How to Get Paid Like a Wall Street Options Trader

A 30-year options veteran and ex-Wall Street trader reveals the steps you can take to make sure you get paid like a pro – every time you trade.

It’s an open secret on Wall Street:

Professional investors make sure they get paid.

No one on Wall Street will pick up a phone, send an email, meet with a client, let alone TRADE their own money – unless they’re getting paid up front.

I should know, I worked on Wall Street at an investment firm called Oppenheimer Funds.

I got paid no matter what. Every phone call. Every text. Every minute I was doing something in the market: it boosted my bottom line.

And I realize that most people don’t have this relationship with the market. Most people don’t put their portfolio first.

Most people don’t make sure they’re getting paid.

I firmly believe the main difference between people who prosper from the market and those who don’t is that the first group of people have a laser focus on getting paid.

That’s why I’ve put this presentation together. I want you to understand the importance of making sure you’re getting paid when you make a financial move.

For most investors, this sounds like a foreign concept.

Get paid?

To trade in the market?

Get paid to invest?

I think you probably have an inkling that this is technically true – but maybe you’re not sure exactly how it works.

That’s what this presentation is all about.

I’m going to show you that yes:

You can get paid, up front, and generate upwards of thousands of dollars a month using a handful of simple, low-risk options strategies.

In many cases, you can get paid just for making the same regular transactions you’re already making.

That’s right…

- You can get paid to buy stocks.

- You can get paid to sell stocks.

- You can even get paid to hold stocks.

- It might sound insane, but you can even get paid NOT to buy stocks!

I’m going to show you exactly how to earn income from each and every one of these four categories.

And I get it.

I know this sounds ridiculous.

For most investors and traders you’re right. Not one investor or trader in 100 will collect this kind of income.

But I also know that if you’re reading this, it’s likely that you’re easily leaving hundreds of dollars on the table.

You’re not getting paid – but you could be.

In this presentation, I’m going to show you exactly how to earn income with every move you make, in every market – and I’ll even give you some live examples of how it works.

Why Most Investors Trade Income for Wishes

My name is Andy Crowder. I worked on Wall Street and learned pretty quickly that real professional traders and investors get paid.

And I also just as quickly noticed that everyday investors were doing the paying.

Is it fair that some people always get paid in the market, and others don’t?

Probably not. I’m not sure “fair” is even possible. That’s part of the reason I quit Wall Street – I wanted to show everyone (not just the rich and well-connected) how to earn income from the market – always.

So maybe it’s not “fair…”

But if you want to learn how to be on the receiving end of getting paid…

If you want to earn income no matter what you do in this market.

The information in this letter might be for you.

But I have to warn you: I’m going to be blunt in this letter.

I’m not going to hold your hand or spare your feelings.

The truth is: most investors and traders are doomed.

First off (and you probably already know this) but most investors…

Aren’t even investors.

They’re speculators.

They’ve got a burning wish in their heart that the stock they buy will skyrocket 100X in a year.

They’ve got a tiny part of themselves that likes to fantasize about how rich they could be if they catch a lucky star and one of their trades pans out perfectly.

But if you really want to be successful as a trader or an investor, I have some straight talk for you:

You must kill that dreamer in yourself in order to win.

The dreamer doesn’t care about the likely path to success – they care about the thinnest possibility that every dream will come true.

They play the lottery, and on the walk back to their apartment, they think about the fancy houses and cars they’ll buy when they win the jackpot, and the money they’ll give to family and friends.

“$1 million for Aunt Harriet so she can retire in that beach house she’s been dreaming about, and $500k for Cousin Mark so he can start his own garage, and $100,000 for all of my nieces and nephews so they can go to college.”

Etc. Etc.

Sound familiar?

We’ve all had these wild dreams. They feel nice. It’s a mild escape.

And you might think these dreams are harmless. They’re free, after all, right?

What’s a little bit of fantasy to brighten your day for a moment?

Well, it’s not harmless, and it wasn’t free. Lottery tickets cost money.

I hate to tell you this, but the market is made up mostly of these kinds of people.

But if you only take away one thing from this letter, you need to understand these people (myself included, once upon a time) never get paid to be in the market.

You’ll note that they always pay.

The dream that never comes true is not free.

It costs the $5 for the lottery ticket. Or it costs the $500 for the microcap stock that you hope will jump 100-fold.

The dreamer will gladly trade $5 at a time for an endless supply of fantasy – and end up with nothing to show for it.

As they say, the lottery is a tax on people who are bad at math.

And of course, you can’t just start your own lottery and sell tickets to people.

But you can do something very similar in the stock market.

Again, to be blunt: you can take advantage of the unrealistic expectations of people who use the market as a way to feed their fantasies.

These people are so desperate to dream – that they will gladly pay you… over and over... to sell them a ridiculous fantasy about their success in the markets.

I want you to remember what I said at the beginning of this letter.

I listed a group of things you can get paid to do.

And I meant it.

People will absolutely PAY you to buy stocks.

They’ll pay you to sell stocks.

They’ll pay you to hold stocks.

They’ll pay you NOT to buy stocks.

How is this possible?

Well, the market is filled with all kinds of people who ASSURE themselves that something big and fantastic is going to happen.

They’re so sure … so hopeful … so full of dreams about what will happen if …

That they make big bets on these events.

You can take the other side of their big bets.

And unlike them, you can use statistics to win most of those bets – at their expense.

You can get paid by the 99% of people who invest and trade with their hopes instead of their brains.

In fact …

The rest of this letter is dedicated to nothing except showing how you can get paid doing those four things I just mentioned.

Get Paid to Buy Stocks

Right now, shares of Apple sell for about $150.

But there are a bunch of people betting a small fortune that it’s going to dip down to $145.

Why?

Maybe they think market weakness is going to drag Apple shares down.

Maybe they think the stock is overpriced.

But honestly: who knows why …

The fact is, hundreds or maybe even thousands of people are betting a total of about $700,000 on Apple falling a little over $5 a share in the next 3 days.

I didn’t make this up.

I grabbed this information from my broker’s options data.

Take a look:

The red circle is the number of 100-share lots of Apple that people have bet will fall to $145 a share.

You can see the $145 in the 3rd column, 3rd from the bottom.

Right now, through any brokerage, you can take $35 per 100-share lot from any of these people – as long as you promise to buy shares at $145 if the price falls to that level in the next 3 days.

It might go without saying, but the odds of this happening are basically zero.

This is the first lesson of earning income no matter what you do:

If you want to buy shares of most companies, there are hundreds, maybe thousands of people who will line up to pay you before you buy a single share.

It’s not just Apple. You can get paid to agree to buy shares of thousands of publicly traded companies and ETFs.

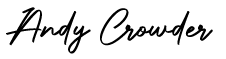

Take a look at the S&P500 ETF (SPY):

Right now, you can get paid $257 if you agree to buy 100 shares if the price drops $4 a share in the next 3 days.

There are 71,355 100-share-lot bets at $257 a pop betting that the price will drop.

That’s over $18 million that’s already been sent to people – people who are getting paid to agree to buy shares of SPY.

The same thing is happening with most of the stocks you’ve heard of in the market.

Certainly, every stock in the Dow, most stocks in the Nasdaq, every stock in the S&P 500, and most ETFs – all have massive amounts of money being bet that they’ll fall $1/share … $2 a share … Sometimes $100/share.

If this seems like it doesn’t make sense, I agree.

People making side-bets on stock price movement is a staggeringly large part of the market. It’s mind-boggling.

According to Investopedia.com, the total value of the derivatives market (another word for options) is $1 quadrillion. That’s 1 million billions. It’s 1,000 trillions.

That’s a lot of people pinning their dreams on some kind of unlikely stock move.

If someone is right in their bet – they might stand to make 100%, 300%, even 500% in a matter of days.

It happens.

Of course, some people win the lottery too …

But most of these people will lose every dime they put into their bets.

That won’t stop them from making that bet again next week or next month.

Which means – if you want to get paid to buy stocks, you can get paid every week or every month by these big dreamers …

The best part: it doesn’t matter what’s going on in the market. People will pay you to buy stocks in good markets and bad.

In options terminology, this is called “selling puts.”

And it’s the simplest income trading strategy in the options world. Selling puts – just means that you agree to buy shares at a certain price in a certain time period. You pick the price. You pick the time.

And people pay you. I know it sounds wacky … And I’ll explain how it all works in detail in a minute.

But I promised you I would go through the other ways you can get paid…

And maybe you don’t want to buy stocks. Maybe you have enough stocks.

Maybe you want to get paid to sell stocks …

Here’s How to Get Paid to Sell Stocks

Let’s say you’re sitting on 100 shares of Amazon – and you want to sell. The company has had a historic run … and you want to lock in some profits on the off chance that the company declines further.

At over $2,100 a share, that’s going to be a nice little payout of about $210,000.

It might be tempting to just put in a market order to sell.

If you did, you’d be leaving a significant sum of money on the table.

In fact, you could add another $5,500 to your take by just waiting a few days to sell.

That’s because there are 1,000 contracts paying $5,500 right now if you just agree to wait 3 days to sell – instead of selling now.

These people are betting an incredible $5,500,000 total that the price will rise in the next few days.

They’ll pay you $5,500 up front if you agree to sell your shares in 3 days instead of now as a part of their bet.

Weird.

I personally wouldn’t pay any amount of money on this kind of odd speculation. Who cares what Amazon’s price does in the next 72 hours? Let alone $5,500 worth?

Sure, if they’re right and the price rises, they might make a quick $1,000 …

But I’m not sure the $1,000 dream is worth it.

You’ll notice this looks like the same kind of goofy bet that the folks were making on SPY and Apple a minute ago.

It is the same kind of bet – just going the opposite way.

And it works on just as many stocks and ETFs as selling puts. As you might have guessed, this is known as “selling calls.”

Selling a call just means agreeing to sell shares at a certain price at a certain time.

Just like with selling puts – you get to choose the time and price.

And people will pay you. No matter what’s going on in the market, people will pay you to agree to sell shares you already wanted to sell.

It sounds strange because it is strange.

But it gets much stranger.

Because remember: I also wrote that you can get paid to hold stocks.

At this point, I need you to bear with me, because this next method of collecting income might make the least amount of sense.

But hey … if people want to pay us for doing nothing … who are we to question them?

Here’s How to Get Paid to HOLD Your Stocks

So, I already covered that there are people who will pay you to buy stocks. And there are people who will pay you to sell stocks.

But let’s say you own 100 shares of Amazon again …

And you don’t want to sell in the next few days because you think the price isn’t likely to go anywhere in the short term. After that, maybe you’ll want to – but for now, you’re happy holding.

Amazon, of course, doesn’t pay a dividend, so while you wait, you won’t make a dime in income.

Unless …

Click here to start your risk-free trial.

You have two people pay you:

One person pays you to sell at a higher price.

The other person pays you to sell at a lower price.

You can collect twice the income (over $10,000 in a few days if you play your cards right).

And because you get to pick the prices … you can give yourself a massive margin of error.

Just for holding your stock … that you were going to hold anyway.

At this point you might think it’s a little unfair or even kind of mean to take money from these kinds of stock market gamblers.

But these people are just playing the lotto. They’re going to play the lotto anyway. And you’re going to buy, sell and hold shares anyway, right?

What’s wrong with getting paid to do it?

I don’t think there’s anything wrong with it. These are grown adults who know what they’re getting into – or they should.

Many of them are certainly wealthy enough to afford it. Think about the kind of money you’d have to have burning a hole in your pocket to lay down $5,500 on a three-day bet on Amazon’s stock price move …

Don’t feel bad for them. They apparently have money to burn.

And they want to burn it giving it to people like you.

Okay …

So far, I hope this letter has made sense.

Maybe it has. Maybe not.

But this next income method is probably the weirdest.

At the risk of making you think I’ve completely lost my marbles …

Here’s How to Make Money by NOT Buying Stocks

Just like you can make money by holding a stock, you can get people to pay you for not buying stocks.

This strategy is much more complicated, because it involves 3 different option trades executed all at once, and you have two different people paying you, no matter what.

Why make this trade? Well, it’s an easy way to make money if you think a company’s shares aren’t likely to move higher or lower in a given period.

Similar to the previous trade, you have two different people paying you not to buy shares…

The best part of this trade is that you can limit your risk – and choose exactly how much you want to earn – just for NOT buying a single share of any stock.

It’s goofy. I know. In fact, it even has a weird name: people call it the Jade Lizard.

Does it matter to you if some people want to pay you not to buy higher and some people want to pay you not to buy lower? Why would it?

Now, unfortunately I can’t get into the details of this trade … there’s too many moving parts to explain succinctly in this letter.

But I have written a special report detailing this income secret – and the other three income trades.

It’s called the Cabot Options Institute Income Guide.

This report shows you, step by step, how to create your own income trades based on whatever you’re doing in the market.

Get paid to buy, sell, hold or even to not buy shares.

I know it seems far-fetched, but I’ve been making these same kinds of trades for myself for nearly 3 decades.

Here’s a recent example of what I’m talking about…

In this case, I showed how to get paid to buy Wal*Mart (WMT).

If you had followed my work, you could have earned $167 in just 30 days – just for agreeing to buy Wal*Mart below its market price.

If you repeated this trade every 30 days (and I’ll show you how) you would have earned $2,004 or 14.5% annually…

I’d like to send you a copy of this report so you can see for yourself how easy it is to earn income in any market.

In fact, I’ve come up with a way for you to get access to this report for no obligation on your part.

I’ll tell you how to claim it in just a minute.

But first, I want you to know that my Income report is just a small part of a brand-new segment of Cabot: the Cabot Options Institute. And within this segment, I’m running a special portfolio dedicated entirely to collecting the kind of income I’ve been talking about.

It’s called Cabot Options Institute Income Trader.

In this new service, I not only have a report on how to make these trades – I’m also starting up a model portfolio – where I’ll send out live trades of the four types I’ve mentioned.

What Kind of Trades Can You Expect?

I’ve just launched this service, and it seems likely that I will add more “core” trades as I go, but right now, I’m focusing on these four income trades.

The world of options is so massive, there’s practically no end to the ways you can generate income.

And I’ve been doing this for a long time.

In the past, I’ve helped thousands of readers learn about these kinds of fundamental options trades.

I was even hired to go teach an options class in Chicago to a tiny group of high-net-worth investors.

And I’ve been writing about and trading options for nearly 3 decades.

In the past, I’ve been paid upwards of $300,000 a year for my research …

But today, to get access to all of my Income options research …

Through this special charter offer, you’ll pay just $1,497 for a full year’s access to Cabot Options Institute Income Trader.

That’s not all you’ll get though …

You’ll also get a copy of my brand-new report: “My Number 1 Options Tool You Can Use to Trade Right Now.”

This report shows you one of my favorite, most basic option trading tools that you can use to build your own trade …

Whether you’ve traded options before or not: this report shows you exactly how to find a sweet spot of a trade that gives you exactly the amount of income you want – for as little or as much risk as you want to take on.

In short: this report reveals my favorite tool to know how to make trades for yourself.

That’s not all you’ll get though…

In addition:

Issues

Every Friday I will publish a weekly issue that discusses our open trades and how we plan to proceed going forward. Each weekly issue will include the companies that I plan to focus on plus several other trade ideas for those that wish to trade a bit more often on their own.

Member Calls

Every month, on the third Thursday of the month (options expiration), we will get together for a live Member Call. In each Member Call we will discuss not only open trades, but potential trades as well.

These live Member Calls are my bread and butter – where I can give you true value and education so that you fully grasp my concepts and how to get the most out of your membership.

Alerts

You will receive email alerts when market or trade conditions warrant it; during each expiration cycle I will issue between 3-8 alerts using our risk-defined strategies.

Special Reports

Our catalog of Special Reports provides further options analysis that offers a deeper dive into trading strategies and tactics. Here you will find all of my step-by-step strategy guides for the strategies we use most frequently, plus the statistical approach I use around each and every trade.

24/7 Archives

Your subscription gives you access to our vast online library of analysis, including past weekly updates, reports, related Member Calls, and other educational content published by Cabot Wealth Network.

Direct Contact

Outside of our live Member Calls where you can ask as many questions as you would like, whenever you have an investment-related question, you can also email me directly. (I’ll send you my email address in the guide when you become a member.)

I pride myself in corresponding and interacting with my readers whenever they have any questions, comments, or concerns. No matter what’s going on, I am available for you as a resource.

I don’t think you’ll see this kind of “behind the curtain” information in any other service.

I reveal this information because I think the best way for you to succeed as a trader is to truly understand what you’re doing … and why …

You can, of course, just follow my trades and make reliable gains …

But once you understand exactly what I’m doing, I know you’ll be able to make even more gains for yourself. You’ll be able to open up your brokerage account to find your own 10%+ gains – any time. Any place.

With or without my help or trades.

You will discover a new skill that will last you the rest of your life. And this skill is something that you’ll have one year, five years, or two decades from now – whether you continue to be a reader of mine or not.

Why Give Away so Much?

I think the best way to create long-term value is for my readers to excel.

If I’m hiding my best ideas from you … you’re not going to excel. You might stay on for a year, but you won’t learn anything. Even if you make money just following my trades.

You probably won’t tell many people about me.

The dirty secret of investment research publishing is that we live or die on word of mouth and customer testimonials.

Readers who do “just OK” but never grow or excel? Well, they don’t tend to write very compelling testimonials or tell their friends, family and neighbors about this great new thing they found.

But if I can help you become an expert-level options trader?

If I can I show you exactly how to make your own trades … to create your own income … month after month?

I bet you’ll tell everyone you know.

Maybe a few people will take a look at my work – and become members themselves.

That’s how I like to do things, and I know it’s how Cabot likes to too.

I want to take a moment to commend you on what you’re doing here.

So, if you’re interested …

If you want to get my Cabot Options Institute Income Guide and my report, My Number 1 Options Tool You Can Use to Trade Right Now…

All you have to do is accept a trial membership to Cabot Options Institute Income Trader.

As a member you will get all of my trade recommendations every single month.

Each trade will give you a statistically likely chance to easily earn hundreds of dollars in pure income every month.

You can also opt-in (for free) to get trade alerts direct to your phone …

AND access to my live portfolios, and updates as needed.

For just $1,497.

I think if you’re making hundreds (or thousands) of dollars of extra income every month, that’s a bargain.

But I also want to give you the best money-back guarantee I can.

I get that my options research may not be ideal for everyone.

Like I said: I want happy, prosperous readers who are succeeding.

If you find that my work is not right for you – I’d rather give you all of your money back and part on good terms.

That’s why we offer a 30-day money-back guarantee.

If you’re not completely satisfied with my work, my trades, my special reports, or my strategy …

If you feel like you just can’t use my research for any or no reason …

You get a full 30 days to decide if you want every dime of your $1,497 back.

For me, it’s a matter of principle. I only think it’s fair to make this guarantee …

And if you decide it’s not a good fit, it’s all good.

Simply call our customer support team and they will send you a full refund, no questions asked!

If that sounds like a fair deal, and you want to start making hundreds or thousands in extra income every month … and you’re ready to start your journey to financial freedom, potentially closing gains as high as 273% in as little as seven days …

Then all you need to do is join today for the special charter offer of $1,497.

I say “special” because I’ve certainly charged more than $1,497 for my research in the past.

And remember, you get a full 30 days to decide if my Income option trades are right for you. That’s plenty of time to see the income roll in. It’s entirely possible that you pay for your entire year of Income Trader with just one trade …

The risk for me is that you take my Tools Report and my Income Guide, and you don’t need my trades.

But I think you’ll want to follow along for at least one year to make sure you’re truly getting it.

What else can I say …

I think if you take a risk-free trial membership to Cabot Options Institute Income Trader, you’ll open up a whole new huge world of reliable income trading.

You might even give up stock trading forever and just focus on these kinds of income trades …

But I know if you read my reports and see my trades for yourself, you’ll agree this is simply the best way to make reliable income from the market – no matter what is going on.

All you have to do:

Click here to start your risk-free trial.

Your Guide to Options Trading,

Andy Crowder

Chief Analyst

Cabot Options Institute