Thank you to all of our new subscribers, we are extremely excited to have you as readers! We continue to work to bring valuable investment insights to help navigate this environment and generate positive returns. Current subscribers – thank you for sticking with us during this recent downdraft for global markets.

When we launched Cabot SX Crypto Advisor under two months ago, all indices began to experience a significant contraction. As a result, our two model portfolios have remained largely in cash.

Cabot SX Crypto Issue: May 17, 2022

Introduction & Market Update

Thank you to all of our new subscribers, we are extremely excited to have you as readers! We continue to work to bring valuable investment insights to help navigate this environment and generate positive returns. Current subscribers – thank you for sticking with us during this recent downdraft for global markets.

When we launched Cabot SX Crypto Advisor under two months ago, all indices began to experience a significant contraction. As a result, our two model portfolios have remained largely in cash.

We currently recommend staying largely defensive to preserve capital. In our view, global markets have not yet reached a bottom.

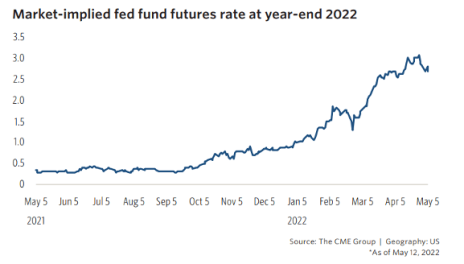

Market volatility cannot decline until later this year when we will receive more concrete forward guidance on the next two interest rate hikes by the Fed. We also need to see some form of positive confirmation that inflation is not continuing to increase rapidly.

Conversations that I have had with several industry leaders suggests that food and materials pricing has begun to ease slightly as inventories have risen.

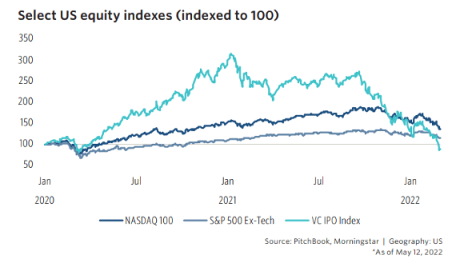

Macro headwinds continue to dominate the trading environment, multiples have come down across the board as the cost of capital has increased as the Fed has begun raising interest rates to combat rising inflation.

If you have built a significant cash position or remain largely exposed to bonds, this current macro environment creates opportunities to begin to be selective and consider allocating more of your overall portfolio to specific U.S. equities and cryptocurrency investments. Valuation risk has decreased – companies and crypto projects today are much more fairly valued relative to historical averages.

Furthermore, the 2021 IPO market was very vibrant – companies (and investment funds) raised a significant amount of capital. Both will look to deploy dry powder productively. This process will serve them well, as many have shored up their balance sheets and remain well capitalized to withstand this challenging environment. In our view, many of these heavyweights will look to acquire competitors or seek to press internal organic growth initiatives while they have the advantage over smaller competitors.

Below we want to highlight the investment perspective of most institutional investors.

Current Public Market Investment Criteria

- Strong proven leadership

- Must be free-cash-flow generative

- Rule of 40

- High switching costs

- Operating leverage (pricing power)

- Large growing markets (blue oceans)

- Product differentiation or cost leadership

Trading Strategy

Mean-reversion as a strategy has proven itself through backtesting historical scenarios. Mean reversion uses probability to derive expected future outcomes. To put it simply, a player hitting .400 in the MLB for May is likely to cool off for the month of June.

High performance is difficult to maintain over a long period of time and the same is true for businesses. As a result, companies and cryptocurrencies that experience rapid moves to the upside or downside are often subject to mean reversion (falling back to normalized levels).

This process is playing out today as the prices and valuations experienced a reset.

Conversely, companies that exhibit high degrees of staying power (longevity, Lindy Effect) by demonstrating the ability to outperform on their financial results over a longer period, makes these assets highly coveted.

We believe today, at the current valuation levels, some companies and crypto assets make sense to remain invested in or begin buying because they have reverted so severely back to their historical mean and have demonstrated high degrees of longevity and competitive advantages.

We highlight these below.

Portfolio Update

Although our cryptocurrency “pure play” portfolio remains largely in cash at this time, we have offered current recommendations to begin positions in Ethereum (ETH), Polygon (MATIC), and Ethereum Naming Service (ENS). These positions are largely predicated on the continued success of the Ethereum network. Ethereum is the global, industry-leading Layer One blockchain solution for distributed computing projects.

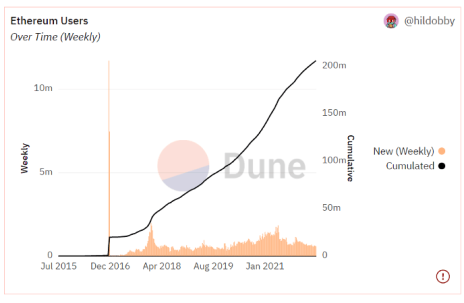

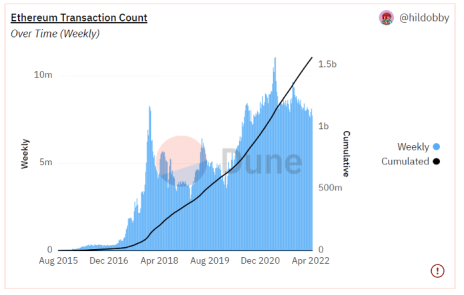

Ethereum enables creators to build and engage in digital commerce through the use of smart contracts, a technology created by Ethereum to allow for blockchain based transactions to take place at scale. Ethereum continues to dominate all other blockchain projects in terms of fees generated on the network (revenue proxy) and total engagement. ERC-20 is the industry standard for tokenized assets, as the world becomes increasingly digital, more people have turned to the Ethereum network.

Crypto Portfolio

Given recent volatility in the crypto markets, new positions will be considered “Full” at 5% of portfolio allocation. Existing holders should maintain the original weight in ETH, however buyers should initiate new positions with a one-quarter weight.

Ethereum (ETH)

Ethereum is continuing to experience growth in key metrics like users, transactions, and fees generated on the network.

Ethereum network transaction volume is increasing as more projects continue to build on the platform, attracting more users.

Ethereum remains the industry leader, demonstrating high switching costs, as projects continue to choose ETH to run their decentralized applications. BUY A QUARTER

Polygon (MATIC) – New Recommendation

Polygon is a Layer Two scaling solution for the Ethereum network. Polygon helps to alleviate congestion and reduce latency and costs for running projects on ETH.

According to company reports, along with data from Alchemy, Polygon reported 6x growth over the past six months in the number of dApps building on its network. DApps are decentralized applications – crypto based businesses that are building out some form of real-world use case.

Key Metrics

- More than 19,000 decentralized applications now on its network, a 500% increase from 3,000 dApps in October.

- Polygon now serves over 8,000 monthly active teams, up from over 6,000 in January and just a few thousand in October.

- Sixty-five percent of the teams were built entirely on Polygon, whereas thirty-five percent were built on Ethereum.

- Processed over 3.4 billion total transactions.

- 135 million unique user addresses.

- Over $5 billion in assets.

A key catalyst for Polygon adoption and acceleration has been partnerships – Polygon has forged ahead with industry leaders like Facebook/Meta Platforms (FB), EY (consulting), and Alchemy (web3 infrastructure).

Since partnering with Alchemy, the number of Polygon apps has increased by more than 95x. Alchemy provides key support in web3 infrastructure and platform capabilities, working alongside Polygon to resolve and prevent problems as they occur at the developer level. This partnership has served as a valuable flywheel and competitive advantage for MATIC.

Turning to trading dynamics, over 650k MATIC tokens have been removed from circulation since their recent network upgrade at the beginning of 2022. These key growth and trading metrics coupled with the recent MATIC price decline has made MATIC an attractive, long-term, risk-adjusted investment opportunity at today’s price level. BUY A QUARTER

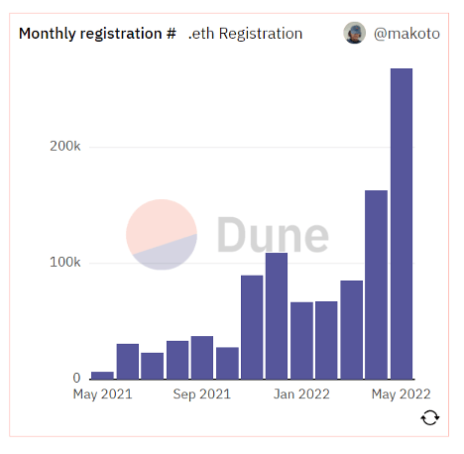

Ethereum Name Service (ENS)

Ethereum Name Service (ENS)

aims to make it easier for users to operate on Ethereum. ENS is similar to GoDaddy, allowing investors to purchase a domain name for their public address and web address. ENS aims to become the go-to naming protocol by making web3 usernames that can be utilized across multiple blockchain networks over time. This process is what many describe as interoperability – moving across blockchains (for example, Ethereum blockchain and Bitcoin blockchain).

Users and businesses are used to traditional web addresses. Users of blockchain technology will likely prefer what they already know instead of having to utilize a long phrase of letters and numbers. ENS will help to overcome this friction and improve the user experience.

It gets better. Companies are increasingly beginning to offer “sign in with Ethereum.” ENS is helping improve this authentication process for companies.

The ENS governance token (crypto), created on the Ethereum blockchain, enables participants to propose changes within the organization, much like voting rights are afforded to members of a traditional company board.

ENS has a low supply of 100 million tokens, making it an attractive investment if adoption continues to increase – buying pressure will move the price of ENS quickly. BUY A QUARTER

| Ticker | Original Weight | Price | Price at Rec | Performance | Rating |

| LUNA | 20.0% | 0.00 | 105.98 | -100.00% | SELL |

| ETH | 15.0% | 2,007.15 | 3,444.22 | -41.72% | BUY A QUARTER |

| ENS | 1.25% | 10.22 | 10.22 | — | BUY A QUARTER |

| MATIC | 1.25% | 0.68 | 0.678 | — | BUY A QUARTER |

| APE | — | 8.07 | — | — | WATCH |

| SOL | — | 54.00 | — | — | WATCH |

| CASH (USD) | 62.5% | — | — | — |

Equity Portfolio

ProShares Bitcoin Strategy ETF (BITO)

Bitcoin is digital property. BTC is quickly becoming the reserve currency of the digital era, as other DeFi protocols, traditional companies, and institutional investors continue to purchase Bitcoin to serve both as a form of collateral and a store of wealth. The inherent properties of BTC make it a highly desirable asset in today’s period of high inflation. BTC has 1/10 the market capitalization of gold.

Fidelity recently announced that they are adding the ability to purchase Bitcoin in 401k accounts. This is a significant move by the industry giant. Currently, 23,000 companies use Fidelity to administer their retirement plans. This is extremely bullish for the crypto asset class, as current investor exposure to BTC is under a 5%.

In our view, the easiest and best way to gain exposure to BTC is through BITO in a traditional brokerage account. BUY A QUARTER

Arista Networks (ANET)

Arista Network designs and sells multilayer network switches to deliver software-defined networking for large datacenter, cloud computing, high-performance computing environments. ANET is positioned to benefit form workloads transitioning to the cloud. Acceleration in the digital economy, partially powered by increasing web3 and cryptocurrency adoption will benefit Arista.

According to the IDC 2021 Report, 200G-400G switches are growing at 70% due to hyperscale and cloud providers continuing to build out larger datacenter footprints. Companies have increasingly shifted workloads from on-premise datacenters onto the cloud, utilizing primarily AWS, Azure, or Google, as server providers. Data growth has been exponential, and as a result, companies are looking for scalable solutions to reduce internal dependency on hardware update cycles. However, companies still prefer to have infrastructure on-premise within their own datacenters for security, data governance, and lower latency. This is often performed through the AWS Outposts solution and requires switching devices like the ones that Arista provides. As early as 2018, there has been a push to 400G infrastructure to increase network speed and performance. BUY A QUARTER

| Ticker | Original Weight | Price | Price at Rec | Performance | Rating |

| Coinbase (COIN) | 2.5% | 61.70 | 142.5 | -56.70% | SELL |

| Proshares Strategy Bitcoin ETF (BITO) | 2.5% | 18.32 | 25.93 | -29.35% | BUY A QUARTER |

| Arista Networks (ANET) | 2.5% | — | 105 | — | BUY A QUARTER |

| Concord Acquisition (CND) | — | 9.90 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 8.57 | — | — | WATCH |

| Nvidia (NVDA) | — | 172.64 | — | — | WATCH |

| Unity (U) | — | 36.14 | — | — | WATCH |

| CASH (USD) | 92.5% | — | — | — |

Recent Sells:

Terra (LUNA) – suffered a devastating short attack that resulted in a crippling of the blockchain network. In the future, we will no longer be investing in assets with high correlation to other risk assets or factors outside of their internal control. Our initial investment thesis found Terra to be a differentiated way to gain exposure to BTC. Today, owning BITO is a more attractive way to gain exposure to BTC.

We remain bullish on the overall adoption of stablecoins.

Coinbase Global Inc (COIN) – the recent earnings report showed a decrease in operating income and EBITDA. COIN remains extremely undervalued, but in today’s market we are unable to offer a buy recommendation. COIN needs to demonstrate profitable growth and a diversification of revenue streams away from trading fees alone. Their new NFT platform and SaaS product may offer the means to do so.

Coinbase’s venture portfolio alone is likely to be worth more than the Company’s current market capitalization in the future.

Watch List

Solana (SOL) – more centralized but powerful Layer One blockchain solution focused on gaming and NFT applications.

Nvidia (NVDA) – industry leading designer of GPU, datacenter semiconductors, AI and software for a wide range of industries.

Bored Ape Yacht Club (APE) – ETH-based Layer Two coin used to power the Bored Ape Yacht Club’s emerging metaverse ecosystem.

The next Cabot SX Crypto Advisor issue will be published on June 21, 2022.

About the Analyst

Ian Beaudoin

Ian Beaudoin is Chief Analyst of Cabot SX Crypto Advisor.

Ian provides deep insights into emerging disruptive technologies, covering cryptocurrency, blockchain, play-to-earn gaming, fintech, and the venture ecosystem. He has independently invested in and traded cryptocurrencies, securities, and derivatives since 2015 and actively seeks to identify asymmetric investment opportunities in both public and private markets through fundamental research, event driven strategies, mean reversion, and arbitrage.

Ian also serves as the Senior Analyst at Hyperion Capital Partners.