So far, November’s markets have been a nice respite from the volatility of October, and the Dow Jones Industrial Average actually gained about 900 points. Investors—for the most part—seem to be ignoring China tariffs, impeachment hearings, and Brexit. And why not? After all, the economy remains strong and sentiment—as you’ll see in our Advisor Sentiment Barometer, as well as in our Market Views—remains very bullish.

Wall Street’s Best Investments 823

[premium_html_toc post_id="191180"]

Market Views

Still bullish

The broad stock market continues to plow ahead, as $SPX has made new closing or intraday all-time highs on 10 of the last 14 days, including the last two. Thus, momentum is strong and the $SPX chart remains bullish. The $SPX and $VIX charts are bullish, while other indicators are on or near sell signals, and/or are in very overbought states. That’s not as bullish as things were a week or more ago, but it’s still bullish.

Lawrence G. McMillan, The Option Strategist, www.optionstrategist.com, 973-328-1303, November 15, 2019

A Little Cautious

Investors are justified in maintaining long positions in the stock market. However, I recommend holding off in initiating new long positions until the new 52-week lows on both exchanges dwindle to below 40 on a daily basis for several days. Right now, there’s simply too much internal selling taking place in the energy and biopharma sectors, and while I don’t believe this is sufficiently strong to give the bears a major advantage, it could be enough to temporarily halt the bull’s advance at some point in the coming weeks. I’m still bullish, but we’ll need to remain vigilant in the coming weeks and watch for continued signs of weakness.

Cliff Droke, Momentum Strategies Report, www.cliffdroke.com, 707-282-5594, November 16, 2019

New Highs Keep Coming

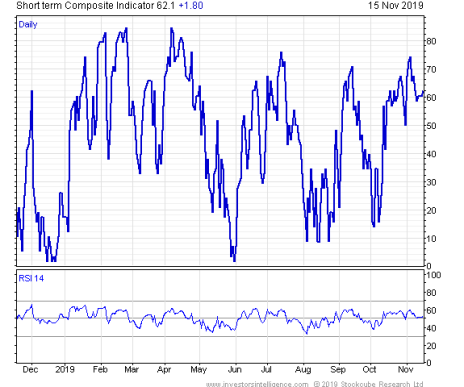

The S&P 500 makes new highs. The Nasdaq 100 also makes new highs. The Short Term Composite now trades at 62. Healthcare breaks resistance at 1100 and makes new medium term highs.

John Gray, Investors Intelligence, www.investorsintelligence.com, 914-632-0422, November 18, 2019

To read the rest of this month’s issue, download the PDF.

The next Wall Street’s Best Investments issue will be published on December 18, 2019.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2019. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved.