Cryptocurrency markets have had a very good month led by Ethereum-based projects. Our crypto portfolio of Ethereum (ETH), Polygon (MATIC), and Ethereum Name Service (ENS) are all performing very well, and this trend is expected to continue.

Broader market sentiment has improved with the Nasdaq up over 9% this month.

Earnings reports for large-cap tech companies have generally been quite strong. We have seen Nvidia (NVDA) just publish a downward revision for the quarter. If you have purchased a position per our recommendation near the lows of $140, as we’ve been following the company for several months now, it is a favorable time to lock in some profits. However, we maintain high conviction on the long-term favorability of the company.

Nvidia (NVDA) Update: NVDA revised revenue guidance for the quarter down to $6.7 billion from $8 billion due to supply chain issues and a leveling of gaming GPU demand. The company’s datacenter segment is expected to remain robust and is forecast to maintain a growth rate of 61% y/y.

Datacenter and software represent the future of the business with expected revenue from datacenter alone at $3.8 billion for the quarter.

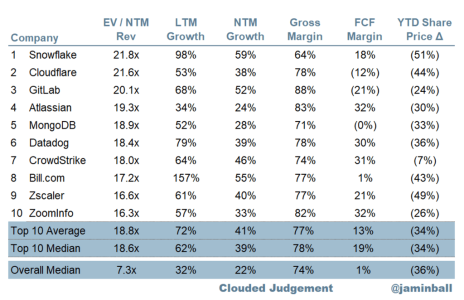

Extrapolated over four quarters, revenue from datacenter operations would leave NVDA trading at 25.5X sales leaving you with the rest of the business for free. According to Altimeter Capital’s cloud company comparison data, historic median SaaS multiples are 18.8X.

This valuation puts NVDA in a favorable position when looking forward the next 12-18 months.

Colette Kress, executive vice president and CFO of Nvidia, said she believes the company’s long-term gross margin profile remains intact.

“We have slowed operating expense growth, balancing investments for long-term growth while managing near-term profitability,” she said. “We plan to continue stock buybacks as we foresee strong cash generation and future growth.”

Nvidia is scheduled to report fiscal second-quarter results on Aug. 24 (Source: CNBC).

Upcoming Macro Data & Exciting Announcement

Stock buybacks are forecast to be over $1 trillion for 2022. This is the highest on record, suggesting corporations’ demand for their own stock remains unabated and should serve as a key catalyst for the remainder of the year as companies look to acquire their own shares at more favorable valuations.

Consumer Price Index (CPI) will report inflation data on Wednesday, which is likely to impact the market as the Fed considers the appropriate level for the interest rate.

Coinbase (COIN) will report earnings today on Tuesday 8/9 after the market close. The stock has roared back over 50% upon their recently announced partnership with Blackrock (BLK). Blackrock is the worlds largest asset manager, overseeing trillions of dollars in ETF value, helping investors gain exposure to different asset classes at lower cost.

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets,” Joseph Chalom, BlackRock’s global head of strategic ecosystem partnerships, said in a statement.

Their partnership with Coinbase does instill confidence in our bull thesis that institutional adoption of cryptocurrency remains in the earliest innings. Further adoption is likely to serve as a catalyst for the prices of best-in-class crypto assets including Bitcoin (BTC) and Ethereum (ETH) platform projects.

Upcoming Ethereum (ETH) Event

“The Merge” is expected to be completed by the end of the summer. This is a long-awaited significant update to the Ethereum network. Ethereum is a significant position in our portfolio, and we believe today’s valuation to be extremely favorable.

This event is significant because it equates to a Bitcoin (BTC) halving event where supply is reduced. These prior events have led to price appreciation for crypto assets.

Following the update, the amount of ETH to be dispersed as an award for validation will decline, moving ETH as an asset to be more deflationary – thus reducing supply.

Citi recently released their own analyst note that is inline with our own recommendations regarding “The Merge.”

The merge has further significance as it moves Ethereum from Proof of Work to Proof of Stake, where the network will use much less energy and be out of the ire of potential regulators over environmental impact. The merge is expected to reduce Ethereum network energy costs by as much as 98%, as mining will no longer be used to verify transactions.

Watch List

We are adding Chainlink (LINK) to our watchlist. Chainlink allows blockchains to securely interact with external data feeds and payment methods, providing the critical off-chain information needed by Ethereum smart contracts to become the dominant form of digital agreement (Source: CoinMarketCap).

CrowdStrike (CRWD) – end to end, tier-one, cyber security company offering services to three quarters of the Fortune 500.|

ProShares Short Bitcoin ETF (BITI) – potentially useful as a future hedge against our long portfolio.

Block, Inc (SQ) – peer-to-peer Cash App solution provider that allows participants to send currencies including crypto. SQ also has a B2B-focused payment processing engine.

Helium (HNT) – decentralized blockchain network for Internet of Things devices (IOT). Users who operate Helium hotspots mine and earn rewards in Helium’s native cryptocurrency HNT.

Avalanche (AVAX) – competing layer one blockchain solution to ETH with 6,500-transaction-per-second capacity.

Bored Ape Yacht Club (APE) – token for the growing community of creative digital content like Pixar.

Crypto Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| ETH | 18.0% | 1,783.13 | 3,444.22 | -48.23% | BUY A HALF |

| ENS | 7.00% | 16.72 | 10.22 | 63.60% | BUY A HALF |

| MATIC | 7.00% | 0.93 | 0.678 | 36.74% | BUY A HALF |

| APE | — | 7.33 | — | — | WATCH |

| SOL | — | 42.50 | — | — | WATCH |

| HNT | — | 9.29 | — | — | WATCH |

| STEPN | — | 0.9404 | — | — | WATCH |

| AVAX | — | 28.59 | — | — | WATCH |

| LINK | — | 8.55 | — | — | WATCH |

Equity Portfolio

| Ticker | Initial Weight | Price | Price at Rec | Performance | Rating |

| Proshares Strategy Bitcoin ETF (BITO) | 2.50% | 14.79 | 25.93 | -42.96% | BUY A QUARTER |

| Arista Networks (ANET) | 2.50% | 124.71 | 105.00 | 18.77% | BUY A QUARTER |

| Nvidia (NVDA) | 2.50% | 177.93 | 188.20 | -5.46% | BUY A QUARTER |

| Okta Inc. (OKTA) | 2.50% | 107.22 | 95 | 12.86% | BUY A HALF |

| Block Inc. (SQ) | — | 85.50 | — | — | WATCH |

| Concord Acquisition (CND) | — | 10.00 | — | — | WATCH |

| CrowdStrike (CRWD) | — | 189.52 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 8.12(CAD) | — | — | WATCH |

| Proshares Short Bitcoin ETF (BITI) | — | 32.73 | — | — | WATCH |

| Unity (U) | — | 49.76 | — | — | WATCH |