Cabot Options Institute Fundamentals – Dogs of the Dow Alert (CSCO,VZ, DOW, KO, WBA)

The Dogs of the Dow is an investment strategy that involves investing in the top ten Dow Jones Industrial Average stocks with the highest dividend yields. The theory behind the investment strategy is that the highest-yielding stocks have most likely lagged the market and as a result, are undervalued and due to outperform in the year ahead.

The strategy is implemented by rebalancing the portfolio at the end of each year, selecting the ten highest-yielding Dow stocks and making equal investments in each security. Some may choose this route, others may decide to simply invest in equal contracts per underlying stock.

Another alternative to the Dogs of the Dow is taking the ten highest-yielding Dow stocks and selecting the five cheapest stocks. The strategy is known as the Small Dogs of the Dow. Both portfolios have outperformed the market over the long term.

There are also two other alternatives that I plan on tracking going forward and that is the Dogs X and the Small Dogs X. The Dogs X portfolio consists of the cheapest seven of the Dogs of the Dow stocks. The Small Dogs X consists of the cheapest three out of the five Small Dog stocks.

In fact, the returns have been quite impressive. According to DogsoftheDow.com, “Since the turn of the century, the Dogs of the Dow had an average annual total return of roughly 9.5%. The Small Dogs of the Dow have fared even better — gaining an average of 10.0% per year — notable considering that the time period involved included the dot-com bust, a historic financial crisis and a pandemic-induced economic shutdown.” The Dogs X and Small Dogs X have performed even better on average, although portfolio diversification in both approaches is somewhat compromised which can lead to greater volatility.

And when you think that adding on a poor man’s covered call strategy can increase returns on average by 3-5 times, well, I think all the Dogs strategies are approaches worth considering.

The 2024 Dogs (and Small Dogs) of the Dow

Dogs of the Dow and Dogs X

- Amgen (AMGN)*

- Cisco Systems (CSCO)

- Chevron (CVX)*

- Dow (DOW)*

- International Business Machines (IBM)*

- Coca-Cola (KO)

- Johnson & Johnson (JNJ)

- 3M (MMM)*

- Verizon (VZ)*

- Walgreens Boots Alliance (WBA)*

*Denotes stocks that reside in the Dogs X portfolio

Small Dogs of the Dow and Small Dogs X

- Cisco Systems (CSCO)*

- Dow (DOW)

- Coca-Cola (KO)

- Verizon (VZ)*

- Walgreens Boots Alliance (WBA)*

*Denotes stocks that reside in the Small Dogs X portfolio

Today I want to introduce my first trade, going through the trade step by step, so that we are all on the same page as to how the strategy works. While some of you are veterans at poor man’s covered calls, there are quite a few “newbies” in the group that need some handholding. And that’s okay. Again, I’m going to go through the first Dogs of the Dow trade in a detailed manner and plan to follow up today’s alert with the other nine trades over the next two days.

I intend to start with the cheaper Small Dogs of the Dow stocks listed below, starting with Cisco Systems (CSCO) and following up with the other four later today.

- Cisco Systems (CSCO)

- Verizon (VZ)

- Dow (DOW)

- Coca-Cola (KO)

- Walgreens Boots Alliance (WBA)

Once I’ve introduced trades in the Small Dogs, I will follow up with the remaining Dogs of the Dow trades.

- 3M (MMM)

- IBM (IBM)

- Amgen (AMGN)

- Chevron (CVX)

- Johnson & Johnson (JNJ)

My Approach to the Dogs of the Dow Using Poor Man’s Covered Calls

There are numerous ways to approach poor man’s covered calls. My preference is to use LEAPS that have at least two years left until expiration.

Let’s take our first look/trade at one of the Small Dogs of the Dow stocks for 2024, Cisco Systems (CSCO).

As you can see in the chart below the stock is currently trading for 50.27.

Now, if we followed the route of the traditional covered call, we would need to buy at least 100 shares of the stock. At the current share price, 100 shares would cost $5,027. Certainly not a crazy amount of money. But just think if you wanted to use a diversified covered call strategy on, say, numerous higher-priced stocks like Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA) or even an index ETF like SPDR S&P 500 ETF (SPY). For some investors, the cost of 100 shares can be prohibitive, especially if diversification amongst a basket of stocks is a priority. Therefore, a covered call strategy just isn’t in the cards … and that’s unfortunate.

But with a poor man’s covered call strategy you can typically save 65% to 85% of the cost of a covered call strategy.

So again, rather than purchase 100 shares or more of stock, we only have to buy one LEAPS call contract for every 100 shares we wish to control.

As I said before, my preference is to buy a LEAPS contract with an expiration date of around two years. Some options professionals prefer to only go out 12-16 months, but I prefer the flexibility the two-year LEAPS offers.

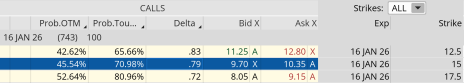

The image below shows every expiration cycle available for CSCO. Again, I want to go out roughly two years in time. The January 16, 2026, expiration cycle with 743 days left until expiration is the longest-dated expiration cycle and would be my choice.

So, when my LEAPS reach 10-12 months left until expiration, I then begin the process of selling my LEAPS and reestablishing a position with approximately two years left until expiration.

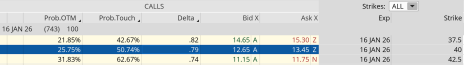

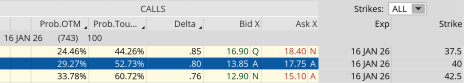

Once I have chosen my expiration cycle, I then look for an in-the-money call strike with a delta of around 0.80.

When looking at CSCO’s option chain for the January 16, 2026, expiration cycle, I quickly noticed that the 40 call strike has a delta of 0.79. The 40 strike price is currently trading for approximately $13.10. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $13.45.

So, rather than spend $5,027 for 100 shares of CSCO, we only needed to spend $1,310. As a result, we saved $3,717, or 73.9%. Now we have the ability to use the capital saved to diversify our premium amongst other Dogs of the Dow stocks if we so choose.

After we purchase our CSCO LEAPS call option at the 40 strike, we then begin the process of selling calls against our LEAPS.

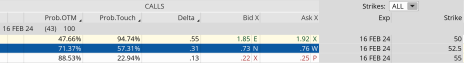

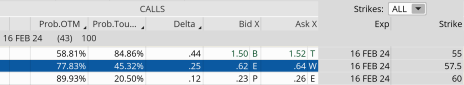

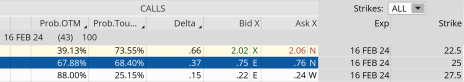

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 90%.

As you can see in the options chain below, the February 16, 2024, 52.5 call strike with a delta of 0.31 falls within my preferred range. We can bring in roughly $0.74 worth of premium from the trade.

Our total outlay for the entire position now stands at $12.36 ($13.10-$0.74). The premium collected is 5.6% over 43 days.

The Trade

Here is the trade:

Buy to open the CSCO January 16, 2026, 40 call for roughly $13.10. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open the CSCO February 16, 2024, 52.5 call for roughly $0.74. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.6%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $13.10 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in CSCO.

If we were to use a traditional covered call our potential return on capital would be less than half, or 1.5%.

And remember, the 5.6% is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 8-12 months, thereby generating additional income or lowering our cost basis even further.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your LEAPS as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital.

Again, I will be back with the remainder of the Dogs of the Dow trades over the next two days, including another alert later today. Stay tuned!

As stated above, and in the webinar yesterday, let’s finish up the Small Dogs and Small Dogs X portion of our Dogs of the Dow.

- Verizon (VZ)

- Dow (DOW)

- Coca-Cola (KO)

- Walgreens Boots Alliance (WBA)

I’ll send out the remaining five trades in AMGN, IBM, JNJ, CVX and MMM tomorrow shortly after the opening bell.

The Trades

Verizon (VZ)

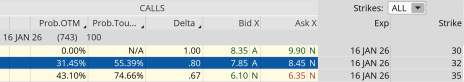

VZ is currently trading for 39.60.

Here is the trade:

Buy to open the VZ January 16, 2026, 32 call for roughly $8.20 (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open VZ February 16, 2024, 41 call for roughly $0.46 (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.6%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $8.20 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in VZ.

And remember, the 5.6% is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 8-12 months, thereby generating additional income or lowering our cost basis even further.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your LEAPS as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital.

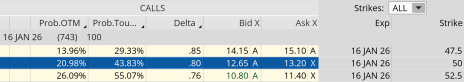

Dow Inc. (DOW)

DOW is currently trading for 54.08.

Here is the trade:

Buy to open the DOW January 16, 2026, 40 call for roughly $15.85 (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open DOW February 16, 2024, 57.5 call for roughly $0.62 (Adjust accordingly, prices may vary from time of alert.)

Premium received: 3.9%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $15.85 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in DOW.

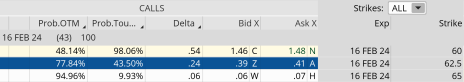

Coca-Cola (KO)

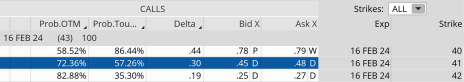

KO is currently trading for 60.07.

Here is the trade:

Buy to open the KO January 16, 2026, 50 call for roughly $12.95 (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open KO February 16, 2024, 62.5 call for roughly $0.39 (Adjust accordingly, prices may vary from time of alert.)

Premium received: 3.0%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $12.95 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in KO.

Walgreens Boots Alliance (WBA)

WBA is currently trading for 23.76.

Here is the trade:

Buy to open the WBA January 16, 2026, 15 call for roughly $10.10 (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open WBA February 16, 2024, 25 call for roughly $0.75 (Adjust accordingly, prices may vary from time of alert.)

Premium received: 7.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $10.10 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in WBA.

And, as always, if you have any questions, please feel free to email me at andy@cabotwealth.com.