In today’s trade alert I want to sell cash-secured puts in JPMorgan (JPM).

JPMorgan (JPM)

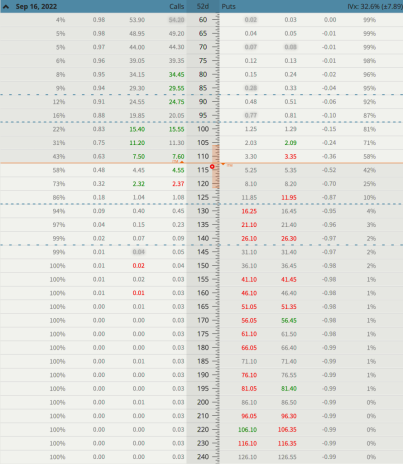

IV: 32.53%

IV Rank: 38.2

Expected Move (Range): The expected move (range) for the September 16, 2022, expiration cycle is from roughly 105 to 122.5.

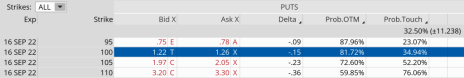

With JPM trading for 113.76 I want to sell puts at the 100 put strike (outside of the expected move) going out 52 days for roughly $1.22, if not higher. Of course, due to a wide variety of factors, prices may and most likely will vary slightly.

The Trade

Sell to open JPM September 16, 2022, 100 put strike for a total of $1.22 or higher. (As always, prices will vary, so please adjust accordingly.)

Delta of short put: 0.15

Probability of Profit: 81.72%

Probability of Touch: 34.94%

Total net credit: $1.22

Max return (cash-secured): 1.2%

Risk Management

I’m still on the fence as to whether or not I will be using JPM as part of our Income Wheel Portfolio. If I do decide to use JPM as part of the Income Wheel Portfolio and if JPM closes below our put strike at expiration, we will be issued shares at the 100 strike and begin the process of selling calls against our newly acquired shares. Until that point, we will repeatedly sell puts on JPM. Of course, any necessary trade alerts/updates will follow.