The government is making moves to support domestic industry and incentivize consumers to choose environmentally friendlier products. That provides the tailwinds for a new buy recommendation this issue, a manufacturer of in-demand products in a booming market. Click through to our issue to learn the market (hint: it’s not the U.S.) and what stocks appears set to make the next leg higher in its bullish run.

As always, too, three more strong ESG stocks to consider, our market outlook and updates on our portfolios.

Cabot SX Greentech Issue: July 20, 2022

Greentech’s Outlook

Commentary on current investing conditions and the Greentech Timer

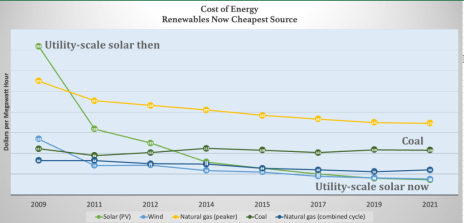

Earlier this month I wrote a column for Cabot Wealth Daily, the free daily investing commentary, about how the Supreme Court’s decision to block the ability of the Environmental Protection Agency’s ability to regulate carbon dioxide emissions won’t derail the move to clean energy in the long run. The primary basis for this belief is from a chart some of you have probably seen before – it’s one of my favorites. It’s the levelized cost of utility-scale energy sources in the U.S., an annual study by the investment bank Lazard Freres.

I simplify Lazard’s data here for ease of viewing, dropping a number of power sources that don’t change the big picture and I included price points only every other year. That’s to emphasize my point: green energy is getting cheaper – better technology makes solar panels more effective, reduces electrical transmission loss, makes wind turbine retrofits more efficient and makes energy storage more feasible. That’s why in 2009, solar was easily the most expensive energy source and now it is the cheapest. Wind is second-cheapest now. Coal, which doesn’t have any technological advances – it’s still a dirty rock – is basically the same price as 2009, while natural gas peaker – power plants built solely to meet peak demand in summertime – are more efficient from turbine improvements and gas availability, but are now the most expensive power source. The Supreme Court can legislate from the bench against efforts to combat climate change, but the market will win out.

More effective, for the moment, in stifling efforts to combat climate change is Senator Joe Manchin, who appears singularly driven to stop the evenly divided Senate from doing anything to support Greentech. Last week he again torpedoed what some saw as a firm deal to pass legislation that would have included provisions support the domestic clean energy efforts. Having invested in clean tech stocks for more than 15 years now, I’m a firm believer that government largesse can often be a two-sided gift, goosing the market now but harming it when it disappears later. (I’m also a believer that wading too much in politics leads even the best investors to introduce needless bias into their decisions.) So I’m not terribly upset about Manchin’s self-interest in blocking climate legislation (his family owns a company that provides a specific coal to power plants, according to a New York Times investigation), because eventually Greentech will break through the downtrend and resume its long-term bull market. But as we’ll see with our featured stock this issue, government action can help.

Here is a chart of the current downtrend in Greentech, represented by the ETF PBW. The blue line is the downtrend I see, the green circle highlights the layers of resistance we face now – the 40-day moving average (the thin green line) and the downtrend line. If we can see the sector break over 50 and hold there, we can start to feel more confident we have bottomed.

Other indicators suggest Greentech may be doing that – the sector’s Relative Strength line against the S&P 500 has formed a floor (that means the price performance of Greentech relative to the market has stopped worsening). And there is the simple fact the sector is off the two-year bottom set in mid-May.

Sub-sector-wise, wind and nuclear are bearish, while solar and water are a bit more positive, with each looking like they are firming over medium-term support.

Greentech Timer

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential). As the chart here shows, we’re mixed, with Greentech over the 20-day but struggling to hold over the 40-day. The lines are starting to level out and turn higher, a positive development. There remains long-term resistance at the 200-day line, about 30% higher from today’s levels. Remain cautious, but there is some space to make well-considered trades here.

Featured Stock: Li Auto Inc. (LI)

Overview

China is the world’s largest car market and the largest market for new energy vehicles, mainly EVs. More than 20 million new cars are sold annually in the country, with 24.6 million sold in 2021, despite a slowdown due to COVID shutdowns of factories. New energy vehicles – more than 80% of which are battery EVs – sold 3.3 million units in 2021. China is good for nearly one out of every three cars sold on Earth. In the first half of this year, about 12 million vehicles were sold. Market data on China sales can vary, given that cars do get exported from the country (but at a lesser rate than one might assume), so you will see somewhat different figures on both sales and market share because some companies and researchers go by car registrations, to strip out exports.

SUVs are the most popular style of cars in the country, accounting for nearly half sales, with sedans selling nearly the same number and what are called MPVs in the China market – minivans mainly – a little over 1% of the market. SUVs come in different sizes, small to large, and is a reflection of body type and wheelbase length as judged by market data collectors.

Brand-wise, the joint ventures of the major global brands are the market leaders – Volkswagen, Toyota, GM and so on – with Chinese brands accounting for half the market, of which BYD is the clear leader, with about 18% of share. As the recent decision by Stellantis to end its Jeep joint venture in China shows, the market is tending to favor domestic companies over foreign JVs.

Business Model

Li Auto (LI) is a Chinese new energy vehicle only maker founded in 2015. The company focuses on the middle-class heart of the market, vehicles priced between the equivalent of $21,000 to $70,000. Its first model being is the Li ONE, a large SUV of which it delivered 31,716 in its most recent quarter, up more than 150% from the prior year’s quarter. The vehicle is targeted to families, with three rows and seating for seven. The ONE is an extended range model that primarily runs on batteries while using a small gas tank and internal combustion engine to charges batteries on the go and provide extra distance – putting its range at about 550 miles.

The extended range version – dubbed an EREV by Li management – helps address range anxiety from consumers since China, like the U.S., is behind on the number of EV chargers the market needs. The ONE began rolling off assembly lines in November 2019. Because of a spike in the price of batteries in China, the ONE saw a price increase come in for the second quarter, which has yet to have its earnings release. Management told analysts on its first-quarter earnings call in May that the price hike wasn’t affecting demand.

This quarter (Q3), Li will have its first full quarter of sales of its second model, the L9 (It began taking orders for the L9 at its 247 retail stores on June 22). It’s a luxury large SUV, that also uses the EREV system. It has the trappings of a high-end SUV, with Napa leather seats, three rows and a heads-up display with driving information like speed and lane direction projected onto the windshield. The L9 is priced around $68,000, which management says is a relative value compared to similarly outfitted SUVs in China today. The L9 had 30,000 refundable deposits as of June 24, the company disclosed.

In 2021 – reported in U.S. dollars by the company – Li sold $4.24 billion of cars and related services – up from $4 billion in 2020, with a gross profit of $904 million. The net loss for 2021 was $50.4 million, or three cents a share, narrowed from a loss of 17 cents. Sales were negatively affected by the pandemic in 2021. 2019 sales were about $1.9 billion.

Business Outlook

As a centrally planned economic system, China’s economy behaves in classic fashion of such arrangements – the economy at large and (especially) individual industries lurch ahead and back quite dramatically on government pronouncements. Right now, government policy is a positive for the auto industry and EVs. China wants EVs to be 25% of the new car market by 2025, which means EV sales need to double from their current level if annual auto sales stay flat. There are already incentives to buy EVs, mainly receiving the taxes on EVs back as a credit. This spring, the Chinese government also signaled its support for the auto industry at large, desiring more car sales, by cutting sales taxes for all vehicles and supporting various local incentives.

The policy tide helps Li, which expects the L9 to sell well, allowing it to introduce three more models to the Chinese market in 2023: a newly designed EREV, Li’s first battery-only EV and a model that targets the lower end of the middle-class market, the $30,000 to $45,000 price range.

For the second quarter, financials to be reported in late August, Li disclosed it delivered 28,687 vehicles, beating earlier projections (in the May analyst call) to deliver 21,000 to 24,000 vehicles, roughly a 25% rise over the 2021 quarter. That should mean Li will report more than $1.3 billion in revenue for Q2, which would be a 67% increase over 2021. For the year brokerage analysts expect a three cents per share net loss.

The big question with China right now is how quickly the country can return to normal, as it continues to have spates of strict pandemic lockdowns. Expectations are that the market will be robust once COVID stops halting manufacturing and consumer behavior.

Issues to Consider:

- China’s automobile association said earlier this month the industry will sell 27 million cars this year, up 3% from 2021 but down from earlier projections, due to anti-pandemic measures hurting the economy.

- It is believed commercial vehicles are hurt most by pandemic measures. However, Li sources parts from the Yangtze Delta region, which has seen a fair bit of pandemic shutdowns. That could affect its ability to deliver vehicles.

- Chinese stocks are greatly affected by government policy and should generally be held with sell-stops.

- Stellantis’ decision to leave China could reflect more general market concerns than what we believe are specific to the dynamics among foreign carmakers and Chinese JV partners and the government.

Technical Analysis

Li has the look of a stock that is consolidating recent gains and building a base for further advances. Shares rallied off recent lows of 19 with May’s earnings, bringing hope the Chinese auto industry is rebounding. The rally broke through the top of a long trading range, putting LI at a 19-month high in the 38 area this week. The all-time high for shares, on a closing basis, is 43.46, hit in November 2020.

Right now, 40 is a mild ceiling, having halted advances since late June. Mainly, shares have been consolidating gains after a quick run from 21 in late May. The pause has let LI blow off an overbought condition, with various price technicals suggesting a new move upward to come. Shares also just experience a Golden Cross, where the 40-day moving average crossed over the 200-day moving average. While it’s a simple reflection of the price action of late, a Golden Cross is a generally predictive sign of further gains, reflecting longer-term sentiment improving. The next step up may signal the end of the bullish leg for LI, based on momentum indicators, so we will be quick to raise our stop-loss to break even and then to lock in profits in advance of a reversal.

LI held its IPO, on the Nasdaq, in July 2020. Shares were prices at 11.50. The company now has a second listing on the Hong Kong.

What to Do Now

LI is a very strong stock, technically, in a growth market that is still a reopening play and is insulated from the inflation and economic fears dominating U.S. sentiment. We’ll buy here in expectation shares will climb higher and test the upper 40s. A reasonable sell-stop would be around 32 – it’s where the 40-day moving average is as well as being three times the Average True Range (ATR), a measure of what should be “normal” volatility based on the past two weeks of price action. We expect more support to exist between the 200-day moving average down to the bottom of a recent price gap, 29 to 27 area. We’ll set our sell-stop at “around 27.” That would be a30% loss on the trade if we executed there, or 2.5% of the Real Money Portfolio, which is based on 12 positions of equal starting size. 2.5% is value-at-risk level appropriate for a long-term actively traded portfolio to avoid risk of ruin through a string of losing trades. BUY

Li Auto (LI)

Revenue (trailing 12 months): $5.15 billion

Earnings per share (TTM): 0.00

All-time high (intraday): 47.70

Market cap: $31 billion

Recommendation: Buy

Intended Portfolio: Real Money

ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook. As a general rule, we exclude fossil fuel producers from ESG consideration given their clear environmental impacts.

Centene Corp. (CNC)

What is it?

A health insurance and managed care provider.

Why is it ESG?

The largest maker of cystic fibrosis therapies has a robust employee engagement program and the company is considered superior to industry peers on environmental and governance metrics, according to MSCI. ESG funds own $92 million of shares.

Why now?

Centene is the largest Medicaid managed care company in the country. If the economy weakens, it’s expected to gain more Medicaid members. States including Georgia and Oklahoma are expanding Medicaid to managed care, which could benefit the business too.

Kellogg Co. (K)

What is it?

A maker of snack and convenience foods.

Why is it ESG?

The company has taken steps to mitigate water supply risk among its supply chain. A focus on plant-based foods, like cereals, means there is less environmental footprint relative to other food producers. ESG funds own $166 million of shares.

Why now?

The company is spinning off two businesses: its global snack business and the plant-based meat alternative business. The two spin-offs should create more value, long term, than consolidated Kellogg would, although spin-offs tend to underperform in the period after separation. The remaining business will be centered on North American cereal operations.

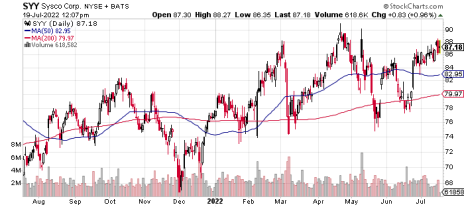

Sysco Corp. (SYY)

What is it?

A U.S. food distributor.

Why is it ESG?

The company provides good benefits for employees and it retained, rather than lay-off, truck drivers during the pandemic slowdown. Its quality assurance system for monitoring food safety is considered effective. ESG funds own $105 million of shares.

Why now?

Management feels restaurants weathered the pandemic well and have been able to push through price hikes, which allow the distributor to maintain margins. It serves less than half of independent eateries, leaving lots of room for market share growth.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 7/19/22 | Gain/Loss | Rating | Sell-Stop |

| Clean Earth Shares | CLIN | 3/4/22 | 9.69 | 9.84 | 1.55% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.23 | 0.06 | -73.91% | Hold | None |

| Clean Earth Rights | CLINR | 3/4/22 | 0.2 | 0.12 | -40.00% | Hold | None |

| Cleanway Energy | CWEN.A | 3/17/22 | 33.41 | 31.42 | -5.96% | Hold | Around 28 |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.72 | 2.97% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.07 | -61.11% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.11 | -35.29% | Hold | None |

| Montauk Resources | MNTK | 10.69 | Watch | ||||

| Natural Grocers by Vitamin Cottage | NGVC | 16.65 | Watch | ||||

| Ormat Technologies | ORA | 80.26 | Watch | ||||

| Vertex Energy | VTNR | 6/1/22 | 13.88 | 11.49 | -17.22% | Buy | None |

* Buy prices for Clean Earth and Growth for Good components are adjusted to reflect unit splits

* Returns don’t include dividends of $0.3536 per share for CWEN/A

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 7/19/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 0.82 | -51% | Hold | |

| Altus Power Warrant | AMPS.WS | 5/19/22 | 1.06 | 1.48 | 40% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 55.00 | -14% | Hold | |

| ESS Tech Warrant | GWHWS | 6/9/22 | 0.53 | 0.44 | -17% | Buy | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 3.51 | -33% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.06 | -56% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.15 | -86% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.30 | -28% | Hold | |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.40 | -82% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 96.70 | -26% | 5/9/22 | sell includes dividend |

| Aecom | ACM | 2/17/22 | 73 | 74.36 | 2% | 4/25/22 | sell includes dividend |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 19.93 | 9% | 5/10/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/22 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.00 | -23% | 4/21/22 | Half sold this date |

| Darling Ingredients | DAR | 4/21/22 | 84.94 | 73.06 | -14% | 6/15/22 | |

| Daseke | DSKE | 2/3/22 | 11.23 | 7.32 | -35% | 5/26/22 | |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 10.14 | -46% | 5/12/22 | Half-sized position |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 10.15 | -23% | 4/25/22 | |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 42.89 | 4% | 9/21/21 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 26.14 | -5% | 4/25/22 | |

| MP Materials | MP | 3/9/22 | 45.01 | 40.86 | -9% | 4/25/22 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long term.

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

No news from our cleantech SPAC, on the hunt for a merger target. Expect the SPAC market to be quiet for some time until the appetite for growth stocks returns. Having split our original units, we’re profitable on the trade, with shares able to claim $10.10 in trust cash at a merger vote or on expiration of the SPAC next year, 11 cents more than we paid for each unit. The component warrants and rights, though weak, are pure profit. HOLD

Clearway Energy (CWEN/A)

The U.S. renewable energy farm owner/operator will announce Q2 earnings on August 2 before the market opens. Consensus is for earnings of 44 cents per share. Shares remain rangebound, above support in the 31 area. Our sell-stop remains “around 28.” HOLD

Growth for Good Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

No news from our ESG SPAC remaining on the hunt. The SPAC still has about 13 months to find a deal (assuming its sponsors will exercise a three-month extension in exchange for funding a further 10 cents a share into the trust). Shares right now have claim to $10 in the trust, making us profitable on the original unit purchase. Warrants and rights are weak, but represent pure profit. HOLD

Montauk Renewables (MNTK)

The renewable natural gas producer is improving but remains under a zone of resistance from about 10.50 to 11. Short interest in RNG producers has risen sharply of late, so expect a fight to get through that resistance zone. The company will report earnings on August 9. WATCH

Natural Grocers by Vitamin Cottage (NGVC)

NGVC gives signs of breaking higher, out of a zone of converging support and resistance. In the current market, it’s better to wait for further confirmation than get whipsawed by bears coming in to squelch a breakout. The organic grocer will report earnings August 4, with consensus looking for 20 cents a share earnings. WATCH

Ormat Technologies (ORA)

We’re waiting for the geothermal energy producer to break through the 85.60 area, which would crack the trading range and some layers of chart pattern resistance. That catalyst may come on August 3, when the company releases earnings after the market closes. Expectations are for 20 cents a share earnings. The company started commercial operation of Casa Diablo IV, in California, a 30MW geothermal plant, this week. WATCH

Vertex Energy (VTNR)

Vertex has been hurt by proposals to lower gasoline prices that were seen as too aggressive against refiners. Though Vertex is a renewable energy producer – from waste oil and a planned move to produce renewable diesel in Mobile Alabama starting in 2023 – it right now produces fossil fuel gas too, from the acquisition of the Mobile refinery to make renewable diesel. Technically VTNR appears to be coming off the bottom of a recent downward move. We do not have a sell-stop on shares. HOLD

Excelsior Portfolio

Excelsior is our special opportunities portfolio and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior.

In June 2021 we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas was closed in February at a total of a 127% return.

ADS-TEC Energy (ADSEW)

We continue to feel ADS-TEC’s EV charger system – utilizing local battery storage to eliminate the need for power line upgrades while being able to provide super-fast charging, is among the better EV charger offerings on the market. No news this week, but warrants seemed to have bottomed a few weeks back and are firmer this week. HOLD

Altus Power (AMPS/WS)

Warrants are stabilized around the 1.50 area, well above our buy price. No news this week. We’re anticipating shares’ eventual rise to $10 or above, which will make our warrant position highly profitable under terms of cashless redemption for them. The rating is hold because we’re about 50% over the price when recommended. HOLD

Constellation Energy (CEG)

Shares are at the bottom of their recent range, with buyers coming in Monday confirming support. The company will report earnings before the open on August 4, with 44 cents per share earnings expected. HOLD

ESS Technology (GWH.WS)

The iron-flow battery maker shows signs of having bottom in its shares, recently in the mid-3 area. Earnings will be announced August 11, which will be an important catalyst. The main goal there: revenue recognition on installed units in San Diego. Warrants remain risky, if slightly stronger this week. They would pay off handsomely if ESS shares can push back over 10 in the next four years – the same strategy we’re using with AMP/WS, above. Given our investment thesis remains intact and the price is more advantageous, our rating remains at Buy. BUY

FuelCell Energy (FCEL)

Fuel cell maker shares outperform Greentech in bull markets and underperform in bears, a feature we’ve seen all year. Our initial horizon is holding FCEL through year end, in anticipation of the market recovery. FCEL, along with other fuel cell stocks, were quite volatile this past week as hopes of a bill to support clean energy ahead of midterms were dashed. HOLD

Origin Materials (ORGNW)

Origin will announce quarterly results ahead of the open on August 3, with expectations for a loss of seven cents per share. More importantly is management continuing to report the opening of its first carbon-negative plastics plant is on track for Q4 this year. HOLD

Ree Automotive (REEAW)

On July 28, Ree will host an investor event in Michigan for a walk-in van it will build with the EAVX division of Morgan Olson, an established delivery truck maker. Warrants are flat, at 14 cents of late. Here are pictures of the vehicle, named the Proxima – the Ree P7 chassis, and the vehicle prototype. HOLD

ReNew Energy Global (RNWWW)

The company will release financial results for the full year ended March 31 on July 21. Two Wall Street analysts see GAAP earnings per share of six cents and eight cents. Warrants are a touch stronger on the week. HOLD

Volta Inc (VLTA.WS)

The EV charger maker remains weak but appears to have halted its fall. The next earnings report will come mid-August. HOLD

Thank you for being a subscriber. Our next SX Greentech Advisor issue will be published Wednesday, August 3. Weekly updates will come each Wednesday, and timely notices are sent as needed. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabotwealth.com.

The estimated carbon generated in the production and distribution of this newsletter is offset by CO2 removal with Climeworks at its plant in Iceland.

The next Cabot SX Greentech Advisor issue will be published on August 3, 2022.

About the Analyst

Brendan Coffey

Brendan Coffey, Chief Analyst of Cabot SX Greentech Advisor, has been immersed in investing for more than 25 years, including as an investment advisory editor, investor, markets reporter and writer about and for a wealth of Wall Street’s most influential minds. He’s discussed investing strategy with the likes of Carl Icahn, Mark Cuban and Leon Cooperman and collaborated with hedge fund managers and entrepreneurs on books and essays. He’s written about investments and markets for Forbes, Bloomberg, Fortune, The Wall Street Journal and numerous other outlets.

Brendan is a Certified Financial Technician (CFTe), representing extended study and achievement in technical analysis of securities. He combines technical and fundamental analysis in pursuit of a long-held passion for environmental and ESG stocks that began with the study of environmental law as an undergraduate at Boston College. Brendan’s also been a fellow at the Scripps Howard Institute on the Environment, served on a municipal energy planning board and, last decade, was editor of Cabot Green Investor and Cabot Global Energy Investor. In addition to ESG, he conducts proprietary research into billionaire-owned stocks, SPACs, sports-related equities and other sectors.