This week, we profile an under-the-radar podcast hosting company in secular growth that is about to announce the results of a strategic review.

Our micro-cap recommendations have performed well in aggregate. Nonetheless, I believe my open BUY recommendations remain significantly undervalued as they have been left behind in this surging market.

Micro caps don’t benefit from passive investing as they are not owned by any indexes or ETFs. Nonetheless, the historical performance (~18% annual CAGR) of micro caps speaks for itself.

If we continue to patiently buy undervalued micro caps, we should do quite well over time.

If you have not already, I recommend that you read my Cabot Micro-Cap Insider Guide. It will help you get the most out of your Cabot Micro-Cap Insider membership, and make your investing decisions easier and more profitable. It will also explain much of the shorthand we use in Cabot Micro-Cap Insider, and explain our ratings.

Our monthly member call will take place this Thursday, June 11, 2020 at 2 p.m. ET. We will review all open recommendations and answer subscriber questions. You can register here.

If you have any questions about any of my recommendations, I encourage you to reach out to me directly at rich@cabotwealth.com.

Now let’s get into my newest recommendation.

Cabot Micro-Cap Insider 620

[premium_html_toc post_id="207303"]

Patience Will Pay Off

This week, we profile Liberated Syndication (LSYN), an under-the-radar podcast hosting company in secular growth that is about to announce the results of a strategic review. Make sure to use limits when buying LSYN as the stock is very illiquid.

Our micro-cap recommendations have performed well in aggregate. Nonetheless, I believe my open BUY recommendations remain significantly undervalued as they have been left behind in this surging market.

Micro caps don’t benefit from passive investing as they are not owned by any indexes or ETFs. Nonetheless, the historical performance (~18% annual CAGR) of micro caps speaks for itself.

If we continue to patiently buy undervalued micro caps, we should do quite well over time.

If you have not already, I recommend that you read my Cabot Micro-Cap Insider Guide. It will help you get the most out of your Cabot Micro-Cap Insider membership, and make your investing decisions easier and more profitable. It will also explain much of the shorthand we use in Cabot Micro-Cap Insider, and explain our ratings.

Our monthly member call will take place this Thursday, June 11, 2020 at 2 p.m. ET. We will review all open recommendations and answer subscriber questions. Sign up here.

If you have any questions about any of my recommendations, I encourage you to reach out to me directly at rich@cabotwealth.com.

Now let’s get into my newest recommendation: Liberated Syndication.

New Recommendation

Libsyn: A Podcast Hosting Company in Secular Growth

Company: Liberated Syndication

Ticker: LSYN

Price: 3.06

Market Cap: $90 million

Enterprise Value: $80 million

Price Target: 6.00

Upside: 96%

Recommendation: Buy Under 3.35

Recommendation Type: Rocket

Executive Summary

Liberated Syndication (LSYN) is a profitable podcast and website hosting company with $10MM of net cash on its balance sheet growing at a double-digit clip. As the business does not require much capex, it generates significant free cash flow. Despite its high business quality, sticky revenue and secular growth trajectory, LSYN trades at just 8.6x 2019 EBITDA. An activist recently won a proxy fight with management and has undertaken a strategic review for the company. The conclusion is expected to be announced soon. My 6.00 target implies 96% upside.

Background

I closely follow spin-offs as they are a fertile area to find profitable investments. Liberated Syndication is a 2016 spin-off of a company called Fab Universal. Since its spin-off just four years ago, LSYN is up over 1,000%. Despite its strong stock performance, LSYN continues to grow and trades at a very reasonable valuation. I believe the stock is poised for further strong performance.

Libsyn Overview

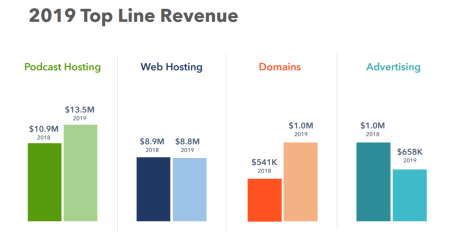

Libsyn has two businesses: podcast hosting and website hosting. Both businesses are excellent as the vast majority of revenue is recurring and capital requirements are low. Podcast hosting is its primary business (accounts for 59% of revenue) and is the key growth driver. It grew 15% in 2019, but I expect it to grow 20% in 2020.

Website hosting represents 41% of the overall business. It grew 4% in 2019, and I expect a similar level of growth in 2020. The website hosting business was acquired in 2017. I originally did not like the acquisition, but management has done a good job of getting the business to grow and harvesting cash flow from it. It is a cash cow and management disclosed that it generated ~$2MM of cash flow in 2019.

The podcast business is the most exciting part of the company and the reason to own the stock.

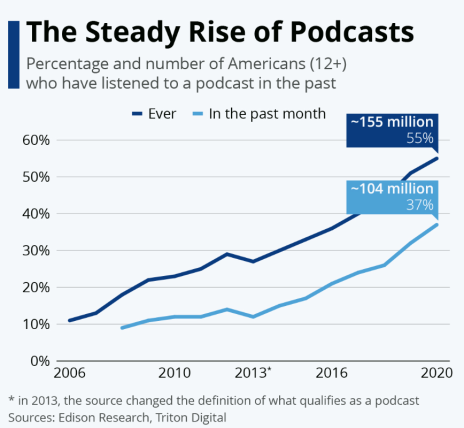

For those unfamiliar with podcasts, they are digital audio files that can be downloaded or streamed to computers or mobile devices. As shown below, podcasts are in secular growth.

Libsyn, founded in 2004, is one of the oldest and most reliable podcast hosts in the world. Hosting allows someone to upload an mp3 file with the podcast, tell the listener what the episode is about, and generate an RSS feed. The RSS feed connects to iTunes, Spotify, and other podcasting apps so listeners can browse episodes and download them.

Business Outlook

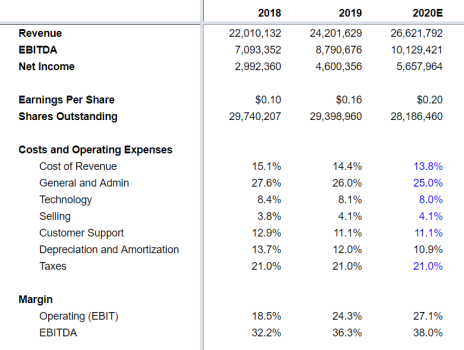

In 2019, LSYN grew revenue by 10%. The podcast business grew 15% while the website hosting business grew by 4%.

Podcast and website hosting is not economically sensitive. In fact, Libsyn noted during a recent investor call that April was its second strongest month ever for new sign-ups.

As such, I’m expecting Libsyn to continue to generate strong results in 2020.

In 2020, I’m expecting revenue to grow by 10%, consistent with 2019. I’m expecting modest margin expansion as the company continues to leverage its fixed cost base. As a result, I’m expecting EBITDA to growth by 15% and EPS to grow by 28% to $0.20 (shares outstanding will decline due to cancelled equity grants).

LSYN CEO and Camac Partners

LSYN’s CEO is named Chris Spencer. While I believe Spencer has actually done a fine job managing the business historically, the company’s share count has been diluted by the Board of Directors (Spencer is Chairman of the Board) granting themselves and management excessive stock-based compensation. Further, cash compensation has been egregious.

Fortunately, that has come to an end thanks to an activist campaign run by Camac Partners, a hedge fund.

Camac first established its position in December 2018 and proceeded to call a special meeting and moved to replace management and the entire Board of Directors. Here is the proxy solicitation, which outlines its issues with management and the Board of Directors.

In October 2019, Libsyn announced a “settlement” with Camac Partners, which was a huge win for shareholders.

The most important terms of the settlement are:

- A change to the Board of Directors.

- The Board previously included four individuals: Chris Spencer (CEO) and three “independent directors” who were friends of Spencer. The new Board will ultimately include five people: Eric Shahinian (Managing Partner at Camac), Brad Tirpak (nominee from Camac), Spencer and two other independent directors.

- Eric Shahinian (Camac Managing Partner) will become Chair of the Compensation Committee. As a result, Spencer will no longer receive excess compensation.

- Review of Strategic Alternatives

- A committee was formed to review strategic alternatives for Libsyn. Here is language from the settlement: “For the avoidance of doubt, the Committee is explicitly authorized to conduct, with the assistance of its advisors, a market check to determine whether a buyer exists for the Company in a transaction that the Committee is willing to recommend to the Board. The Review Committee and the Financial Advisor will work in good faith to provide an appropriate recommendation to the Board.”

Based on my conversations with Spencer, I believe the results of the strategic review will be announced shortly. It could include the announcement of a company sale, a share repurchase authorization, a one-time or recurring dividend, or something completely different.

Valuation and Price Target

Libsyn is not dirt cheap, but trades at a very reasonable valuation given its secular growth, recurring revenue, and strategic alternatives.

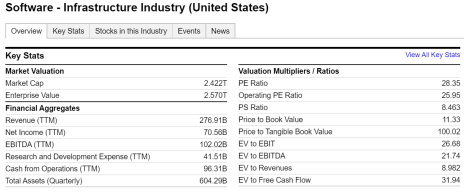

Currently, the company trades at an EV/2019 sales multiple of 3.1x, and EV/2019 EBITDA multiple of 8.6x, and a price/2019 EPS multiple of 18.7x.

As shown below, public peers in the software and infrastructure industry trade at a significant premium to Libsyn.

My 12-month price target is 6.00, as I believe LSYN deserves to ultimately trade at 30x my 2020 EPS estimate of $0.20.

I believe downside is limited given that LSYN has net cash on its balance sheet of $10 million (~11% of market cap), generates significant free cash flow ($7.2 million in 2019), and has an activist investor who is focused on increasing LSYN’s stock price.

Make sure to use limits when buying LSYN as the stock is very illiquid.

My rating for LSYN is Buy Under 3.35.

Risks

- LSYN has not filed its 10-Q for the first quarter of 2020.

- The 2019 10-K was also delayed but has since been filed. The delay was due to an IRS audit, which determined that LSYN had miscalculated its net operating losses and owed taxes for 2018. Nonetheless, the restatement actually resulted in higher net income. My understanding is that work to complete the 10-Q was delayed as the company and its auditors were working to complete the 10-K. I expect the 10-Q to be filed any day now.

- Management team has a history of excessive compensation and diluting shareholders.

- While excessive compensation has been an issue in the past, I believe it is behind the company now that an activist investor (Camac Partners) has taken over control of the compensation committee.

Recommendation Updates

Changes This Week

No Changes

Updates

HopTo Inc (HPTO) was down this week, with no news or SEC filings. HopTo reported first-quarter results on May 20. Sales declined 21%, which appears very bad at first glance. However, sales for hopTo are typically lumpy on a quarter-by-quarter basis. The 10-Q discloses that the decline was due to timing of revenue recognition and a larger order in Q1 2019 that did not renew. Most importantly, management noted that it expects “sales in 2020 to be similar to sales” in 2019. In other words, management doesn’t expect a decline in sales in 2020 despite the Q1 drop. This is the same language that hopTo used in 2019 (sales grew 13% in 2019). As such, I’m not concerned with the headline drop in sales in Q1.

One issue that I will continue to watch relates to the rights offering that hopTo closed in March. As part of the agreement, there was a backstop agreement whereby management and a consortium of accredited investors agreed to purchase at $0.30 per share up to $2.4 million of hopTo stock. Essentially, the backstop agreement is a massive insider buy and bodes very well for the outlook of the stock. That transaction was expected to close in April but the 10-Q indicated that it was now expected to close in May. If the backstop agreement doesn’t close, it will be a negative signal for the stock. Since I issued my BUY under 0.45 rating, the stock has appreciated above my 0.45 limit. As such, my current rating is HOLD. If the stock drops back to 0.44 or lower, my recommendation will change back to BUY. HOLD

Medexus Pharma (PDDPF) was down slightly this week on no news. I’m looking forward to the company reporting earnings later this month as it will be the first time we get a look into the outlook including the transformative acquisition of XINITY (hemophilia drug). On May 22, Medexus issued a press release stating: “We continue to generate steady growth across our key product lines and, despite the disruption from the COVID-19 pandemic, our sales teams have continued to be remarkably productive by finding new ways to connect creatively and productively with clinicians and patients.” As such, I’m expecting a positive quarter. Pro forma for the recent acquisition of XINITY, it is trading at an EV/revenue multiple of 0.8x while peers trade at 3.0x. My rating for PDDPF is Buy under 2.32.

P10 Holdings (PIOE) continued to gradually grind higher this week on no news. PIOE reported earnings on April 30. Revenue grew 8% y/y due to additional fundraising by RCP Advisors. Cash earnings stayed flat y/y at $0.04 although that was due to costs related to acquiring Five Points and almost acquiring another private equity manager. RCP Advisors noted it has already raised $165 million of additional capital commitments for its private equity funds. It will launch two more funds this year and Five Points will also begin a new fundraise. Excluding one-time costs, PIOE will generate $0.27 in cash earnings in 2020. As such, PIOE is trading at 8.1x 2020 free cash flow. This is too cheap a valuation for a company that has sticky revenue, high margins, and strong growth potential. The investment case is on track. BUY Under 2.25

Recro Pharma (REPH) has bounced back from a disappointing quarterly report but will remain in purgatory for the next couple of quarters, unfortunately. As a reminder, management decreased annual revenue guidance due to 1) increased competition from Mylan, a competitor to Recro customer, Teva; 2) slower-than-expected new business growth, which REPH believes is primarily attributable to COVID-19; and 3) notifications by two customers of discontinuations for two commercial product lines, which resulted in a decrease of approximately $4 million on previous 2020 revenue guidance and is estimated to have an annual impact to 2021 revenue of approximately $7 million to $8 million. Given COVID-19 headwinds, I recently took my price target down to 13.00, which corresponds to a 15.0x EV/2020 EBITDA multiple, a 25% discount to public peer Catalent. While my price target still implies significant upside longer term, I continue to believe REPH will be in “purgatory” for at least the next couple of quarters given COVID-19 headwinds. As such, my current rating is HOLD.

Riviera Resources (RVRA) was up slightly on the week but has lagged energy peers, many of which have appreciated significantly. This is a result of RVRA being a micro cap with a tiny float. While it’s frustrating to see RVRA left behind as other bankrupt energy companies (see WLL) or near-bankrupt companies (see CHK) rally 100%+, we will continue to patiently hold RVRA knowing that ultimately, value will be recognized. The next catalyst for the stock would be the announcement of a sale of one of RVRA’s assets. This would likely result in another distribution for investors. RVRA continues to be an attractive long-term holding. It has minimal debt and is generating positive free cash flow. Further, it has a valuable asset in its Blue Mountain midstream business. Once the energy market turns (and it always does eventually), Riviera will be well positioned to benefit. BUY Under 2.25

U.S. Neurological Holdings (USNU) was flat on the week. There was no news this week for USNU. USNU operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and holds interests in radiological treatment facilities. USNU reported Q1 2020 earnings on May 15. The company generated $0.02 of earnings and $399,000 of free cash flow in the first quarter, and as a result net cash on the company’s balance sheet increased to $1.7 million, or $0.22 per share. USNU did note that revenue declined 12% in the quarter driven by fewer procedures being performed due to the outbreak of COVID-19. Eventually, I would expect deferred procedures to resume. Since I issued my BUY under 0.20 rating, the stock has appreciated above my 0.20 limit. As such, my current rating is HOLD. If the stock drops back to 0.19 or lower, my recommendation will change back to BUY under 0.20. HOLD

Watch List

Dorchester Minerals (DMLP) remains on my watch list. DMLP is an oil and gas royalty company that pays out all its of its earnings to its shareholders. It has no debt and thus has no risk of bankruptcy. The lowest quarterly distribution that DMLP has made over the past 10 years was $0.15 in 2016 (the last time energy prices were depressed). At DMLP’s current price, it’s trading at a trough yield of 4.0%. I will continue to research this name and may recommend it in a future issue.

One additional name on my watch list is Sonic Foundry (SOFO). SOFO is a video software company that specializes in solutions that cater to the education market. The company has struggled over the past three years but appears to be very well positioned to increase sales in the COVID-19 world as many schools will be embracing remote classes. Further, the chairman of the company recently tried to take the company private at 5.00 per share but relented when minority shareholders complained that the price was too low.

Recommendation RATINGS

| Stock Name | Date Bought | Price Bought | Price on 6/10/20 | Profit | Rating |

| HopTo | HPTO | 0.39 | 0.45 | 15% | Hold |

| Liberated Syndication | LSYN | 3.06 | 3.06 | 0% | Buy under 3.35 |

| Medexus Pharma | PDDPF | 1.78 | 1.86 | 5% | Buy Under 2.32 |

| P10 Holdings | PIOE | 1.98 | 2.22 | 12% | Buy under 2.25 |

| Recro Pharma | REPH | 8.16 | 5.66 | -31% | Hold |

| Riviera Resources | RVRA | 2.60 | 1.84 | 0%* | Buy under 2.25 |

| U.S. Neurological Holdings | USNU | 0.14 | 0.25 | 79% | Hold |

*Includes 0.75 distribution

Please email me at rich@cabotwealth.com with any questions or comments about any of our stocks, or anything else on your mind.Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

The next Cabot Micro-Cap Insider issue will be published on July 8, 2020.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2020. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.