Nasdaq 100 ETF (QQQ) – New Trade

I’m adding another new bear call spread to the mix and intend on adding several more trades over the coming days.

IV: 19.3%

IV Rank: 35.8

Expected Move (Range): The expected move (range) for the April 26, 2024, expiration cycle is from 420 to 458.

Call Side:

The Trade

Simultaneously:

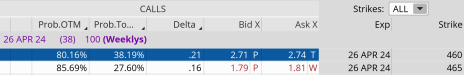

- Sell to Open QQQ April 26, 2024, 460 call strike

- Buy to Open QQQ April 26, 2024, 465 call strike … for a total of $0.91. (As always, the price of the spread can vary from the time of the alert, so please adjust accordingly if you wish to take on a position.)

*Our margin of error is roughly 5.0% to the upside

Delta of spread: -0.05

Probability of Profit: 80.16%

Probability of Touch: 38.19%

Total net credit: $0.91

Total risk per spread: $409

Max return: 22.2%

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so keeping each trade at a reasonable level allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I tend to set a stop-loss that sits 1 to 2 times my original credit. Since I’m selling the bear call spread for roughly $0.91, if my bear call reaches approximately $1.82 to $2.73, I will exit the trade. As always, I will keep you updated on the status of the position (in the weekly reports) as it progresses and send any necessary updates.

Copyright © 2024. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.