Yale Endowment Portfolio (SPY)

For those who are new and wish to enter a trade, all of the details are listed in the alert (as always) for those wanting to initiate a position. As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

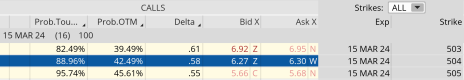

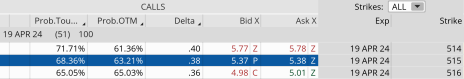

Our SPY position continues to perform well, up 36.3%. The ongoing rally in SPY has pushed the price of the underlying ETF above our short strike and as a result, the delta of our short March 15, 2024, 504 call is nearing parity with our LEAPS position. With 16 days left until the March 15 expiration cycle, I’m going to buy back our short calls in SPY and sell April calls. This will extend our deltas and allow us to take advantage of any continued upside in the ETF.

SPDR S&P 500 ETF (SPY)

SPY is currently trading for 505.71.

In the Yale Endowment portfolio, we currently own the SPY January 17, 2025, 345 call LEAPS contract at $98.00. You must own LEAPS in order to use this strategy.

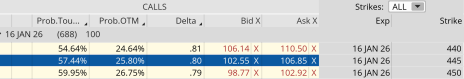

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 16, 2026, 445 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in SPY before placing the trade, otherwise you will be naked short calls):

Buy to close SPY March 15, 2024, 504 call for roughly $6.29. (Adjust accordingly, prices may vary from time of alert.)

Sell to open SPY April 19, 2024, 515 call for roughly $5.37. (Adjust accordingly, prices may vary from time of alert.)

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.