All-Weather Portfolio (GLD)

GLD has pushed through our short call strike and the deltas of our LEAPS and short call contract are at parity. As a result, let’s buy back our short call and sell more going out to the April expiration cycle. As a reminder to those with an established position, I will be selling our LEAPS contract the next time around and initiating a new LEAPS position going out to the January 2026 expiration cycle. Our position is up over 22%, while the individual ETF, by comparison, is only up 10% over the same time frame.

SPDR Gold Shares ETF (GLD)

GLD is currently trading for 192.14.

In the All-Weather portfolio, we currently own the GLD January 17, 2025, 171 call LEAPS contract at $32.00. You must own LEAPS in order to use this strategy.

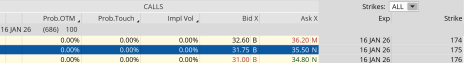

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 170 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in GLD before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

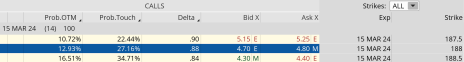

Buy to close GLD March 15, 2024, 188 call for roughly $4.70. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position):

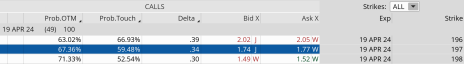

Sell to open GLD April 19, 2024, 197 call for roughly $1.75. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.5%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $32.00 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in GLD.

As always, if you have any questions, please do not hesitate to email at andy@cabotwealth.com.

Buffett’s Patient Investor Portfolio (TXN)

For those who are new to the service and wish to add a position, please read through the alert carefully and if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Texas Instruments (TXN)

TXN is currently trading for 171.54.

In the Buffett’s Patient Investor portfolio, we currently own the TXN January 17, 2025, 135 call LEAPS contract at $53.05. You must own LEAPS in order to use this strategy.

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 16, 2026, 130 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in TXN before placing the trade, otherwise you will be naked short calls):

Buy to close TXN March 15, 2024, 170 call for roughly $4.20. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

Sell to open TXN April 19, 2024, 180 call for roughly $2.87. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $53.05 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in TXN. That being said, since TXN resides in one of our active portfolios, there is the potential we take the trade off during our periodic monthly rebalancing which falls around each options expiration cycle.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.