Investors always like a safe place to salt away some cash, particularly during a period of market volatility.

Traditionally, that’s been money market funds, or as part of an asset allocation strategy, many have turned to short-term investment-grade bonds.

Those more typical fixed-income funds often play a role as a way to dampen the volatility of equities, and provide some stability during times of high volatility.

These days, with fixed income not delivering the kind of return that investors typically need to meet their financial goals, other types of investments are playing a role as safe havens.

For example, dollar-related ETFs have been trading to the upside while the broader market declines. One reason for that is the nearly two-decade high of the dollar relative to other currencies.

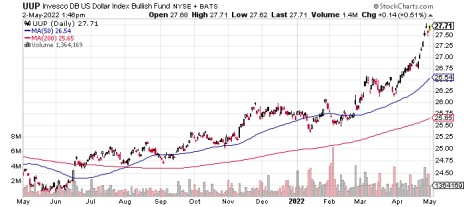

The Invesco DB US Dollar Bullish ETF (UUP) rose 1.92% in the past week, 4.83% in the past month and 6.57% in the past three months.

This index ETF captures movements of the greenback against a basket of six major developed-market currencies: the yen, euro, British pound, Swiss franc, Swedish krona and Canadian dollar.

The index is comprised of long U.S. dollar Index futures contracts traded on the ICE futures exchange. The “bullish” designation is because the futures contract is designed to replicate performance of being long the dollar against the basket of currencies.

An actively-managed U.S. dollar strategy, the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) climbed 1.29% in the past week, 4% in the past month and 4.80% in the past three months.

Sure, during a roaring bull market those returns may not seem terribly exciting, but it sure beats stashing your cash in a money market fund, which are yielding about 0.25%. That rate jumped sharply recently as the Federal Reserve increased interest rates, but still lags what you can get with another alternative strategy, such as a dollar-related ETF.