Legendary investors like Warren Buffett and Peter Lynch

know that in the stock market …

…One class of investments provides by far the best potential for mega profits...

…But only a few can invest.

(Buffett can’t, but you can!)

This class of investments might not be what you think.

It’s not colossal money-minting giants like Walmart (WMT)…even though their revenue dwarfs the economies of many countries (Walmart out-earned Norway in 2019!).

It takes a lot of money to move that needle a significant percentage.

It’s not stately Dividend Aristocrats like Exxon Mobile (XOM) with their modest dividend payouts and slow asset appreciation.

You won’t find a lot of doublers or triplers, let alone ten-baggers there.

It’s the class of stocks that has outperformed all others.

For more than a century.

It’s the class of stocks that really savvy investors, world class investors, have long known about.

But it’s also the class of stocks that many excellent investors are not able to play in.

You can. (I’ll explain that in a moment)

Imagine that.

You are able to take advantage of stock market opportunity that Warren Buffett can’t.

He used to.

And he would still like to.

But he can’t.

So, just to be clear, I’m not saying you and I are better investors than Warren Buffett.

It’s just that his success has limited his options.

While no investment is completely risk free, this option has consistently proven to be the best way to make serious profits on your investments.

And you and I can still make profits like 50% in 3 weeks. Or 147% in 13 months. Or even 561% in 34 months.

There just are not many legal investments you can make that have those kinds of profits. In fact, as an individual investor, there is virtually no other class of investment that can make you this kind of money.

So, what is this amazing investment that is able to provide these kinds of stunning profits?

Micro-cap stocks.

Those little companies with market capitalizations of $250 million or less.

Investing in micro-cap stocks is how Warren Buffett made his first millions.

Unfortunately, he can’t invest in them anymore, because all that money would move the market.

“The universe I can’t play in has become more attractive than the universe I can play in. I have to look for elephants. It may be that the elephants are not as attractive as the mosquitoes. But that is the universe I must live in.” — Warren Buffett

Turns out Warren Buffett knows what he’s doing.

And, if you think about it, it makes sense.

An $80 billion large cap company needs to grow by $80 billion in value to double. A micro-cap company worth $80 million can double, triple, or more much more easily.

Micro-cap stocks are, by definition, smaller companies. The stocks generally trade under $10, often for less than $5.

The trading volume of these stocks can be very limited. So, institutional investors, which tend to drive both higher price multiples and greater price stability, almost never wade into the micro-cap waters.

And the small price and low trading volume means there aren’t multiple analysts at the big New York brokerages that track the stock. In fact, there is rarely even a single analyst that covers a micro-cap stock on a regular basis.

And for every micro-cap stock that is less profitable, is losing money, or going out of business (although, it’s worth noting that bankruptcy rates for micro-cap companies are about the same as all other categories), there are micro-cap companies whose fortunes are rising much, much faster.

These are the companies that attracted the Warren Buffetts and Peter Lynches of this world to invest in micro-cap stocks.

“Big Companies Have Small Moves; Small Companies Have Big Moves.”

— Peter Lynch

And these are the companies that can make you money.

A lot of money.

As I mentioned, this isn’t all the micro-cap companies. Not even most.

There are more than 3,000 micro-cap stocks in the United States alone. So even a very small percentage of big-time winners can make you very, very wealthy!

But, as you might guess, with so many small companies, and without the scrutiny of a regular analyst, there is a wide range of actual performance.

The micro-cap market has a lot of room for monkey business if you’re not careful.

Did you know there are unscrupulous small, public companies that specialize in taking money from unsuspecting investors?

They are constantly looking for the hot trend in investing. When solar power stocks are hot, they announce some sort of solar project. When investors are rushing to biotech, they magically announce a biotech product in the works. Or cryptocurrency. Or online retail. Or financial services. Whatever sector is hot they magically have an initiative to go along with it.

They say all the right buzzwords, taking advantage of the fact that there aren’t analysts watching them closely, and they dupe unwitting investors into buying what they have been led to believe will be the next Amazon, the next Tesla, or the next Facebook.

And the projections from these cons always look like the proverbial hockey stick.

Remember there are more than 3,000 micro-cap stocks in the United States alone ...

It simply isn’t possible or economically viable to have trained analysts cover them all.

So, how can you avoid the con artists and still find the smaller companies that can deliver you ENORMOUS PROFITS?

How do you find the needles in the haystack?

Those diamonds in the rough that can make you rich? It’s what I call the Micro-Cap Rockets.

How I Find Micro-Cap Rockets

I’m going to tell you about a proven system I have developed to help me consistently identify the Micro-Cap Rockets, but first a quick digression.

I love researching and analyzing investment opportunities. It’s what I’ve done for my entire career.

And between you and me I don’t just do it for a job. At home, on nights and weekends, you’re likely to find me reading brokerage firm, investment advisor, and company financial reports. I feel very fortunate to be able to make a living doing something I love.

For almost 20 years I have been developing a proprietary system to sort through the thousands and thousands of micro-cap companies across North America. I’ll tell you more about my background in a moment, but for now I want to tell you about my system.

I call this The Micro Cap Profit Max system.

My first step is to screen micro-cap stocks for …

- Profitability – the company must be profitable

- No debt – I want to see zero debt on the balance sheet

- Growing revenues – an indication from the market that they’re producing something

- Growing earnings – proof that the business model works

Once I have sorted out all the companies that don’t meet these criteria then I really go to work.

My research takes up a lot of time here as I check a variety of databases and other sources.

There are a number of additional filters I apply in this phase of my research.

I use some additional, slightly more subjective criteria to further whittle down the list:

- Is the management team and board of high quality with a proven track record?

- Does the company have a credible list of customers and partners?

- Does the company operate in a growth industry?

- Could the company be acquired (which almost always produces an acquisition premium)?

And these characteristics will disqualify a company from my further consideration …

- History of multiple name changes

- Founders with history of fraud

- Multiple reverse stock splits

- Articles or press releases that reveal that the company, or its founders, have been involved with companies in more than two “hot” investment areas

Finally, I dig into the financials and the management team to make sure it all aligns with my third-party information resources.

Then, and only then, do I consider recommending an investment, at a specific price range.

The Micro Cap Profit Max system identifies 3 types of companies.

- Rockets

These companies have all of the characteristics I describe above – profitability, no debt, growing revenue, growing earnings, great management, etc. As these companies grow they become increasingly attractive to institutional investors. That means the stock price goes up because the underlying company performance is better. PLUS there’s an added boost when institutional investors come in. The combined effect really gives you a profit pop!

About two thirds of the micro-cap stocks I recommend are Rockets, and they can deliver a GREAT ride for investors.

- Quick Trades

While it doesn’t happen every day, corporate restructurings or spinoffs can create opportunities in which a newly created public company is undervalued for a variety of reasons. Sometimes their cash on hand per share alone is worth more than the price of the stock. These opportunities tend to come and go pretty quickly as the market will figure out the valuation problem quickly and causes prices to snap back up to a higher valuation.While these situations don’t produce triple-digit profits, they can often produce 20%-50% profits in just a few weeks or months. Another investing win! Only about 10% of my micro-cap stock recommendations are Quick Trades (or other special situations) but they are a profitable part of the mix.

And, finally …

- Slow & Steady

These companies don’t have the massive growth potential of the Rockets. The low liquidity tends to hold these companies back a bit, making them undervalued. They’re profitable and have net cash on their balance sheets. These can often be bought dirt cheap.Often times these are stocks you can buy for less than you could liquidate the company for. The right Slow & Steady companies will grow their way up to full value over a year or two, delivering you profits of as much as 100%-200%. (As in doubling or tripling your money!) The Slow & Steady stocks make up about a quarter of my recommendations.

Let me give you an example of the type of trade I make based on the results of this method.

Example #1: Nuvectra Corporation (Nasdaq: NVTR)

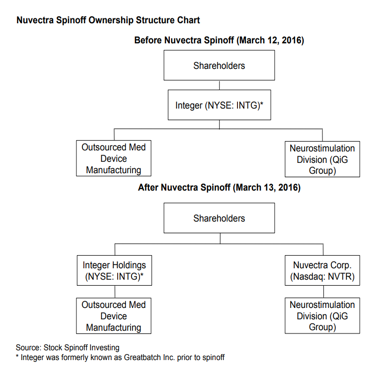

In 2015, Integer (NYSE: ITGR) spun off its neuromodulation business, Nuvectra Corporation.

Integer’s core business was outsourced medical device manufacturing.

Nuvectra was a small money losing division within Integer that was developing a new medical device platform to treat various disorders through neurostimulation (the electric stimulation of tissues associated with the nervous system).

These were very different businesses.

While broadly speaking they were both focused on the medical device business, Integer (after the spin-off) was focused solely on manufacturing medical devices for other medical device companies while Nuvectra was focused on creating and manufacturing its own medical devices.

Further, Integer had just announced it was making a major acquisition which would require it to take on $1.8 billion of debt.

That’s significant for Integer whose total market cap was only about $1.0BN.

Shedding the money-losing Nuvectra would improve Integer’s ability to service debt and increase margins.

Nuvectra’s Business Prospects

Nuvectra was focused on creating and manufacturing its own medical devices.

At the time of the spin-off, Nuvectra had one product approved, Algovita, which was approved for the $1.6 billion spinal cord stimulation market for chronic pain.

Algovita generated about $5 million in revenue in 2015, but management expected to grow revenue exponentially as Nuvectra’s sales force was built out.

Besides Algovita, Nuvectra had a number of additional products in development.

At the time of the spin-off, one sell side analyst (Piper Jaffray) covered the stock and projected revenue of $78 million in 2018.

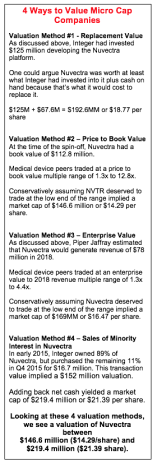

While Nuvectra appeared to be a high-risk micro-cap start up, there were a couple factors that suggested Nuvectra had a promising future.

- Integer had invested about $125 million over 7 years developing the Nuvectra platform.

- Nuvectra owned 107 patents.

- Nuvectra was well capitalized with $67.6 million of net cash ($6.58 per share).

- Nuvectra already had an approved product that was growing rapidly.

- The CEO of Nuvectra, Scott Drees, had an impressive medical device pedigree. He had 34 years of medical device experience. He recently had been President, Worldwide Sales and Marketing, at Advanced Neuromodulation Systems, a neuromodulation company that was acquired by St. Jude for $1.3 billion. Drees would not have been interested in building Nuvectra as a public company unless he had high conviction in its prospects.

- The management team was highly incentivized. Nuvectra’s Form 10 disclosed that the company reserved 1,128,410 shares (11% of shares outstanding) for equity compensation. It further disclosed that the CEO and CFO of Nuvectra had elected to frontload their stock options that would have been granted in years 1, 2 and 3, all into year 1, suggesting that management believed the stock would trade at an attractive initial valuation.

Soon after Integer completed its spin-off of Nuvectra, it became apparent investors were selling the spin-off indiscriminately.

This was unsurprising given Nuvectra’s initial $103 million market cap was too small for most institutional investors to bother with so the trading was confined to small firms and individual investors.

Nuvectra began trading on March 14, 2016 at $10 per share and closed the day at $7.38, down 26%.

Shares bottomed at $4.02 on March 18, 2016, 60% below where they had traded just four days earlier, and 38% below the company’s $6.58 of net cash per share.

During the first six months of trading, Nuvectra’s average closing price was $7.27, giving investors ample opportunity to build a position at prices well below even the most conservative valuation.

Nuvectra grew revenue significantly.

Total revenue grew from $5.2 million in 2015 to $31.8 million in 2017.

Sell side analysts expect revenue to hit $106 million in 2020 (1,957% growth in just 5 years!).

As is often the case with spin-offs, additional investors discovered Nuvectra over time and the stock appreciated significantly. In the fall of 2018 Nuvectra traded for $22 per share, up over 200% from its initial trading range.

That’s tripling your money in 3 years!

At that time, it was time to cash in our chips. The market recognized Nuvectra’s growth potential and was valuing it as such and it was time to take our profits and exit.

(Great timing too. We made a lot of money on that trade and Nuvectra announced bankruptcy last year!)

My Micro Cap Profit Max system has identified so many big winners over the years. Here’s another example…

Example #2: Liberated Syndication (OTC: LSYN)

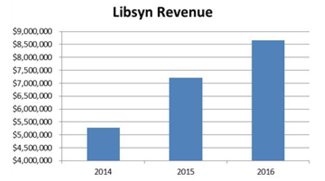

Liberated Syndication is an under-the-radar publicly traded, podcast hosting company. In December of 2016 LSYN was trading at $0.44 per share.

What exactly is podcast hosting? Hosting allows a podcast producer to upload an mp3 file, tell the listener what the episode is about, and generate an RSS feed. The RSS feed connects to iTunes and other podcasting apps so listeners can browse episodes and download them.

Despite having grown revenue 25% in 2016, the stock was trading at a P/E ratio of 3.1x.

The company was off the radar of almost all investors due to its tiny market capitalization of just $8 million.

Liberated Syndication’s Business Prospects

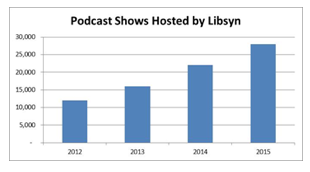

In 2016, Liberated Syndication or Libsyn, had excellent growth prospects.

The number of shows on Libsyn’s network had grown tremendously.

As a result, revenue was growing consistently.

And most importantly, the outlook for future growth was strong as more and more people were and continue to listen to podcasts.

Valuation

LSYN had grown revenue 25% in 2016 and had a very strong balance sheet with $3.8 million of cash and no debt.

Despite these strong fundamentals, the stock traded at a P/E ratio of 3.1x and an Enterprise Value to EBITDA multiple of 1.8x. Competitors in the Internet Content and Information Industry traded at a P/E multiple of 30.2x and an Enterprise Value to EBITDA multiple of 20.8x, on average.

After completing my research, I concluded LSYN was the real deal. Assuming the stock deserved to trade at a 15x P/E multiple, still a significant discount to its publicly traded peers, it would be worth $2.70, significantly higher than its then share price of $0.44. That looked like a potential profit of more than 500%.

So, what happened?

As expected, Libsyn’s stock price appreciated as more investors discovered the stock. The market cap has climbed from $8 million to $111 million, giving it more visibility and starting to attract institutional investors.

The valuation I had calculated has turned out be correct. (Actually slightly conservative). Today, LSYN trades at $3.00, up 582% from my original recommendation price.

This was a perfect example of when to take profit off the table by selling half of your position to get your investment back together with a substantial profit.

LSYN still appears attractive and remains under the radar of most investors as, at $111 million, its market cap is still below the threshold for many institutional investors.

My current micro cap recommendations include various stocks that the Micro Cap Profit Max system identified as particularly poised for stunning profits.

I can’t go into those here but I will tell you how you can get all of them, and tap into a stream of high-profit micro-cap recommendations on an ongoing basis. In just a moment.

But first,

A little bit about me...

My name is Rich Howe. I have spent nearly 20 years as an investment analyst and I first became interested in the incredible profit potential of micro cap stocks in 2014.

At the time I was a Senior Vice President in a group at Citi Private Bank that was responsible for investing more than $2 billion in new client commitments annually.

Those clients were tough.

They were used to making money – lots of money – on their investments.

I was under a lot of pressure to find high-profit investments.

As a trained economist and drawing on the skills and experience I developed as a Senior Equity Research Associate at investing power-house Eaton Vance, I worked on a wide range of high profit and special situation investing. It’s fair to say I am a recognized expert in the world of these kinds of investments. In fact, I am the founding Chief Analyst and Editor of Stock Spinoff Investing.

The more I researched and tracked these investments, the more I came to realize that micro cap stocks outperform ALL other categories of stocks for profitability.

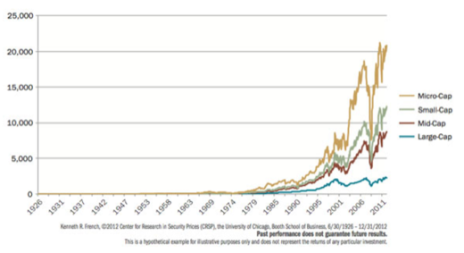

To see how micro-cap stocks have outperformed every other sector since the stock market exploded in the late 1970s, take a look at this chart.

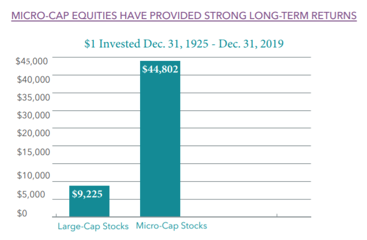

And for comparison, if you invested a single dollar at the end of 1925, here’s what you would have in 2019 if you had invested in large-cap or micro-cap stocks. The micro-cap investment would be 500% of the large-cap investment. 500%!

That’s why I decided to launch a new micro-cap investment advisory service. And, when I did, I knew there was one publisher I wanted to work with.

Cabot Wealth Network

This new service is published by Cabot Wealth Network which was founded in 1970 by Carlton Lutts, a disciplined investor with an engineering mind who developed a proprietary stock picking system using technical and fundamental analyses.

Since then Cabot Wealth Network, headquartered in Salem, Mass., has grown to become one of the largest and most-trusted independent investment advisory publishers in the country, serving hundreds of thousands of investors across North America and around the world.

For more than 50 years Cabot Wealth Network has used its proprietary investing systems and deep expertise to help people become wealthy. That’s a milestone few other investment advisory publishers can claim. And you don’t make it 50+ years without producing great results for your readers.

Together with the entire team at Cabot Wealth Network, I am delighted to announce the launch of our brand-new investment advisory service.

Announcing … Cabot Micro-Cap Insider

Cabot Micro-Cap Insider is created for investors who are looking for an inside edge. The chance to make outsize profits by investing in micro-cap products that can deliver MAXIMUM PROFITS.

And, now open to accepting Charter Subscribers.

Here’s what you’ll receive as a Charter Subscriber to Cabot Micro-Cap Insider …

- Monthly issues featuring a new profile and recommendation plus updates on all of my recommended micro cap stocks

- Weekly bulletins on market developments and stocks

- Trade alerts as dictated by market opportunities

- Exclusive 24/7 access to the Cabot Micro-Cap Insider website and analyst archives

- Exclusive direct access to me, Rich Howe with my personal email address

- MY 100% GUARANTEE: You must be satisfied, you must increase your profits.

Satisfaction 100% Guaranteed: I’m so confident that Cabot Micro-cap Confidential will make you a more skilled investor, that I’m willing to guarantee your satisfaction 100%.

If for any reason during your first 30 days as a subscriber, you don’t believe my advice is helping you increase your investment returns, just let us know. We’ll promptly refund every penny of your subscription fee, 100%.

Free Report Yours to Keep: Or course, the report A Mini Conglomerate with Significant Upside is yours to keep in any case.

The investment for this exclusive service is $1,997 per year. But, as a Charter Subscriber you can get a full year for just $997.

That’s right. You can save $1,000!

There’s just one catch.

And it’s an important one.

Because micro-cap stocks can have thin trading volume and low liquidity I can’t make my recommendations widely available. It would move the market and disrupt this investment strategy.

In fact, we are limiting the number of subscribers to just 100.

So, if you want to make BIG PROFITS you need to act now.

The 100 subscriptions will sell on a first come, first served basis. After they sell out, you may sign up to be on the waiting list. We will notify you if and when a space opens up.

If you take investing seriously. . .

SUBSCRIBE NOW

As Warren Buffett once said:

“The universe I can’t play in (smaller stocks) has become more attractive than the universe I can play in (large-cap stocks).”

Together, you and I can turn Buffett’s problem into your opportunity.

Go to here to subscribe now.

Yours for breath-taking micro cap profits,

Rich Howe

Chief Analyst, Cabot Micro-Cap Insider

P.S. Let me make perfectly clear my offer to help you dramatically increase your income in the coming 12 months. Here’s what you receive as a Charter Subscriber to Cabot Micro-Cap Insider:

— You receive a $1,000 discount off the regular price of $1,997—you pay only $997

— You receive a guarantee of 100% money back if you’re not satisfied (first 30 days)

I urge you to act now. This offer is only valid for the first 100 people to respond.

SUBSCRIBE NOW