Cryptocurrency markets are rebounding significantly, led by our investments in Ethereum (ETH) and ETH-based projects.

Both Polygon (MATIC) and Ethereum Name Service (ENS) are performing very well.

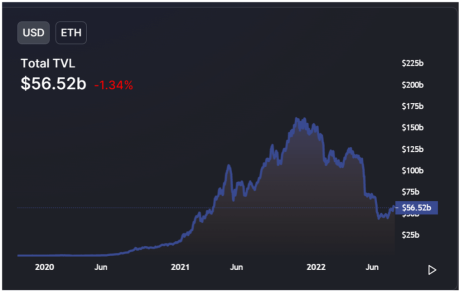

The chart here is very favorable for Ethereum (ETH) and represents future upside having built an established price floor when ETH double bottomed around $1,100.

We are increasing our weighting of both Polygon (MATIC) and Ethereum Name Service (ENS) to each represent 7% of our overall portfolio. At these price levels we recommend buying half of your total expected position.

We are adding to our Ethereum position to reduce our cost basis following our launch of Cabot SX Crypto Advisor when ETH was trading at elevated levels. We are updating our portfolio weighting of ETH, and it now will represent 18% of our overall portfolio. We recommend buying half of your total expected position at these current price levels.

In our view, crypto and equity markets have significant downside already priced in. We are putting cash to work, buying best-in-class names.

Ethereum (ETH)

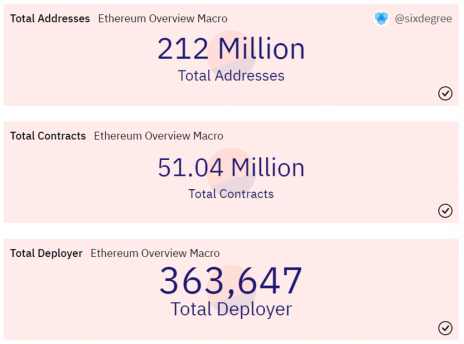

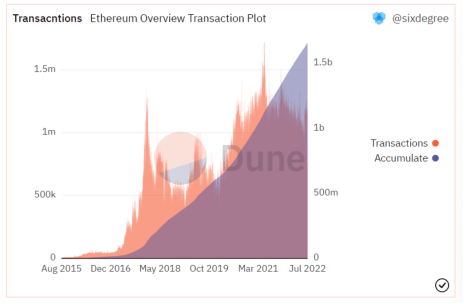

ETH is the world’s leading Layer One blockchain. It leads in fees generated on the network, total locked value, transactions on the network, and developer and user activity. As the market leader, we believe a significant amount of future value will be generated on this platform operating system.

Transactions on the blockchain and developer activity continue to grow. In our view, most of the new value generated from crypto will continue to come from the Ethereum network.

We are seeing both the Ethereum price and total locked value rebound.

The largest concentration of holders with staked tokens is MakerDAO at 15%. This is seen as positive because we do not want to invest in projects where the concentration of staked assets is too high with any one specific counterparty.

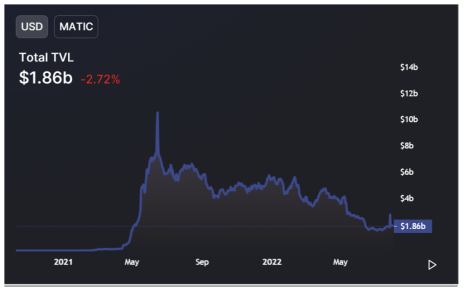

Polygon (MATIC)

Polygon continues its focused B2B strategy as a Layer Two scaling solution for Ethereum. It is the leading L2 technology provider and has been partnering with best-in-class global brands such as Disney to help catalyze their blockchain strategy moving forward.

Staked holders of MATIC are fairly diversified with the largest, AAVE, at 23.4%.

Ethereum Name Service (ENS)

Web Address - ENS

Interesting interview with ENS founder Nick Johnson - ENS Discussion

Ethereum Name Service (ENS) is now the gold standard for blockchain domain names. ENS is the governance token for the Ethereum Name Service decentralized organization (DAO). This operates like a democracy, where holders of ENS tokens can vote on the passage of proposals by everyday citizens. Holders are eligible for future token airdrops which operate like a stock split – token holders will receive a fixed amount of new ENS.

Founder of the Ethereum Network – Vitalik Buterin – cites ENS as the most successful non-financial Ethereum Application thus far. This is a big deal – as most blockchain-based projects have been focused on building decentralized financial applications as opposed to other real-world use cases.

As recently as July, we have seen a 216% rise in registered domains despite the price of ENS dropping to all-time lows. As of writing, ENS is beginning to significantly rebound off its lows to $14.49 and we think this is an attractive entry point to purchase ENS.

Due to a very low fixed circulating supply and growing demand for Ethereum domain names we believe there is significant future upside for ENS token.

Watch List

CrowdStrike (CRWD) – end-to-end, tier-one, cyber security company offering services to three quarters of the Fortune 500.

ProShares Short Bitcoin ETF (BITI) – potentially useful as a future hedge against our long portfolio.

Block, Inc (SQ) – peer-to-peer Cash App solution provider that allows participants to send currencies including crypto. SQ also has a B2B focused payment processing engine.

Helium (HNT) – decentralized blockchain network for internet of things devices (IOT). Users who operate Helium hotspots mine and earn rewards in Helium’s native cryptocurrency HNT.

Avalanche (AVAX) – competing layer one blockchain solution to ETH with 6,500 transaction per second capacity.

Bored Ape Yacht Club (APE) – token for the growing community of creative digital content like Pixar.

Crypto Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| ETH | 18.0% | 1,622.27 | 3,444.22 | -52.90% | BUY A HALF |

| ENS | 7.00% | 13.95 | 10.22 | 36.50% | BUY A HALF |

| MATIC | 7.00% | 0.89 | 0.678 | 31.99% | BUY A HALF |

| APE | — | 6.58 | — | — | WATCH |

| SOL | — | 41.11 | — | — | WATCH |

| HNT | — | 8.89 | — | — | WATCH |

| STEPN | — | 0.9362 | — | — | WATCH |

| AVAX | — | 23.16 | — | — | WATCH |

Equity Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| Proshares Strategy Bitcoin ETF (BITO) | 2.50% | 14.22 | 25.93 | -45.16% | BUY A QUARTER |

| Arista Networks (ANET) | 2.50% | 117.74 | 105.00 | 12.13% | BUY A QUARTER |

| Nvidia (NVDA) | 2.50% | 184.41 | 188.20 | -2.01% | BUY A QUARTER |

| Okta Inc. (OKTA) | 2.50% | 98.53 | 95 | 3.72% | BUY A HALF |

| Block Inc. (SQ) | — | 77.77 | — | — | WATCH |

| Concord Acquisition (CND) | — | 10.01 | — | — | WATCH |

| CrowdStrike (CRWD) | — | 183.3 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 7.26(CAD) | — | — | WATCH |

| Proshares Short Bitcoin ETF (BITI) | — | 34.21 | — | — | WATCH |

| Unity (U) | — | 38.92 | — | — | WATCH |