In Cabot Options Institute Income Trader, I use four different options strategies with the intent of producing steady, consistent income from one expiration cycle to the next.

The four strategies are as follows:

- Selling Puts

- Income Wheel Strategy

- Covered Strangle

- Jade Lizards

In this section I will go over my approach to each options strategy and what a typical trade will look like within the service.

As always, if you have any questions, please do not hesitate to email me at Andy@cabotwealth.com.

Selling Puts

Selling puts is an integral part of the service. Now I know some of you may have reservations about selling puts as a strategy, but I think after a little education on how I approach the strategy your thoughts on the strategy will certainly change. There is a reason why so many professional options traders sell puts as their bread-and-butter income strategy.

For starters, most investors think of selling a naked put as an aggressive, advanced options strategy. Nothing could be further from the truth, if the strategy is used appropriately.

Synthetically speaking, selling a put carries the same risk as a covered call. The difference is when selling a put I have the ability to not only choose my own probability of success, but the capital outlay is also far less.

But again, the approach must be sound. I only sell puts on stocks that I am willing to own. That being said, I rarely buy a stock or ETF at its current price. Why would I? Selling puts is a much better alternative.

If I’m truly interested in buying a security, I typically have a price target below the current price of the stock. Most investors just set a buy limit at their price target and hope they get shares at their chosen price. But that approach is short-sighted and, well, uninformed.

Because again, there is a much better alternative.

Selling puts allow investors to collect premium (income) while waiting for the stock to hit their price. That’s right, let me say it again, investors can essentially produce income while waiting for a stock to hit their chosen price. And the premium produced can be used as a potential source of income or to simply lower the cost basis of the stock they want to buy.

But the thing is, you don’t have to purchase stock when selling puts, unless you really want to own the shares. In most cases, I simply buy back the puts prior to expiration and continue to sell more puts in the same underlying or simply move on to another opportunity. Either way, my goal is to continually produce income through the use of selling puts.

But there will be times when I actually want to own shares, which I’ll talk about further in the Wheel Options Strategy section below. But before we get there, let’s go over the basics of how I approach the strategy of selling puts for income.

The first step is choosing a well-known, mostly low-beta stock that has a highly liquid options chain … and that I don’t mind holding shares of, if needed.

For instance, let’s say you are interested in selling puts on Walmart (WMT) and you would be willing to buy shares, if needed.

In this example, the stock is currently trading for 156.86.

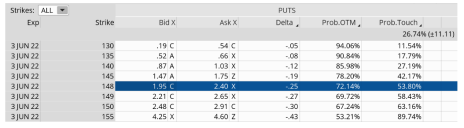

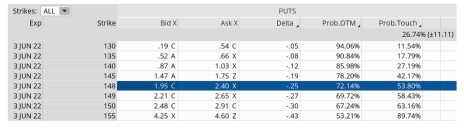

You prefer to sell puts at the 148 strike and potentially own the underlying security at both a future date and a more favorable price, in this case 148.

Now, most investors, would simply set a buy limit at 148 and move on, right? But that approach is archaic. Because you can sell one put for every 100 shares of WMT and essentially create your own return on capital (depending on the strike you choose).

Some say, it’s like creating your own dividend and in a way, I kind of agree.

Inherently, a short put, or selling puts, is a bullish options strategy with undefined risk and limited profit potential. Again, short puts have the same risk and reward as a covered call. Shorting or selling a put means you are promising to buy a stock at the put strike of your choice. In our example, that’s the 148 strike.

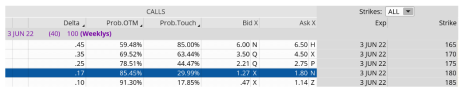

If you look at the options chains for WMT below you will quicky notice that for every 100 WMT shares we want to purchase at 148, we are able to bring in roughly $2.15 or $215 per put contract sold, every 40 days.

The trade itself is simple: Sell to open June 3, 2022, WMT 148 puts for a limit price of $2.15.

Quick note: when selling options, set your limit price just under the mid-price of the bid-ask spread. In the example above the bid-ask price of the 148 strike is 1.95 to 2.40. The mid-price is between 2.15 and 2.20, so selling the 148 puts for $2.15 seems reasonable. By not selling at the bid, we are saving $0.25. Doesn’t seem like a lot, but when you start to add up $0.25 for each trade you place, well, it doesn’t take long to realize the impact over the long term. So, the lesson here is never sell at the market price. Always, use a limit price. Again, using this approach will create significant returns over the long term that you would otherwise forfeit. Trade intelligently!

So, by selling the 148 put options in June you can, again, bring in $215 per put contract, for a return of 1.4% on a cash-secured basis over 40 days. That’s $1,935 or 12.6% annually. Again, you can use the premium collected from selling the 148 puts either as a source of income or to lower your cost basis.

Just think about that for a second.

You would like to buy shares of WMT at 148 or possibly just sell WMT puts as a source to produce steady income. The stock is currently trading for 156.86.

If choosing the former, by selling puts at the 148 strike you can lower your cost basis to 154.71. That’s 1.4% below where the stock is currently trading. And you can continue to sell puts over and over, lowering your cost basis even further, until your price target is hit.

As for the latter, you could simply sell puts for a consistent source of income, knowing that if you are put the stock, it’s okay. It was a stock you did not mind owning from the onset.

Or, like most investors, you could just sit idly by and wait for WMT to hit your target price of 148. Losing out on all that opportunity.

In review, by selling puts at the 148 strike we receive $215 in cash, immediately. It’s ours to keep, to do with what we choose. The maximum reward is the $215 per put contract sold. The maximum risk is that the short 148 put is assigned and you have to buy the stock for 148 per share. But, you still get to keep $215 collected at the start of the trade, so the actual cost basis of the WMT position is 148 – $2.15 = $145.85 per share. The $145.85 is our breakeven point. A move below that level and the position would begin to take a loss.

But remember, most investors would have purchased the stock at its current price, unaware there was a better way to buy a security. We rarely take that approach. We know better. We understand we can purchase stocks at our own stated price and collect cash until our price target is hit or simply just use the low-beta stock as a consistent source of income. It’s a no-brainer.

Income Wheel Strategy

The income wheel strategy is an inherently bullish, mechanical, options income strategy known by various names. The covered call wheel strategy, the income cycle, and the options wheel strategy are just a few of the many names that investors use. But one thing is certain, the systematic approach remains the same.

More and more investors are choosing to use the income wheel strategy over a buy and hold approach because of the ability to create a steady stream of income on stocks you want to or already own.

The mechanics are simple.

- Sell Cash-Secured Puts on a stock until you are assigned shares (100 shares for every put sold)

- Sell Covered Calls on the assigned stock until the shares are called away

- Repeat the Process!

Basically, find a highly liquid stock that you are bullish on and have no problem holding over the long term. Once you find a stock that you’re comfortable holding, sell out-of-the-money puts at the price where you don’t mind owning the stock.

Keep selling puts, collecting even more premium, until eventually you are assigned shares of the stock, again, at the strike price of your choice. Once you have shares of the stock in your possession begin the process of selling calls against your newly issued shares. Basically, you are just following a covered call strategy, collecting more and more premium, until the stock pushes above your call strike at expiration. Once that occurs, your stock will be called away, thereby, locking in any capital gains, plus the credit you’ve collected.

Let’s go through an example to show you exactly how the wheel options strategy works.

Like when selling puts, my preference is to look for low-beta high-quality stocks, household names, that I feel comfortable holding over the long term. I’ve found that dividend aristocrat stocks work well with the wheel options strategy because they have a history of stability, strength and a proven ability to weather market turbulence.

Walmart (WMT)

Wheel Options Strategy – Step One

The retail behemoth is currently trading for 156.86.

Let’s say we decide to go with the 148 put strike.

We can sell to open the 148 puts for roughly $2.15, or $215 per put sold.

By selling the 148 puts for $2.15 our return is 1.4% cash-secured, or 9.5% on margin over 40 days.

If WMT stays above our 148 put strike at expiration we begin the process of selling puts again, thereby creating more premium to use as income or to lower the cost basis of our position. So, if we bring in a conservative 1.4% every 40 days, and we can sell puts roughly 9 times over the course of a year (if the stock stays above our chosen short put strike) our annual return is 12.6% on a cash-secured basis … or 85.5% on margin. Again, it bears repeating, we can use that capital to either produce a steady stream of income or to lower the cost basis of our position.

But what if WMT closes below our short put strike?

No biggie. We are issued or assigned shares at the price where we wanted to buy the stock. Think about it for a sec. We collect a premium as a source of income to wait for a stock to hit our chosen price.

Wheel Options Strategy – Step Two

So, let’s say WMT closes below our 148 put strike at expiration. If so, we are issued 100 shares at $148 for every put contract we’ve sold.

Once we have shares in our possession, we begin the process of selling out-of-the-money calls against our shares, which begins the covered call portion of the wheel options strategy on WMT.

Now the question is which strike to choose. Again, ultimately it just comes down to preference. My preference is focusing on call strikes that have a probability of success ranging from 68% to 85%.

Let’s say, for example, we decide on the selling the 165 calls against our newly issued WMT shares for roughly $1.85 per call contract. Our probability of success on the 165 calls stands at 75.99%

Our static return or return on capital is 1.3% over 40 days.

If WMT stays below our 165 call strike at expiration we begin the process of selling calls again, thereby creating more premium to use as income or to lower the cost basis of our position. So, if we bring in a conservative 1.3% every 40 days, and we can sell calls roughly 9 times over the course of a year (if the stock stays below our chosen short call strike) our annual return is 11.7%. Again, it bears repeating, we can use that capital to either produce a steady stream of income or to lower the cost basis of our position.

But what if WMT closes above our short call strike?

Again, no big deal. Our shares are called away, so of course, we keep our $185 per call contract, plus we are able to reap any capital gains from our stock. In this case, we would keep the $185 plus an additional $17 per share or $1,700 per 100 shares for a 11.5% gain.

Once our shares are called away, the wheel options strategy cycle ends, and the decision has to be made whether or not to continue using the strategy with the same stock.

The wheel options strategy is a wonderful strategy for those wanting to generate steady income, with lower risk compared to most options strategies. It also gives the investor an opportunity to lower the overall cost basis of a position.

The strategy isn’t a get rich quick strategy, rather a methodical, systematic approach to trading options that generates consistent returns, month after month, on stocks that you want to hold in your portfolio over the long term.

Covered Strangle

A covered strangle is simply a covered call strategy coupled with a short put–or just buying a stock and wrapping a short strangle (sell out-of-the-money put and sell out-of-the-money call) around it. Either way, it’s a covered strangle.

Investors want to use a covered strangle when they wish to enhance the returns on a long position (stock or ETF) by two to four times, while also having the opportunity to buy even more shares at a price of their choosing. It’s a great income strategy to use on stocks you already own or wish to acquire.

But, let’s go through an example to really get down to the nitty-gritty of how a covered strangle works.

Apple (AAPL) – Covered Strangle

I’m going to keep it simple by using tech behemoth Apple (AAPL) for our covered strangle example.

With AAPL trading for 161.79, we are going to buy 100 shares for $16,179.

Once we’ve purchased at least 100 shares we then will sell a delta-neutral short strangle around the shares. Since AAPL is trading for roughly 162, we will look to sell a short strangle that has a delta of roughly 0.10 to 0.30 for both the call and put. Moreover, I will look to go out 20 to 50 days. My preference is to go with a shorter duration for my short strangle, but the amount of premium I can bring in will define my choice of expiration cycle.

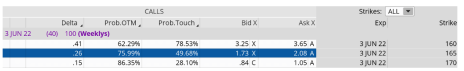

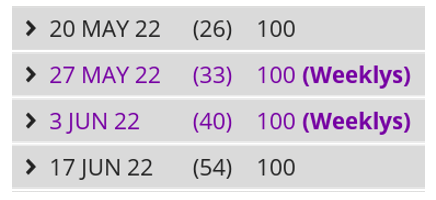

Here are our choices for expiration cycles. I’m going to use the June 3, 2022, expiration cycle with 40 days left until expiration.

Once I’ve chosen my expiration cycle, I then must decide which strikes I wish to use for my short strangle.

In most cases, I want to sell a short strangle that has an 80%+ probability of success, or a delta of roughly 0.20 or less.

On the call side:

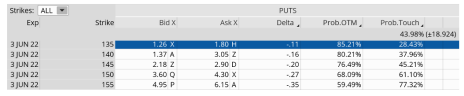

We can sell the 180 call strike for roughly $1.50. The 180 call strike has a probability of success of 85.45%, and a delta of 0.17.

On the put side:

We can sell the 135 put strike for roughly $1.50. The 135 put strike has a probability of success of 85.21%, and a delta of 0.11.

The Trade

Simultaneously:

- Sell out-of-the-money call

- Sell out-of-the-money put

Sell to open AAPL June 3, 2022, 180 call

Sell to open AAPL June 3, 2022, 135 call for a total credit of $3.00

Premium Return: $3.00 ($1.50 for the call + $1.50 for the put)

A Few Possible Outcomes

Stock Pushes Above Short Call Strike

If Apple pushes above the 180 short call strike, no worries, we get to keep the put premium of $1.50, the call premium of $1.50 and we make roughly $18 on the stock. Overall, our gain would be $2,100, or 12.98% over 40 days.

Stock Stays Within the Range of 135 to 180

If Apple stays between our short put and short call, we get to keep the entire premium of $3.00, or 1.85% over 40 days. We can use the covered strangle strategy roughly 9 more times over the course of the year for a total annual return (just premium) of approximately 16.7%.

Stock Pushes Below our Short Put Strike

If Apple pushes below our short put strike of 135, we still get to keep our overall premium of $3.00. But we would be issued 100 shares of stock for every put sold. Our breakeven on the newly issued shares would be $132.00, a discount to where the stock is currently trading of 18.4%.

To sum up a covered strangle options strategy, if you wish to enhance a stock position, like AAPL, consider this often overlooked but highly flexible covered strangle. You start with the same exposure as a long stock and have protection if the stock moves above or below the stock price. And again, if the stock stays between the short put and short call, you will be rewarded with significantly more premium than with a standard covered call.

Jade Lizard

Weird name, I know, but it seems almost all options strategies have strange names. Nonetheless, the jade lizard is an incredible, defined-risk strategy that offers investors the opportunity to take advantage of high implied volatility environments.

In fact, when used correctly, the strategy offers no risk to the upside … that’s right, absolutely no risk to the upside. But before we get to that aspect, let’s go over the basics of the strategy.

A jade lizard consists of a short put and a short call vertical spread (bear call spread) with limited maximum profit potential, and no risk to the upside. The strategy has a neutral to bullish market assumption but can also make money on slightly lower markets as well.

The credit that is created is higher than the width of the bear call spread.

The trade setup for a jade lizard options strategy is as follows:

- Sell an out-of-the-money put

- Sell an out-of-the-money bear call spread (short call vertical spread)

However, the above doesn’t get into the necessary details. The key is to create a credit from the short put and bear call spread that is greater than the overall width of our bear call spread.

For this to occur, in most cases, my goal is to bring in roughly 70% of the overall credit from my short put, which means 30% of my credit must come from the bear call spread. Now, of course, the percentages are approximations, but remember, the goal is to bring in an overall credit that is greater than the strike width of our bear call spread. By doing so, we eliminate all risk to the upside.

Jade Lizard Strategy – Step-By-Step

Remember, this is neutral to bullish strategy, so that should be our leaning going into the trade.

The first item is to look for an underlying stock that has a high IV rank and IV percentile. Implied volatility (IV) is one of the key components to any options pricing model, so when IV is high, we have the opportunity to bring in more premium.

After doing a quick screen (I’ll show you how to set up a similar screen in a follow up video) on stocks with a mid-to-high IV rank, I found a decent candidate, Intel (INTC). Just remember, we are simply going through the mechanics of a jade lizard, so if the trade doesn’t meet your expectations, no worries, at least you will know how to implement the trade when an opportunity arises.

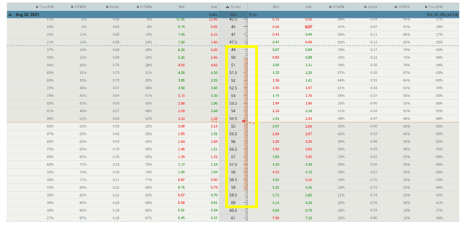

The next step is to take a look at the expected move of the expiration cycles ranging from 30 to 60 days.

Below is the August 20, 2021, expiration cycle with 32 days until expiration. It’s an older example, but the focus should be on the mechanics of the trade, not the dates. As you can see from the vertical bar highlighted in yellow, the expected range or move is from roughly 50 to 58.50.

Ideally, we want to place our jade lizard outside of the range. But the most important aspect is to keep our probabilities as high as we can while making sure the amount of credit we bring in exceeds the width of our bear call spread.

Let’s start by taking a look at the put side of things.

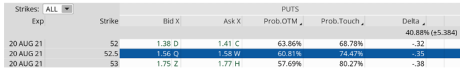

I plan on going with a 2-strike-wide bear call spread, so we need to look for a put that totals roughly 70% of the $2.00, or roughly $1.40.

So, taking that into account, we can choose either the 52 strike or 52.5 strike.

Let’s go with the 52.5 strike. We can bring in roughly $1.56, which covers 78% of our 2-strike-wide bear call spread.

In this example, the probability of success on the downside is 60.81%. My preference is to be closer to one standard deviation out, or approximately 68%.

Quick note: If I’m not pleased with my probabilities, at any time I can move on to another potential trade, possibly looking for an underlying stock that has a higher implied volatility.

Now that we know we can bring in $1.56 worth of premium from selling the 52.5 put, we can look towards the bear call spread to bring in the remaining premium, or $0.44. Again, this will meet our requirement of bringing in enough premium to cover our 2-strike-wide bear call spread.

If we look at the 57.5/59.5 bear call spread, we can bring in roughly $0.45 worth of premium. Our probability of success on the upside is 60.74%, but remember, in total, between selling the put and bear call spread we are able to bring in $2.01 ($1.56 + $0.45). So, our upside has no risk, whatsoever. INTC can move $20 higher, and we will not experience any risk.

How to Manage Risk When Using a Jade Lizard Options Strategy

If INTC does move higher and through our bear call spread, even though we have no risk to the upside, we can roll up our put strike and bring in additional premium, thereby giving us a greater return on the trade.

If INTC pushes lower, we can roll down the bear call spread to bring in more premium.

Worst case, scenario is that we can allow ourselves to be put INTC stock, in this case for 52.5, or simply close out the trade. Just remember, we have brought in $2.01 worth of premium, so our downside risk is 50.49 (52.5 put strike – $2.01 premium).

I manage winning trades by taking off the trade when I can take off 50% to 75% of the premium that I brought in. In our example that would be $1.00 to $1.50.

Trade Summary for Intel (INTC)

Directional Assumption is neutral to bullish.

- Trade Setup: Sell OTM put

Sell OTM bear call spread (short call vertical)

- Trade: Sell to open 52.5 put for $1.56

Sell to open 57.5/59.5 bear call spread for $0.45

Total credit or premium = $2.01

- Max Profit: Credit received from trade or $201. Max profit occurs when the stock, in this case INTC, closes between the short put strike and short call strike at options expiration.

- Breakeven: strike price of short put – premium or credit received (52.5 – $2.01) = 50.49

- No risk to the upside.

The jade lizard is a great alternative to an iron condor, or if you’ve sold puts and would like to add a risk-defined strategy to create more income on your current position. It’s certainly a worthwhile strategy to add to your options strategy toolbelt.