Gold and silver prices have perked up since our last regular issue, thanks in part to a substantial reduction in short positions among commercial hedgers. Other segments of the market are improving as well, including platinum and palladium.

Elsewhere, titanium has fallen from grace—in part due to a TikTok rumor mill video. Other industrial metals, meanwhile, are coming off major lows but have recovery potential.

In the trading portfolio, I’m putting our favorite silver-tracking ETF back on a buy, while adding another steel-related position.

Cabot SX Gold & Metals Advisor Issue: August 9, 2022

Geopolitical Worries Boost Gold’s Haven Appeal

Interest Rate Factors Support the Metal

In what has become a rare occurrence, gold posted a solid string of gains in the last three weeks. Since bottoming at $1,700 an ounce in mid-July, the yellow metal is up 6% and just inches away from getting above its key 50-day trend line for the first time since April.

The ride off last month’s low was largely a result of renewed safe-haven demand from international investors worried about the geopolitical backdrop. House of Representatives Speaker Nancy Pelosi’s recent visit to Taiwan stoked fears of renewed U.S.-China tensions and sent many investors scurrying into gold as a hedge against potential broad market volatility.

Another recent support for the metal has been the persistent fear of a U.S. recession and a global economic slowdown. Putting some teeth behind the recession fears was back-to-back quarterly U.S. GDP weakness, which has classically defined a recession.

Moreover, the collapse in the 10-year minus three-month Treasury yield curve (below) has historically served as a recession harbinger. Specifically, when this yield curve falls under zero, recessions tend to follow within six to 12 months. As you can see, the Treasury yield curve is at 0.25 and very close to sending a recession signal.

Traditionally, nothing boosts gold’s appeal quite like a recession. The last two recessions served as catalysts for huge gold price rallies, including a 70% rise in the immediate aftermath of the Great Recession of 2008, and a 40% increase following the short-lived recession of 2020. Prior to that, gold gained 15% during the 2001 recession and performed even better in the year after it ended.

From this perspective, the economic outlook is arguably the best argument in gold’s favor going forward. If a recession actually occurs in the coming months, it should further increase safe-haven demand and could well serve as the catalyst gold needs to launch another major bull market.

Another interest rate consideration for gold are so-called “real” rates (as opposed to nominal rates), which further help determine gold’s appeal to investors—especially since gold has no yield. Right now, real rates (i.e. the U.S. inflation rate minus the nominal rate) are still negative, so this should provide another bullish argument for gold going forward.

A final rate-related factor for gold in the intermediate term was pointed out by the World Gold Council (WGC), which noted that expectations are increasing on Wall Street for the Fed to be less hawkish with its monetary policy in the coming months. Moreover, said WGC, high investor cash holdings could serve to weaken the U.S. dollar in which gold is priced, in turn triggering a “more sustained recovery” in both stocks and commodities, including gold.

Moreover, according to CFTC Commitments of Traders data, net short positions among the “managed money” category in the gold futures market have recently risen to levels not seen in years. (Another way of saying this is that net long positions in gold have reached multi-year lows.) Such high levels of net shorts—and low levels of net longs—among managed money have typically been associated with positive gold returns in the months that follow, as WGC points out.

All told, the ingredients for another gold bull market are quickly falling into place. And while we don’t yet have confirmation that a new bull has begun, the odds are that we’ll soon see one.

What to Do Now

We were recently stopped out of our conservative trading position in the GraniteShares Gold Trust (BAR). No new trading positions are recommended in any gold-related stocks or ETFs until I see some additional improvement, particularly in the gold mining stocks. WAIT

New Recommendations/Updates

Silver Could Soon Get a Big Break

The beleaguered silver market could soon get a big break, based on a recent series of statistics. The data paint a sanguine picture for the industrial metal and suggest higher prices are ahead.

Although silver prices are down over 20% from a year ago, recent CFTC Commitments of Traders (COT) reports reveal that commercial hedgers (the so-called “smart money” in the silver market) are at one of their lowest levels of holding short positions in years.

Moreover, the Silver Institute’s World Silver Survey 2022 report states that higher mine production (due to project ramp-ups gains in established mines’ output), plus higher industrial recycling are expected this year, resulting in a projected 3% increase in global silver supply.

However, the higher supply will be insufficient to meet the 5% increase in global demand the Silver Institute is forecasting for 2022 (due to improvements in industrial fabrication along with higher post-pandemic jewelry demand).

Specifically, the report predicts total silver supply this year will exceed 32,000 tons, not enough to match the more than 34,000 tons of silver demanded projected, leaving a market deficit of around 2,220 tons.

As an aside, the Silver Institute notes that the accelerating demand for electronic vehicles (EVs) and autonomous vehicles should serve as a long-term boost for silver demand. The 2022 survey said the shift to EVs has resulted in “growing demand for silver-coated or silver-alloy wires, that provide high-frequency transmission of big data” used in today’s high-tech automobiles.

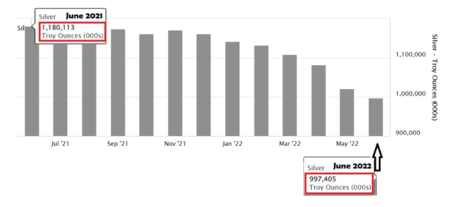

On the supply side, Mining.com recently observed that “the quantity of silver held in London Bullion Market Association (LBMA) vaults has been hemorrhaging for the past seven straight months.” LBMA vaults now hold less than a billion ounces, which amounts to a 15% loss from a year ago and the lowest since December 2016 (and immediately prior to the launch of a 17% rally in silver prices in the four months that followed).

Putting all the pieces together, silver’s outlook is as positive as it has been in recent memory. Accordingly, I’m moving to add a new position in our favorite silver-tracking ETF.

What to Do Now

My favorite silver-tracking fund, the iShares Silver ETF (SLV), has shown some notable technical improvement in the last several days. SLV is back above its 25-day line after spending the better part of the last four months under it. The fund is still under the more psychologically significant 50-day line, but with short interest factors in silver’s favor (per our recent discussions), the odds favor SLV eventually getting back above this key trend line. Accordingly, investors who don’t mind the volatility risk associated with buying near a major low can purchase a conservative position in SLV. I suggest using a level slightly under 17.15 as the initial stop-loss on a closing basis. BUY A HALF

The Sprott Physical Platinum & Palladium Trust (SPPP) is arguably the lowest-cost way to play a potential palladium market short-covering rally. As mentioned above, I view this as an asymmetric trading opportunity given the strong short-covering trend among commercial hedgers in the palladium market. Moreover, the white metals should be prime beneficiaries of China’s reopening from recent Covid-related shutdowns as industrial activity (particularly in the automotive sector) ramps up again. However, because this ETF is coming off a major low and doesn’t enjoy the tailwind of forward momentum (as most of my recommendations do), it also represents an above-normal volatility risk. For that reason, I’m not recommending this trade for conservative traders. That said, participants who don’t mind the risk recently purchased a small position in SPPP using a level slightly under 12.60 as an initial stop-loss (closing basis). BUY A HALF

Copper, Zinc Supply Outlook Improves

The latest U.S. jobs report, which showed an addition of 528,000 jobs and the return of the jobless rate to 2019 levels, brought both good and bad news to various industries. One industry that saw some good news from the report, however, was copper.

Copper prices on the Comex responded to the bullish jobs data by rising 3%, and a report from Shanghai’s SMM News provided a reason why: U.S. factory copper orders rose in June while related service industry activity unexpectedly rebounded in July.

Meanwhile on the supply front, Europe’s largest copper producer Aurubis said last week it plans to reduce gas usage in Germany and pass on higher power costs to its customers as the region’s energy crisis deepens. Mining.com reports:

“The Hamburg-based company is looking to switch to alternatives like fuel oil but is bracing for a potential restriction in gas supply that could impact its sprawling industrial operations in the country.”

The implication of the gas use reduction is that copper output could be curtailed in Europe, in turn favorably impacting the near-term supply/demand balance in favor of the bulls and potentially boosting prices.

In a related development, zinc prices just hit their highest level in five months after Anglo-Swiss mining giant Glencore warned that Europe’s energy crisis “poses a substantial threat to supply.”

According to Mining.com, Glencore has suspended production at one of its zinc smelters in Europe, leading to a sharp drop in its metal output this year. The company further disclosed that its other smelters in the region are “barely turning a profit.”

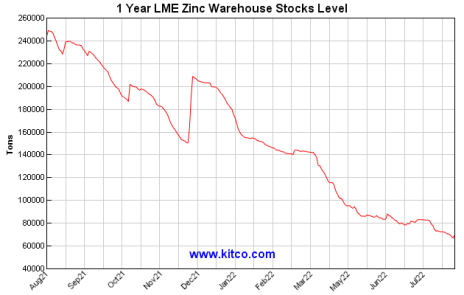

On that score, Kitco is reporting that LME zinc warehouse stocks are at a one-year low and not far from a five-year low.

What to Do Now

Our recent examination of the copper/gold ratio revealed that copper tends to rally when the ratio falls under 0.19, which it did recently. A 14-year statistical survey further shows that in every case without exception, copper posted a meaningful price gain (i.e. between 30% and 50%) in the six to 12 months following the signal. With that in mind, participants who don’t mind the short-term volatility risk recently purchased a conservative position in the Global X Copper Miners ETF (COPX) using a level slightly under 28 as the initial stop-loss on a closing basis. BUY A HALF

China’s Property Crisis Worries Steel Market

Margins at China’s steel mills are improving, yet investors worry that the country’s real estate crisis could dampen demand for the construction metal.

According to one survey, China’s July new home prices and sales fell from the prior month. Bloomberg, meanwhile, is reporting that China’s banks are facing mortgage losses of $350 billion.

Chinese homebuyers are also protesting the inability of developers to finish their new homes by refusing to make payments on mortgages. As Aljazeera points out, real estate has been one of the biggest drivers of economic growth in China, accounting for a third of its $18 trillion GDP.

With the brewing real estate storm in China, it’s not hard to imagine how global steel demand could be impacted by it. Consequently, U.S. hot-rolled coil steel prices recently hit a 20-month low of around $820 a ton in reflection of the global demand concerns.

Steel stock prices, by contrast, remain nonplussed by the China crisis and are holding up well after recent gains. Projected lower steel production (mainly due to China’s strict emission standards) and the fact that numerous Chinese steel mills are currently idled for maintenance have created a tailwind for domestic producers like Cleveland-Cliffs (CLF) and U.S. Steel (X).

Cleveland-Cliffs, which enjoys a leadership position in providing steel for the U.S. automotive industry, expects that a huge backlog for vehicles will result in higher steel demand in the coming quarters, in turn pushing domestic prices higher.

U.S. Steel, meanwhile, just posted a record-setting Q2 replete with its best-ever quarterly adjusted earnings and better than expected revenue. The firm also announced a $500 million stock repurchase authorization, reflecting management’s confidence about the coming quarters.

What to Do Now

Alliance Resource Partners (ARLP) is a producer of metallurgical coal (for the steelmaking industry) and thermal coal (for electrical utilities), with approximately two billion tons of coal reserves in several U.S. midwestern and southern states. Alliance is currently the second-largest coal producer in the eastern U.S. with additional mineral and royalty interests in the highly productive Permian, Anadarko and Williston Basins. (The company markets its mineral interests for lease to operators in those regions and generates royalty income from the leasing and development of those mineral interests.) ARLP has been one of the few standouts in an otherwise weak market as coal prices surge around the world (forming what one analyst called a “space needle pattern”) in response to the recent natural gas crisis in Europe. Consequently, many industry experts foresee shortages and sky-high energy prices persisting until at least 2024. During Q2, the company’s average realized coal price was $72 per short ton—$25 above the prior quarter’s prevailing price. The recent earnings also revealed the firm’s revenue increased 70% from a year ago, to $617 million, while per-share earnings were $1.23 (29 cents above estimates). Management indicated that coal operations have delivered “significant” year-over-year per ton margin expansion, adding that it sees ARLP well positioned to see further margin growth in 2023 and 2024. On a technical note, I suggest raising the stop-loss on the remaining position (after our recent profit-taking move) to slightly under 20 on a closing basis, where the 50-day line currently resides. HOLD A HALF

Cleveland-Cliffs (CLF), North America’s largest flat‑rolled steel and iron ore pellet maker, just reported mostly upbeat second quarter earnings. Revenue for the steelmaker in Q2 rose 26% from a year ago to $6.3 billion, while per-share earnings of $1.31 missed estimates by five cents. Other highlights included free cash flow that more than doubled from the prior quarter, plus the firm’s largest quarterly debt reduction since it began its transformation two years ago. The company, which enjoys a leadership position in providing steel for the U.S. automotive industry, expects the enormous backlog for vehicles will result in higher steel demand in the coming quarters, which could help push prices for the metal higher. The stock, meanwhile, is subject to what looks like a growing short-covering squeeze as 9% of the float is currently sold short. Traders can purchase a conservative position in CLF here using a level slightly under 17 as the initial stop-loss on a closing basis. BUY A HALF

Reliance Steel & Aluminum (RS) is the largest metals service center operator in North America, providing metals processing, inventory management and delivery services for several industries, including construction, energy, electronics, automotive and aerospace. Reliance expects its average selling price per ton sold for the third quarter of 2022 to be down 5%, due to recent weakness in aluminum and steel prices. Despite this, however, the company sees improving demand and pricing for higher-value products sold into the aerospace, energy and semiconductor end markets. In Reliance’s just-released Q2 report, revenue of $4.7 billion was 37% higher from a year ago and surprised estimates to the upside. Per-share earnings of $9.15, meanwhile, beat estimates by 13 cents. Looking ahead to Q3, management sounded a sanguine note, observing that “customers tend to hold less inventory in times of declining metal prices and increase their reliance on us to provide the metal they need quickly and more frequently, as well as to fulfill their value-added processing needs.” Wall Street expects Q3 sales to increase 8% with full-year sales expected to jump 20%, both of which could prove too conservative if the dollar weakens and the industrial metals market reignites. In view of the strong relative performance of this dual steel/aluminum company in recent weeks, traders recently purchased a conservative long position in RS using a level slightly under 175 as the initial stop-loss (closing basis). BUY A HALF

Titanium Hit With “Bad” News

There’s good news/bad news on the titanium front. The good news is that the “bad” news is apparently overstated (as we’ll discuss here). The worse news—for investors—is that the market doesn’t appear to believe the good news, resulting in selling pressure for some leading titanium stocks.

Let’s start with the good news. On the financial front, some of the leading titanium dioxide producers have lately reported solid sales for the second quarter. Valhi Inc. (VHI) announced that total revenue in Q2 came in at $635 million, a 21% increase from a year ago.

Valhi’s chemical segment sales were 18% above the year-ago period, thanks to higher average selling prices for titanium dioxide (TiO2). Per-share earnings of 98 cents, meanwhile, were 30% higher. However, they weren’t nearly as high as Wall Street expected, which is why VHI shares were pummeled last Friday, resulting in our trading position in the stock being stopped out (see below).

Elsewhere, Chemours (CC) announced a record-setting quarter, thanks also in part to higher TiO2 prices. In its Q2 earnings call, Chemours’ management stated that there are still significant supply constraints relating to titanium-bearing ores and expressed a need for more mining to be brought online to relieve the situation.

Now let’s talk about the bad news. A TikTok video with more than three million views has been circulating online claiming that certain tampons contain TiO2 (a common coloring agent), and that this can cause ovarian cysts. According to one news site, “Tens of thousands of users have flooded the comments—many claiming to have had similar experiences.”

The U.S. Food & Drug Administration (FDA), however, maintains that regulated amounts of TiO2 are considered safe. Several doctors have also subsequently made TikTok videos assuring women that the relatively small amounts of TiO2 used in feminine hygiene products are safe. But the rumor mill isn’t entirely convinced and continues to look askance at TiO2.

Aside from the bad press the titanium-based product is receiving, benchmark titanium futures prices have recently plunged 21%, apparently on demand concerns. Consequently, I’m recommending that we reduce our exposure to the metal for now until the outlook improves.

What to Do Now

On August 5, we were stopped out of our conservative long position in Valhi (VHI), a leading titanium industry stock, after the 41.60 level was violated on a closing basis. The big earnings miss was the main reason for the stock’s sharp decline, as discussed above. SELL

Current Portfolio

| Stock | Price Bought | Date Bought | Price on Aug. 8 | Profit | Rating |

| Alliance Resource Partners (ARLP) | 18.75 | 7/5/22 | 22.25 | 19% | Hold a Half |

| Cleveland-Cliffs (CLF) | 18.3 | 8/8/22 | 18.3 | 0% | Buy a Half |

| Global X Copper Miners ETF (COPX) | 30.5 | 8/2/22 | 30 | -2% | Buy a Half |

| iShares Silver Trust ETF (SLV) | 18.3 | 8/8/22 | 18.3 | 0% | Buy a Half |

| Reliance Aluminum & Steel (RS) | 190 | 8/2/22 | 189 | -1% | Buy a Half |

| Sprott Physical Palladium Trust (SPPP) | 13.5 | 7/26/22 | 14.5 | 7% | Buy a Half |

| Valhi Inc. (VHI) | 48 | 7/20/22 | 41.5 | -13% | Sold |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on August 23, 2022.

Analyst Bio

Clif Droke

Clif Droke is Chief Analyst of Cabot SX Gold & Metals. For over 20 years, he has worked as a writer, analyst and editor of several market-oriented advisory services and has written several books on technical trading in the stock market, including “Channel Buster: How to Trade the Most Profitable Chart Pattern” and “The Stock Market Cycles.”