The old Wall Street bromide that says “bull markets climb a wall of worry” can be applied to lithium. The battery metal is facing new worries over the impacts of a proposed tax that many fear will keep supplies restricted. While potentially bad for the EV market, it has so far been good for prices.

Elsewhere, steelmaking coal is on the rebound while related stocks are looking good. Industrial metals, meanwhile, are coming off major lows but have rebound potential.

I continue to recommend that we remain mostly defensive until weakness subsides.

Cabot SX Gold & Metals Advisor Issue: July 12, 2022

Dr. Copper is Key for Metals’ Outlook

Oversold Metal Market Near Inflection Point

Weakness continues to abound in the broad metals market, with precious metals like gold and silver bearing the brunt of the latest selloff. On a short-term basis, however, the metals market is oversold and the odds are high that we’ll see some short-covering rallies unfold soon.

Before discussing the short-term outlook, let’s take a quick look at the intermediate-term (3-6 month) picture, starting with copper. Dr. Copper—the metal with a PhD in economics—has flashed a high-profile “recession signal” according to a number of market analysts who track the relationship between copper prices and economic performance.

Yet statistical studies compiled by Jason Goepfert of SentimenTrader suggest that there is no hard-and-fast correlation between copper bear markets and economic downturns. In Goepfert’s words, copper crashes “show a mixed record at best when signaling a recession,” and when recessions did occur the copper price collapse tended to be coincidental rather than leading.

Nevertheless, copper does have a strong history of predicting strength or weakness in the broad commodities market—including industrial metals.

When copper prices plunge more than 22% in a short period (i.e. a few weeks), what typically happens is that commodity prices in general show flattish returns in the six months that follow. And at some point during that six-month period, commodities showed additional weakness before recovering.

Why is copper so critical to an analysis of the broad metals market? Because of its hypersensitivity to changes in the outlook for a number of industries—from building to high-tech—it tends to lead other metals in bull and bear markets. The latest bear market was no exception as copper was the first major metal to signal a trend reversal (back in early March).

With that in mind, it’s important to watch the copper price for signs of returning strength on a short-term basis. The next confirmed breakout signal in copper will provide us with a useful “heads-up” signal that another trading opportunity has arrived for the industrial metal market.

As mentioned above, most metals are showing signs of being sold out on a very short-term basis. Granted, there could be some additional spillover weakness in the days ahead, but it’s likely that we’ll start to see some short covering as we head further into July.

For the gold and silver outlook, it’s worth mentioning that platinum and palladium have already begun to rally from their previously oversold positions. Palladium is up 20% from its June low, while platinum has been nudging higher off its low from last week in recent days. Palladium’s strength is noteworthy since big rallies in this metal have often preceded gold market strength.

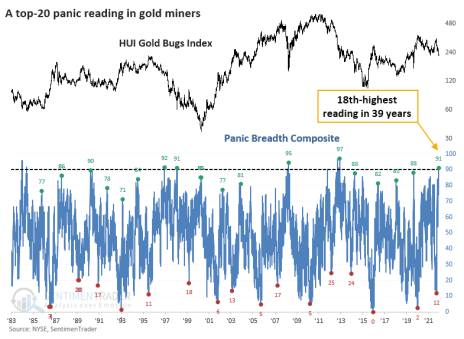

As for the gold mining stocks, several leading senior, mid-tier and junior miners have shown signs of panic selling in the last two weeks. From a contrarian’s perspective, this increases the chances that a short-term bottom isn’t far away.

SentimenTrader’s Panic Breadth Composite indicator for the gold stocks showed more panic selling than at any time in years, ranking in the top 20 among panic signals of the last 40 years. As the above chart shows, whenever this indicator reached such a level of panic in the past, it always produced a worthwhile short-term buy signal for the miners, with a rally lasting several weeks. The bad news, however, is that those gains faded away and led to lower lows in every instance.

All told, it’s probable that we’ll soon have another opportunity to buy the beaten-down gold/silver stocks and ETFs. But once we have the next trading signal, we’ll have to watch our positions very closely due to the reversal risk that always accompanies a bear market rally.

What to Do Now

We were recently stopped out of our conservative trading position in the GraniteShares Gold Trust (BAR). No new trading positions are recommended in any gold-related stocks or ETFs until the market confirms a bottom has been made. WAIT

New Recommendations/Updates

July: Silver’s Best Chance to Rally

So far into July, silver has been a disappointment. You’ll recall our discussion of past weeks when I pointed out silver’s historical tendency to rally in the first full month of summer.

Statistically, silver’s best percentage gains have occurred in July. That tendency is even more pronounced when silver enters the month in a downward trend or “oversold” technical condition. And that was definitely the case for silver earlier this month.

Entering July, silver was coming off its worst performance in over a year and was down 30% from its March peak. But now the white metal has become vulnerable to short covering given just how “oversold” it is on a short-term basis.

The extent of silver’s selloff can be seen in the chart of the iShares Silver ETF (SLV), my favorite silver-tracking ETF. Normally whenever SLV is over- or under-extended from its 50-day line by more than 2 points (as is now the case), a technical rally ensues.

With July not yet half over, there’s still a high probability we’ll witness a relief rally this month. Silver’s seasonal factor is still bullish, and there can only be so much additional selling pressure before short covering overwhelms the market. For that reason, I’ll be closely monitoring silver in the coming days for a breakout signal that would give us another buying opportunity in the silver ETF.

What to Do Now

From a short-term strategic perspective, no new silver ETF purchases are recommended. WAIT

China Could Come to Copper’s Rescue

As mentioned earlier in this report, copper’s recent weakness is definitely a cause for concern in terms of the broad commodity outlook. It also calls into question (to some extent) the demand outlook from top copper consumer China.

But an argument can be made that copper has already factored in the bad economic and manufacturing outlook and is looking ahead to a potential recovery for China. The red metal rallied last week on news that China’s government is planning to stimulate its beleaguered industrial sector in the wake of recent Covid-related lockdowns.

Beijing will reportedly set up a state infrastructure investment fund worth $75 billion in an attempt to stimulate infrastructure spending and revive its softening economy, according to a Reuters report. The fund is expected to be set up sometime this quarter, the report said.

Such a stimulus package could lift copper out of the doldrums as construction spending and manufacturing presumably will increase in response to it.

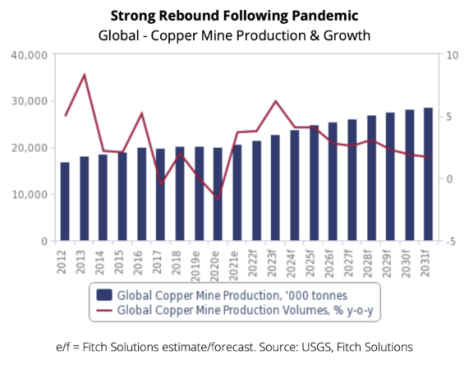

Along those lines, the ratings agency Fitch just reiterated its outlook for higher copper prices based partly on increased demand for copper-intensive renewable energy projects worldwide.

Fitch is also forecasting global copper mine production to increase by an average annual rate of 3% between now and 2031.

What to Do Now

From a short-term strategic perspective, no new copper ETF purchases are recommended. WAIT

Steel Supply Outlook Should Improve

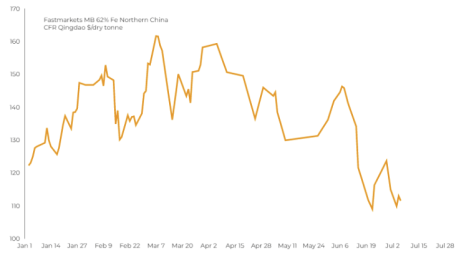

Panic is afoot in the steel market as mills in China report crisis conditions due to weak demand in the wake of the nation’s recent series of woes.

Steel Rebar futures are down to their lowest level since a 10-month low in November 2021. Dozens of major blast furnaces in China have been shuttered in the face of high inventories and weaker demand after recent Covid lockdowns in Shanghai and Beijing.

China’s portside inventories have risen in the face of surging iron ore shipments from Australia and Brazil, according to reports. Additional factors weighing on steel market sentiment include China’s plan to reduce steel output under its decarbonization plan, plus a bad string of recent weather in steel-producing cities.

China’s Hunan Valin Iron & Steel Group last week reportedly met with officials to discuss the downturn in the nation’s steel industry and discussed the need for shutting down unprofitable production facilities. Hunan Valin said it expects the crisis to persist for five years, according to Mining.com.

On the input front, prices for iron ore cargoes with a 62% iron content for delivery to Northern China fell to below $111 per ton, reaching levels not seen since last year and prompting steel mills to cut production.

Goldman Sachs, meanwhile, has reduced its three-month price target for iron ore to $90 per ton from $110 a ton and expects the bulk metal price to average $100 per ton in the third quarter.

With the bad news likely fully baked into prices already, however, steel prices have likely seen their lows for now as the market will begin pricing in production cuts, along with China’s plans to revive its flagging economy through infrastructure spending (which should benefit its domestic steel industry).

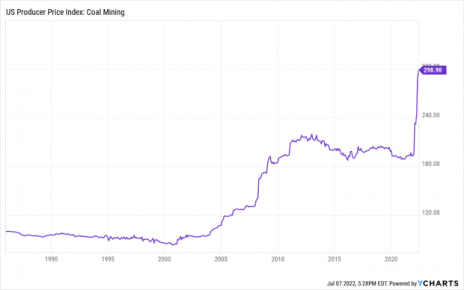

Another steelmaking input is faring considerably better, however. Prices for metallurgical and thermal coal are near record highs, with spot coal prices at Australia’s Newcastle port (a major supplier to Asia) hitting $400 a ton for the first time ever last month. Per The Wall Street Journal, the push for coal:

“…is being led by Europe, which is boosting coal purchases to ensure it can keep power flowing to homes and factories after Russia cut gas supplies to the continent. Germany, which has promised to eliminate coal as a power source by 2030, is among the nations now importing more.”

Additionally, Italy, France, Britain, the Netherlands and Austria have also indicated they plan to restart coal-fired power plants, boost their coal production or keep them running longer than planned.

In view of this bullish fundamental backdrop for coal, the U.S. Coal Mining Index is on track to hit record highs this year, according to forecasts by the International Energy Administration (IEA). This in turn should prove supportive for the stock prices of metallurgical coal producers, including the one in our portfolio (below).

What to Do Now

Alliance Resource Partners (ARLP) is a producer of metallurgical coal (for the steelmaking industry) and thermal coal (for electrical utilities), with approximately two billion tons of coal reserves in several U.S. midwestern and southern states. Alliance is currently the second-largest coal producer in the eastern U.S. with additional mineral and royalty interests in the highly productive Permian, Anadarko and Williston basins. (The company markets its mineral interests for lease to operators in those regions and generates royalty income from the leasing and development of those mineral interests.) Additionally, Alliance provides terminal services for the transloading of coal, and develops and markets industrial and mining technology products and services. On the financial front, analysts foresee 55-ish percent revenue growth and 170-ish percent EPS growth in the next two quarters. Traders recently purchased a conservative position in ARLP using a level slightly under 17.10 as the initial stop-loss on a closing basis. BUY A HALF

We were stopped out of the remainder of our long position in Kronos Worldwide (KRO) last week when the 17.50 level was violated on a closing basis. SOLD

New Worry for the Lithium Industry

Lithium carbonate prices are up over 70% since the start of 2022, making it the top performer of all major industrial metals. While other metals have seen substantial weakness in recent weeks, the battery metal is one of the only ones to hold on to most of its yearly gains to date.

One of the factors keeping lithium prices supported—and in short supply—is a recent legislative proposal in California. The Golden State’s government recently proposed a flat-rate tax on lithium, which it says is needed to help restore the Salton Sea region—one of the state’s poorest areas that was heavily damaged by years of heavy pesticide use in agriculture and where lithium is abundant.

California’s government further believes a flat tax on lithium would make it easier for the state to forecast revenue. The proposal would impose a tax of $400 per ton for the first 20,000 ton of lithium produced annually, $600 per ton for the next 10,000 tons and $800 per ton for an output of greater than 30,000 tons.

In response to the proposal, industry executives told Reuters that the tax would delay lithium deliveries to electric vehicle (EV) makers like General Motors and Stellantis N.V. and could cause serious supply disruptions elsewhere.

Industry analysts believe the tax could also keep lithium prices elevated in the foreseeable future by restricting domestic supplies of the metal.

What to Do Now

The Global X Lithium & Battery Tech ETF (LIT), my favorite lithium tracker, has perked up and is showing relative strength for the first time this year. LIT invests in companies throughout the lithium cycle, including mining, refinement and battery production, cutting across traditional sector and geographic definitions. Traders recently purchased a conservative position in LIT here using a level slightly under 69.70 as the initial stop-loss on a closing basis. BUY A HALF

Current Portfolio

| Stock | Price Bought | Date Bought | Price on 7/11/22 | Profit | Rating |

| Alliance Resource Partners (ARLP) | 18.75 | 7/5/22 | 20.1 | 7% | Buy a Half |

| Global X Lithium & Battery ETF (LIT) | 75.8 | 6/28/22 | 74.8 | -1% | Buy a Half |

| Kronos Worldwide (KRO) | 15.25 | 4/12/22 | 17.4 | 14% | Sold |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on July 26, 2022.

Analyst Bio

Clif Droke

Clif Droke is Chief Analyst of Cabot SX Gold & Metals. For over 20 years, he has worked as a writer, analyst and editor of several market-oriented advisory services and has written several books on technical trading in the stock market, including “Channel Buster: How to Trade the Most Profitable Chart Pattern” and “The Stock Market Cycles.”