The market shows some uncertainty over what the Federal Reserve may do today, so we’re advising some caution. Still, our Greentech portfolios are exposed to all the best performers in the sector right now. This issue, we round out our setup for entering the red-hot solar sector.

Our ESG Three offers fresh ideas to explore as well, and we run down our portfolios and potential moves we may make.

Cabot SX Greentech Issue: September 21, 2022

Greentech’s Outlook

Commentary on current investing conditions and the Greentech Timer

Greentech has been holding up better than other sectors of the market, in what has been a poor September. So far this month our benchmark, Wilderhill Clean Energy Index (PBW), is up about 7/10th of one percent while the less-broad Nasdaq Clean Edge Green Energy Index (QCLN) is up 3.4% – the latter is weighted 19% in just two stocks, Real Money Portfolio holding Enphase (ENPH) and Tesla (TSLA). By comparison, the S&P 500 is down 3.3% for the month while the Nasdaq 100 is down 2%.

Tuesday’s action – ahead of the Fed’s interest rate decision today – shows a lot of defensiveness. Obviously, the market’s reaction to the news, which comes after you have this in your inbox, will dictate where we go from here. Going into the decision, at least, Greentech has shown good stability, relative to the market.

Right now, we are in a middle ground, skewing a bit bullish. For instance: a 10% decline in Greentech from here would put us still on top of a good zone of support. A 10% rise from today’s levels would be a break of resistance formed by a downtrend line from the November high and the August peak. The point is, volatility upward will be much more technically important than volatility downward. That’s a sign of the hard work Greentech bulls have done over the late spring and summer to arrest the bear move. Recall in early May, the sector tested support given by the February 2020 long-term peak. It would take a 20% drop in Greentech to threaten that support again. That seems unlikely, given our sector has good fundamentals now bolstered by the spending and tax credits of the August climate bill. Overall market sentiment matters, however – a rising tide raises all boats and vice versa.

Greentech Timer

The Greentech Timer is largely bearish. Our timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending (ideally, the index is also above an upward trending 200-day moving average too, but not essential). Today, we’re under all three of those moving averages. The 40-day is upward trending, but the index is on the wrong side of it. Since we’re nearly fully invested in our Real Money Portfolio while now in a bearish Timer condition, the more cautious among us may wish to take profits and cut losses. We continue to expect better times ahead, but conditions suggest we should be ready to move quickly to pare our positions.

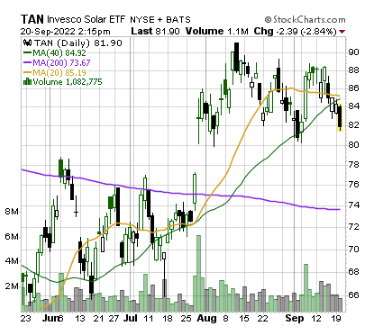

Subsector-wise, solar remains the best looking, as seen here in the chart of the Invesco Solar ETF (TAN).

Nuclear also looks positive. Here is the chart of the Van Eck Uranium and Nuclear ETF (NLR).

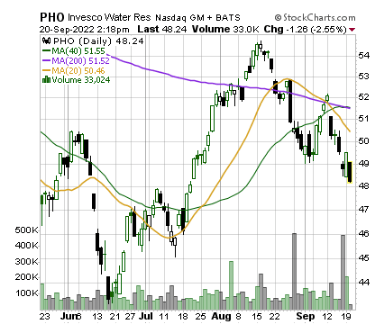

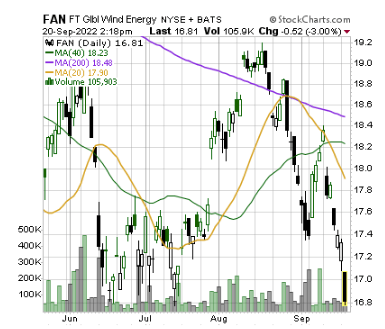

Water and wind subsectors are bearish, as seen with the Invesco Water Resources ETF (PHO) chart and the FT Global Wind Energy ETF (FAN).

Featured Stock: First Solar (FSLR)

Overview

Solar is the strongest sector in the stock market right now, showing extraordinary strength relative to equities overall. The recent catalyst is the climate funding Congress passed in August, but the sector was already showing signs of having bottomed and turned upward, which means investors were buying into solar’s outlook before the Inflation Reduction Act. That act, as a reminder, came as a surprise to seemingly everyone who had seen prior efforts founder on proponents’ razor-thin political margins, so the earlier strength was on the assumption no government help was coming. We’ve also noted numerous times that utility-scale solar, on a levelized cost of energy, is the cheapest source of electricity around without subsidies. That means installed photovoltaic capacity is expected to double by 2026, from 2021.

Business Model

First Solar (FSLR) designs and manufactures a line of high-performance solar panels. Their thin-film panels use cadmium telluride (CadTel), a crystalline structure, which is different from most other photovoltaic panel makers, who use crystalline silicon (CSi) as the medium to turn sunlight into electricity. CadTel has some advantages – it uses a lot less semiconductors and is quicker to manufacture, taking hours inside one First Solar plant as opposed to CSi which has multiple steps and can take days. The downside is that, by most third-party estimates, First Solar is slightly more expensive than CSi panels mass produced in China (First Solar disputes such estimates). However, CadTel performs better under some conditions than CSi – delivering about 4% more power in hot, humid conditions – with less degradation over a 30-year panel lifespan. Is it too obvious to say that the future holds hotter or more humid conditions nearly everywhere solar will be deployed? In First Solar’s primary markets of the U.S. and India, as well as its notable markets of Australia and sub-Saharan Africa, climate change ensures that will be the case.

Right now, the company sells its panels primarily to utility-scale projects. For full-year 2022, First Solar will generate $2.55 billion to $2.8 billion in revenue, management guidance that was hiked with the Q2 earnings results. The bottom line will be affected by the sale of a solar utility plant in Chile, expected to occur by year’s end, which has estimates ranging from a loss per share for 2022 of 8 cents to perhaps a profit of 8 cents. The sale of the Chilean plant will largely conclude CEO Mark Widmar’s plan to shed operating solar assets and focus on being a pure-play PV panel producer. Strip away the effects of operating assets and higher shipping costs from the worldwide tight shipping market, and the core business of First Solar is performing well. Wall Street knows about Chile and its negative impact will be ignored. Shipping costs and supply chain costs remain a variable of some concern. The company has some contracts where customers are responsible for the costs of shipping, and others where the deals are adjustable based on higher costs. For 2023, assuming shipping costs ease back, First Solar is expected to make $1.55 per share, with some expecting more than $2 a share earnings.

Business Outlook

First Solar manufactures its panels in six factories in Ohio, Malaysia and Vietnam with a fully integrated plant in India expected to begin production in 2023. Spurred by the recent climate bill and its tax credits, the company announced it will build a new plant somewhere in the southeast U.S. and expand its Ohio facility. Morningstar estimates that First Solar should be able to qualify for 17 cents per watt of incentives, which balances very nicely against manufacturing costs of 20 cents per watt, excluding shipping.

The company also has a very strong backlog of orders, of 44.3 gigawatts worth of panels. It will ship 2.5 GW of panels in 2022. Through 2025, sales on a per watt basis will be $0.301, which is on par with this year – and good, considering solar prices are continually falling in a highly competitive market. If First Solar can drive that lower with technological or manufacturing advances (or raise it if various cost adjusters around transportation are re-triggered), it will be a positive surprise.

Longer term, there is the hurdle of the capacity of PV panels to convert sunlight to electricity. Right now, the theoretical efficiency of a panel is believed to be about 24%, though the U.S. National Renewable Energy Laboratory recently tested a panel that is 39.5% efficient, but for various reasons that likely will be deployed in space applications. In production, PV panels are less efficient – First Solar’s most efficient panels, its Series 7, are 19.3% efficient. SunPower (SPWR) is most efficient at 22.8%, according to a July ranking by Clean Energy Reviews.

Intriguingly, First Solar has an equity investment in a panel maker called CubicPV, which was formed last year from the merger of two other companies. CubicPV has pushed its cell efficiency to 30%, using perovskite semiconductors to capture more visible and infrared light overall.

Issues to Consider:

- Solar panel manufacturing is a highly competitive sector. Crystalline silicon panels have largely vanquished other technological approaches in the past 15 years, and Chinese producers continue to be low-cost, high-volume producers.

- First Solar will have about $1.4 billion in cash at year’s end. Debt is low, at $232 million.

- North America (by far) then India and the European Union are First Solar’s biggest markets for future sales. Recent U.S. incentives and expected ones in India will likely make those markets more important.

- The company will likely seek to continue to expand capacity to take advantage of incentives as well as capture what is expected to be quickening growth in the U.S.

- Shares advanced about 35% after the August climate bill. This likely builds in more downside risk on potential valuation concerns if the company has any stumbles.

Technical Analysis

Looking at the very long-term charts, FSLR recently broke through a congestion zone of 100-120 that has been consequential for shares since 2008. In practice, it seems unlikely to be that significant – people probably don’t trade off past prices older than about eight years, by my research (the reasoning being if you have a loss on a stock, you probably give up and take the tax loss after eight years). FSLR has broken to a new 11-year high this month, which means there probably isn’t pent-up selling overhead. Buying volume has been very good, even as shares are paused in a consolidation in the 130-137 range. Normal volatility for shares right now suggests a move down to near the 40-day moving average, currently at 117, wouldn’t be concerning. That would be a good entry point. Support around 120 should be quite good. A point of concern is that the 200-day moving average is well below current prices, at 84. That’s often a sign shares will make a concerted effort to sell down, as a return-to-the-mean type action.

What to Do Now

The broad tide of the market has us wary of entering a new position today. First Solar should be a leader in the sector for the foreseeable future, but there is risk that if the markets continue to weaken, we could face a re-setting of the valuation that could send shares back down below 100. WATCH

First Solar Inc. (FSLR)

Revenue (trailing 12 months): $2.5 billion

Earnings per share (TTM): 23.15

All-time high (intraday): 317.00

Market cap: $14.4 billion

Recommendation: Watch

Intended Portfolio: Real Money

ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook. As a general rule, we exclude fossil fuel producers from ESG consideration given their clear environmental impacts.

Consolidated Edison Inc. (ED)

What is it?

A New York electric utility.

Why is it ESG?

It’s aligned with New York’s goal to reach zero-emission electricity by 2040. ESG funds own $200 million of shares.

Why now?

Utility stocks are in a long-term uptrend and are defensive in poor equity markets. Around 98, shares are just off all-time highs at 101.

Eli Lilly & Co (LLY)

What is it?

A pharmaceutical company.

Why is it ESG?

Better than its peers at the three ESG metrics, as measured by MSCI. ESG funds own $1.1 billion of shares.

Why now?

A strong drug pipeline, including an Alzheimer’s treatment that could get fast-track approval this year. Shares should see support at their 200-day line, providing a good entry point.

Iron Mountain (IRM)

What is it?

Storage and disposal services primarily for physical corporate records.

Why is it ESG?

Board and management structure lend themselves to good pay oversight and shareholder advocacy. ESG funds own $67 million of shares.

Why now?

Companies face lots of requirements to maintain records – on paper or on data drives – for a set period of years. That’s a built-in market for Iron Mountain. Moves to digital and consumer services are helping its long-term outlook.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 9/21/22 | Gain/Loss | Rating | Sell-Stop |

| Clean Earth Shares | CLIN | 3/4/22 | 9.99 | 9.88 | -1.10% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.01 | 0.12 | 1100.00% | Hold | |

| Clean Earth Rights | CLINR | 3/4/22 | 0.01 | 0.15 | 1400.00% | Hold | |

| Cleanway Energy | CWEN.A | 3/17/22 | 33.41 | 33.89 | 1.44% | Hold | Around 28 |

| Energy Recovery | ERII | 9/9/22 | 25.57 | 24.34 | -4.81% | Buy | |

| Enovix | ENVX | 8/18/22 | 20.49 | 22.25 | 8.59% | Buy | |

| Enphase Energy | ENPH | 8/11/22 | 298.56 | 304.80 | 2.09% | Buy | |

| Growth for Good Shares | GFGD | 2/3/22 | 9.97 | 9.81 | -1.60% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.01 | 0.07 | 600.00% | Hold | |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.01 | 0.09 | 800.00% | Hold | |

| Li Auto | LI | 7/21/22 | 36.01 | 25.38 | -29.52% | Hold | |

| Montauk Resources | MNTK | 8/11/22 | 15.51 | 17.98 | 15.93% | Hold | around 16.50 |

| Onsemi | ON | 8/11/22 | 67.32 | 68.44 | 1.66% | Buy | |

| Ormat Technologies | ORA | 8/1/22 | 86.72 | 95.64 | 10.29% | Buy | Around 85.30 |

| Shoals Technologies | SHLS | 22.95 | Watch | ||||

| Sunrun | RUN | 34.46 | Watch | ||||

| Vertex Energy | VTNR | 6/1/22 | 13.88 | 6.46 | -53.46% | Hold |

*Clean Earth units cost 10.01 each; Growth for Good units 9.99. Buy prices above reflect an allotment for each component after splitting the units.

*Returns don’t include dividends totaling $0.714 per share for CWEN/A

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 9/21/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 1.10 | -34% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 87.86 | 37% | Hold | Sell-stop ‘around 77' |

| ESS Tech Warrant | GWHWS | 6/9/22 | 0.53 | 0.74 | 40% | Hold | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 3.90 | -25% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.12 | -54% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.17 | -85% | Hold | Convert in tender |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.28 | -29% | Hold | |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.63 | -71% | Hold |

* Returns don’t include dividends totalling $0.282 per share for CEG

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 96.70 | -26% | 5/9/22 | sell includes dividend |

| Aecom | ACM | 2/17/22 | 73 | 74.36 | 2% | 4/25/22 | sell includes dividend |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Altus Power Warrant | AMPS.WS | 5/19/22 | 1.06 | 3.07 | 190% | 8/24/22 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 19.93 | 9% | 5/10/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/22 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.00 | -23% | 4/21/22 | Half sold this date |

| Darling Ingredients | DAR | 4/21/22 | 84.94 | 73.06 | -14% | 6/15/22 | |

| Daseke | DSKE | 2/3/22 | 11.23 | 7.32 | -35% | 5/26/22 | |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 10.14 | -46% | 5/12/22 | Half-sized position |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 10.15 | -23% | 4/25/22 | |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 42.89 | 4% | 9/21/21 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 26.14 | -5% | 4/25/22 | |

| MP Materials | MP | 3/9/22 | 45.01 | 40.86 | -9% | 4/25/22 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. We have 11 full positions right now. With three stocks on Watch, we’ll need to create room. One obvious candidate to sell is Vertex Energy (VTNR), which has been bedeviled by management missteps in recent months. Li Auto (LI), which is in a drawdown we expect to see reversed, is another candidate. For now, we’re not buying any new positions this week, so we’re standing pat.

When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark, rather than intraday lows – but either way will work fine in the long term.

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

No news for the SPAC. It has until late July 2023 to complete a merger, with a management option for a three-month extension beyond that in exchange for another 10 cents a share into the trust. HOLD

Clearway Energy (CWEN/A)

Clearway sold off Tuesday sharply, but there remains support down to 32.60, the bottom of a gap window. A couple of Wall Street brokerages downgraded the stock this week to neutral ratings. Our sell-stop remains “around 28.” We’re shifting our recommendation from “Buy” to “Hold” given price action and market conditions. HOLD

Energy Recovery (ERII)

ERII has found initial support at the 20-day average, which coincides with chart support. Technically it looks positive overall still. No news. BUY

Enovix (ENVX)

ENVX continues to consolidate in a range between 19 and 25. There’s a band of support below, down to 16.50 and a zone of resistance at 24-28. Charts suggest shares are more likely to push higher than lower. BUY

Enphase Energy (ENPH)

Enphase struck a deal with a Netherlands company to offer microinverters in Holland. Shares are trading in increasingly tight daily ranges at the top of their recent trading zone, hinting at an impending move higher. At all-time highs here, there is no overhead resistance. Support is at 300, 293 and 266-263. BUY

Growth for Good Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

No news from our ESG-focused SPAC. The company has until early June 2023 to complete a merger, with management holding the right for a three-month extension in return for 10 cents more a share into the trust. We’re patient and won’t be looking to start cashing in warrants or rights ahead of 2023, everything else equal. HOLD

Li Auto (LI)

General positive indications of central government economic support in China boosted Chinese shares Tuesday. LI gained a bit, breaking resistance from a gap down on Friday and signaling a potential change in sentiment to be more bullish. No company-specific news. HOLD

Montauk Renewables (MNTK)

Chart-wise, MNTK could be signaling that last week was a peak, by virtue of a weekly doji candle, a formation that represents market indecision and a potential reversal point. We’re moving our sell-stop to “around 16.50,” a level of support, with the aim of booking some profit if shares erode from here. We’re shifting our recommendation from “Buy” to “Hold.” HOLD

Onsemi (ON)

Onsemi is winding down a legacy division associated with its old Quentanna (WiFi solutions) business. The division is about 3% of revenue. It continues Onsemi’s efforts to exit the lower-margin chip business to redirect resources to higher-margin renewable energy and EV chips. Shares are in a zone of support at 68-69, with support down to about 60. Over 72 will show resistance. HOLD

Ormat Technologies (ORA)

ORA continues to consolidate in the mid-90s, support looks very good around 93 then around 88-89. No news. BUY

Shoals Technologies (SHLS)

SHLS continues to ease mildly, slipping under the 40-day average this week. It looks fine. We’re standing on the sidelines still with Shoals, given the market conditions. WATCH

Sunrun (RUN)

Sunrun looks good too, sitting on support. No news and we continue to wait, given market conditions. WATCH

Vertex Energy (VTNR)

VTNR has broken below support in the 7-8 range on follow-through selling in response to the delayed completion of renewable diesel facilities in its Mobile, Alabama refinery. It’s a likely candidate to sell given there are likely better opportunities in Greentech in the months ahead. Any notable move higher is probably a good spot to cash out. We’re holding off on any formal sell call right now. HOLD

Excelsior Portfolio

Excelsior is our special opportunities portfolio and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior. In June 2021 we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle, was closed at a 4% profit in December. Navitas was closed in February at a total of a 127% return.

A note on a past holding: As we predicted, Altus Power (AMPS) is calling its warrants. If you still own the warrants the portfolio sold on August 24, you must sell them or take the steps with your broker to convert them to shares. Otherwise, you will be cashed out at 10 cents a warrant on October 17.

ADS-Tec Energy (ADSEW)

ADS-Tec remains one of our favorite holdings, despite the fact the warrants aren’t moving of late even with management’s excellent outlook. It will be discovered eventually. HOLD

Constellation Energy (CEG)

Our spin-off trade is looking great, with shares pushing over 89. The company’s nuclear reactors ran at nearly 100% this summer, likely incrementally improving results for the third quarter. We’re going to move our sell-stop up to “around 77,” from “around 70,” which would give us about a 20% profit on shares if the trade begins to turn. There is support at 79. HOLD

ESS Technology (GWH.WS)

ESS signed a deal this week to provide 200 megawatts of iron-flow battery storage to the Sacramento Municipal Utility District. That boosted our warrants from around the 59 cents area to 77 cents. Recall, this is a trade to take advantage of low warrant pricing relative to the potential ratio they would convert into shares if ESS management exercises its right to convert warrants when shares are over 10. Odds are still strong that buying over 70 cents a warrant can be very profitable, but we bought much lower, at 53 cents, so we’re shifting our recommendation from “Buy” to “Hold.” HOLD

FuelCell Energy (FCEL)

Lack of firm guidance for the quarter ahead means FCEL is slumping again, to under 4 of late. We committed to seeing the trade through until 2023, meaning we’re not concerned about near-term weakness. Significant resistance is at 4.72. HOLD

Origin Materials (ORGNW)

Warrants are a bit weaker at 1.134 recently, but action is unconcerning. Origin management is making its pitch at some investor conferences, with the opening of its first carbon-negative plastics plant to come by year’s end. HOLD

Ree Automotive (REEAW)

Ree is offering to convert every five warrants to one share in a tender ending tomorrow. We recommend doing this conversion because it does remove some warrant-related risk in the future. This conversion must be done through your broker. There is a proposal for the company to forcibly convert warrants afterward at a less-advantageous ratio. CONVERT WARRANTS TO SHARES IN COMPANY TENDER.

ReNew Energy Global (RNWWW)

Warrants are a touch weaker at 1.30. No news from the India renewable energy owner-operator. HOLD

Volta Inc (VLTA.WS)

Warrants are up this week, around 62 cents. Volta shares have seen good buying action suggesting some accumulation. National EV charger incentives are improving sentiment. HOLD

Our next SX Greentech Advisor issue is published Wednesday, October 5. Weekly updates are published every non-issue Wednesday, and any timely notices get distributed as needed. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabotwealth.com. Thank you for subscribing.

The estimated carbon generated in the production and distribution of this newsletter is offset by CO2 removal with Climeworks at its plant in Iceland.

The next Cabot SX Greentech Advisor issue will be published on October 5, 2022.

About the Analyst

Brendan Coffey

Brendan Coffey, Chief Analyst of Cabot SX Greentech Advisor, has been immersed in investing for more than 25 years, including as an investment advisory editor, investor, markets reporter and writer about and for a wealth of Wall Street’s most influential minds. He’s discussed investing strategy with the likes of Carl Icahn, Mark Cuban and Leon Cooperman and collaborated with hedge fund managers and entrepreneurs on books and essays. He’s written about investments and markets for Forbes, Bloomberg, Fortune, The Wall Street Journal and numerous other outlets.

Brendan is a Certified Financial Technician (CFTe), representing extended study and achievement in technical analysis of securities. He combines technical and fundamental analysis in pursuit of a long-held passion for environmental and ESG stocks that began with the study of environmental law as an undergraduate at Boston College. Brendan’s also been a fellow at the Scripps Howard Institute on the Environment, served on a municipal energy planning board and, last decade, was editor of Cabot Green Investor and Cabot Global Energy Investor. In addition to ESG, he conducts proprietary research into billionaire-owned stocks, SPACs, sports-related equities and other sectors.