It’s my daughter’s school vacation week, the weather is getting warm, and I got my first vaccine shot – things are looking up!

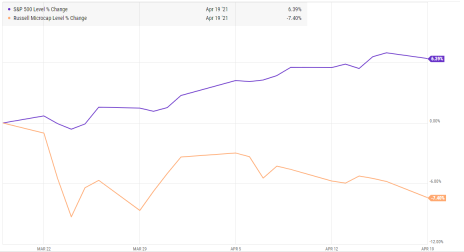

Even the S&P 500 is back near all-time highs.

So why does it feel like there’s been a pullback in the market?

Because there has … if you’re a micro-cap investor.

The Russell Micro-cap index has pulled back and has underperformed the S&P 500 by 13% in the past month.

In fact, the Russell Micro-cap index has pulled back by 9.5% and is on the cusp of a market correction.

While pullbacks are never fun, I’m not at all concerned.

The Russell Micro-cap Index is up over 100% in the past year and is due for a breather.

It’s an opportunity to focus on new, interesting ideas, and to double down on high conviction ideas (like Medexus Pharma).

Some other news before we jump into our updates.

This Thursday (April 22) at 2 p.m. ET, I’m hosting a webinar called: 3 Micro-Cap Stocks that Could Triple in the Next Year

I will walk through how I find attractive micro-caps and review three ideas with high upside potential. Two of the ideas will be familiar to you; one will be new.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, May 12. As always, if you have any questions, don’t hesitate to email me at rich@cabotwealth.com.

Changes This Week

No ratings changes this week

Updates

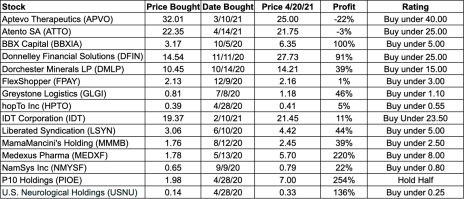

Aptevo (APVO) continues to be relatively weak. Aptevo reported Q4 2020 quarterly results and announced that it has agreed to sell Ruxience Royalty stream for $35MM up front and milestone payments of up to an additional $32.5MM in 2021, 2022, and 2023. Aptevo did not announce any details on the sale of its IXINITY royalty stream; however, I estimate it is worth $19MM. Aptevo’s enterprise value is $92MM. Counting $67.5MM in payments for Ruxience and $19MM for IXINITY, Aptevo’s pipeline is being valued by the market at $10MM, which seems low considering APVO436 has generated one complete response and another partial response in very difficult-to-treat AML patients. With regards to Tang’s unsolicited offer, management noted that it couldn’t agree to a non-disclosure agreement and so talks broke down. I still believe Aptevo looks like a great asymmetric bet and believe Tang will follow through with his proxy fight to get Aptevo sold to the highest bidder. Original Write-up. Buy under 40.

Atento S.A. (ATTO), our latest recommendation, is up slightly in the past week. The company is a Latin American customer relationship management (CRM) business that is growing, expanding margins, and an acquisition candidate. It’s majority owned by sophisticated private equity investors who are restricted from selling the company until May 2022. At that time, I expect a sale of the company for more than 100% above Atento’s current price. Original Write-up. Buy under 25.00.

BBX Capital (BBXIA) had no news this week. It reported its fourth-quarter results recently. The story remains on track. The most important positive relates to the company’s real estate business. Management wrote in its press release: “Although BBX Capital Real Estate (“BBXRE”) was initially adversely impacted by the COVID-19 pandemic during 2020, it has largely recovered and has to some extent benefited from the recent migration of residents into Florida. We believe that there has been an increase in the demand for single-family and multifamily apartment housing in many of the markets in which BBXRE operates.” This news is a major positive as the company has over $100MM of fair value invested in real estate primarily in Florida. The company’s Renin subsidiary (a distributor of building products, including barn doors, closet doors and stair parts) appears to be performing well and should benefit from a strong economic recovery in 2021.The one negative in the quarter was that the company didn’t buy back any shares despite its $10MM share repurchase authorization. A share buyback would make perfect sense given the stock is trading well below any reasonable estimate of fair value. The investment thesis remains on track and the stock is too cheap trading at 39% of book value. Original Write-up. Buy under 5.00.

Donnelley Financial Solutions (DFIN) has performed well but had no news this week. Recently, Donnelley reported a solid quarter. Revenue increased 10.5%, beating consensus expectations considerably. The revenue upside was driven by strong capital markets activity (IPOs and SPAC issuance) as well as continued growth of software and tech enabled solutions. Software solutions revenue increased 8% y/y to $54.2MM and now represent 25.8% of total sales. The company also announced the launch of a new software solution for SEC filing and announced a $50MM share repurchase authorization that will replace its current $25MM authorization. All in all, an excellent quarter. Currently, the stock trades at 7.6x free cash flow and 7.1x forward EBITDA. Original Write-up. Buy under 25.00.

Dorchester Minerals LP (DMLP) continues to look attractive. With oil over $60/barrel, Dorchester will generate substantial dividends. While oil has pulled back recently it’s still above $55/barrel and the company will generate substantial dividends at this price level. In 2020, the company generated $39.4MM of free cash flow. Given the pandemic, we can view this free cash flow generation as a trough. As such, DMLP is trading at 12.4x trough free cash flow. This is an extraordinarily cheap multiple for such a high-quality royalty business. Original Write-up. Buy under 15.00.

FlexShopper (FPAY) recently reported an excellent quarter but has pulled back. In the quarter, revenue increased by 25.3%, beating consensus by 4%. Adjusted EBITDA increased by 136% to $2.6MM. And better yet, new originations increased 26.5%, which implies that revenue and earnings growth for 2021 should be very strong. I continue to like FlexShopper. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 6.2x 2021 earnings. Importantly, the chairman of FlexShopper owns over 20% of the company and has recently been buying in the open market. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00.

Greystone Logistics (GLGI) has been strong despite what appears to be a weak quarter. Revenue declined in the quarter by 26% while EPS declined by 65% to $0.02. However, the 10-Q revealed that the decline in revenue was primarily due to a timing issue. In March (one month after quarter end), Greystone received an order for $7.8MM. If that quarter had been received in February, revenue would have grown by 13% and earnings would have grown significantly as well. As such, it makes sense that the stock has been strong. Given the $7.8MM order in March, fiscal Q4 should be a blowout for Greystone. The company also noted that a client that had previously decided to diversify its purchase order of case pallets has reversed that decision. All in all, several positive developments and the stock looks attractive. I estimate that Greystone will generate $0.15 of earnings this fiscal year (we are in the last fiscal quarter now). As such, the stock is trading at a P/E of 8.0x. This represents a good value for a company with such a strong long-term growth outlook. Original Write-up. Buy under 1.10.

HopTo Inc (HPTO) recently filed its 10-K to disclose Q4 earnings. Revenue increased 6% y/y to $0.8MM. For the full year, revenue grew 3%. While not a blowout quarter, it is a positive nonetheless. Insiders own a significant stake in the company and have an incentive to grow revenue and earnings to increase value. I believe HPTO is worth ~0.80 per share. The stock is currently trading at an EV/EBIT multiple of 6.5x. This is way too cheap. To put it in perspective, the software and Internet industry trades at an average EV/EBIT multiple of over 50x. Original Write-up. Buy under 0.55.

IDT Corporation (IDT) has performed well since reporting strong earnings recently. Consolidated revenue increased by 5%. National Retail Solutions (NRS), BOSS Revolution Money Transfer, and net2phone-UCaaS subscription revenues increased by 151%, 73% and 36%, respectively. In particular, NRS’ growth of 151% was incredibly impressive. NRS deployed 1,300 billable POS terminals during the quarter, increasing its network to 13,700 terminals, and had 3,800 active payment processing merchant accounts at January 31, 2021. IDT believes that the market for NRS’ point of sale terminals is 100,000. On a sum-of-the-parts basis (which I think is the right way to view this name given IDT’s propensity to sell and spin off its assets), the stock is worth 34. Original Write-up. Buy under 23.50.

Liberated Syndication announced this week that it will be making another acquisition. This time, it will buy Glow, a podcast monetization platform. Financial terms of the transaction were not disclosed. The more interesting acquisition was announced a few weeks ago when Libsyn revealed plans to acquire AdvertiseCast, an independent podcast advertising company. The combination of Libsyn’s 75,000 podcasts with AdvertiseCast’s advertising capabilities should result in accelerating revenue growth going forward. Last year, AdvertiseCast grew revenue 45% to $12MM and has scaled profitably since launched in 2016 with no outside investment. Under the terms of the transaction, Libsyn will pay $30MM ($18MM in cash, $10MM in newly issued Libsyn shares, and $2MM in earnouts). Libsyn will issue $25MM of stock to pay for the deal in a PIPE transaction which will be led by Camac Partners. The transaction is expected to close in Q2 2020. The acquisition looks like a steal. Libsyn is paying 2.5x revenue for a podcast advertising business that is growing 45% per year and profitable. With the acquisition, podcast revenue growth will increase from 11.1% to 26.2%. Total company growth increases from 5.0% to 17.5%. Original Write-up. Buy under 5.00.

MamaMancini’s Holding (MMMB) is performing very well. We originally recommended the stock last summer and for a long time it didn’t really do anything. The stock moved slightly up but didn’t make any large moves. It wasn’t as exciting as some of our other fast-moving micro-cap recommendations. But we stuck with the stock because it had solid fundamentals (good revenue and earnings growth), a strong balance sheet, and reasonable valuation. And our patience is starting to pay off. After treading water for a while, the stock looks like it’s breaking out. Not a ton has changed from a fundamental perspective. Recently, the company announced that it appointed a managing partner from Alta Fox Capital, Connor Haley, as a member of the board. This is a major positive as it suggests that Alta Fox Capital (the firm has excellent performance) will remain a shareholder for the long term. MamaMancini’s is in the process of uplisting to the Nasadq, but that isn’t really new news. The company did recently announce that it is looking to make bolt-on acquisitions of companies with $12MM to $20MM of sales and positive EBITDA. Any acquisition will be complementary to the company’s current portfolio of products and will be immediately accretive. Given strong performance and a cheap valuation, I recently increased my buy limit to 2.50. My 12-month price target is 3.80, which is driven by an estimated price-to-earnings multiple of 20x on expected fiscal 2021 earnings of $0.19. Original Write-up. Buy under 2.50.

Medexus Pharma (MEDXF) has been a little weak, but it remains our highest conviction idea. I expect Medexus to announce that it will be uplisted to the Nasdaq very soon and this could be a nice catalyst to see the stock continue its upward march. Management believes its current drug portfolio (including recently licensed Treosulfan) has peak sales potential of $350MM to $400MM CAD. Assuming the company can trade at 3x this revenue estimate (the company will execute additional licensing deals so I expect revenue to ultimately grow even higher) in line with slower-growing peers, MEDXF would trade at ~24 per share, implying 200% upside from here. Original Write-up. Buy under 8.00.

NamSys Inc. (NMYSF) recently reported positive full-year results. In the fiscal year, revenue increased 15% to $4.7MM. Free cash flow increased 34% to $1.9MM. NamSys is attractively valued, trading at 15.3x free cash flow. The biggest news remains that the company recently announced that it has terminated its long-term incentive plan. The plan was originally put in place in the mid-2010s to incentivize the team to help transition NamSys’ software from on-premise to a cloud-based offering. However, the long-term incentive plan had no limit as participants in the bonus plan are entitled to 15% of the value of the company, no matter how high it’s valued. The payout for the termination of the bonus plan will be made in cash and stock. This is a major positive as it will increase the company’s earnings growth rate going forward. Further, it’s possible that this announcement could be a prelude to a sale of the company. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 15.3x free cash flow. It has a pristine balance sheet with significant cash and no debt, and insiders own more than 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80.

P10 Holdings filed its 10-K and issued its annual letter to shareholders. It is always a great read and quick (only three pages). In the letter, Co-CEOs Robert Alpert and Clark Webb lay out high level guidance for P10 Holdings financial outlook. The business currently has $12.7 billion in assets under management and charges ~1.00% on average for its management fee. The business should generate 55% to 60% EBITDA margins. Taxes and interest payments currently amount to $18.4MM per year. After doing the basic algebra (assuming a 55% EBITDA margin), I determined that the business is currently on track to generate ~$70MM of EBITDA and $51MM of free cash flow. As such, it’s trading at 15.8x EBITDA and 12.4x free cash flow. This isn’t dirt cheap, but it is very reasonable for such a well-positioned company with organic growth and additional acquisition opportunities. It’s closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 31.9x EBITDA and 21.3x free cash flow. My official rating is Hold Half, but I may eventually switch my rating back to Buy given how well the business is positioned. Original Write-up. Hold Half.

U.S. Neurological Holdings (USNU) filed its 10-K to report Q4 earnings. In the quarter, revenue grew 55% due to a strong snap back of demand. For the full year, revenue grew 3% which is impressive given the pandemic. In 2020, the company generated EPS of $0.07. As such, it is trading at a P/E of 4.9x. It also has $2.0MM ($0.26 per share) of cash on its balance sheet and no debt. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Original Write-up. Buy under 0.25.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, GLGI, HPTO, LSYN, MMMB, MEDXF, PIOE, FPAY, IDT, and APVO. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.