My message remains the same.

I plan on ramping up the positions in our actively managed portfolios (Buffett and Growth/Value) over the next expiration cycle. My goal is to have a minimum of 5 positions per portfolio, but I’m not going to race to get there. I’ll continue to pounce when the opportunity presents itself. We’ve taken our time adding positions since initiating our portfolio and, so far, our patience has served us well.

As for the performance of our portfolios, well, all of our positions are delta positive, so inherently they are all bullish leaning. So, we should expect to continue to see nice returns as the market continues to push higher, and that has mostly been the case.

That being said, our Dogs of the Dow positions have been challenged since the onset of the new year. But this is often typical when we initiate new positions, as we haven’t had the opportunity to build much in the way of call premium. And remember, depending on the underlying stock, we should have the opportunity to sell at least 20% to 60% of call premium over the course of the year, which acts as a nice hedge if our positions turn lower.

Current Positions

Click here to access the “Portfolios” section to view each portfolio’s respective positions.

Options Education

It doesn’t matter if you are just starting or have an advanced grasp of all things options, if you don’t think of yourself as a risk manager first, you will fail, it’s just a matter of time.

Proper risk management is what separates those that succeed from those that continually struggle or simply just give up.

What people continue to struggle with is trying to find the latest and greatest strategy, constantly hopping from one strategy to the next. Strategy is far less important than proper risk management.

Placing trades, well, it’s the easiest part of the trading process. Anyone can place a trade. It’s how you handle the trade that allows you to be profitable over the long term.

Which is why you MUST think of yourself as a risk manager first, especially if you are taking a truly quant-based approach. The Law of Large Numbers is your foundation but managing sequence risk is the obstacle that most traders just can’t overcome.

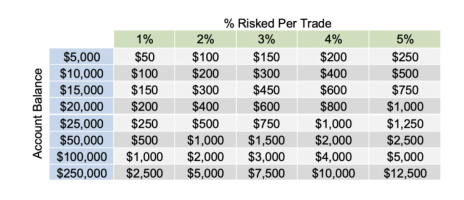

As stated above earlier, sequence risk is the inherent risk that a trader could suffer multiple losses in a row. The best way to combat sequence risk is through proper position sizing. Position sizing mitigates the impact of consecutive losses. The lower the capital risked per trade, the lower the probability that a sequence of losing trades will cause a significant drawdown.

The table in the section above shows how sequence risk can impact your overall account and why it is imperative that you use proper position size when investing/trading.

Again, we know losing trades are going to occur. It’s a hard fact that we must accept. So, trades must be managed appropriately….

And the first step is proper position size.

The most important decision you will make as a successful options trader is how much to allocate per trade. From a risk-management standpoint, maintaining a consistent position size among your trades is of the utmost importance. We want to limit the havoc that one trade could have on our portfolio.

For simplicity’s sake, let’s say our trading account stands at $10,000 in this example.

In one case, we have allocated 50% per trade. In the other, we have allocated 5% per trade.

$10,000 Account (50% allocated per trade):

One position, equally weighted at $5,000. So, with each trade, a 10% drop will cause a 5% drop in our overall portfolio. A 20% drop will cause a 10% drop, 30% would be 15% . . . you get the picture.

Just knowing this gives every options trader the insight necessary to shape a position size and stop-loss strategy for maximum effectiveness.

Let’s say with each trade we set our stop-loss order at 50% of our allocated amount. For example, with 50% allocated to each trade, our stop-loss would be set at $2,500.

Two trades would only allow us to diversify among two positions with 50% of our overall portfolio value at risk.

$10,000 Account (5% allocated per trade):

One position, equally weighted at $500. So, with each trade, a 10% drop will cause a 0.5% drop in our overall portfolio. A 20% drop will cause a 1% drop, 30% would be 1.5% . . . again, you get the picture.

Our stop-loss with 5% allocated per trade is $250.

For example, if we had four iron condor trades open simultaneously, we would have $2,000 in play with only $1,000 or 10% of our overall portfolio at risk.

Worst-Case Scenario

If we assume our position size of $500 per trade and had four trades going at one time, our maximum loss is 10% or $1,000 of our overall portfolio.

A 10% loss in the portfolio would need a 11.11% overall gain to make up for the loss.

Summary

I realize the prior exercise is fairly simplistic. Again, it only begins the important discussion of risk management. Without some form of risk management, emotions take over.

And emotions are the enemy. Hindsight never exists in the present. We must realize that we will be wrong on occasion.

Being privy to this allows us to prepare accordingly. We know over the long term that having a defined stop-loss will only serve to benefit the performance of our respective portfolios. More importantly, we always know when to sell. Of course, all of the above assumes that we prefer the straight percentage stop-loss.

If you want to be a successful trader/investor over the long term, then taking the time to figure out an appropriate position-sizing plan is imperative. Please, please, please do not overlook this important concept.

You will not regret it.

Portfolio Discussion

All-Weather Portfolio

The ongoing four-month rally has pushed the All-Weather portfolio up a respectable 19.3%, with our poor man’s covered call in the Vanguard Total Stock Market ETF (VTI) continuing to do the heavy lifting, up 41.2%.

But over the past two months, our SPDR Gold Shares ETF (GLD) position has also participated in some heavy lifting. After being down roughly 20%, our poor man’s covered call position in GLD now sits 30.8% higher … double what it was at February expiration

Both bond funds (TLT and IEF) and the commodity fund (DBC) continue to lag behind, but as I always state, that is the yin-yang protective nature of the All-Weather portfolio just doing its job. All three have made considerable gains over the past few months, before taking a small step back recently.

All of our positions continue to outperform their respective ETF benchmarks, once again showing the power of using a poor man’s covered call approach.

Three of our short call positions (TLT, VTI, IEF) need to be rolled this week. I plan to buy back our short calls and immediately sell more call premium for the March expiration cycle.

Yale Endowment Portfolio

Our Yale Endowment portfolio is up 24.5% since initiating back in early-June 2022.

Not much has changed from the last expiration cycle. Our S&P 500 (SPY) position is up 37.9%, emerging markets (EEM) is up 9.5%, and the European Union (EFA) is up 18.2%. The three ETFs have led the way for the Yale Endowment Fund while bonds (TIP) and real estate (VNQ) continue to lag, even though both continue to make great strides to get back to breakeven levels.

Two of our short call positions (TIP, EEM) need to be rolled this week. I plan to buy back our short calls and immediately sell more call premium for the March expiration cycle.

Dogs (and Small Dogs) of the Dow

Our first year (2023) using the Dog-based approach at Cabot came with decent results.

- Dogs of the Dow: -2.0%

- Dogs X: -2.2%

- Small Dogs: 18.9%

- Small Dogs X: 35.3%

Our 2024 Dog portfolios continue to stumble, however, as we move closer and closer to the second calendar quarter of the year:

- Dogs of the Dow: -3.3%

- Dogs X: 2.8%

- Small Dogs: -5.1%

- Small Dogs X: -4.4%

As I stated earlier, these types of early losses are actually normal at the onset of each year for the Dogs as we have only sold premium for one expiration cycle. As we continue to build our call premium sold, we should start to see the Dogs positions even out a bit. And of course, a push higher in our held positions will obviously help our bullish-leaning positions.

I’ll be rolling our remaining March 15, 2024 call positions into April expiration early this week. We only have two trades due to expire at the March 15, 2024 expiration, which I will be rolling this week.

Warren Buffett’s Patient Investor Portfolio

Our average return per trade in the portfolio stands at 8.0%.

At the moment, we have three positions (AAPL, GOOGL, TXN) and, as stated before, intend to add several more over the coming weeks, if the market cooperates … again, a statement we’ve been making for quite some time now.

Back in late June we added Alphabet (GOOGL). Since adding the position, we are up 28%, while the overall stock is up only 12.5%.

Our TXN position has made great strides over the last expiration cycle as it sits higher by 1.8%, compared to the stock, which is down 3.4%. We’ve seen TXN push 13.4% over the past expiration cycle. Let’s hope this good fortune continues in the stock so we can start to see some real, sizable returns in our TXN position.

Our longest-standing position, AAPL, is down 4% after being down close to 25% several months ago. A rally in AAPL will obviously help to push our position higher, and until then we will continue to lower our cost basis by selling more and more call premium.

As I have written in our last few issues, I will be building out the portfolio to a minimum of five positions over the coming expiration cycles, and remember, because this is an active portfolio, we will be rebalancing every month around expiration, with the next one occurring around the March 15 expiration cycle.

James O’Shaughnessy’s Growth/Value Portfolio

Our average return per trade in the portfolio stands at 35.5%.

Absolutely nothing has changed since last expiration. Like the Patient Investor portfolio, my Growth/Value portfolio continues to take a cautious approach. My hope is to add numerous positions over the next few expiration cycles. Of course, we’ve been planning this approach for several months, but our indicators and low options premium have kept us on the sidelines. A short-term pullback would certainly help to present a much greater opportunity to build out the portfolio.

Next Live Analyst Briefing with Q&A

Our next Live Analyst Briefing with Q&A is scheduled for tomorrow, March 12, 2024, at 12 p.m. ET, where we will be discussing the options market, giving a detailed look at open positions, strategies used, and will have a follow-up with live questions and answers. Register here.

The next Cabot Options Institute – Fundamentals issue

will be published on April 8, 2024.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.