By Mike Cintolo, Chief Analyst, Cabot Growth Investor and Cabot Top Ten Trader

Chart reading is a skill that can benefit all investors. Technical analysis of stock trends helps investors determine how the markets in general, and their stocks in particular, are likely to behave going forward. When deciding whether to buy (or sell) a stock, investors should examine both the fundamentals of the company and the technical health of the stock.

Technical Analysis Definitions

Here are some of the terms you’ll need to know to understand how to read stock charts:

Momentum

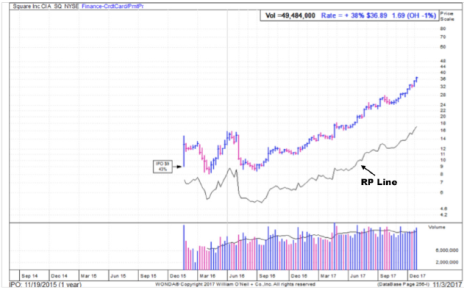

We measure a stock’s momentum by examining its Relative Performance (RP) line. The RP line compares the stock’s price to a major market index (we usually use the S&P 500). If the RP line is trending higher, the stock is outperforming the overall market. If the RP line is falling, the stock is underperforming the market. And a sideways RP line means the stock is basically performing with the market.

Trading Volume

Trading volume is the number of shares of the stock that have changed hands that day (or week or month). This number can usually be found on the price chart.

[text_ad]

Moving Averages

Moving averages smooth the fluctuations in a stock’s price. To get a moving average, you simply add up all the closing prices for a stock over a certain time period (say, 50 trading days) and divide by the time period (50). You will get the average price at which the stock has closed over that time. Do this calculation every day and plot it, and you get a “moving” line on the price chart. We usually watch the short-term (25-day) and intermediate-term (50-day) moving averages; the 200-day moving average is useful for determining longer-term trends.

There are dozens of other technical indicators you can look at, but many of them will confuse rather than enlighten. Keeping it simple by studying the price, volume and moving averages will capture the real picture of the stock’s supply and demand relationship.

How to Use Basic Technical Analysis

Select Stocks Based on Momentum

Our stock selection system is based on momentum analysis. Any new stock we buy must have positive momentum. A stock has positive momentum if its RP line has been advancing for at least 13 weeks (the number of weeks in a quarter). We’ve found that this period of time is usually enough to establish a new momentum trend. Once a trend (either positive or negative) is in place, it tends to stay in place for a relatively long period of time. That’s why you want to focus on stocks that are going up (see below)!

The chart below of Palantir’s (PLTR) performance relative to the S&P 500 is a good illustration:

You can see the Relative Performance in the primary chart, with the performance of Palantir (PLTR) and the S&P 500 in the two secondary charts.

The consistent uptrend in Relative Performance reflects outperformance by PLTR.

Once you’ve selected a few stocks that have positive momentum, you need to take your search to the next level. At this point, look for stocks that have particularly strong RP lines. (You can compare your stock to an index such as the S&P 500 to establish your stock’s relative performance.)

Brief corrections (timewise) tell you that there are lots of buyers in the market who are willing to snap up the stock on any decline. This is exactly the type of situation you want to be invested in! Ideally, the corrections should be both brief and shallow, but brevity is more important than depth.

Once you’ve selected stocks with positive RP lines, analyze their strength by asking: How long have the corrections been over the past six to nine months?

How deep have the corrections been?

How steep is the rising or uptrending RP line? (The steeper the line, the more the stock has been outperforming the market.)

How has the RP line acted during market corrections? (A stock whose RP line remains strong when there’s turmoil in the general market indicates super-strong buying pressures.)

All in all, you should only buy stocks with positive momentum. The perfect RP line will have a steep upward slope, with corrections that are brief and shallow. Finding stocks with strong RP lines is half the battle in technical stock analysis.

Study the Stock Price Action

After examining the RP line, we shift our attention to the stock price. Often, the stock price and the RP line will look similar. But sometimes they differ, often during market corrections. The strongest stocks hold up the best during corrections and have price charts that resist the downward pull of the general market. In this case, you’ll see the price trending sideways, but the RP line will be heading higher! This is because, relative to the overall market, the stock is making a lot of progress.

Another area to study is the stock’s support and resistance.

On the price chart, you’re looking for the same characteristics you looked for in the RP line—brief and shallow pullbacks with an overall steep uptrend. And steep rebounds after corrections are also a telltale sign of strong sponsorship.

As a side note, checking the new stock price highs list daily in your newspaper or online is one of the best ways we know of to discover new stock ideas.

Use Trading Volume to Confirm an Uptrend

Studying volume is helpful, but there are no hard and fast rules when using it. In general, you want the stock’s volume to confirm its uptrend by rising to a higher level on days when the stock advances and falling to a lower level when the stock declines.

You can see this represented well in this chart of CoreWeave (CRWV) where the post-IPO price decline coincides with declining volume and the surge higher comes on growing volume.

This indicates that the supply and demand relationship is truly in your favor because there’s lots of buying power but little selling pressure.

Volume tends to confirm your convictions rather than lead you to a great stock idea all by itself.

Once in a while, though, a stock will soar or plummet (as shown above) on massive volume, which is what we call a Volume Clue. It’s a sign that big investors are getting in or out. In particular, look for stocks that rise 10% or more the day after reporting earnings—these stocks often have further to run.

Look for Support at the Moving Averages

We look primarily at the 50-day moving average because it’s long enough to allow for corrections but not so long that the trend hasn’t turned down by the time the stock touches it. But there’s an even better reason: great growth stocks tend to find support (meaning that they stop declining) when they reach this moving average. Buying a stock as it’s bouncing off this moving average is often a good strategy. Any stock you’re considering for purchase should have stayed mostly above its 50-day moving average over the past few months.

The 25-day moving average isn’t as vital, but it, too, often lends support to the strongest market leaders. In a powerful situation, contained drops to the 25-day moving average can offer buy points.

Technical Stock Analysis Summary

We’ve covered a lot of material in this report, and it’s pretty complex, so don’t expect to fully grasp all of it at once. It’s going to take some practice with your own money before you are comfortable with (and can get the most benefit from) our momentum system.

Let’s review the main points:

- When you’re looking for potential purchase candidates, look at both fundamental and technical analysis.

- When you’re doing technical analysis of stocks, focus primarily on the stock’s momentum and price chart, along with its volume pattern and 50-day moving average.

- A stock MUST have positive momentum before you consider buying it. Your goal in technical analysis should be to find RP lines with steep slopes and corrections that are brief and shallow.

- When you’re looking at stock prices, look at the price chart, not just the daily fluctuations of the stock. Look for price charts that have steep upward trends, with brief and shallow corrections. These are the same characteristics a desirable RP line has.

- A stock’s trading volume pattern can confirm your initial opinion of a stock but is unlikely to lead you to a great stock idea all by itself. Look for heavy volume on up days (showing accumulation) and lighter volume on down days.

- The 50-day moving average is a helpful indicator in two ways. First, your potential purchase should have held up above this line for the past few months. Second, look for a pattern of sharp rebounds after the stock touches the moving average, and then time your purchases after the stock begins to bounce off the moving average.

Advanced Technical Analysis

Now that you know some of the basics of technical analysis, it’s time for the advanced course! Here are a few patterns to look for when analyzing a stock chart.

Double Top

A double top is a bearish pattern. A double top pattern occurs when a stock attempts to break out above a recent peak but fails. (Remember, that first peak is resistance!)

If a stock doesn’t immediately get through an old peak, it doesn’t mean a double top is forming. In order to get confirmation, the correction low (valley) between the two peaks must be broken to the downside. For a visual representation of this, see the chart of Cummins Inc. (CMI).

When a double top has been confirmed, the price objective is the same distance down from the valley as the distance from the peak to the valley. Given that CMI’s range was 345 to 385, the break of 345 created a target price of 305 … which CMI blew through during the market-wide correction in early April.

Double Bottom

The mirror image of a double top is the double bottom. A double bottom formation is a bullish pattern. But care should be taken not to buy into the stock until the formation is confirmed by a breakout above the peak that’s between the two bottoms.

Earnings Gaps

Gaps occur when a stock begins a new trading day at a price that’s vastly different from the previous day’s closing price. In effect, there is no trading at prices between the closing price and the opening price, so a “gap” appears on a price chart.

You want to see a stock gap up significantly on earnings—usually 10% or more, and hopefully much more. A mild 5% or so doesn’t cut it.

Second, you want volume to be extremely heavy. That’s usually the case, but as with the size of the gap, the bigger the volume, the better.

Third, and a bit trickier to get a handle on, you want to keep in mind where the stock is within its overall upmove. If a stock has been advancing strongly for a few months, possibly enjoying a bullish earnings gap (or two) during that time, any further gap up might not be a good buy (it could even mark a top) as enthusiasm peaks.

Fourth, you should give extra credence to big, liquid stocks that sport great growth numbers and gap strongly on higher earnings. These stocks are often irresistible to institutions who pile in for weeks after an unusually bullish report.

A fundamentally strong company that gaps up huge on its earnings is often a great candidate to be purchased right then. So while earnings season provides plenty of risk (that it can gap down), it provides even more opportunity for stocks you own gapping up and new leadership that you can buy.

Head & Shoulders

Head & shoulders is a negative reversal pattern, and one of the most common and reliable of all the reversal patterns. It consists of a left shoulder, a head and a right shoulder.

The left shoulder is usually formed at the end of a major advance, followed by a good-sized retreat in the stock. During the recovery, the stock moves ahead to a fairly marginal new high, only to correct again. The new high is the “head” part of the pattern. Its low in the ensuing correction will usually be around the low of the previous correction. This low point is called the “neckline.”

Once the low has been reached, the stock advances again, only to falter below the previous high. This is the right shoulder. The stock then rolls over and heads down to the neckline again. In a clean head and shoulders formation, the stock would, at this point, break down below the neckline.

In our example, you can see the head and shoulders pattern in the chart of Visa (V), with its left shoulder near 230 in April, the head around 245 in July, the right shoulder at 230 and the neckline at 215. V would go on to break the neckline in the end of October before setting new 52-week lows in December.

Reverse Head & Shoulders

Reverse head & shoulders is a positive reversal pattern. It’s the mirror image of the head & shoulders formation. It follows the same rules as the head & shoulders but it occurs as a stock is forming a bottom, especially after a prolonged downtrend.

Triangles

Head & shoulders, double tops and double bottoms are reversal patterns. The triangle is a continuation pattern. Occasionally, a triangle will reverse a trend, but in most cases, the trend will continue after the triangle has run its course.

Triangles usually occur when a stock price gets ahead of itself. Temporary consolidation is necessary. The shape of a triangle can take various forms, but the most common type is the symmetrical triangle.

In order for a triangle to be formed, at least four reversals must occur. As the stock consolidates, a series of lower highs and higher lows will be put into place. Once the triangle pattern is completed, the stock will break out in one direction or the other from the apex.

As we’ve said, in most cases, the prevailing trend will continue. Thus, if the stock was previously in an uptrend, it’s likely that trend will continue as the stock moves out of the triangle.

Occasionally, triangles produce false breakouts. If the stock breaks out of the triangle, it may quickly roll over and head in the other direction. In order to protect against a false upside breakout, pay close attention to the trading volume. The stock should break out on heavy volume that’s at least two or three times the daily average.

That’s what happened in our example—Stamps.com (STMP) formed a triangle pattern on the weekly chart in late 1999 and then tried to break out in September. But volume was light and the stock spent another month in the 50s before exploding to new highs in October and more than doubling in just a couple of weeks! Of course, that was the Internet Bubble, when moves were crazy, but it shows how fast a stock can resume its uptrend after lifting from a triangle pattern.

Trendlines

Stock prices generally trend in one direction or the other. When there is more demand for shares than there is supply, the stock will trend higher. In a downtrend, supply outweighs demand, forcing the stock to trend lower.

It is important to understand individual stock trends as well as the trend of the market in general.

A stock can be in the midst of multiple, simultaneous trends. Sound confusing? It’s not. A stock may be in a long-term uptrend, an intermediate-term downtrend and a short-term uptrend.

(FYI: We loosely define long-term as greater than one year, intermediate-term as more than two months but less than a year, and short-term as two months or less.)

For long-term investors, the long-term trend is obviously the most important. But when you’re ready to take action (buy or sell), the short- and intermediate-term trends can be extremely important. To assist you in identifying how a stock is trending, you should use a trendline.

Trendlines help you determine the prevailing trend of a stock. If a stock is advancing, a trendline should be drawn as a straight line that connects at least three successively higher bottoms. When that line is broken, the uptrend has run its course and the stock will either move sideways or begin a downtrend of unknown duration and severity.

When dealing with a downtrend, the trendline should connect at least three successively lower tops. As long as the stock’s price remains below the trendline, the downtrend remains in effect. Oil stocks in early 2017 provide a good example.

If a stock decisively breaks through a trendline, the odds favor a reversal in trend. And as we discussed above, depending upon which trend you’re analyzing (long-, intermediate- or short-term), the ramifications of a trend break could be significant. If a long-term trend has been broken, it’s more significant than a short-term trend break.

Gaps

Generally speaking, gaps up are considered positive and gaps down are considered negative. However, in many (but not all) cases, price gaps get filled. So if a stock gaps up, you might expect that at some later time (from minutes to months later) the stock will drift back down into the gap. Conversely, if a stock gaps down, it’s likely to bounce back up to fill or partially fill the gap.

Gaps typically offer support or resistance. If a stock gaps down, the gap will offer resistance if it attempts to recover. A gap up will provide support when the stock corrects. There are many types of gaps, but the two most important types are exhaustion gaps and breakaway gaps.

Exhaustion gaps signal the ends of major moves and are associated with rapid advances and declines. If, after a long and powerful move, a gap is created, it could mark the end of an intermediate- or longer-term trend. To be sure, look for huge trading volume. As its name implies, an exhaustion gap typically signals the end of a major move and that a reversal of trend is imminent. The camp that is in control (buyers or sellers) has exhausted itself in a last-ditch effort to push the stock. Once this occurs, the other camp quickly takes control and the stock moves in the opposite direction.

Nvidia (NVDA) was an example of an exhaustion gap that ended an intermediate-term uptrend. After a huge rally in 2016, the stock gapped up three times in the second half of December of that year before finally being rejected at 120 (pre-split). While there were ups and downs, the stock was 20% lower than that peak three and a half months later.

Breakaway gaps signal the beginning of a move. They typically occur when a stock that’s been basing (moving sideways) breaks out of the base with such power that a gap is created in the price chart.

Breakaway gaps are important because they typically portend higher future prices. Many earnings gaps (see above) can be breakaway gaps.

In many cases, a breakaway gap will not get filled. The buying is so intense that the gap marks the beginning of a significant upmove in the stock. Meta Platforms (META) is the classic example, with shares exploding out of a post-IPO consolidation and never looking back.

Breakaway gaps can also occur when a weak stock has been forming a base down near its lows. If support is broken with such intensity that a gap is created on the price chart, a negative breakaway gap is created. This will likely mean significantly lower prices are on the horizon.

Tight Trading

We like to buy tightness. Tight trading refers to a stock that really isn’t doing much of anything. For a large-cap stock like Johnson & Johnson (JNJ) or Coca-Cola (KO), tight trading isn’t unusual and isn’t meaningful. But when you see it in a volatile growth stock after a big run-up, it’s almost always a bullish sign.

Why? Because tight trading following strong price action signifies two things. One: that there isn’t much selling coming into the stock despite the advance; shareholders are content to hold their positions. Two: it usually tells you that big institutional investors are accumulating stock in a certain price zone–they’re telling their traders to buy, say, 200,000 shares in the next couple of weeks, as long as the stock is between 80 and 83. When a few institutions are doing this, the stock basically oscillates between those two levels.

The theory behind it is all well and good, but the reason we love to spot tightness is that it can highlight low-risk entry points into some of the market’s most dynamic stocks. The best way to spot them is by using stock charts, and here are some guidelines to work with:

First, we prefer to spot tightness on daily charts (as opposed to weekly charts). Tight weekly closes are a good sign, too, but we find it easier to home in on true tightness on the dailies.

Second, you want the stock to be in a major uptrend—tight action after a big downtrend doesn’t mean anything. You want to see the stock is above its 200-day moving average, and hopefully its 50-day line, too.

Third, you want to see at least six or seven days—and preferably 10 or more days—of tight action. Two days of quiet action after a big run-up doesn’t do it. During those days, you want volume to dry up (which helps tell you that there’s no more selling coming into the stock), with a day or two marking the lowest volume in many weeks. And, remember, you’re looking for a consolidation, not a deep correction, so the stock shouldn’t retreat more than 10% to 15% or so.

If you see tight trading like and the market is healthy, you can usually buy the stock right away and put in a pretty tight stop-loss (an order placed with your broker to sell once the stock reaches a certain price, thereby limiting your loss on the stock).

For example, setting a stop-loss order for 10% below the price at which you bought the stock will limit your loss to 10%. This set-up makes for a great risk-reward investment (lots of upside, little risk). That’s a good thing!

Bottom Line

There are a lot of factors to weigh when deciding which stocks to buy. Is the company you’re considering investing in well-run? Is it growing sales and earnings? Does it offer a revolutionary product like Netflix (NFLX), Tesla (TSLA) or Nvidia (NVDA)?

The story and the numbers are very important. But so is the chart. And being able to properly read a chart is vital. We hope this report has helped you do just that.

And if you feel you need more help selecting stocks of all types, click here to subscribe to any of our 18 investment advisories here at Cabot Wealth Network.