator of positive momentum ahead. End result: 14 stocks.

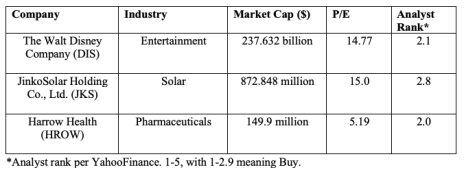

3 Best Undervalued Stocks Today

I put those 14 stocks through a number of other tests, including some technical parameters that indicated which stocks looked attractive to enter at this point, and I came up with the following as the three best undervalued stocks to buy now.

These companies range from mega cap (Disney stock) to very small cap (HROW).

Each of these undervalued stocks looks interesting, fundamentally and technically, but please make sure they will fit into your stock portfolio before jumping in. And in the case of Harrow Health, realize it is a very small-cap stock, and speculative, with light trading volume, so please be judicious when buying shares.

[author_ad]