Today, we are recommending a special situation. The stock is a closed-end fund that is in the process of transitioning to a real estate investment trust (REIT). Once the transition is complete, the universe of investors that can buy the stock will double, driving indiscriminate buying pressure. Other key points:

- Trades at a 40% discount to NAV.

- High insider ownership (CEO owns 14% of company).

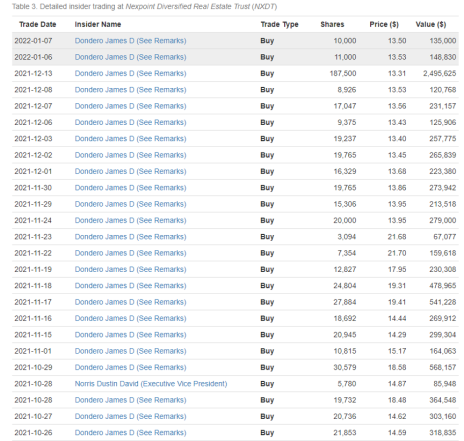

- Relentless insider buying.

All the details are inside this month’s Issue. Enjoy!

New Recommendation

Why I Love Micro Caps

Over the long term, investing in stocks has been a great decision as equities (no matter the market cap) have outperformed almost every asset class.

Historically, stocks have returned about 10% per year, an excellent result. But what if you want to make more than 10% per year?

You could concentrate on a few high-conviction ideas, use leverage, or try something completely different. My personal favorite way to achieve superior results is by investing in micro caps (shocking, I know!).

Micro caps have far and away outperformed larger stocks. From 1927 to 2016, micro caps have generated average annual returns of 25.6%. That is an astounding number, and in an efficient market, this opportunity shouldn’t exist. If the returns for micro caps are so good, more investors should be attracted to the space which should push down the returns.

But the beauty of micro caps is that large, sophisticated investors cannot invest in them. There is not enough liquidity, and the companies aren’t large enough to support the massive amounts of capital that these investors manage.

Most of the best investors of all time (think Buffett, Lynch, Greenblatt, etc.) started in micro caps and then “graduated” to large-cap stocks as their portfolios swelled.

Of course, there are caveats:

- You need to be comfortable buying and holding illiquid stocks. Some stocks will have very limited trading volume. Don’t despair. Just use limits and slowly build your position over time.

- Be patient. Sometimes micro-cap stocks can stay flat or drift lower for months or even years only to shoot 200% higher after the company issues a press release announcing major positive news.

- Be diversified. This can help smooth out the volatility that micro caps can experience.

This week’s recommendation is a perfect example of why I love investing in micro caps. It is trading at a massive discount to fair value and management has a clear plan to unlock value.

Without further ado, let’s discuss this month’s micro-cap idea: NexPoint Diversified Real Estate Trust (NXDT).

New Recommendation

NexPoint Diversified Real Estate Trust: A Special Situation with 50% Upside

Company: NexPoint Diversified Real Estate Trust

Ticker: NXDT

Price: 13.74

Market Cap: $501 million

Price Target: 21

Upside: 53%

Recommendation: Buy under 15

Recommendation Type: Rocket

Executive Summary

NexPoint is a closed end fund that is transitioning into a real estate investment trust (REIT). It trades at a 40% discount to NAV and is significantly below where it traded pre-pandemic. Once the transition to REIT is complete, it will be eligible for many more investors to own including funds and ETFs. This will likely drive indiscriminate buying pressure. The CEO of the company owns 14% of the company and has been buying the stock in the open market relentlessly. A near-term re-rate to NAV could drive 50%+ upside, but longer term, a bigger opportunity could materialize as the REIT is repositioned to capture value.

Company Overview

Background

NexPoint is a little different from the typical micro cap.

It isn’t a “company” per se, but a closed-end fund.

The Fund was formed in 2006 and has been operating as a closed-end fund since then.

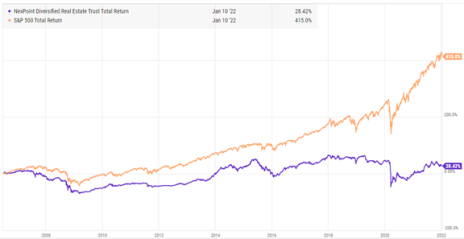

The Fund has performed poorly since inception, underperforming the S&P 500 by a wide margin.

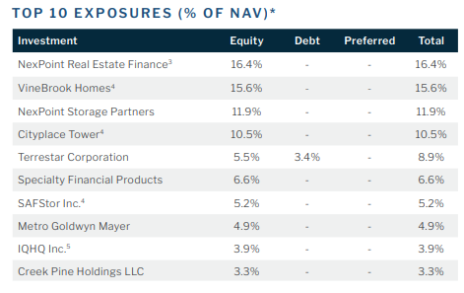

As of Q3 2021, the Fund holds a hodgepodge of assets. The top ten exposures are displayed below.

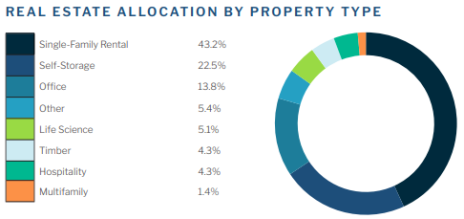

The majority of the Fund’s assets are invested in real estate. As of June 30, 2021, 77% of the Fund’s assets were invested in real estate.

The Fund’s real estate exposure is quite attractive, with single-family rental and self-storage as the two biggest area of focus.

Currently, NexPoint has a net asset value of $22.37 (as of Q3 2021) and it trades at a 39% discount to that value.

It’s a cheap stock, but not for long…

Transition to REIT

In 2020, management announced that they were going to transition the closed-end fund into a REIT. In August 2020, shareholders approved the vote.

Why transition to a REIT?

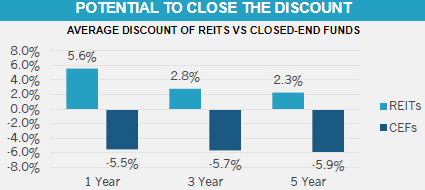

The biggest reason is because it will open up a whole new assortment of investors that can invest in the security.

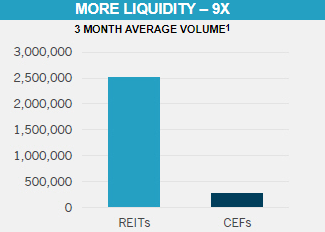

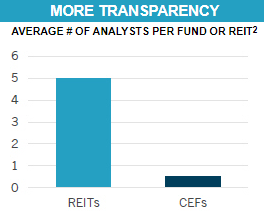

Not many retail investors (and no professional investors) choose to invest in closed-end funds. However, retail investors love dividend-paying REITs. Further, once the transition to REIT is complete, the stock will be added to REIT indexes and REIT index funds and ETFS will be “forced” to buy the stock.

In its proxy statement, NexPoint shared several charts that showed why a REIT structure is superior to a closed-end fund structure.

It hard to argue that the plan to convert to a REIT is not compelling. And insiders agree as they have been relentlessly buying shares on the open market.

Business Outlook

Over the past 10 years, NexPoint has increased its NAV on average at 12% per year. And I see no reason why it can’t grow at that clip or better as it repositions the portfolio in the coming years.

Management hasn’t shed too much light on how its going to reposition the portfolio, however, I have confidence management will create shareholder value.

NexPoint’s CEO, James Dondero, is also the CEO of NexPoint Residential Trust (NXRT), a REIT that was spun out of a closed-end fund in 2014. Sound familiar?

That REIT has gone on to perform exceptionally well as shown below.

I think we could see similar strong performance from NexPoint Diversified REIT.

The key catalyst from my perspective is the finalization of the transition to REIT.

When management originally proposed the transition, it expected it to be completed by Q2 2021. Obviously, management missed that deadline.

Unfortunately, the transition is at the mercy of approval from the SEC, but I think it’s just a matter of time. Shareholders approved the transaction in August 2020, and I sense that approval is imminent given 1) relentless insider buying and 2) the company recently changed its name from NexPoint Strategic Opportunities (NHF) to NexPoint Diversified REIT(NXDT).

Insider Ownership

As Cabot Micro-Cap Insiders know, insider alignment is high on my checklist.

The CEO, James Dondero, owns 14% of shares outstanding and is buying shares hand over fist. Other insiders are buying as well.

Valuation and Price Target

NexPoint currently trades at a large discount to NAV at $22.37. NAV has appreciated at 12% per year on average over the past 10 years. The company pays out a 4% dividend. As such, if the discount to NAV stays the same, I expect a 12% return (consistent with NAV growth) plus a 4% dividend yield, or a 16% annual return going forward, in a conservative scenario.

In a more realistic scenario, I think the return will be higher given that 1) the REIT structure will provide the management team more flexibility to create value by restructuring the portfolio and optimizing debt usage and 2) the REIT structure will attract a wide range of additional investors (both passive and active).

I see ~50% upside over the next twelve months and potentially much more over the long term.

My official rating is Buy under 15.00.

As is always the case with micro-caps, use limits as volume is quite low.

Risks

- Corporate governance. The CEO has a litigious history (feel free to Google his name, James Donder). Further, the NexPoint currently owns several related party investments.

- Mitigant: While related party transactions are something to watch, I’m not particularly concerned in this case given that the CEO owns ~14% of shares outstanding and has been buying in the open market. He is aligned with us as a large minority shareholder.

- REIT Conversion Never Happens. While I believe that the REIT conversion will occur, there is no guarantee that it will. Further, it could be delayed indefinitely.

- Mitigant: The CEO’s continued insider buying gives me confidence that the REIT conversion, while delayed, will happen. If the REIT conversion does not happen, downside would be mitigated given the stock trades at a large discount to NAV. In this scenario, I believe the management team could take other actions (such as a large share repurchase) to close the gap to NAV.

Updates, Watch List and Ratings

Recommendation Updates

Changes This Week

Increasing buy limit on TRUX to Buy under 75

Updates

Aptevo (APVO) is all the way back to where it traded prior to the positive news that a patient treated with APVO436 experienced a complete remission. Where do we go from here? I don’t know, but I know there are many positive catalysts on the horizon. First, we have the JPMorgan healthcare conference in January. This can be a catalyst for the biotech sector. Second, Aptevo will report additional data from its ongoing trials and any positive news will move the stock upwards. Original Write-up. Buy under 15.00

Atento S.A. (ATTO) has started to perk up. I think it’s mainly due to the news that an activist investor, Kyma Capital, now owns 5% of the company, and is engaging with the management team to unlock value. This is a strong positive, given healthy fundamentals and an incredibly cheap valuation. 2022 could be the year that Atento gets sold. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) recently published a new shareholder presentation which highlights the value of its real estate. While BBX has performed very well since our initial recommendation, it remains a high-conviction idea, given 1) positive fundamentals (real estate in Florida is hot) and 2) a very cheap valuation (the stock is still trading at a 50% discount to book value). Original Write-up. Buy under 10.00

Cipher Pharma (CPHRF) has stabilized after selling off in November and December. The stock is currently dirt cheap, has no debt, and significant optionality. Finally, insiders own a significant portfolio of shares outstanding and are incentivized to maximize value. The company is buying back shares aggressively. Original Write-up. Buy under 2.00

Dorchester Minerals LP (DMLP) has rebounded with energy prices but still looks attractive from a valuation and fundamentals perspective. The current annualized dividend yield is ~10.2%. Further, we saw an insider (COO) buy more stock on the open market recently. I’m optimistic that the current COVID wave caused by the Omicron variant will be the last and we will see strong economic activity in 2022 that drives energy prices higher. Original Write-up. Buy under 19.00

Epsilon Energy (EPSN) reported a strong quarter in November, generating $3.3MM of free cash flow. Given no debt and a large and growing cash balance, I expect the management team to announce a large special dividend or accelerated share repurchase within the next few quarters. Original Write-up. Buy under 5.50

Esquire Financial Holdings (ESQ) has pulled back slightly with the market despite no company news. It is a niche bank focused on lawyers and the litigation industry. Due to its specialty and expertise, it has been able to grow very well. Lawyers are low credit risk, and consequently losses have been low. Despite strong growth (~20% per year), the stock trades at ~10x forward earnings. Looking out a couple of years, Esquire should be trading significantly higher. Original Write-up. Buy under 35.00

FlexShopper (FPAY) continues to tread water as insider gobble up shares. I expect a strong 2022 for the stock and for the stock to appreciate sharply. Given less government stimulus, more consumers will need to use FlexShopper’s solutions which will increase revenue and earnings. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 2.50

IDT Corporation (IDT) had no news this week and has pulled back to the mid-40 range. Results from its recent quarter were solid with consolidated revenue up 8%. Most importantly, NRS revenue increased by 104% and net2phone revenue increased by 37.5%. The company announced that it is making progress towards spinning off net2phone. I expect the transaction to take place in Q1 2022. All in all, the investment case is on track. Original Write-up. Buy under 45.00

Leatt Corporation (LEAT) continues to look very attractive. In November, the company reported an incredibly strong quarter despite supply-chain bottlenecks. The stock initially shot up but has given back much of its gains. It looks compelling trading at under 10x annualized EPS. I think ~20x is a more appropriate multiple. Original Write-up. Buy under 40.00

Liberated Syndication (LSYN) filed an 8K announcing that it had canceled 7.5MM shares (22% of shares outstanding!) that had been fraudulently issued to Zhang Parties prior to LSYN’s spin-off. This is a major positive. Zhang Parties have 90 days to challenge the cancellation. Given Zhang Parties didn’t respond to the initial lawsuit that resulted in the cancellation of shares, it’s possible that there will be no challenge. While I do have some questions regarding LSYN’s business trajectory, I think it remains quite attractive at its current valuation. I estimate that it’s trading at 3.0x (EV/revenue) with high-teens revenue growth. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) looks completely washed out. Given a recent positive meeting with the FDA, it looks like Treo will be up for approval in the second half of this year. If approval is gained (I estimate 50% probability), I believe the stock is worth $10+. As such, I think the risk/reward looks very favorable at current levels. Original Write-up. Buy under 3.50

P10 Holdings (PX) recently reported a great quarter. Adjusted EBITDA increased 147% to $21.8MM. Adjusted EPS increased 66% to $0.15. Meanwhile, three brokers (JPMorgan, KBW, and UBS) all initiated coverage with Buy ratings. The investment case remains on track as fundamentals are strong, yet the stock remains cheap on a relative and absolute basis. Original Write-up. Buy under 15.00

Truxton (TRUX) is a rapidly growing bank and wealth management business based in Nashville, Tennessee. Since its initial public offering nine years ago, revenue is up 325% while the stock has generated a 587% total return, beating the S&P 500 by more than 200%. Despite this impressive performance, the stock trades at just 13x earnings given its low liquidity. I expect strong performance to continue in the future and anticipate significant upside in the years ahead. Original Write-up. Buy under 75

Watch List

American Outdoor Brands (AOUT) remains on my watch list. It is a recent spin-off that sells outdoor apparel and hunting paraphernalia. The company recently reported a disappointing quarter where revenue growth turned negative. However, management noted the decline was due to timing of orders and insiders continue to buy the stock in the open mark. The stock still looks cheap trading at ~10x forward earnings. However, I’m a little concerned with revenue growth given the disappointing recent performance.

BNCCORP (BNCC) is a cheap bank that is returning all excess cash to shareholders via special dividends. Last year, it paid out $14/share in special dividends (32% of current share price). It looks like an attractive low-risk idea.

Nanophase Technologies (NANX) is a name that is remaining on my watch list. It is a fast-growing (~50%) skin care company that is trading at a reasonable valuation (30x 2022 EPS). It continues to execute and has performed very well despite other micro caps falling.

Recommendation Ratings

| Stock | Price Bought | Date Bought | Price 1/11/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 7.50 | -77% | Buy under 15.00 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 26.85 | 30% | Buy under 30.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 10.25 | 223% | Buy under 10.00 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 1.34 | -26% | Buy under 2.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 22.20 | 130% | Buy under 19.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 5.73 | 15% | Buy under 5.50 |

| Esquire Financial Holdings (ESQ) | 34.10 | 11/10/21 | 34.49 | 1% | Buy under 35.00 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.09 | -2% | Buy under 2.50 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 42.43 | 119% | Buy under 45.00 |

| Leatt Corporation (LEAT) | 24.00 | 10/13/21 | 32.40 | 35% | Buy under 40.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 4.05 | 32% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.11 | 19% | Buy under 3.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | New | — | 13.77 | — | Buy under 15.00 |

| P10 Holdings (PX)** | 1.98 | 4/28/20 | 13.00 | 557% | Buy under 15.00 |

| Truxton Corp (TRUX) | 69.50 | 12/8/21 | 73.50 | 6% | Buy under 75.00 |

Glossary* Return calculation includes dividends

**Original Price adjusted for reverse split.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, PIOE, MEDXF, LSYN, IDT, FPAY, DMLP, and LEAT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on February 9, 2022.