A Major Sentiment Shift for the Metals

Commercial hedgers turn surprisingly bullish on base metals

After being in the proverbial doghouse for the last five months, most industrial metals have likely seen final washout lows for the year as of October. Precious metals (gold in particular) are still under varying degrees of pressure, but for steel, copper and aluminum, the bottom is likely in.

Make no mistake, the fundamentals haven’t drastically improved in recent months as economists and industry analysts alike expect next year to see lower metals demand across the board on the assumption that the global economy will remain soft.

The World Steel Association expects global steel demand to drop over 2% this year, to 1.8 billion tons, which represents a downward revision from its prior forecast this spring. The projected demand drop was based on skyrocketing energy costs, higher interest rates and strict Covid lockdowns, which continue to crimp construction and industrial activity on a global basis.

China just instituted a fresh lockdown of over a million citizens in the iPhone manufacturing hub of Zhengzhou, as well as in parts of the central metropolis of Xi’an. Additionally, global metals giant Rio Tinto reported a decline in iron ores sales as steel-related demand in China has sharply dropped.

Meanwhile, the International Monetary Fund (IMF) has revised its global growth estimates downward to 2.7% this year, based on inflation and the aggressively tight monetary policy of the world’s major central banks, and expects a recession in 2023. This, coupled with continued power rationing in top consumer China, is expected to crimp copper demand next year.

But as experienced investors are aware, markets are forward-looking and typically discount fundamentals by at least six to nine months in advance. And it would appear the broad market for base metals has already baked in the bad news and is looking forward to brighter days ahead, presumably by later in 2023.

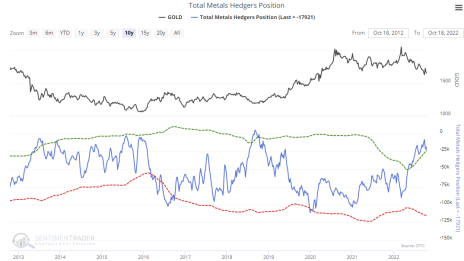

The major clue that better times are expected is the prevailing market sentiment among informed participants, which has showed stunning improvement in recent months. According to CFTC data, commercial hedgers (the so-called “smart money”) have reversed net short positions on total metals to a net long position. It typically pays to follow in the footsteps of this important class of traders since they tend to be correct when their combined positioning reaches an extreme level (as it has now).

Indeed, the total metals hedgers’ position has reached its most net long position on the metals since 2018, which was around the same time that gold, silver and platinum were about to take off.

Meanwhile, huge levels of short interest are mounting in several metal-related stocks and ETFs. The SPDR S&P Metals & Mining ETF (XME) is a case in point, having recently shown short interest of around 30% of shares outstanding. This is a level of short interest that screams, “Oversold!”

With “smart” players unwinding short bets and “dumb” retail traders increasing shorts, the stage has been set for a potentially large short-covering rally in the coming weeks. All that is required to catalyze a short-covering event would be an unexpectedly bullish series of new headlines (a preview of which we saw last week with stronger-than-expected earnings in a couple of major steel makers). Dollar weakness would, of course, be another potential catalyst.

Regardless of the spark that sets off the next rally, the market’s risk/reward profile has notably improved from the last few months. As such, I’m recommending that investors allocate more of their cash into attractive metals and mining stocks (which we’ll discuss more specifically later in this report).

What to Do Now

As a temporary holding until the gold price outlook improves, investors may wish to own a conservative position in the Invesco DB U.S. Dollar Index Bullish Fund (UUP). I previously suggested using a level slightly under 29 as the stop-loss for this position; I now recommend raising the stop to slightly under 29.60. BUY A HALF

Kinross Gold (KGC) is a senior mining firm that acquires, explores and develops gold properties in the U.S., Canada, Brazil, Chile, and Mauritania. Kinross was one of the few actively traded gold miners that posted higher revenue from a year ago in Q2, with total sales of $822 million increasing 16% from the comparable 2021 quarter. The company also reported cash and equivalents of $719 million, and total liquidity of approximately $2 billion, as of the quarter’s end, plenty of capital to take on new projects and fund existing operations. Management also provided upbeat guidance, with plans to “significantly” increase production in the second half of the year, primarily driven by stronger production at its Paracatu, Tasiast and La Coipa gold projects. Kinross expects all-in sustaining costs per gold equivalent ounce sold to be approximately $1,240—about $430 per ounce above the current gold price. On the development front, the company is proceeding with development of its 70%-owned Manh Choh project in Alaska, which is expected to increase the firm’s production profile by approximately 640,000 attributable ounces over the life of mine at lower costs. Kinross’s world-class Great Bear project in Ontario, meanwhile, continues to make excellent progress, with drilling results from the first half of the year continuing to confirm Kinross’ vision of developing a large, long-life mining complex. Most recently, Kinross announced approval from the Toronto Stock Exchange to increase normal course issuer bid as part of the firm’s $300 million stock buyback program. The amendment increases the maximum number of common shares that may be repurchased (up to 65 million shares), representing 10% of the company’s public float. Purchases under the bid began August 3 and will end no later than next August 3. The stock is showing observable relative strength versus most actively traded gold shares, suggesting accumulation by informed interests is taking place. Participants can accordingly purchase a conservative position in KGC using a level slightly under 3.30 as the initial stop-loss on a closing basis. The next earnings report is due out November 9. BUY A HALF

New Recommendations/Updates

Silver Hedgers Turn Bullish

Along with the dramatic reversal in sentiment (from bearish to bullish) among commercial hedgers in the total metals market, silver hedgers in particular have shown a bullish bias in recent weeks.

According to Jay Kaeppel of the Kaeppel’s Corner newsletter, commercial hedgers recently swung to a net long position in silver futures for one of the few times in the last 20 years. Whenever this has happened in the past, it has been followed by strong performance in silver in the six-month and 12-month period that follows for a 100% win rate, based on Kaeppel’s data analysis.

That said, we’re still in a seasonally unfavorable period for silver, which will continue through November. Where silver’s seasonal outlook typically brightens is later during the fourth quarter, especially in December. In fact, the December-to-February period is when silver typically posts some of its biggest gains for the year (which was the case in the last two years).

Moreover, it’s worth noting that silver is highly correlated to the euro currency, with the white metal typically following the euro’s advances while being hindered by the currency’s declines. Shown here is the chart of the Invesco CurrencyShares Euro Currency Trust (FXE), which tracks the euro.

A strong reversal in the euro currency (as reflected by the progression of FXE) could serve as a trigger for the next sustained silver rally. Otherwise, once silver enters the seasonally favorable December-to-February period, another buying opportunity is likely to arrive.

Either way, silver’s intermediate-term (6-to-12-month) outlook has become very favorable. A technical breakout for silver (i.e. a close above the nearest high of $21.10) is all that’s needed to confirm a bullish trend change for the metal.

What to Do Now

As previously discussed, white metals—particularly palladium—are holding their own relative to other metals. And while I’m not yet ready to pull the trigger on our favorite platinum/palladium ETF, I’m keeping a close watch on one of the biggest stocks in this segment, Platinum Group Metals (PLG). The South African-based company is focused on platinum and palladium production and operates the Waterberg large-scale platinum group metal (PGM) resource, which has an attractive risk profile given its shallow nature. The project also has the potential to be one of the lowest-cost operations in the PGM sector. An even bigger attraction for the company right now, however, is its partnership with Anglo American Platinum (ANGPY). The two companies have created Lion Battery Technologies to support the use of palladium and platinum in lithium battery applications. Lion has entered into an agreement with Florida International University to further advance a research program that uses platinum and palladium to unlock the potential of Lithium Oxygen and Lithium Sulfur battery chemistry, which can perform better, by orders of magnitude, than the best-in-class Lithium-ion batteries currently on the market. This new generation of lightweight, powerful batteries has the potential to grow to scale on the back of the attractiveness of electric vehicles (EVs) and the use of lithium batteries in other applications beyond mobility. Given that alternative energy is one of the market’s strongest performing sectors right now, this could position PLG to significantly outperform in the coming quarters. Accordingly, I’m recommending that we purchase a conservative position in PLG if the stock closes above 1.80 (the stock most recently closed at 1.54). BUY A HALF ABOVE 1.80.

Copper Supplies Fall to “Dangerously Low” Levels

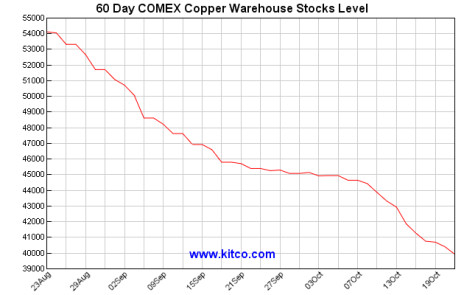

For the second time in the past year, global supplies of copper have hit dangerously low levels.

That outlook was shared by metals analyst Kostas Bintas at the FT Mining Summit last week. According to Bintas, copper inventories can cover just five days of global consumption and could potentially finish this year at three days. (Historically, copper inventories are usually counted in weeks.)

The driving factors behind the supply drop include explosive demand for the red metal used in alternate energy (i.e. “green tech”) applications, including electric vehicles (EVs) and solar power generation. Bintas observed that the EU has moved forward its timeline for doubling Europe’s solar energy capacity, which is weighing on supply.

“While there is so much attention being paid to the weakness in the real-estate sector in China, quietly, the demand for infrastructure, electric-vehicle-related copper demand, more than makes up for it,” he told the Financial Times. “It actually not only cancels completely the real estate weakness, but also adds to their consumption growth increase.”

Consequently, Bintas foresees higher copper prices in the months ahead.

Echoing Bintas’ forecast, a report from Wood Mackenzie estimates that some 10 million tons of new copper supply is needed over 10 years from projects that have not attracted sufficient investment or received necessary government permits to meet Paris Climate Accord goals.

To put this number in perspective, that’s the equivalent of putting a new La Escondida (the world’s largest copper mine) into production each year, according to Wood Mackenzie. The consultancy firm said, “The investment required [to fill copper’s global demand]…needs urgent attention.”

More specifically, Wood Mackenzie estimates that more than $23 billion a year will be needed over 30 years to deliver new projects, a level of investment seen only during China-led commodity super-cycle of the previous decade.

In summary, the firm said “the global energy transition presents an almost unattainable mine supply challenge, with significant investment and price incentives required.”

Further affirmation that global copper supplies have fallen to critical levels, top miner BHP Group (BHP) said the market may swing to a deficit by the end of the decade as alternate energy demand applications increase and the metal becomes harder to dig up. The risk is that there will be “a mismatch between the timing of increase in demand and when supply meets that demand,” said BHP’s CEO Mike Henry.

Moreover, Freeport-McMoRan’s (FCX) chief executive Richard Adkerson told last week’s FT Metals Summit that copper prices don’t reflect a “strikingly tight” physical market, implying that prices will have to rise in the coming months and years.

What to Do Now

We were stopped out of our conservative position in the Global X Copper Miners ETF (COPX) recently when the 28 level was violated on a closing basis. No new positions in the copper market are currently warranted until further technical improvement has been made. WAIT

A Tale of Two Steel Markets

Global steel demand is expected to decline for 2022, thanks largely to Europe’s energy crisis and China’s economic slowdown, according to projections by the World Steel Association (WSA).

The WSA expects world steel demand to drop 2.3% for the year, with top producer China’s consumption predicted to decline 4%, due largely to the nation’s real estate slump. And according to Jefferies, European Union (EU) steel consumption is expected to contract both this year and in 2023, with a tenth of the EU’s steelmaking capacity already offline.

The bearish forecasts are seemingly underscored by the fact that hot-rolled steel prices are down 60% from last year’s highs. Yet despite the bad news, major U.S. steel producers are seeing a completely different demand profile for the metal than their European and Chinese counterparts.

Steel Dynamics (STLD), which is one of America’s largest producers of carbon steel, reported surprisingly upbeat third-quarter results last week, achieving several records along the way. According to management, strength in Steel Dynamics’ steel fabrication business “meaningfully” offset lower sales from its flat-rolled operations, with total steel shipments hitting a quarterly record of 3.2 million tons, thanks to higher prices and steady steel demand from the construction industry, and complemented by the automotive, industrial, and energy sectors.

The firm also reported records in steel fabrication operating income and shipments, as well as record cash flow from operations of $1.5 billion (up 138%). Management said customer order entry activity continues to be “healthy” across all business segments, but expects seasonally moderated volume for steel and metals recycling operations in the coming months.

However, it also sees strength in the company’s long product steel going forward, while both input costs and imports are expected to be lower—in turn supporting steady-to-expanding metal margins. Moreover, the company’s steel fabrication operations order backlog is “historically high” and stretching well into 2023.

Also on the domestic front, top North American producer Nucor (NUE) observed last week that “while economic uncertainty and inflation continue to put pressure across a myriad of sectors in the U.S., we believe the medium- and long-term outlook and fundamentals in our industry remain positive.”

What’s more, not just in the U.S., but also in some east Asian countries production and consumption is also set to grow through next year, particularly in India, according to the WSA. World demand is further expected to rebound slightly in 2023, according to the industry group.

What to Do Now

Last week I recommended that we dip our toes back in the water and make a foray into the steel sector, which is beginning to look interesting again. U.S. Steel (X) is one of the major steel producers that has lately shown relative strength. While analysts have significantly lowered their expectations for Q3 (earnings are due out October 27), the company owns around 10% of the global steel-making market. Moreover, having exposure to a critical war material in high demand right now provides U.S. Steel with excellent positioning for increased military spending. For these and other reasons, I’m recommending a conservative position in X, with a suggested stop-loss slightly under 18.80 as the initial stop-loss on a closing basis. BUY A HALF

Titanium Supply Crunch Continues

The global supply tightness that has plagued the titanium market all year continues, exacerbated by recent international sanctions placed on Russian supply of the key aerospace metal.

According to a recent editorial published by the aviation industry website, Aerotime Hub, aerospace and defense contractors that rely heavily on titanium have begged regulators to avoid placing heavy sanctions against Russia as it pertains to the metal. Airbus, the European multinational aerospace firm, has been a particularly vocal critic of sanctions against Russian titanium.

Aerotime Hub noted that multiple reports suggest up to 65% of the titanium used by Airbus currently comes from Russia. After the last titanium production facility in North America closed last year (namely the Titanium Metals Henderson plant), firms like Airbus are more reliant on Russian titanium than ever.

In order to circumvent Russian supply, aerospace industry experts are recommending purchasing titanium from China, which usurped Russia’s place as the world’s largest producer of titanium decades ago, according to Aerotime Hub. “However,” the editorial noted, “this is still problematic because, although China’s titanium production is increasing day by day, it would simply be shifting the West’s titanium dependency to another country.”

A more practical solution, experts believe, would be to return production of titanium to North America. Several firms are moving in this direction, while U.S.-based IperionX (IPX) and Canada’s Rio Tinto (RIO) have begun the process of resuming titanium production. This is a huge potential positive for North American supply, as the U.S. is currently 100% dependent on titanium imports from abroad.

For Europe, however, the titanium supply situation is far more tenuous with supplies of the metal practically non-existent outside of Russia. For that market, as Aerotime Hub observed, “more creative solutions will be needed to address the issue.”

What to Do Now

Allegheny Technologies (ATI) is one of my favorite stocks for having exposure to the titanium market. The firm specializes in producing titanium- and nickel-based alloys, stainless steel and specialty components for the global aerospace and defense markets (44% of sales), including next-generation jet engine components and 3D-printed aerospace products. A recent survey revealed that three out of four aerospace industry executives expect their firm’s revenues to increase over the next 15 months, which bodes well for the jet engine market Allegheny serves. Along those lines, the company reports demand for its wide-body engine spare parts as “spiking” as airlines address the recovering strength in international travel. Another big growth driver for the company going forward is the war in Ukraine, which has forced many players in the industry to shift their titanium purchases (a key aerospace metal) to Western sources like Allegheny. On that score, Allegheny just announced a major multi-year agreement to supply Britain’s GKN Aerospace with titanium materials used to make commercial and military airframes. On the financial front, Wall Street analysts see 30%-ish top-line growth in the next two quarters. The Q3 report is due out November 2. Participants can purchase a conservative position in ATI using a level slightly under the 26.15 level (where the 200-day line can be seen in the daily chart) as the initial stop-loss on a closing basis. BUY A HALF

Current Portfolio

| Stock | Price Bought | Date Bought | Price on Oct. 24 | Profit | Rating |

| Allegheny Technologies (ATI) | 29.25 | 10/25/22 | 29.25 | 0% | Buy a Half |

| Invesco U.S. Dollar Bullish ETF (UUP) | 30.3 | 9/26/22 | 30.3 | 0% | Buy a Half |

| Kinross Gold (KGC) | 3.75 | 10/4/22 | 3.6 | -4% | Buy a Half |

| United States Steel (X) | 21 | 10/21/22 | 21.65 | 3% | Buy a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.