The unprecedented changes in the retail industry look alarming at first sight—but there are significant opportunities in the retail sector for those with an eye for finding value stocks.

A value investor is constantly in search of certainty to make a sound judgment. The challenge faced by a value investor in the retail industry today is uncertainty due to technological changes in the demand and supply side of the retail economy. In Benjamin Graham’s terms, any attempt to bet on such uncertainty would be ‘speculative’ in nature. On the other hand, one need not be a data scientist to predict that people will continue to buy furniture or jewelry in the future. Only the channels of selling those goods are changing—increasingly, to online and off-price retailers.

A quick view of the data reveals that among publicly listed companies, 20 out of 32 apparel stores, six out of eight department stores, eight out of 10 grocery stores, two out of four electronics stores, two out of four sporting goods stores, three out of five furniture stores and three out of five jewelry stores have negative earnings growth this year. Sears (SHLD) and Kmart are closing around 358 stores, Macy’s (M) is closing about 68 stores and many apparel retailers are going bankrupt due to decreasing mall traffic and increasing competition from online stores like Amazon.

On the other hand, off-price retailers and e-commerce sales are showing terrific growth.

[text_ad]

E-Commerce, Discount Retailers Thriving

Out of 11 discount stores, only four are having a negative earnings growth this year. Off-Price retailers such as Ross Stores (ROST), The TJX Companies (TJX), Burlington Stores (BURL) and Dollar General (DG) are seeing robust growth and higher profit margins than department stores. But their growth comes with a price: higher stock valuation.

On the e-commerce side, Amazon (AMZN) is increasingly dominating the online retail industry with more than 20% share of total e-commerce sales in the U.S. Amazon is growing at about 25% YoY in North America, while other e-commerce merchants are growing at around 12% YoY. Amazon has extensive distribution centers and with the help of Amazon Flex, its in-house delivery system, one to two hour delivery service will become more common—threatening department stores, whose key advantage over Amazon is the proximity to their consumers.

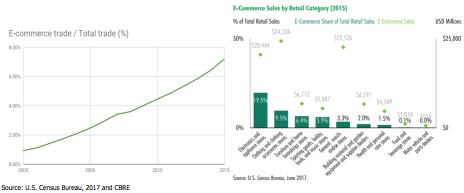

In 2015, $340 billion of the total $4.7 trillion retail trade was done online, a penetration rate of 7.2%, and it’s rapidly growing. Some categories like electronics and appliance stores have seen 19.5% online penetration while furniture and home furnishing stores have seen only 6.4% online penetration according to CBRE.

In order to understand the mechanics of the downward spiral of department stores, the booming sales of off-price retailers, and the disparity in e-commerce penetration among different categories, we need to understand the supply and demand side of the retail economy.

On the demand side, one of the key drivers is consumer preferences, which include the urgency of product delivery, brand loyalty, need to ‘feel’ the product before purchasing and the threshold amount customers are willing to spend online.

Online retailers are evolving to satisfy those consumer needs by constant innovation and supply-chain improvements. For instance, Amazon Prime Now guarantees to ship within one to two hours in certain cities for specific product categories such as grocery, where the online penetration rate is meager due to delivery lag. Home furnishing retailer Williams-Sonoma (WSM) has acquired 3D imaging and augmented reality company Outward Inc., while diamond retailer Signet Jewelers (SIG) has acquired R2Net and JamesAllen.com to provide superior online customer ‘feel’ for their products. As for consumers’ unwillingness to purchase expensive goods online, e-tailers have come up with innovative financing solutions.

The underlying question many investors ask is what will be the saturation point, the point at which the online penetration of a particular industry would not increase.

At this nascent stage where online penetration is only around 7% to 10%, and the full advantage of technology is not yet realized, any attempt to answer that question will turn out to be speculative. For instance, technology like augmented reality with 3D visualization will help customers switch to online purchasing in less online-penetrated industries like jewelry and furniture. Use of Uber-like third-party crowdsourced delivery services by specialty retailers will significantly reduce the delivery time. Also the advent of 3D printing shopping, where a customer can install a 3D printer at home to purchase moldable products like toys and plastic products may significantly change the structure of some retail industries.

The Key to Finding Value Stocks in the Retail Sector

Given the expectation of such technological breakthroughs, finding value stocks among brick-and-mortar stores that are immune to e-tailers would be in vain from a long-term perspective. In fact, almost no brick and mortar business is e-commerce proof. It’s true that some retailers like Home Depot (HD) and Lowe’s (LOW) are likely to be more immune than Macy’s or J.C. Penney (JCP) due to the nature of their products and services, but the extent of such immunity is only limited by the lack of innovations.

However, as the Amazon website becomes increasingly cluttered, user experience will continue to diminish, providing opportunity for agile retailers.

As an investor, you should make sure that the retailer’s management is using the latest innovations in its corporate strategies, including a focus on omni-channel, where retail stores can leverage their inventories in local stores for quicker delivery, and providing superior online experiences.

Off-price discount retailers have thrived by mastering supply chain improvement, which at one time was leveraged almost solely by Wal-Mart (WMT). Discount stores now target overproduced inventory, make bulk purchases and methodically distribute it at low prices to its customers thanks to improved supply chain software and artificial intelligence. And the off-price retailers have higher profit margins, despite the higher selling prices of the department stores!

This gap in margin will eventually shrink as the department stores sort out efficient supply chain mechanisms and in-mall lease expenses decline, and the best-managed department stores will then see their stocks rebound from their deeply oversold levels of today.

Finding value stocks in the retail sector doesn’t have to be brain surgery. In fact, I’ve identified two of these bargain-priced retail stocks—I’m sure you know their names—and you can get their names by becoming a regular reader of Cabot Benjamin Graham Value Investor. Click here for all the details.

[author_ad]