Investment Highlight

The Ethereum Name Service (ENS) has reached a milestone of 2 million “.ETH” names created, just three months after it took them five years to generate 1 million addresses!

ENS operates like GoDaddy. These .ETH domains allow users to attach their digital wallet to the address, replacing the need for difficult-to-remember alphanumeric “0x” codes akin to IP addresses.

Web users can simply type in a text web address thanks to DNS.

ENS is creating the same database for crypto, and Ethereum is the place to be – ENS Operates a B2B and B2C Business model with real utility.

A fee must be paid regularly to the ENS treasury in USD to maintain ownership of an ENS domain.

Ethereum co-developer, Vitalik Buterin tweeted in Aug. 2020 that three- and four-letter ENS names are assets with fixed supplies and have notable utility.

Currently, the average sale price for an ENS address is 0.06 ETH, a 20x return on the mint price.

According to Nansen, 70% of ENS address holders own no other NFTs. Therefore, most of these participants are largely bullish on this particular use case, representing a thesis that the broader ETH and DeFi ecosystem will continue to prosper and appreciate.

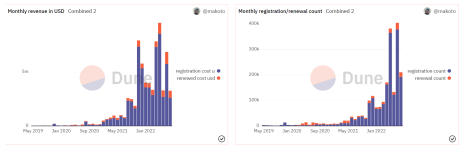

ENS revenues are spiking.

Global Economic Activity Update

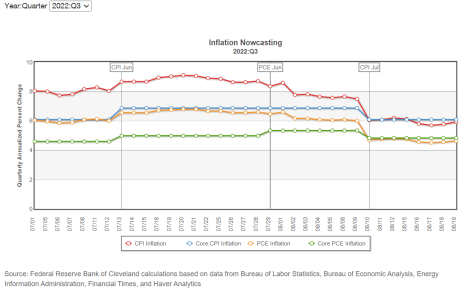

Inflation is slowly moderating, according to data from the Federal Reserve Bank of Cleveland.

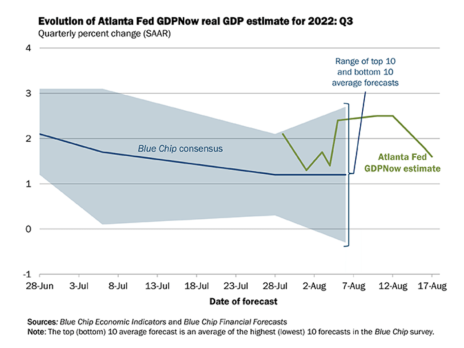

Real-time estimates for GDP from the Atlanta Fed are forecast to be lower than consensus estimates.

Why Crypto Matters

“For example, some prominent economists are deeply skeptical of Bitcoin, even though Ben S. Bernanke, formerly Federal Reserve chairman, recently wrote that digital currencies like Bitcoin ‘may hold long-term promise, particularly if they promote a faster, more secure and more efficient payment system.’ And in 1999, the legendary economist Milton Friedman said: ‘One thing that’s missing but will soon be developed is a reliable e-cash, a method whereby on the Internet you can transfer funds from A to B without A knowing B or B knowing A – the way I can take a $20 bill and hand it over to you, and you may get that without knowing who I am.’” – Mark Andreessen

Ethereum Merge (Proof of Stake)

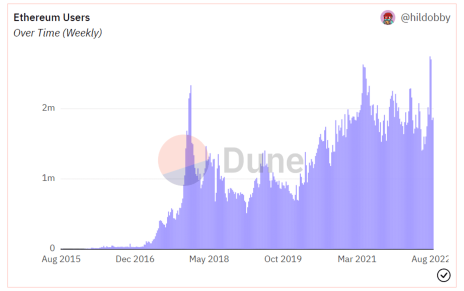

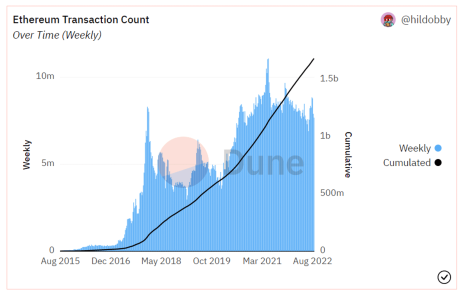

Ethereum continues to outperform other blockchains with respect to growth in on-chain economic and developer activity.

Users and transactions both continue to grow steadily as the network moves towards its most significant technological upgrade to date – shifting from proof of work to proof of stake.

Vitalik Buterin, co-developer of the Ethereum blockchain, discusses the importance of the network upgrade. Proof of Stake will further prevent the possibility of hacking the Ethereum blockchain by overpowering the network.

“In the PoS case, however, things are much brighter. For certain kinds of 51% attacks (particularly, reverting finalized blocks), there is a built-in ‘slashing’ mechanism in the proof of stake consensus by which a large portion of the attacker’s stake (and no one else’s stake) can get automatically destroyed.

Hence, attacking the chain the first time will cost the attacker many millions of dollars, and the community will be back on their feet within days. Attacking the chain, the second time will still cost the attacker many millions of dollars, as they would need to buy new coins to replace their old coins that were burned. And the third time will... cost even more millions of dollars. The game is very asymmetric, and not in the attacker’s favor (2).”

Crypto Tax Benefits

There is one small silver lining to bear markets in crypto. In equities and other securities, there is a rule which prohibits “wash sales.” A wash sale occurs when you sell securities at a loss and within 30 days buy them back. The Internal Revenue Service rules prohibit you from deducting losses related to wash sales.

For example, you’re not allowed to sell IBM shares to lock in a tax loss and immediately buy them back at basically the same price. You have to wait 30 days and take the risk they rally.

Currently, the wash sale rule only applies to stock and securities. It does not appear that this rule extends to cryptocurrencies (although due to the evolving picture surrounding cryptocurrencies, you should consult with a tax advisor).

If you hold crypto positions that have mark-to-market losses, you can sell and immediately buy them back to take a tax loss – at the high ordinary income rate.

This would also lower your tax basis. If the market rallies back – and you hold the new position for over a year – you will get long-term capital gains tax treatment on the gains (3).

Sources

- Mark Andresseen https://a16z.com/2014/01/21/why-bitcoin-matters-nyt/)

- Vitalik Buterin, PoS Systems

- Pantera Capital: https://panteracapital.com/blockchain-letter/defi-worked-great/ )

Crypto Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| ETH | 18.0% | 1,567.72 | 3,444.22 | -54.48% | BUY A HALF |

| ENS | 7.00% | 13.03 | 10.22 | 27.50% | BUY A HALF |

| MATIC | 7.00% | 0.79 | 0.678 | 16.50% | BUY A HALF |

| APE | — | 5.02 | — | — | WATCH |

| SOL | — | 34.61 | — | — | WATCH |

| HNT | — | 6.40 | — | — | WATCH |

| STEPN | — | 0.7665 | — | — | WATCH |

| AVAX | — | 22.08 | — | — | WATCH |

| LINK | — | 6.84 | — | — | WATCH |

Equity Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| Proshares Strategy Bitcoin ETF (BITO) | 2.50% | 12.94 | 25.93 | -50.10% | BUY A QUARTER |

| Arista Networks (ANET) | 2.50% | 127.17 | 105.00 | 21.11% | BUY A QUARTER |

| Nvidia (NVDA) | 2.50% | 170.34 | 188.20 | -9.49% | BUY A QUARTER |

| Okta Inc. (OKTA) | 2.50% | 93.5 | 95 | -1.58% | BUY A HALF |

| Block Inc. (SQ) | — | 72.98 | — | — | WATCH |

| Concord Acquisition (CND) | — | 10.02 | — | — | WATCH |

| CrowdStrike (CRWD) | — | 185.88 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 6.19(CAD) | — | — | WATCH |

| Proshares Short Bitcoin ETF (BITI) | — | 36.93 | — | — | WATCH |

| Unity (U) | — | 45.25 | — | — | WATCH |