A diversified portfolio constructed with the right ETFs can not only smooth your risk and mitigate losses in a bear market, but it can also help you capture gains when more traditional portfolios are in decline.

The S&P 500 is down over 10% in recent months. See how ETFs in Kate Stalter’s “Undiscovered” Portfolio are beating that by up to 25% or more...

If you’re a retirement investor, I have good news and bad news . . .

Good news: You have only two things to worry about.

Bad news: Either could totally destroy your retirement:

1) Today’s rampant inflation is gnawing away at your nest egg—and may soon enough reduce it to nothing

2) The next market crash—which is absolutely inevitable—could smash and grab most of your nest egg in one swoop

As you’ll discover below, both these dangers are real. They threaten every investor . . . right now.

But let me also be honest: These disasters are preventable.

You only have to worry if you haven’t taken steps to protect yourself.

I’ve been helping investors prosper—safely—through the global roller-coaster economy for 25 years now.

Let me share my proven formula for beating inflation and surviving market crashes . . . while still sleeping soundly every night.

Dear Fellow Retirement Investor:

Before I tell you how my simple formula cushions investors from hard bumps in the stock market—and even crashes, inflation and recessions . . .

let’s take a sober look at two ways today’s economy threatens us investors.

Surely, you’ve seen the headlines:

Recently, President Joe Biden warned Americans that we’re in “the worst economic crisis since the Great Depression.”

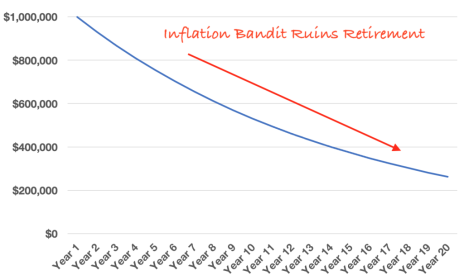

The Inflation Bandit is the first of two dangers looming for retirement investors.

In November, the U.S. inflation rate jumped to 6.8%—a 10% increase over October and the highest rate since June 1982. That’s the worst in almost 40 years!

The Bureau of Labor Statistics tells us

- Gasoline has risen 58.1%

- Energy now costs 33.3% more

- Used vehicles are up 31.45% and new vehicles are up by 11.1%

- The UN Food Price Index has leaped a shocking 30% this fall

Fed Chair Powell indicates inflation will not likely decline in 2022—it may even rise.

Do you know what happens to the value of your retirement nest egg at 6.8% inflation?

In just 12 short years, a $1,000,000 retirement plan is slashed by more than half!

Your $1,000,000 in assets shrink catastrophically to only $494,492 in buying power.

Within 20 years—if you don’t do something to counteract today’s ravaging inflation—your $1 million nest egg will, horrifically, be worth only $262,363.

Think about it: With an annual retirement budget of just $70,000 a year, you’d be dead broke in just four short years.

At current inflation rates, a $1 million nest egg loses 71% of its value in just 20 years, shrinking to only $281,505.

At this rate . . .

. . . millions of retired Americans will face poverty. Millions more will become destitute.

You—and all of us—stand at the threshold of having our retirement robbed from us by the nameless, faceless Inflation Bandit.

So much for the American Dream of working hard to ensure a comfortable retirement.

Inflation can strip it all away.

I couldn’t be more serious . . . or more appalled—because so many are so unprepared.

The fact is . . .

. . . most retirement investors simply don’t have an intentional plan for beating inflation.

But I have good news: The right investment strategy can compensate for inflation.

A well-constructed portfolio can today safely deliver returns of 25% or more—so you offset and dramatically exceed inflation.

In just a moment, I’m going to show you how you can actually boost your net worth . . . even in the face of inflation.

But remember, dollar devaluation is just the first huge threat we face.

The second danger is a stock market crash.

I usually scorn hucksters who threaten investors, claiming that an Economic Armageddon will ruin us any day now. “The sky is falling!” they warn.

But we don’t need overhyped scare tactics. Sometimes actual facts are scary enough.

President Biden may have been exaggerating when he compared the current U.S. economic situation to the Great Depression . . .

But what if he’s right?

We just don’t know. But . . .

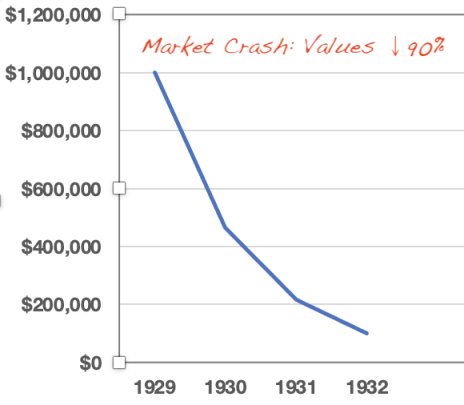

Consider this: The Great Depression sunk stock values by 90% and lasted four years.

Tens of millions of investors were totally wiped out—forever. Most made penniless.

Investors’ stock value fell by 90% over just four years during the Great Depression crash

The 2008 market crash crushed values by 50% and lasted “only” 18 months.

You remember: It was brutal. Some investors recovered—many never did.

How about today? The ten greatest one-day point losses in Dow Jones history have taken place in the last five years! Obviously, we live in highly volatile times.

Consider this, too: In the last 70 years, the stock market has crashed or corrected by at least 10% some 38 times—about once every 1.87 years.

The devastating March 2020 correction happened 1.8 years ago.

It means statistically we’re “due” for another one anytime now.

Here’s what this means to you and me:

We must face the fact that stock market crashes—large and small—happen frequently . . . about every two years on average.

The next one—or ones—could happen any time. They could last a short or a long time.

We don’t know when or how long.

But here’s what we know with almost absolute certainty:

The stock market will crash or correct again—multiple times in our lifetime.

Like inflation, market crashes can destroy retirement plans.

Worse: They can ruin lives. Cause hunger. Homelessness. Desperation.

Please believe me: The threats of inflation and a market crash are not abstract.

The tragedies they cause are real. These reversals of fortune happened during the Great Depression. They also happened after the crash of 2008.

Good, hard-working people were out on the streets—dependent on their children . . . or the state.

These tragedies will happen again . . . perhaps even to your neighbors next door who saved every penny.

Rather than retirement, they could be forced back to work—not the career job they had in the past, but the jobs many senior citizens are forced to take. Walmart. Burger King.

It’s not a scare tactic to say that if you haven’t taken steps to protect yourself . . . such reversals of fortune could affect any one—even yourself.

Take a second to think about what financial disaster could look like for you.

Not fun. Not pleasant.

Now let’s go beyond this frightening idea . . . let’s focus on the good news:

A disciplined investment strategy can prevent this nightmare.

Indeed, the approach I’m about to explain—which has worked consistently for my clients for decades—can protect you from drastic stock market fluctuations:

- reduce your losses during crashes or corrections

- speed your economic recovery

- achieve annual investment returns up to 25% or more . . . and

- build a portfolio that sets risk precisely to your needs and comfort level

I call it Failsafe ETF Investing.

Before I explain the amazing power of Failsafe ETF Investing, let me take a moment to introduce myself.

I’m Kate Stalter. As a licensed investment advisor, I’ve spent more than 20 years helping retirement investors protect and grow their portfolios.

When I say I’ve helped clients increase their net worth by hundreds of millions of dollars, I don’t exaggerate.

While I still manage client portfolios, I’m also a capital markets contributor at Forbes.com, a columnist for the investment advisory channel at U.S. News & World Report and have contributed to Investor’s Business Daily.

Most importantly to our subject here, I am Chief Analyst at Cabot ETF Strategist.

It’s here where I developed the Failsafe ETF Investing strategy for retirement investors.

It’s failsafe because it protects your wealth from worst-case scenarios . . .

. . . both voracious inflation as well as wild market swings.

Here’s the best part: While Failsafe ETF Investing is always mitigating your risk . . .

. . . it also defeats the sapping effects of inflation and market volatility by continuously INCREASING your net worth—keeping pace with the stock market, even exceeding it.

If it sounds like a dream come true . . . it actually is.

But Failsafe ETF Investing is no fantasy.

It’s grounded in disciplined strategy, hard-nosed research . . . plus 25 years and trillions of dollars in market-tested experience.

Most importantly, it’s the key to protecting yourself from inflation and market volatility.

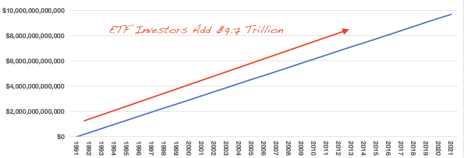

The driver of Failsafe ETF Investing is a modern financial miracle: Exchange Traded Funds.

Mighty ETFs—when managed correctly—can give you virtual iron-clad security, while also offering a plethora of rock-solid, high-return, growth investments.

No wonder ETF popularity has skyrocketed—going from zero to $9.7 trillion of investor money in just the last 30 years.

Investor confidence in ETFs has boosted values from zero to $9.7 trillion in just 30 years.

Today, investors can choose from some 7,500 ETFs.

But remember these words: “ETFs ARE SAFE . . . WHEN MANAGED CORRECTLY.”

That’s because ETFs, despite their attraction, when purchased without a strategy—or motivated by pure greed—can wipe out a portfolio faster than a Ponzi scheme.

So, before you start buying ETFs willy-nilly, register this cold, hard fact: Losing ETFs drained investors’ wealth by $124 billion in 2021.

The top 20 worst-performing ETFs robbed investors of more than 50% of their value. Just this last year! The worst ETF lost 86.8% of its value.

On the other hand, the best performing ETF over the past year delivered a 587.2% gain.

In other words, like any securities, ETFs can be great for disciplined investors . . . or disastrous for those who lack a strategy.

You won’t be surprised to learn that the EFTs that lost big and won big have one thing in common: They were all high-risk gambles.

That’s why you won’t find me recommending any high-risk ETFs—neither the kind that chalked up big losses last year . . . nor even those that turned in three-digit profits.

High risk is not our play. And as a retirement investor it shouldn’t be yours.

3 reasons why ETFs form the hard-steel core of my strategy for conservative retirement investors

Before I reveal my secrets for Failsafe ETF Investing, let me give you 3 reasons I love ETFs—and why I believe you’ll want to make them a key element in your portfolio:

1) ETFs are ideal for hedging your investments. Most ETFs are broad-based indexed funds—so if you want to invest in the S&P 500 or the Russell 2000—or any other index—you can find a fund that gives you a stake in every equity in that index. It means you don’t have to risk choosing individual stocks—the ETF gives you all the stocks, which reduces your risk.

2) ETFs let invest more safely in an economic category. Just as ETFs give you a broad stake in an entire index, they also allow you to buy stocks with a specific focus—from China to biofuels to the Japanese yen. Again, you don’t have to pick just one or two stocks in a category: Your ETF gives you a hand-picked selection of top performers.

3) ETFs are low cost and tax efficient. You can buy ETFs commission free—and most assess practically no management fee—so you buy pure value—no add-ons. In addition, unlike mutual funds, most ETFs are managed to minimize taxable year-end distributions, so you only incur taxes when you realize profits on your ETFs.

How my Failsafe ETF Investing strategy simplifies your life, saves you money and keeps you safe.

I hope you’re not paying brokers’ commissions on your stock market trades.

Because for most retirement investors, such commissions are a waste—they’re unnecessary and they simply diminish your retirement assets.

I also hope you’re not paying management fees on “actively managed” mutual funds.

Why?

Because these large-company funds—scandalously—almost always UNDERPERFORM the S&P and Dow Jones indices.

In fact, 84% of “actively managed” large-cap funds FAILED to equal the S&P 500 index return over the last 5 years!

Read it again:

Most actively managed funds had LOWER RETURNS than the S&P 500 index itself!

You don’t need these costly managers . . . you don’t need these mutual funds.

As I noted above, the beauty of ETF investing is that it’s simple and inexpensive:

With ETFs, you don’t gamble on individual stocks.

You also don’t pay brokers’ fees . . . nor must you pay high management fees.

Rather, ETFs let you invest in broad indexes or economic categories at almost no cost.

Instead of having 90 individual stocks in your portfolio—or 50 or 30 or even 20—a portfolio of 10 ETFs may give you stakes in several hundred stocks . . .

. . . so now you need only pay attention to a handful of investments.

Life becomes simpler. Investing becomes more profitable.

With my Failsafe EFT Investing strategy, your only challenge is deciding which ETF funds make the most sense for you based on these two criteria:

1) What are your profit goals—what percentage return do you want or need?

2) What is your risk tolerance—which investments will let you sleep at night?

Given your profit and risk targets, which ETFs can best give you that custom blend of wealth appreciation and investment security?

That’s where my Failsafe ETF Investment strategy can help.

Secrets of the Failsafe ETF Investing strategy:

Our 4 portfolios let you customize your investments to produce the profits you want and the security you need

Remember, my goals are first to keep your retirement nest egg safe . . . and second to help you build wealth with exceptional returns.

But you know how the stock market works: If you want a greater return, you must be willing to take a greater risk.

Conversely, as if you want to increase your safety, you can expect diminished returns.

In fact, successful investing is really NOT about how much money you make . . .

. . . rather it’s how you BALANCE risk and rewards to fit your needs and comfort level.

Failsafe ETF Investing makes it simple to balance safety vs. profit.

My team and I at the Cabot ETF Strategist advisory manage four distinct portfolios—all based on the Failsafe ETF Investing model . . .

They allow you to base your ETF portfolio precisely on one of ours . . . or choose a combination of ETFs from each of our portfolios as it suits you.

Here’s how these 4 ETF Strategist portfolios help you achieve a perfect balance of safety and profits for your needs and comfort:

- Each of the portfolios is rated for profit potential: Aggressive Growth, Moderate Growth and Conservative Growth

- Allocations are updated as needed, to spread the risk while generating the return needed for a specific goal, such as retirement.

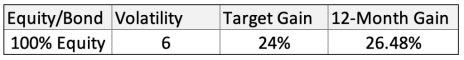

1) Aggressive Growth/Medium Risk Portfolio: Contains 100% Equity ETFs, which we target to gain 24% over the coming year. Volatility Rating of 6.

Over the past year, the ETFs in this portfolio in our assigned allocations have delivered a total gain of 26.48%. (An investment of $100,000 allocated to the ETFs in the proportions we currently recommend would have turned into $126,488 in the last 12 months.)

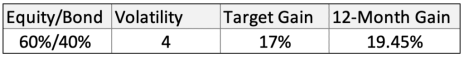

2) Moderate Growth/Moderate Risk Portfolio: Contains 60% Equity and 40% Bond ETFs, which we target to gain 17.4% this coming year. It carries our Volatility Rating of 4. The bond portion of this portfolio reduces risk—but also growth potential.

Over the past year, the ETFs in this portfolio with our assigned allocations have given investors a 19.45% profit. (An investment of $100,000 allocated to the ETFs in the proportions we currently recommend would have turned into $119,459 in the last 12 months.)

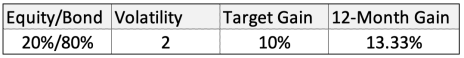

3) Conservative Growth/Low-Risk Portfolio: Combines 20% Equity ETFs with 80% Bond ETFs plus Cash—a mix that significantly increases safety, but further reduces growth potential. We target this portfolio to gain 9.9% in the coming 12 months, with a low Volatility Rating of 2.

Over the past year, the ETFs in this portfolio with our assigned allocations would have given investors a 13.33% gain. (An investment of $100,000 allocated to the ETFs in the proportions we currently recommend would have turned into $113,330 in the last 12 months.)

Of course, as you know, past performance of ETFs is no guarantee of future returns. However, we have high confidence in the safety and performance potential of the ETFs in each of our three portfolios under current and future market conditions.

4) Undiscovered Portfolio: A special “bonus” portfolio, which consists of smaller or less-well-known funds, is diversified with ETFs representing various asset classes currently performing well on a technical basis.

The goal with this portfolio is to generate excess return above the broad market, regardless of what the market is doing at any given time.

Are you ready to protect your retirement nest egg with a disciplined strategy—

to achieve exactly the degree of safety and profit that suits you?

As I’m sure you know, the investors at greatest risk in today’s market are those who lack a rational strategy.

How familiar do these motivations and investment “approaches” sound to you:

• Some investors—out of abject FEAR—retreat from the market: They cling to cash or “invest” in ultra-low-yield money market funds. Some hold a few random bonds.

These investors are condemned to lose their nest egg due to the ravages of inflation.

• Other investors—motivated by GREED—risk their precious retirement assets by gambling them on highly volatile tech stocks or gold or shoot-the-moon IPOs.

These investors stand to lose everything during the next market crash.

• Still others “SPRAY AND PRAY”—scattering their investments according to hunches, advice from friends, news reports and vague hopes of safety and opportunity.

These investors are destined to suffer both from inflation and violent market volatility.

How to take control of your retirement investments—

so you achieve greater safety, profitability and peace of mind . . .

Let me send you—with no risk—a list of every ETF in our Aggressive Growth Portfolio

Given today’s raging inflation and the risk of market correction at any moment . . .

How satisfied are you with your current investing strategy?

- How would you like to start using a disciplined system to protect your retirement nest egg from inflation and a possible market collapse immediately?

- How would you like to get a detailed look at the Cabot ETF Strategist portfolio we’ve pegged to deliver 24% gains . . . safely . . . over the coming year?

Let me give you—with no risk—access to all four portfolio—so you can start using my system to help you manage both your risks and profit targets.

You’ll also see the Failsafe ETF Investing criteria we use to evaluate the ETFs in our three portfolios.

You’ll see our analysis of today’s market conditions.

You’ll receive our latest recommendations for balancing your ETF portfolio.

Just start your no-obligation subscription to Cabot ETF Strategist now.

Note: You have no obligation to continue Cabot ETF Strategist: You can cancel your TRIAL SUBSCRIPTION at any time within 30 days and owe nothing.

What if Cabot ETF Strategist allows you—for the first time—

to dramatically increase your net worth . . . and also sleep soundly every night?

Would you start your risk-free trial subscription now?

Imagine you have simplified your portfolio to include a handful—or several handfuls—of ETF investments. Investing is simple . . . easily manageable.

Imagine these ETFs are performing as you expect—meeting your profit targets regularly. You’re delighted.

Imagine you have utter confidence in the ETFs in your portfolio—they’re in solid indices and economic sectors. They’re top-rated, reliable ETFs. You’re sleeping well.

That’s what Failsafe ETF Investing is all about . . .

If you’re ready to take command of your retirement portfolio using a disciplined strategy and composed of high-quality, low-risk and high performing ETFs, I urge you to start a risk-free trial subscription now.

Monthly issues of Cabot ETF Strategist give you:

• Four model ETF portfolios to match your safety and appreciation goals

- Aggressive Growth/Medium Risk (24% profit target)

- Moderate Growth/Moderate Risk (17.4% profit target)

- Conservative Growth/Low Risk (9.9% profit target)

- Special “Undiscovered Portfolio” to generate excess return above the broad market, regardless of what the market is doing at any given time.

• Reports on emerging, high-potential “Likely to Succeed” ETFs

• Analysis of market and investment trends highlighting impact on your ETFs

• 24/7 online access to our current issue, our current buy/hold/sell recommendations, and the complete library of back issues and recommendations—easy reference, quick portfolio tracking, and guidebooks

Your subscription also includes:

- Weekly audio updates in which I cover breaking news and opinion affecting the ETF investment world . . . and our three ETF portfolios

- Personal answers to your investment questions: You’ll have my personal email address, so you can get guidance anytime you need it.

Best of all, your risk-free trial subscription allows you to review your first issue for 30 days.

If you’re not impressed, just cancel and get a full refund using our toll-free 800 number below.

Imagine how good this feels: You’re increasing your net worth. You’re in control. You’re feeling fully secure about your investment choices.

If this investing style sounds like a potential match, I urge you to start your risk-free trial subscription with no obligation now.

Here’s an additional reason to start your Free Trial Subscription now:

Let me send you FREE my “Cabot Smart Guide to Asset Allocation Using ETFs”

No need to agonize about balancing your ETF portfolio—this guide helps you reduce your risks, increase your gains—and better balance your needs for both . . .

If you start your trial subscription now, I’m happy to send you my concise guide to astute ETF asset allocation—a $24.95 value—at no charge.

The “Smart Guide” puts you miles ahead of most investors in terms of safe, rational portfolio balancing and asset allocation. It tells you:

- How today’s market conditions should affect your allocations

- How to balance equity ETFs vs. bond ETFs (i.e., growth vs. safety)

- Which asset classes—e.g., fixed income, emerging, non-U.S—should be in your nest egg for a balanced portfolio

- Which asset classes are outperforming even the mighty S&P 500

- How to decide which of four asset allocation models will work best for you

In short, this guide gives you the fundamentals for building a disciplined ETF portfolio.

To receive your free copy of “Cabot Smart Guide to Asset Allocation Using ETFs,” please act now and start your trial subscription.

Additional free bonus report:

In this brief letter, I’ve only had space to give you a short overview of the amazing flexibility and profit potential of ETFs.

In fact, because—unlike mutual funds—ETFs are traded on stock exchanges, they offer an expansive world of investment possibilities.

To help you understand and take advantage of these opportunities, I’ve created a special report for subscribers to Cabot ETF Strategist.

“Harnessing the Power of ETFs for Retirement Investors”

When you start your free trial subscription, I’ll send you “Harnessing the Power of ETFs for Retirement Investors,” so you can discover—and take advantage of—inside techniques like these:

- Ease of trading helps you protect your portfolio in case of urgent market threats

- How extraordinary ETF liquidity adds stability to your portfolio

- ETFs give you unparalleled diversification opportunities—across traditional indices, sectors, regions, market cap and themes

- ETFs open doors to unusual specialty markets: blockchain, 5G, video games, lumber and more

- Transparency: EFTs must publish their holdings daily, so you can always track what you own

- Hedging and shorting: Certain ETFs allow adventurous investors to short an index or hedge if you fear a market decline

- Smooth out volatility, since you’re gains and losses are averaged across a “basket” of stocks

- How to use trading volume, chart patterns, relative strength and moving averages to inform your ETF choices

This free report—a $17.95 value—brings you quickly up to speed, so you instantly master the basics, or can explore more advanced strategies, if you wish.

“Harnessing the Power of ETFs for Retirement Investors” is yours free when you start your risk-free trial subscription.

Build and protect your portfolio with Failsafe ETF Investing:

Start your subscription to Cabot ETF Strategist at a 50% discount

I’m confident that once you receiving your first issue of Cabot ETF Strategist, you’ll want to continue your subscription.

I think you’ll see how safe, profitable and easy ETF investing can be for your entire portfolio.

But here’s good news: You don’t have to convert your entire portfolio to Failsafe ETF Investing immediately.

Take it step by step if you wish.

If I’m right, you’ll soon see the advantages of our strategy . . . and the monthly advisory: An immediate improvement in your profits and peace of mind.

Consider this hypothetical:

If you were to invest just $10,000 using our Aggressive Growth/Medium Risk Portfolio model, and you realized our 24% annual target return—that would be $2,400 profit in the first year.

Not bad.

Perhaps you’d pay $800 to receive such advice? Perhaps $500?

That won’t be necessary. To make your this first step a “no-brainer,” I’m slashing the first-year subscription price of Cabot ETF Strategist by 50%.

You will not pay the regular price of $397 per year—but rather just $197

I urge you to start your trial subscription to Cabot ETF Strategist, which includes . . .

- “Cabot Smart Guide to Asset Allocation Using ETFs”—a $24.95 value

- “Harnessing the Power of ETFs for Retirement Investors”—a $17.95 value

Both reports are yours free no matter what.

But if you decide to continue your subscription, you’ll also receive a 50% discount and pay only $197.

TRIAL SUBSCRIPTION

Why I personally back your subscription to Cabot ETF Strategist

with an iron-clad, 100% Money-Back Guarantee

If you believe the Failsafe ETF Investing approach makes sense for you—if you’re attracted to the mix of safely and growth offered by Cabot ETF Strategist, I urge you to respond now. Your risk is zero.

Our company, the Cabot Wealth Network, has backed its investment advice for three generations—51 years—with a 100% money-back guarantee.

Because I’m confident we can help you beat inflation and withstand market fluctuations—plus help you achieve safely achieve extraordinary returns—plus allow you to you sleep soundly every night . . .

If you’re not completely satisfied, you can receive all your money back.

Please be confident when you subscribe now . . .

- I will honor your 50% subscription discount . . .

- I will send your two free reports, valued at $42.90 free . . .

If after reviewing these materials over the next 30 days, you are not completely convinced that Cabot ETF Strategist will protect your nest egg and boost your net worth, you can receive your money back in full—100%—without question, without delay.

To cancel, just call 1-800-326-8826.

If you cancel, you may of course keep your free reports.

A final word before I say . . . “See you soon!”

I’ve spent my entire professional life working with retirement investors like you.

Here’s something I’ve learned.

Some investors believe they can “do it on their own.”

But unless they are dedicated to the stock market day and night—the way my team and I are—their portfolios almost always fail to beat the market . . .

Even more troubling, too often these “do-it-yourself” investors meet disaster. I’ve seen them lose hundreds of thousands of dollars on their “hunches.”

This is just a fact.

On the other hand, investors who succeed—whose portfolios achieve exceptional returns and rebound quickly after the market hits some bumps in the road—are those who rely on reputable experts.

That’s not to say I believe you should follow my every recommendation. You should always think for yourself, of course.

But I firmly believe Cabot ETF Strategist will help improve your thinking and your decisions. When you invest in ETFs, you’ll be well advised. You’ll be more confident.

Chances are, you’ll get better results.

Please act now and take advantage of your 50% discount and your two free reports.

Don’t forget either, that your subscription is completely without risk. After your review of your materials, you may cancel and receive an immediate 100% refund.

Our toll-free number is 1-800-326-8826

Best wishes for exceptional investment returns and a rewarding retirement,

Kate Stalter

Chief Analyst, Cabot ETF Strategist

Cabot Wealth Network

P.S. A quick reminder of everything Cabot ETF Strategist offers you in this letter:

1) A “failsafe” investment method for protecting, growing and balancing your retirement portfolio—using ETFs to achieve exceptional value appreciation with utmost safety

2) A 50% discount off the regular Cabot ETF Strategist subscription price—instead of $397, your price is only $197.

3) Two free reports—valued at $42.90—to help ensure your rapid success in customizing your high-performing, ultra-safe growth retirement portfolio:

“Harnessing the Power of ETFs for Retirement Investors”: Helps you master basic ETF investing skills, plus prepares you for advanced strategies

“Cabot Smart Guide to Asset Allocation Using ETFs”: Gives you the understanding and tools for balancing your portfolio to your specific needs

4) A 30-day 100% Money-Back Guarantee: You must be satisfied or receive all your money returned immediately—we put our trusted, 51-year reputation on the line.