Weekly Commentary

Due to the holiday-shortened week I am going to keep the report short this week.

I am excited to inform everyone that I will be adding educational videos to the mix, focusing on all assets of the service. So, if you have anything, and I mean anything, that you would like for me to discuss or explain in greater detail please do not hesitate to email me with your requests.

We added another bear call spread to the mix for the August expiration cycle and my hope is to add at least one, if not two more trades, for the August 18 cycle. Since we have plenty of short exposure with our bear call spreads, I want to add an iron condor and a bull put spread to balance out our deltas and bring the portfolio closer to a neutral state.

As for our other positions, we only have one other trade at the moment, a bear call spread in QQQ that is due to expire July 21. As it stands, we are getting close to exiting the position for our first loss in months, but if we see a pullback, we should be able to get out of the position with a decent profit. If this indeed occurs, it will extend our win ratio to 32 out of 36 winning trades.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Current Portfolio

Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 5/31/23 | QQQ | Bear Call | July 21, 2023 375/380 | $0.60 | $1.59 | 62.48% | -0.13 |

| 6/30/23 | SPY | Bear Call | August 18, 2023 462/466 | $0.52 | $0.33 | 83.48% | -0.05 |

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/22 | 6/13/22 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/22 | 6/17/22 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/22 | 7/13/22 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/22 | 7/25/22 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/22 | 7/28/22 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/22 | 8/11/22 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/22 | 8/29/22 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/22 | 8/29/22 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/22 | 9/8/22 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/22 | 9/9/22 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/22 | 9/15/22 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/22 | 10/17/22 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/22 | 10/25/22 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

| 10/4/22 | 11/2/22 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.32 | 6.84% |

| 10/6/22 | 11/2/22 | SPY | Bear Call Spread | November 18, 2022 412/416 | $0.43 | $0.28 | 3.90% |

| 11/16/22 | 11/28/22 | IWM | Iron Condor | December 16, 2022 205/200 - 162/157 | $0.75 | $0.24 | 11.36% |

| 11/10/22 | 12/6/22 | SPY | Bear Call Spread | December 16, 2022 420/425 | $0.65 | $0.14 | 11.36% |

| 12/1/22 | 12/6/22 | SPY | Bear Call Spread | January 20, 2023 435/440 | $0.67 | $0.18 | 10.86% |

| 12/13/22 | 12/15/22 | SPY | Bear Call Spread | January 20, 2023 430/435 | $0.54 | $0.17 | 7.99% |

| 12/7/23 | 1/6/23 | IWM | Iron Condor | January 20, 2023 202/198 - 160/156 | $0.70 | $0.06 | 19.00% |

| 1/4/23 | 2/1/23 | IWM | Iron Condor | February 17, 2023 200/195 - 154/149 | $0.65 | $2.00 | -27.00% |

| 1/6/23 | 2/2/23 | SPY | Bear Call Spread | February 17, 2023 415/420 | $0.60 | $2.50 | -38.00% |

| 2/2/23 | 2/15/23 | SPY | Bear Call Spread | March 17, 2023 440/445 | $0.63 | $0.15 | 10.62% |

| 2/10/23 | 2/22/23 | DIA | Bear Call Spread | March 31, 2023 355/360 | $0.70 | $0.17 | 11.86% |

| 2/2/23 | 3/1/23 | IWM | Iron Condor | March 17, 2023 175/180 - 215/220 | $0.72 | $0.51 | 4.38% |

| 3/6/23 | 3/13/23 | DIA | Bear Call Spread | April 21, 2023 350/355 | $0.85 | $0.17 | 15.74% |

| 2/23/23 | 3/28/23 | SPY | Iron Condor | April 21, 2023 435/430 - 350/345 | $0.80 | $0.15 | 14.94% |

| 3/23/23 | 4/11/23 | DIA | Bear Call Spread | April 21, 2023 338/443 | $0.62 | $2.05 | -28.60% |

| 3/23/23 | 4/19/23 | IWM | Iron Condor | May 19, 2023 196/191 - 147/142 | $0.83 | $0.23 | 13.64% |

| 4/12/23 | 4/21/23 | DIA | Bear Call Spread | May 19, 2023 350/355 | $0.82 | $0.44 | 8.23% |

| 4/21/23 | 5/2/23 | SPY | Iron Condor | June 16, 2023 440/435 - 365/360 | $0.95 | $0.63 | 6.84% |

| 4/24/23 | 5/10/23 | DIA | Bear Call Spread | June 16, 2023 354/359 | $0.72 | $0.22 | 11.11% |

| 5/5/23 | 5/24/023 | SPY | Bear Call Spread | June 16, 2023 430/435 | $0.72 | $0.35 | 7.99% |

| 6/15/23 | 6/22/23 | SPY | Bear Call Spread | August 18, 2023 465/470 | $0.70 | $0.24 | 10.13% |

| 5/26/23 | 6/23/23 | IWM | Iron Condor | July 21, 2023 191/196 - 156/151 | $0.79 | $0.50 | 6.15% |

| 159.90% | |||||||

Volatility Talk

Same as it ever was…same as it ever was…same as it ever was. The market continues to climb higher and as a result, investors continue to remain complacent. Just look at the daily intraday swings and how much narrower they have become since the market lows set back in October 2022.

But as I stated last week, seasonally speaking, the VIX is due for a bounce. And if the seasonal tendency holds and a rise in the VIX occurs over the coming months it means we should expect to see a reprieve in the market. What that “reprieve” looks like is anyone’s guess. And really, for our approach, we don’t care what the reprieve looks like, we only care that there is a return in implied volatility (IV). Higher IV means higher options prices (premium) and we always prefer to sell options at higher prices than usual.

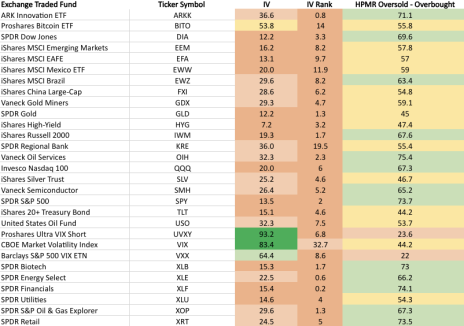

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of July 5, 2023.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

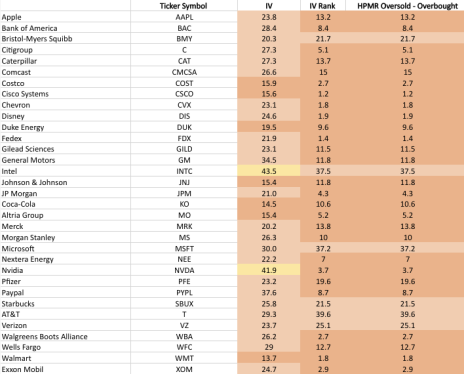

Stock Watch List – Trade Ideas

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

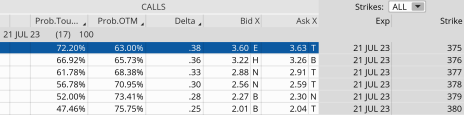

Bear Call: QQQ July 21, 2023, 375/380 calls

Original trade published on 5-31-2023 (click to see original alert)

Background: At the time of the trade, QQQ was trading for 347.14. We sold the July 21, 2023, QQQ 375/380 bear call spread for $0.60. The expected range or move was 326 to 368. We placed our bear call spread 7 points higher than the expected move.

Current Thoughts: QQQ is now trading for 370.29, $7 higher than it was last week, and our bear call spread is now worth $1.59. The probability of success on our bear call sits at 63.00% and the delta of our short call sits at 0.38. With 17 days left until expiration our QQQ bear call spread is nearing our stop-loss. However, if we see a short-term pullback over the next week we might have a good chance to take the position off the table for a decent profit.

Call Side:

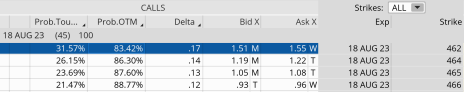

Bear Call: SPY August 18, 2023, 462/466 calls

Original trade published on 6-30-2023 (click to see original alert)

Background: At the time of the trade, SPY was trading for 442.50. We sold the August 18, 2023, SPY 462/466 bear call spread for $0.52. The expected range or move was 428 to 457. We placed our bear call spread 5 points higher than the expected move.

Current Thoughts: SPY is now trading for 443.78, roughly $1 higher than when we placed the trade. The probability of success on our bear call sits at 83.42% and the delta of our short call sits at a comfortable 0.17. With 45 days left until expiration our SPY bear call spread looks in good shape. Time decay will begin to accelerate over the next few weeks, so if all goes well and SPY stays around this area, or better yet, moves lower, we should be able to lock in our second successful trade for the August 18 expiration cycle.

Call Side:

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Quant Trader issue will be published on

July 10, 2023.