Growth investors and value investors both invest to maximize their profits, but they tackle the approach using very different tactics.

Growth investors place their priority on growth while value is secondary, whereas value investors reverse the priorities. Value investors are looking for undervalued stocks with good growth prospects, which is where price multiples can come in handy.

If two companies’ sales and earnings are growing at the same rate and their future growth prospects are exactly the same, it would be nice to know if one is a bargain and the other is overpriced. Is one company selling at a much smaller price-to-earnings ratio than the other?

[text_ad]

On the other hand, if two companies are valued alike with the same price-to-sales, price-to-earnings and price-to-book ratios, but one company is set to grow at a 15% clip during the next five years or more while the other company has little potential to grow at all, you definitely will want to invest in the company with good growth prospects and pass on the company that—although undervalued—has little or no growth potential.

We can draw a simple conclusion here: Don’t invest unless you bring both growth and value into your analysis. So, how can we ensure that we’re not overpaying for growth or undervaluing the fundamentals?

The price of a security is based on a number of tangible and intangible factors: the current status of the company, the prospects for the company, market sentiment, economic or political environment and many other factors.

But keep in mind the old adage, “Price is what you pay; value is what you get.”

Evaluating a company to determine its fair value is an exercise aimed at determining what a company is worth and whether the price is reasonable.

There are many analyses available to find a company’s intrinsic value, but most of these are somewhat complicated. There are a few simpler measures, however, which will provide worthwhile indications of whether your growth stock or value stock is undervalued. The key to using these criteria is to use the right one to assess each type of stock. I like price multiples to evaluate my stocks. Here are a few guidelines.

Using Price Multiples to Determine Your Stock’s Value

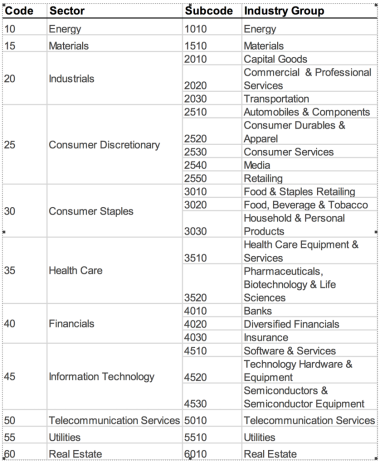

Standard & Poor’s divides the entire business spectrum into 10 sectors and 24 industry groups. S&P’s classifications are known as the Global Industry Classification Standard (GICS). All companies fall into the following business sectors and industry groups, depending on a company’s principal business activity:

The price multiples are the ratios: P/BV, P/CF, P/D, P/E, P/S and PEG.

Price-to-Book Value Ratio

The P/BV (price-to-book value) ratio is calculated by dividing the current stock price by the latest reported book value (or net asset value) per share. I consider the current stock price for a company to be undervalued if the P/BV ratio is less than 1.00. The ratio is best used when evaluating companies in the Industrials and Financials sectors.

Price-to-Cash Flow Ratio

The P/CF (price-to-cash flow) ratio is calculated by dividing the current stock price by the latest four quarters of reported cash flow (or change in cash position) per share. I consider the current stock price for a company to be undervalued if the P/CF ratio is less than 8.00. The ratio is best used when evaluating companies in the Energy, Health Care, Industrials, Real Estate and Telecommunication Services sectors.

Price-to-Dividends Ratio

The P/D (price-to-dividends) ratio is calculated by dividing the current stock price by the latest annualized quarterly dividend (quarterly dividend times four) per share. The inverse of the price multiple is Div/Price, which is the dividend yield for a company. I consider the current stock price for a company to be undervalued if the P/D ratio is less than 50.00. The ratio is best used when evaluating companies in the Consumer Staples, Energy, Financials, Materials, Real Estate and Utilities sectors.

Price-to-Earnings Ratio

The P/E (price-to-earnings) ratio is calculated by dividing the current stock price by the latest four quarters of reported earnings (or profits) per share. I consider the current stock price for a company to be undervalued if the P/E ratio is less than 12.00. The P/E ratio is sometimes the least reliable price multiple because companies adjust earnings per share using different criteria and standards. The ratio is best used when evaluating companies in the Materials, Information Technology and Utilities sectors.

Price-to-Sales Ratio

The P/S (price-to-sales) ratio is calculated by dividing the current stock price by the latest four quarters of reported sales (or revenues) per share. I consider the current stock price for a company to be undervalued if the P/S ratio is less than 1.00. The ratio is best used when evaluating companies in the Consumer Discretionary and Consumer Staples sectors.

Price/Earnings-to-Growth Ratio

The PEG (P/E-to-projected EPS growth) ratio is calculated by dividing the current stock price by the latest four quarters of reported EPS (earnings) per share, and then dividing the result by projected EPS growth for the next three to five years, and adding the current dividend yield to the projected EPS growth. I consider the current stock price for a company to be undervalued if the PEG ratio is less than 1.00. The ratio is best used when evaluating growth companies in Consumer Discretionary, Health Care, Information Technology and Telecommunication Services sectors.

Value Investing Made Easy

How can you use all of this information to become a better investor and make better choices? It’s easy.

For growth investors, I recommend finding companies with strong stock price and/or earnings momentum. Next, figure out which sector the company belongs in by reading about what the company does. Note: According to Warren Buffett, if you don’t understand what the company does, you probably shouldn’t invest in it! After identifying the sector in which your stock resides, use the appropriate price multiple or multiples to determine if your growth stock is reasonably priced using the guidelines (ratio limits) described above.

For value investors, I recommend finding companies with at least one low price multiple using the guidelines above. Keep in mind that an extra, extra low price multiple might indicate that investors see problems in the company’s future. If the multiple seems to be too good to be true, investigate! After determining which sector the company belongs in, test if the recommended price multiple is low. Lastly, analyze the company’s current growth pattern and find sales and earnings growth forecasts for the next several years.

Now, if you want the best of the value world, Cabot Value Investor features a portfolio of some of the best stocks with good growth prospects trading at value prices. Click here to subscribe.

[author_ad]

*This post is periodically updated to reflect market conditions.