The Only 4 Days of the Year You Need to Fund Your Retirement

Write Down These 4 Dates NOW:

July 15, 2022

October 15, 2022

January 15, 2023

April 15, 2023

Wall Street Veteran Reveals: “Whatever else you’re doing in your portfolio, you need to pay attention to these 4 days in the market for the biggest profits possible.”

Most investors and traders believe that the market is a “random walk” and that any trading day has the same average profit potential as any other.

Nothing could be further from the truth.

That’s because there are a handful of trading days where you can maximize your profits 5x-10x more than usual.

These trading days aren’t a surprise either.

They’re noted in every Wall Street trader’s calendar.

In fact, some traders ONLY focus on certain days – because that’s when most of the biggest moves occur …

Sound far-fetched?

Consider this quote from The Wall Street Journal:

“Over the past two decades, 18% of the S&P 500’s total return came from price moves during the week its companies report earnings, according to options-market strategists at Goldman Sachs Group Inc.”

My point:

The Wall Street Journal writes:

“Among the five biggest tech and internet companies—Facebook Inc., Apple Inc., Amazon.com Inc., Microsoft Corp., and Google-parent Alphabet Inc.—earnings-related moves have an even greater impact on their long-term performance. Over the past three years, 52% of those stocks’ total returns have accrued during their earnings weeks, according to Goldman. That means just 11% of trading days have driven more than half of these stocks’ returns, making earnings weeks five times more significant to their share performance than other weeks.”

If you think market moves are not very closely related to important dates … well, you’re missing a huge part of the story.

It’s not an anomaly or some random tendency.

It’s simply because that’s when major companies in the stock market report their earnings.

During this period, massive swings in price, volume, and volatility all come together.

Wall Street has many names for these periods.

They call it “quarterlies” or “earnings.”

But whatever you call these periods, they’re your biggest chances for earning massive gains in a short period of time.

I should know: I’m an ex-Wall Street trader.

And I’ve perfected a few simple trades anyone can make to benefit from the 4 most profitable time periods in the market.

That’s why I put together this presentation …

In fact, you can make up to 10x the normal amount – just trading these periods and doing nothing else.

Sometimes these earnings trades pan out in a matter of hours …

It turns every minute in the market into a super-charger for traders.

And today I’m going to show you exactly how you can trade this upcoming earnings season and make up to 10x profits … in a matter of hours or days.

The Biggest Weeks on Wall Street

Imagine you start out the week with $5,000.

And by next Monday, your account is worth $50,000 – cash. Not capital gains: money in your account.

That might seem ridiculous – but remember, some of the biggest moves in the market coincide with these four periods around earnings …

I’m talking about moves that might usually take weeks or months – or maybe even a whole year – happening in a matter of days.

Take a look at some recent trades I published during the last earnings season:

I published a trade on Visa…

Sold for $0.67, bought back for $0.02 for a return of $0.65, or 14.9%...

Then I made a similar trade on Morgan Stanley:

Sold for $0.43, bought back for $0.03 for a return of $0.40, or 11.1% return.

CVS too:

Sold for $0.53, bought back for $0.02 for a return of $0.51, or 11.4% return.

Those gains might not seem very spectacular…

Until you realize that I closed out ALL 3 of these trades in just one day.

That’s right: I’m talking about 11%-15% gains in a single day.

And this isn’t some temporary trend or fad …

Every publicly traded company is legally required to release their financial results every quarter. It’s guaranteed to happen.

Why?

Because the fines for being even one day late are massive.

For example, in 2020, the SEC fined two companies $1.5 million and $5 million for improperly filing their quarterly earnings reports.

“SEC fines two companies for improperly reporting earnings” -Reuters, September 27, 2020

Good, bad or neutral, every publicly traded company MUST file their earnings reports – and when they do, it creates a very short-term flurry of activity …

And creates a window of profitability that’s not in the market any other time of the year.

As Nasdaq.com writes:

“Earnings season got underway in earnest this morning, with releases from three big banks, Citigroup (C), JP Morgan Chase (JPM) and Wells Fargo (WFC).

…results will come thick and fast from here on out and, by the time things start to slow down a few weeks from now, there will inevitably be some investors left scratching their heads.”

And you might think that these kinds of moves seem a little unusual.

That’s because they are…

I’m an options trader.

Options allow you to magnify gains from even the tiniest of stock movements.

You can also use them to give yourself a margin of safety. Even if a stock makes an unexpected move ... in many cases you can still come out ahead.

You might have traded options before … and if you’re like most people, you probably lost money.

That’s because most people use options incorrectly. They make big leveraged bets on unlikely events.

Most of the trades that people make aren’t just random guesses: they’re statistically doomed guesses.

The overwhelming majority of the time, people buy options with about a 20% chance of success.

Of course, no one tells you that.

But I trade options differently.

I only trade if I have an 80% chance of success.

During earnings season, I can even up those odds to 90% or more.

Suffice to say: if you’re only trading when you have a better than 80% chance of winning …

You tend to do pretty well in the market.

And even if you know nothing about options, I have good news.

You have plenty of time to learn how to profit from this period …

It all begins on July 15 …

And I’m going to reveal exactly how you can profit from this market phenomenon.

But first, let me tell you about myself.

My name is Andy Crowder, and I left a lucrative Wall Street career as a trader over 20 years ago.

If you’ve ever worked in a high-pressure corporate office, you can guess why I left.

Too many meetings, too much time in a stuffy office and not enough time spent doing what I thought I was hired to do:

Help people make money.

Since I left Wall Street, my professional life has been geared 100% towards helping regular investors navigate the markets.

Time and time again, I find that people have the wrong information about how the markets work.

They think the markets are fair (they’re not).

They think the markets are orderly and follow a predictable path (they don’t).

They think markets move slowly and steadily (they don’t).

Markets don’t follow any normal set of rules that make any sense. People have lost fortunes trying to predict markets – over and over.

The fact that companies see their share price wildly fluctuate over just a handful of trading days a year is absurd. Right? It doesn’t make sense …

The value of a company like Exxon (XOM) might fluctuate a few hundred million dollars a day for months on end – and then rise or fall by $10 billion or more in a matter of days after it reports earnings…

That might sound like an exaggeration, but it’s not.

This past March, Exxon lost $44 billion worth of market cap in one week.

Do you really think Exxon dropped in value by $44 billion (a sum larger than the annual GDP of most countries) from one week to the next? Where did that value go?

Who got it? Did it evaporate?

My point is: you can drive yourself crazy if you think this kind of wild price swing is all a part of a rational, normal process.

And you’ll certainly lose money more often than you gain it if you assume the market is rational.

The truth is: markets are clunky, inefficient, and unpredictable.

They’re based on rules and regulations written by politicians and bureaucrats ...

Run by bankers and brokers …

And used by speculators!

Not exactly paragons of virtue or rationality …

And all of these people focus on earnings with such energy that it turns into a feeding frenzy of activity …

So, if you take anything away from this letter, I want you to realize that the market isn’t as uniform or sensical as the mainstream financial media would have you believe.

It’s a wild place that swings from one extreme to another.

And if you know when those extremes happen, you can position yourself to reliably profit from them.

Quickly.

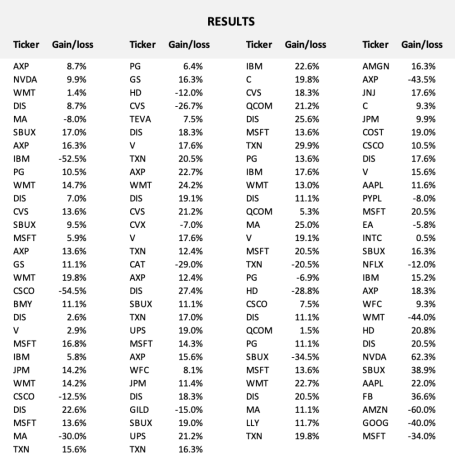

These aren’t cherry picked examples. These are all real trades I’ve sent to my readers over the years. You’ll notice they’re not all winners.

But on balance, you’ll also notice that you can reliably take home substantial gains all based off my earnings trades – with an average gain of 8% - usually in less than 3 days.

Click here to start your risk-free trial.

That’s right: earnings season moves fast.

And to help you get ready for this upcoming earnings season, I’ve put together a brand-new report.

It’s called The #1 Trade to Profit from Earnings Season.

In it, I walk you through the five-step process for trading earnings – with trade examples so you can see exactly how it’s done.

And I firmly believe that if you pay attention to just these four periods in the market around earnings …

That you can easily make 10% ... 20% ... 40%+ gains in a matter of days.

These gains happen every quarter, whether it’s a bull market or a bear market.

And as you’ll see in my report, as long as companies report earnings, there’s money to be made ...

As I said, I’d like to send you this guide.

All I ask is that you take a risk-free trial to my brand-new service:

Cabot Options Institute Earnings Trader

This is my service dedicated to trading the most explosively profitable times of the year.

And if you’re interested in how to make these kinds of trades – four times a year, no matter what the market is doing– you can become a charter member of this service in the next few minutes and immediately learn how to profit from earnings …

What can you expect?

I’ve just launched this service, and I can tell you it’s one of the most comprehensive services in the market.

I think anyone with a brokerage account can benefit from my research … but this might not be the most beginner-friendly service.

In fact, this is my highest-level research. My most expensive.

It’s also the culmination of my 25-year career …

Yes … I’ve been doing this for my entire professional career.

And in the past, I’ve helped thousands of readers learn about these kinds of options trades.

I was even hired to go teach an options class in Chicago to a tiny group of high-net-worth investors.

And I’ve been writing about and trading options for nearly three decades.

In the past, I’ve been paid upwards of $300,000 a year for my research …

But today, to get access to all of my earnings research – you won’t pay anything close to that …

To attend one of my classes in Chicago, you would have paid over $2,000 for just 3 days of training…

But through this special charter offer, you’ll pay just $2,497 for a full year’s access to Cabot Options Institute Earnings Trader.

That’s not all you’ll get though …

I’ve also put together a user guide to get you up to speed.

It’s called the Cabot Options Institute Earnings Trader Guide

Consider it a crash course on everything you need to know about trading options on earnings … Including a glossary of terms, and details on the kinds of trades I’ll be sending you.

But you’ll also get:

Weekly Issues

Every Friday I will publish a weekly issue (even if it’s not earnings season) that covers companies that are due to announce the following week.

Within each weekly issue, you will be made aware of the companies that I plan to focus on plus several other trade ideas for those that wish to trade a bit more often on their own.

Regular Live Member Calls

Every Friday during earnings season, except for major holidays, we will get together for a live Member Call. In each Member Call we will discuss the trades made the prior week and the trades we are looking at for the following week. I will also answer any pertinent questions you may have regarding past trades, future trades or just anything options. Each webinar will be recorded and archived just in case you are not able to attend the live webinar.

Ongoing Alerts

During each earnings season I will issue between 1-4 alerts per week. Typically, I average about 8-10 alerts per earnings season. You will receive these alerts via email or text for immediate action.

Special Reports

Our catalog of Special Reports provides further options analysis that provides a deeper dive into trading strategies and tactics. Here you will find all of my step-by-step strategy guides for the strategies we use most frequently during earnings season, plus the statistical approach I use around each and every earnings trade.

24/7 Archives

Your subscription grants you access to our vast online library of analysis, including past weekly updates, reports, related Member Calls, and other educational content published by Cabot Wealth Network.

Direct Contact

Outside of our live Member Calls where you can ask as many questions as you would like, whenever you have an investment-related question, you can also email me directly. (I’ll send you my email address in the guide when you become a member.)

I pride myself in corresponding and interacting with my readers whenever they have any questions, comments, or concerns. No matter what’s going on, I am available for you as a resource.

I don’t think you’ll see this kind of “behind the curtain” information in any other service.

I reveal this information because I think the best way for you to succeed as a trader is to truly understand what you’re doing … and why …

You can, of course, just follow my trades and make reliable gains …

But once you understand exactly what I’m doing, I know you’ll be able to make even more gains for yourself. You’ll be able to open up your brokerage account to find your own 10%+ gains – any time. Any place.

With or without my help or trades.

You will discover a new skill that will last you the rest of your life. And this skill is something that you’ll have one year, five years, or two decades from now – whether you continue to be a reader of mine or not.

Why Give Away so Much?

I think the best way to create long-term value is for my readers to excel.

If I’m hiding my best ideas from you … you’re not going to excel. You might stay on for a year, but you won’t learn anything. Even if you make money just following my trades you probably won’t tell many people about me.

The dirty secret of investment research publishing is that we live or die on word of mouth and customer testimonials.

Readers who do “just OK” but never grow or excel? Well, they don’t tend to write very compelling testimonials or tell their friends, family, and neighbors about this great new thing they found.

But if I can help you become an expert-level options trader?

If I can I show you exactly how to make your own trades … to create your own gains … month after month?

I bet you’ll tell everyone you know.

Maybe a few people will take a look at my work – and become members themselves.

That’s how I like to do things, and I know it’s how Cabot likes to as well.

I want to take a moment to commend you on what you’re doing here.

So, if you’re interested …

If you want to get my Cabot Options Institute Earnings Strategy Guide and my report, The #1 Trade to Profit from Earnings Season.

All you have to do is take a trial membership to The Cabot Options Institute Earnings Trader.

As a member, you will get all of my trade recommendations every earnings season.

Each trade will give you a statistically likely chance to easily earn hundreds of dollars in profit in as little as a few days.

You can also opt-in (for free) to get trade alerts direct to your phone …

AND access to my live portfolios and updates as needed.

For just $2,497.

I think if you’re making hundreds (or thousands) of dollars of extra profit every month, that’s a bargain.

But I also want to give you the best money-back guarantee I can.

I get that my options research may not be ideal for everyone.

Like I said: I want happy, prosperous readers who are succeeding.

If you find that my work is not right for you – I’d rather give you all of your money back and part on good terms.

That’s why we offer a 30-day money-back guarantee.

If you’re not completely satisfied with my work, my trades, my special reports, or my strategy …

If you feel like you just can’t use my research for any or no reason …

You get a full 30 days to decide if you want every dime of your $2,497 back.

For me, it’s a matter of principle. I only think it’s fair to make this guarantee …

And if you decide it’s not a good fit, it’s all good.

Simply call our customer support team and they will send you a full refund, no questions asked!

If that sounds like a fair deal, and you want to start making hundreds or thousands in extra every earnings season … and you’re ready to start your journey to financial freedom …

Then all you need to do is join today for the special charter offer of $2,497.

I say “special” because I’ve certainly charged more than $2,497 for my research in the past. It’s likely that Cabot will want to raise the price in the future.

And remember, you get a full 30 days to decide if my earnings option trades are right for you. That’s plenty of time to see the gains roll in. It’s entirely possible that you pay for your entire year of this service with just one trade …

The risk for me is that you take The #1 Trade to Profit from Earnings Season and my Cabot Options Institute Earnings Trader Guide, and you don’t need my trades.

But I think you’ll want to follow along for at least one year to make sure you’re truly getting it.

What else can I say …

I think if you take a risk-free trial membership to Cabot Options Institute Earnings Trader, you’ll open up a whole new huge world of reliable trading.

You might even give up stock trading forever and just focus on these kind of trades …

But I know if you read my reports and see my trades for yourself, you’ll agree this is simply the best way to make reliable gains from the market – no matter what is going on.

All you have to do is:

Click here to start your risk-free trial.

Your Guide to Options Trading,