Dogs of the Dow Portfolio (IBM, DOW, KO, WBA, MMM, JNJ, CVX, CSCO)

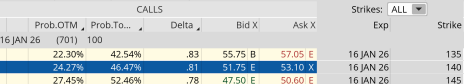

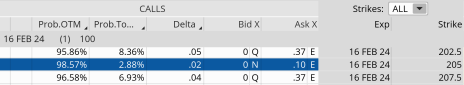

International Business Machines (IBM)

IBM is currently trading for 185.09.

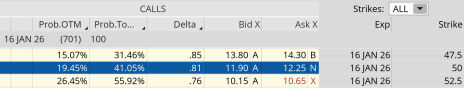

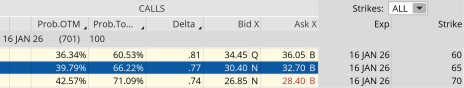

We currently own the IBM January 16, 2026, 125 call LEAPS contract at $40.30. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 16, 2026, 140 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

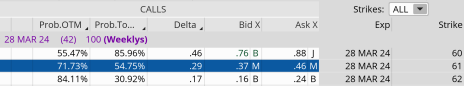

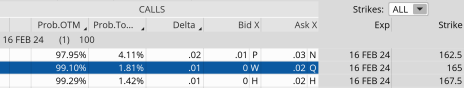

Here is the trade (you must own LEAPS in IBM before placing the trade, otherwise you will be naked short calls):

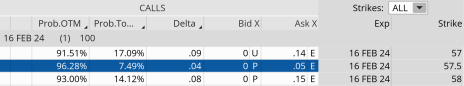

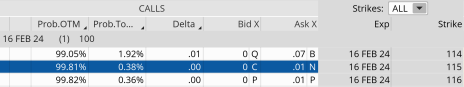

Buy to close the IBM February 16, 2024, 205 call for roughly $0.05. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

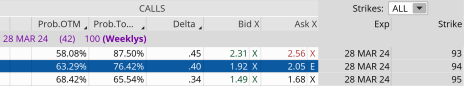

Sell to open the IBM March 22, 2024, 190 call for roughly $2.05. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.1%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $40.30 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in IBM.

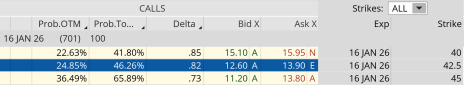

Dow Inc. (DOW)

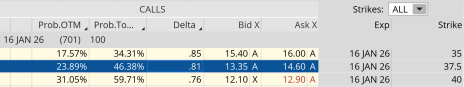

DOW is currently trading for 54.61.

We currently own the DOW January 16, 2026, 40 call LEAPS contract at $15.85. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 42.5 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in DOW before placing the trade, otherwise you will be naked short calls):

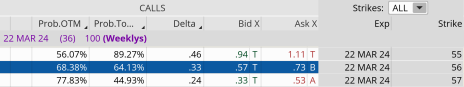

Buy to close the DOW February 16, 2024, 57.5 call for roughly $0.05. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open the DOW March 22, 2024, 56 call for roughly $0.64. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 4.0%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $15.85 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in DOW.

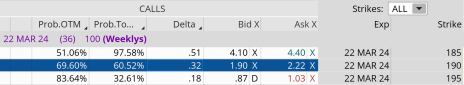

Coca-Cola (KO)

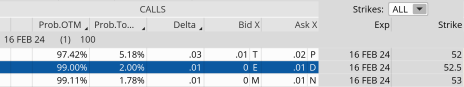

KO is currently trading for 59.51.

We currently own the KO January 16, 2026, 50 call LEAPS contract at $12.95. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 50 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in KO before placing the trade, otherwise you will be naked short calls):

Buy to close the KO February 16, 2024, 62.5 call for roughly $0.01. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open the KO March 28, 2024, 61 call for roughly $0.40. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 3.1%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $12.95 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in KO.

Walgreens Boots Alliance (WBA)

WBA is currently trading for 22.28.

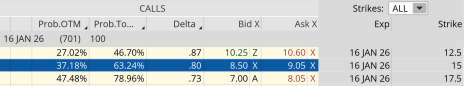

We currently own the WBA January 16, 2026, 15 call LEAPS contract at $10.10. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 15 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

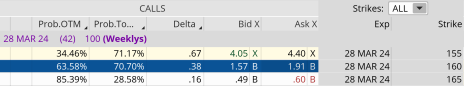

Here is the trade (you must own LEAPS in WBA before placing the trade, otherwise you will be naked short calls):

Buy to close the WBA February 16, 2024, 25 call for roughly $0.01. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open the WBA March 28, 2024, 24 call for roughly $0.60. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.9%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $10.10 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in WBA.

3M (MMM)

MMM is currently trading for 91.92.

We currently own the MMM January 16, 2026, 75 call LEAPS contract at $38.40. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 65 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

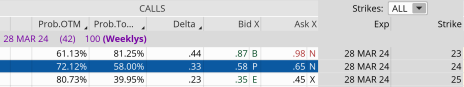

Here is the trade (you must own LEAPS in MMM before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

Buy to close the MMM February 16, 2024, 115 call for roughly $0.01. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open the March 28, 2024, 94 call for roughly $1.97. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.1%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $38.40 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in MMM.

And remember, the 5.1% is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 8-12 months, thereby generating additional income or lowering our cost basis even further.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your LEAPS as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital.

Johnson & Johnson (JNJ)

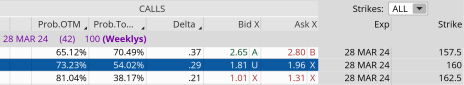

JNJ is currently trading for 157.30.

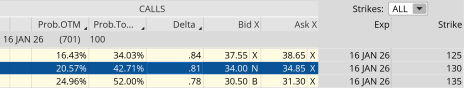

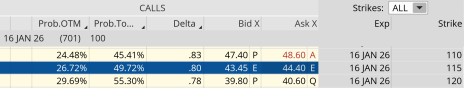

We currently own the JNJ January 16, 2026, 135 call LEAPS contract at $34.30. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 130 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in JNJ before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

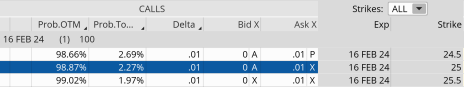

Buy to close the JNJ February 16, 2024, 165 call for roughly $0.02. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open JNJ March 28, 2024, 160 call for roughly $1.70 (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.0%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $34.30 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in JNJ.

Chevron (CVX)

CVX is currently trading for 153.33.

We currently own the CVX January 16, 2026, 115 call LEAPS contract at $42.20. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 115 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in CVX before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

Buy to close the CVX February 16, 2024, 160 call for roughly $0.03. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open CVX March 28, 2024, 160 call for roughly $1.87. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 4.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $42.20 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in CVX.

Cisco Systems (CSCO)

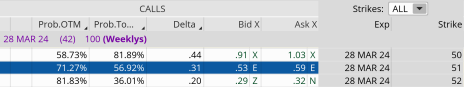

CSCO is currently trading for 49.14.

We currently own the CSCO January 16, 2026, 40 call LEAPS contract at $13.10. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 37.5 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

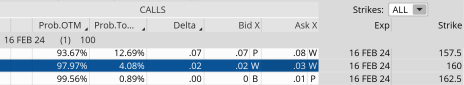

Here is the trade (you must own LEAPS in CSCO before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

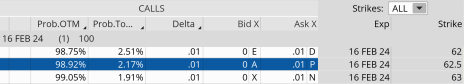

Buy to close the CSCO February 16, 2024, 52.5 call for roughly $0.01. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open CSCO March 28, 2024, 51 call for roughly $0.55. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 4.2%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $13.10 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in CSCO.

And again, as always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.